EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Authors: Jennifer Baziuk, Partner and Business Consulting Insurance Leader & Neil Pengelly, Partner and Insurance Leader

Co-authors: Shray Khurana, Senior Manager, Business Consulting & Mavis Vinluan, Manager, Business Consulting

Insurers that harness innovation and transformation to deliver what customers want right now can thrive in the turbulent market ahead.

- Embrace technology modernization by diving into cloud innovation and the digital era.

- Put humans@centre of transformation — customers, workforce and other stakeholders — to align ways of working with shifting priorities, expectations and values.

- Frame go-to-market strategies around a fundamental focus on environmental, social and governance (ESG) priorities to evolve in ways that meet changing demands.

It’s time to reinvent the insurance business model in Canada with an innovative and customer-centric digital approach. Doing so now is critical for any insurer looking to sustain a brighter future in the face of the transformational market headwinds that are now sweeping the globe.

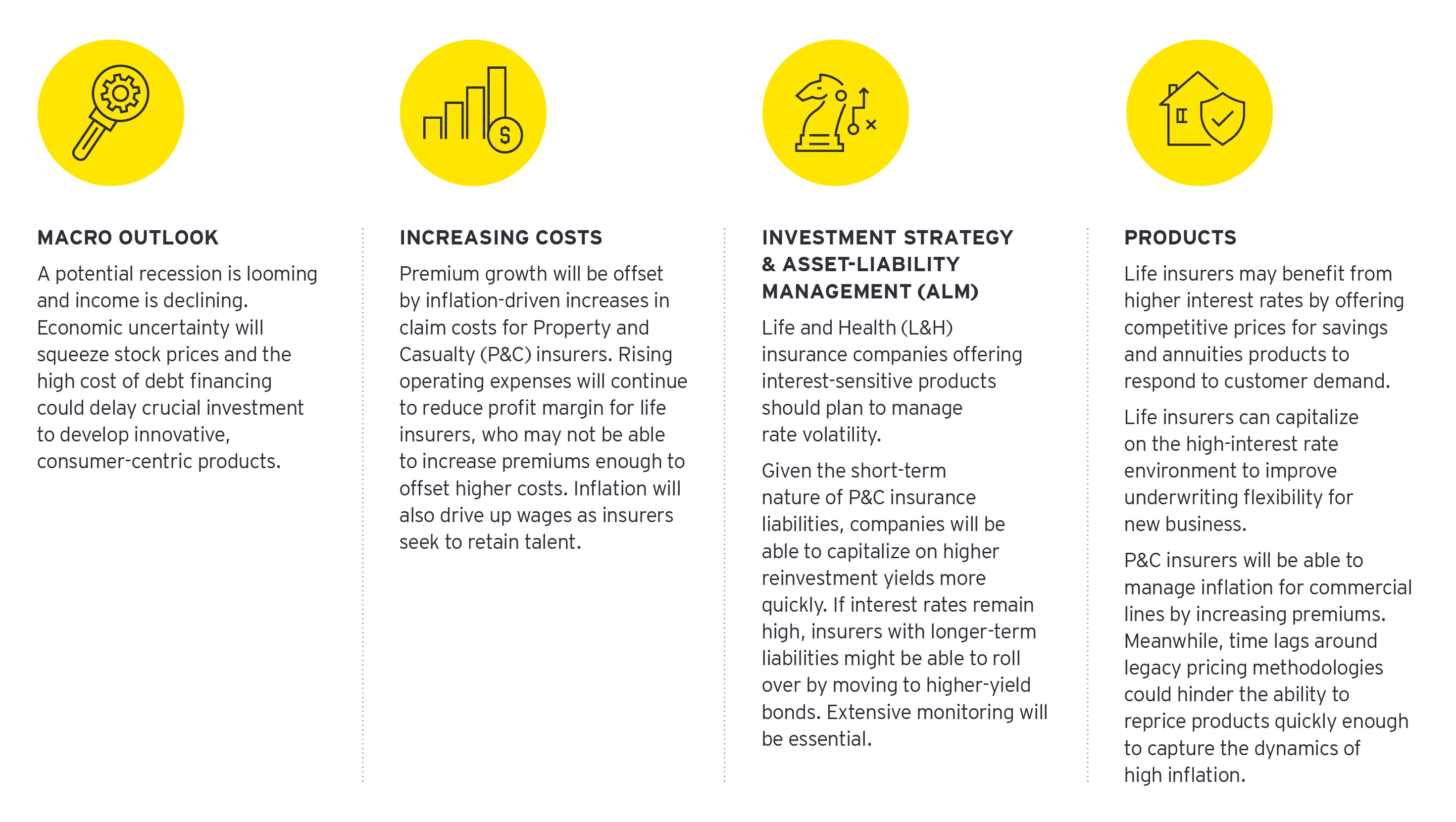

From the war in Ukraine to ongoing supply chain disruptions, from spiking interest rates and inflation to far-reaching macroeconomic risks and opportunities: there’s no doubt that insurers have a lot to consider right now. Layer in the operational challenges that insurers are facing around structural inefficiencies and gaps, and that current state assessment becomes even more critical as we develop a vision for future growth.

The annual EY Canadian Insurance Outlook brings together the point of view on the key issues shaping the industry’s near-term future. Complementing themes from the 2023 EY Global Insurance Outlook, this uniquely Canadian perspective focuses on the need for insurers to take an agile approach to transforming. This is how industry stakeholders can build on what’s happening in the local market now to draw a clear path toward sustainable future growth.

Understanding the big picture

Inflation, costs and a new world of risks and challenges

In keeping with their core mission, central bankers around the world have been focused on taming inflation. While global economic activity is slowing and the outlook remains uncertain, the desire to front-load rate hikes and exit a highly accommodative stance remains strong, even if it brings pain to households and businesses.

Though different jurisdictions may have slightly different rationales, central bankers are committed to reducing demand and lowering inflation even if their actions cause below-potential growth and a higher unemployment rate. Because aggressive monetary measures have yet to lower inflation, many observers seem to believe more rate increases are necessary, despite historic rate increases the world over.

In Canada, inflation is projected to start cooling in 2023, primarily due to:

- Weakening consumer demand

- House pricing drops

- Rising interest rates’ impact on the cost of household and commercial debt

In Canada, inflation is projected to start cooling in 2023, primarily due to:

- Weakening consumer demand

- House pricing drops

- Rising interest rates’ impact on the cost of household and commercial debt

In this environment, new risk management and operational considerations are emerging.

From the consumer point of view, Canadians face short-, medium- and long-term social and economic risks associated with global headwinds, including:

- Cost-of-living crises

- Debt crises

- Rapid and/or sustained inflation

- Failure of climate-change adaptation

- Asset bubble burst

These consumer realities can have a lot of sway over the insurance industry overall. Still, it’s not only external factors that can influence insurers and the industry at large. Ever-evolving success is also conditional on ensuring internal operations are as optimized as possible to weather the disruptive forces reshaping macroeconomics, geopolitics and climate in real time. Functional challenges — like in-silo execution vs. enterprise-wide focus on initiatives, limited application of agile principles and the ability to pivot in the face of unexpected barriers or opportunities — complicate an already complex, and fast-changing, operating environment for insurers in Canada.

All the more reason to embark on a transformation journey that accounts for these factors by integrating a wide range of elements through a singularly powerful transformation plan.

1. Embrace technology modernization by diving into cloud innovation and the digital era

Why prioritize technology modernization now?

Digital is a powerful tool that can help insurers keep their competitive edge in the current landscape of increasing cost and competition. How so?

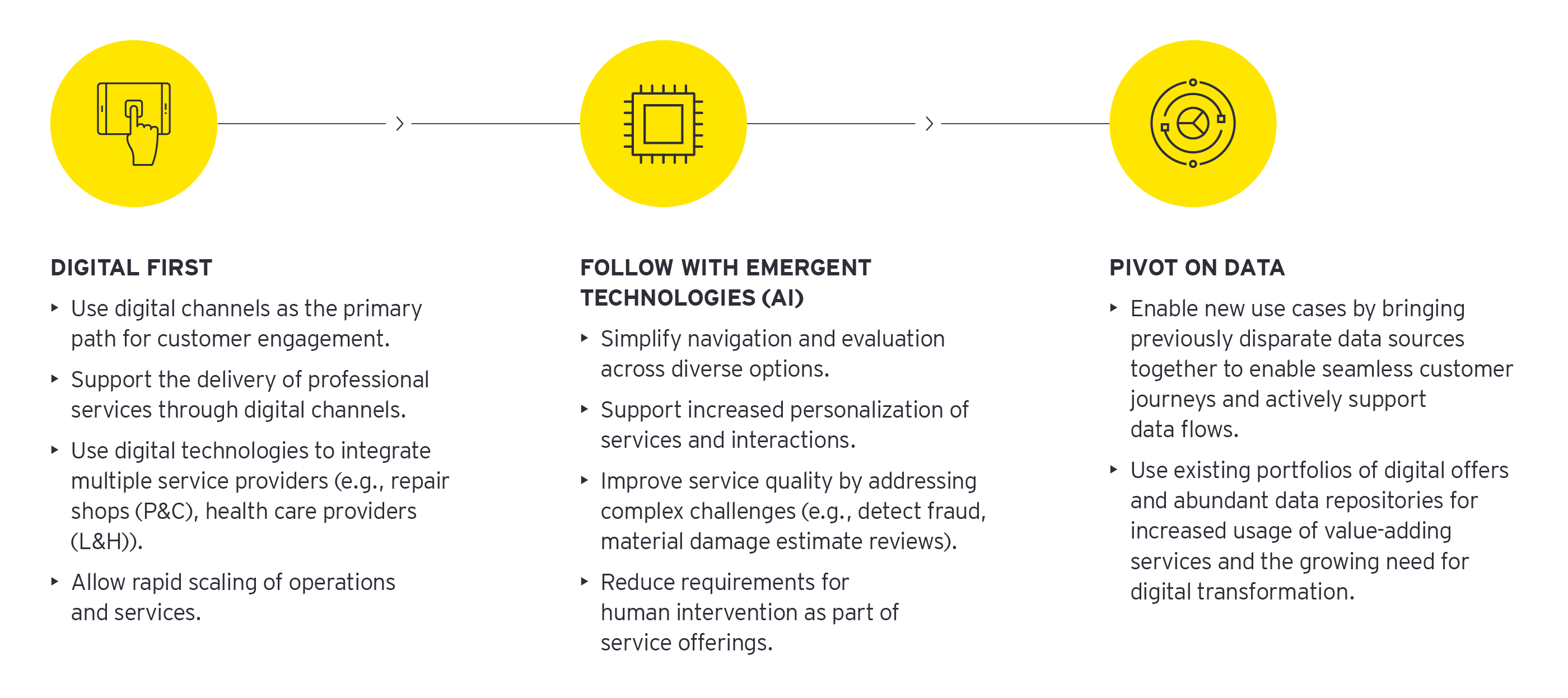

Shifting to real-time data flows allows for better analytics, as well as a more consistent data strategy. Cloud is a great example, allowing for an ease of innovation that can help insurers launch new products and solutions faster. Cloud also enables insurance companies to connect APIs/microservices quickly. Many of these solutions are already built, including low-code solutions.

While insurers have historically struggled with data from multiple sources — and even missing data — cloud can support real-time data feeds to generate better decisions and useful analytics. These real-time data flows are also creating opportunities for insurers and their partners to co-create in the cloud. This expands customer service offerings without necessarily needing to bring new expertise into the business itself — particularly helpful in a workforce where demographic shifts and other factors are making talent harder to attract, recruit and retain.

Essentially, cloud creates an instantly scalable platform that can be built on. Artificial intelligence (AI) plug-ins can be enabled, which can instantly change how business is conducted. Moving to consolidated platforms represents a key way for insurers to sunset legacy systems — and the expense ratios that go with them — while shifting computer power to more energy-efficient partners at the very same time. This helps decrease costs, carbon footprints and total amount of energy being used.

All these new capabilities can help insurers compete in a market where inflation is squeezing customer wallets, causing them to be more price sensitive when renewing existing products and searching for new ones. This digital approach can also help insurers maintain relevance among young, digital natives — who shop for policies through non-traditional, online channels and expect similar digital service experiences — and older demographics, with nuanced preferences of their own, including personalized customer experiences that help them mitigate risks.

Digital platforms offer insurers the flexibility to meet these changing demands with shorter turnaround times.

And technology modernization can help across all these fronts.

How can insurers effectively prioritize tech modernization?

Insurers looking to build a compelling digital strategy for the future will need to prioritize the right tools, at the right time, to effectively compete from here on out.

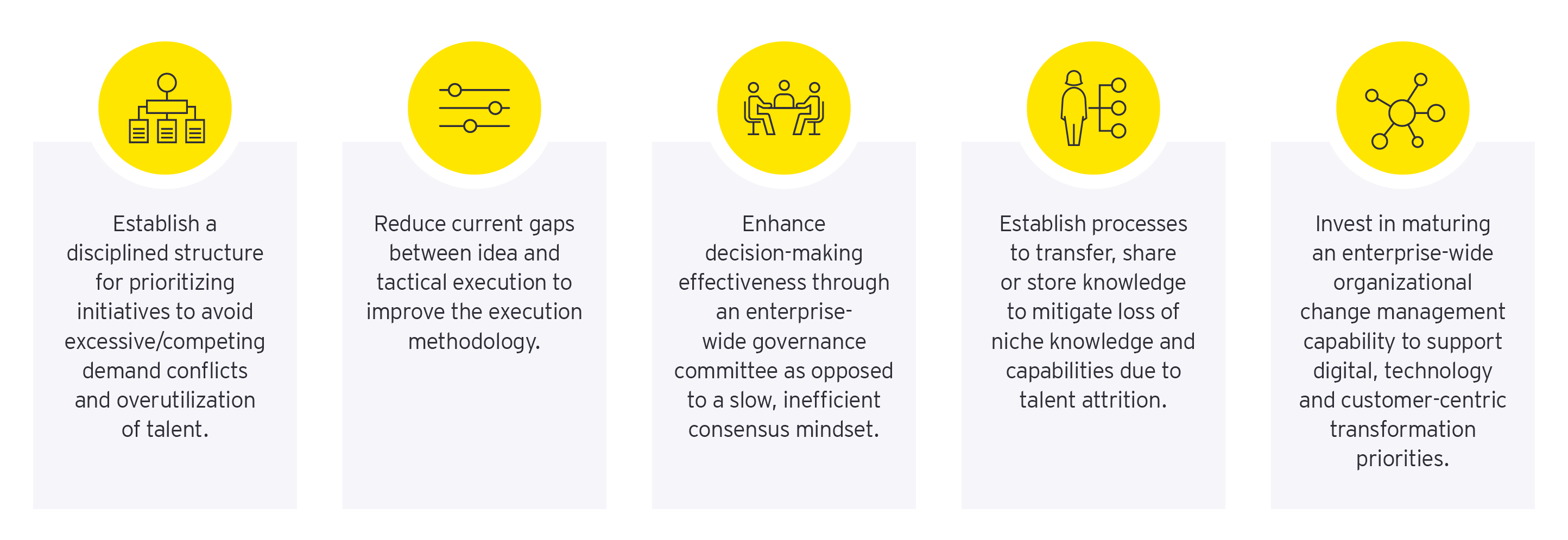

It’s imperative to recognize that achieving optimal technology modernization is a journey that requires you to navigate through a set of complex operational challenges. Key among these include dealing with a legacy mindset of ”silo” execution as opposed to an enterprise-wide focus on improvement initiatives, limited application of agile principles, lack of comfort with pivot/adjustments in strategies to deal with unexpected barriers and opportunities. You need to address these challenges and others if you’re going to succeed.

Given that much of this might be new or the challenges are contextual to every insurer, there is no one-size-fits-all approach to modernization. There will be a need to learn as the modernization program execution proceeds, adapting multiple initiatives as new capabilities are put in place.

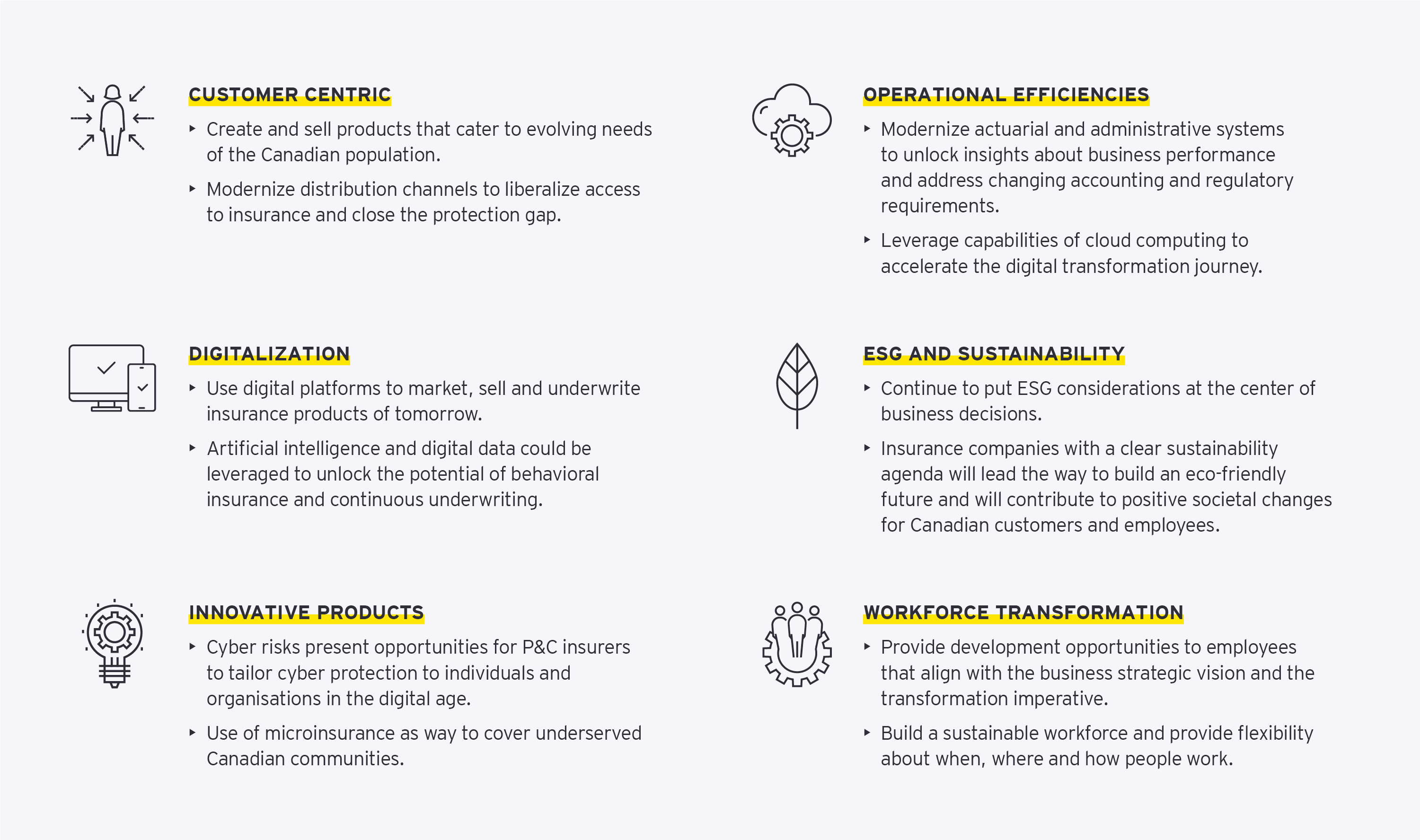

What’s next on the horizon?

Lead with a digital-first strategy to ensure you’re drawing an effective technology roadmap for the future realities your business and customers will face.

2. Put humans@centre of transformation to align with shifting client priorities, expectations and values.

Why reframe with people at the centre now?

We can talk about the evolving macroeconomic conditions or identify opportunities to address protection gaps or even enhance the operational efficiencies to facilitate success. But there’s no getting away from the reality that consumers are changing. Insurers who reimagine who they are serving can create new routes to success.

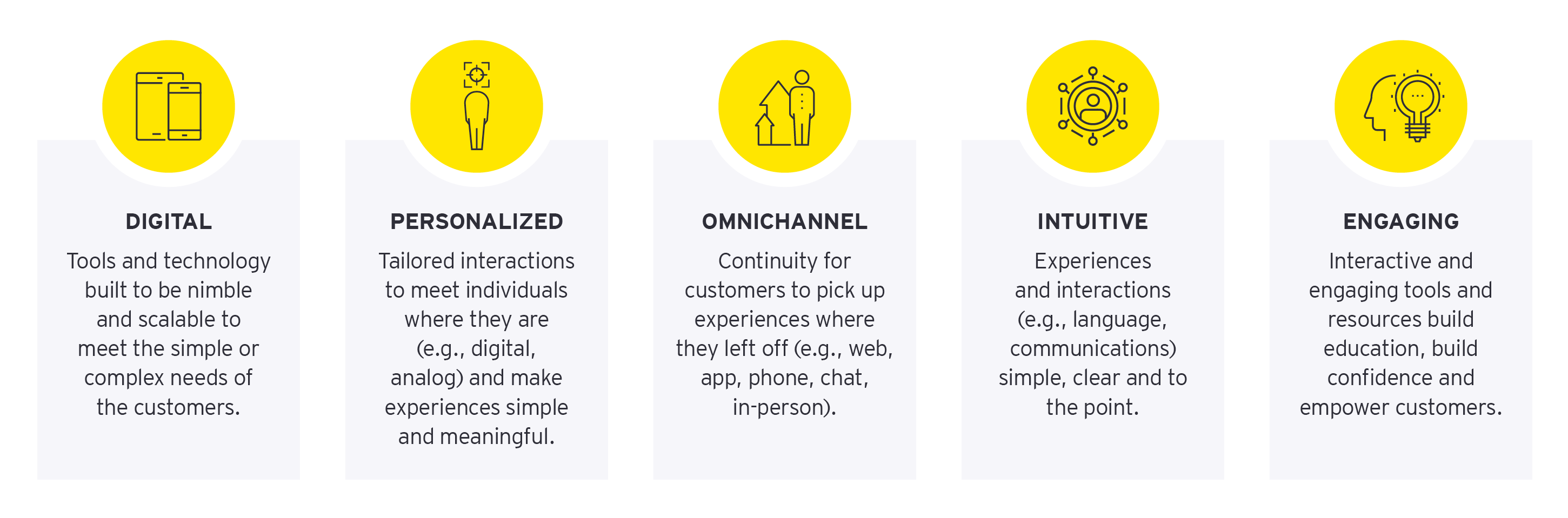

Disruptive entrants are already embarking on this path, bringing digital, personalized, omnichannel, intuitive and engaging offerings into the mix to compete for market share. That’s essential in a world where digital trust can bring consumer advantage. A step away from outdated industry thinking could help insurers develop all-digital “new” companies to cater to these groups accordingly. Similarly, insurers must seek to engage through influencers, social media and non-traditional channels, sharing appropriate messages that reflect the different targets’ values and sensibilities.

As much as young, digital natives are shaking up the industry, senior demographics bring their own distinctive set of factors to consider. Retirees in particular are looking for a hybrid — or omnichannel — approach to accessing education and advice on product offerings. They’re seeking solutions that address intergenerational wellbeing and wealth/savings strategies. Insurers must now endeavour to strike a balance in operating capacities to have a service focus on the senior, while maintaining a sales focus on younger demographics.

Of course, customers aren’t the only ones changing. The talented people who bring your workforce to life are also evolving quickly in this macroeconomic and geopolitical environment. The skillset required to build an efficient workforce has changed significantly due to the digital era and the COVID-19 pandemic. Insurance providers need to consider the new skillsets when cultivating the next-generation workforce. But human capital is scarce, and workers are making decisions based on a different set of values than in years past.

A sustainable workforce is one where the work environment is caring and supports employee wellbeing. Employees are not seen as primary resources that can be deployed — and depleted — to serve employers’ economic ends. In a sustainable workforce, your people’s skills, talents and energies are not overused or overly depleted. Flexibility and hybrid is the new normal, giving your people new options for when and where they can work.

Employees are not afraid to leave their jobs and have broken the pay and role equation, putting pressure on the labour market. However, this is not matched by the employer’s desire to reset pay to retain talent. While some job areas shrink, enablement of other areas requires attracting diverse talent with a range of skills, such as technology and data. To compete, the insurance industry must re-evaluate the ways in which it attracts talent, retains employees and transforms its organization into a place to work — all while seeking continuous employee input.

Putting humans at the centre of the strategy can help insurers address both customers’ needs — with the right segmentation — and employee needs — with an eye to attracting, recruiting and retaining top talent — in ways that bolster long-term results.

How can insurers effectively prioritize people?

Insurers must strive to meet the customer and employee expectations that are being set by traditional competitors, as well as those being set by disruptive entrants like non-financial services players and Insurtechs. Embracing a humans@centre approach must mean customer and employee experiences are equally:

We briefly touched on the operational challenges that need to be recognized in acknowledging the complexity and effort in addressing these transformation priorities. We have highlighted some observations, based on our client experiences, that we believe are important considerations for insurers to address as they embrace the five pillars mentioned above for enhancing their ability to serve their customers well:

What’s next on the horizon?

Identify mechanisms and external data sources to closely track evolving customer and employee needs and market shifts, developing pattern-recognition and insight-generation capabilities to inform strategic and day-to-day decision-making.

3. Frame your go-to-market strategy around a fundamental focus on ESG priorities to ensure you’re evolving to meet changing demands

Why align business and ESG strategies now?

Sustainability strategies and initiatives enable companies to protect and create value by reducing negative impacts and increasing positive impacts on the environment, society and the economy. The Canadian insurance industry is at the forefront of climate-related and societal changes that will inevitably impact business. Today, society is demanding greater responsibility from the organizations they work for, buy from and invest in.

On the one hand, Canadian insurers are well engaged in their ESG journey. About 60% of insurance companies in Canada say they consider ESG in underwriting and new product development practices. Those taking an ESG lens are seeking to increase accessibility in insurance overall, whether through developing new products to ensure individuals or property that were previously uninsurable or developing incentive programs to allow members to access better rates.

Insurers in Canada are also focused on outward-looking ESG priorities. Most have defined emissions targets for their operations, with P&C claims operations highlighted as a having high potential to achieve further reductions. Almost all insurers in Canada are developing and launching socially responsible fund options aligned to ESG goals. In the same vein, most are involved in corporate social responsibility and community outreach programs. Many insurers and reinsurers already report under the Task Force on Climate-Related Financial Disclosures (TCFD), as well as other global reporting initiatives.

All of this marks significant progress for the industry as a whole. Still, there is more work to be done. We know that investors, regulators, customers and employees will increasingly use ESG metrics and principles to evaluate the insurance company of the future. In many ways, ESG is already helping companies in Canada derive real financial value, too.

What’s more, as global citizens push for change in the collective social contract, insurers in Canada actually have a lot of opportunity to lead the charge by closing critical gaps now. For example, pre-pandemic, cyber protection was considered a “‘specialty” risk. The almost overnight switch to online has pushed cyber risk to the top of priority lists across industries.

P&C insurers can be at the forefront of closing that gap by understanding and addressing cyber exposure, developing solutions, managing risk offerings and helping society grapple with the perils of cyber threats.

On the life and health (L&H) side of things, insurers can lend expertise through thought leadership, helping build socially beneficial models and procedures to better protect data. There is also ample room for the insurance industry to collaborate with government and the technology community to build protections and protocols for cybersecurity.

True, too, for insurers looking to address unequal access to insurance protection, develop solutions for underserved markets — like newcomers and at-risk socioeconomic or otherwise marginalized groups — and help close insurance and savings protection gaps in support of the Social pillar that’s so crucial to ESG overall.

All the more reason to align business and ESG strategies more closely, starting now.

How can insurers effectively prioritize ESG?

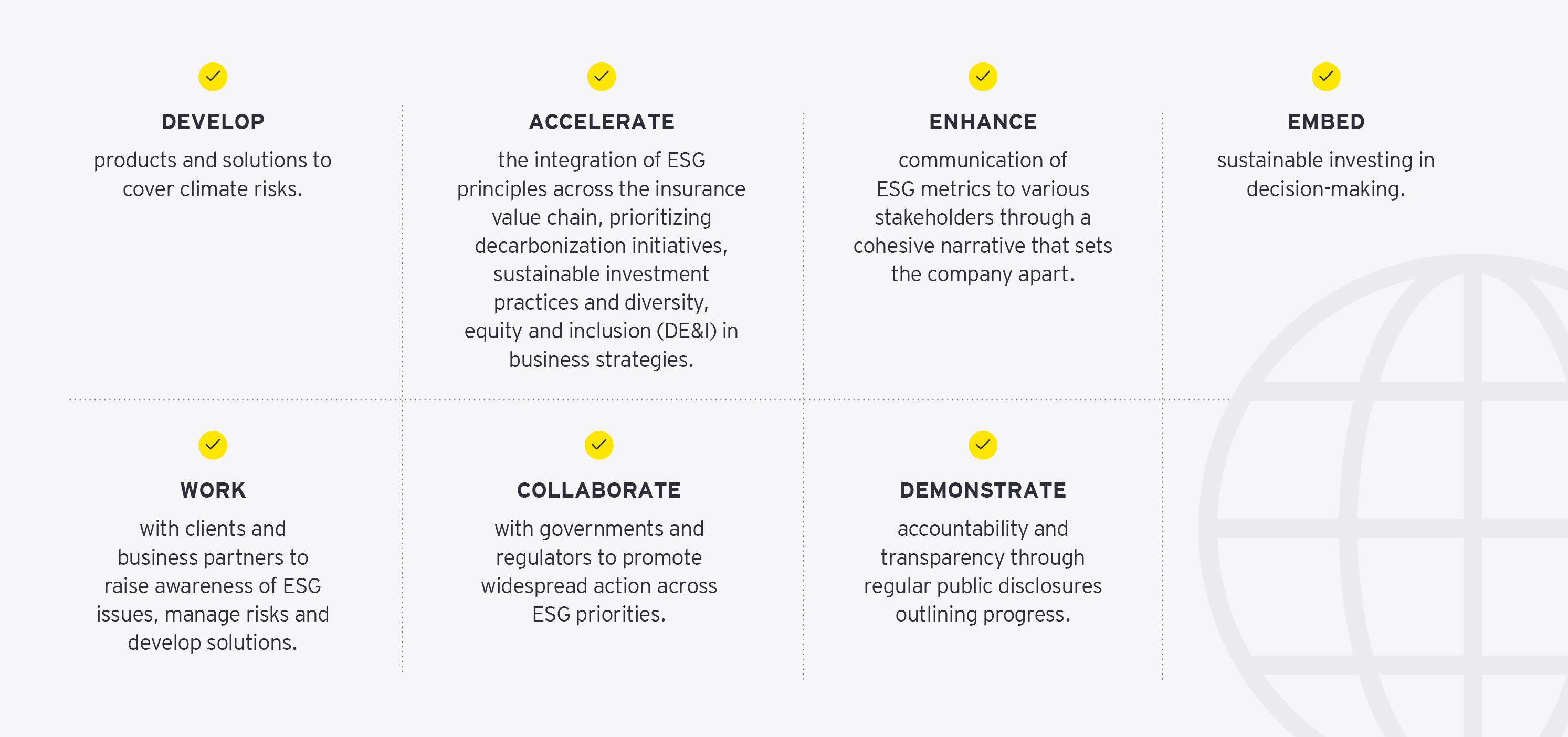

Making ESG part of the organizational and operational DNA can take many shapes and forms. That includes:

What’s next on the horizon?

Continue to put ESG considerations at the centre of business decisions. Insurance companies with a clear sustainability agenda will lead the way to build an ecofriendly future and will contribute to positive societal changes for Canadian customers and employees.

The insurers of tomorrow should be built around strong pillars that will propel the industry in an era where customers, employees and the environment will be at the centre of product design and business imperatives.

Summary

To thrive in a future where customers, employees and the environment are key factors in product design and business success, insurance companies must establish solid foundations. These foundations will drive the industry forward and position insurers as leaders in a new era.