EY se refiere a la organización global, y puede referirse a una o más, de las firmas miembro de Ernst & Young Global Limited, cada una de las cuales es una entidad legal independiente. Ernst & Young Global Limited, una compañía británica limitada por garantía, no brinda servicios a los clientes.

The difference between good investment decisions and bad investment decisions is the right information at the right time. Peru is growing rapidly, creating new and better business opportunities. This changing environment requires stakeholders to keep updated with recent data to make better decisions

Paulo Pantigoso

Country Managing Partner, EY Peru

Peru, a country of 32.5 million people, is one of Latin America’s fastest-growing economies. It has rich deposits of copper, gold, silver, lead, zinc, natural gas and petroleum. It is also a very diverse country due to climatic, natural and cultural variations of its regions. Peru’s economy reflects its varied geography, an arid coastal region, the Andes further inland, and tropical lands bordering Colombia and Brazil. Abundant mineral resources are found mainly in the mountainous areas, and Peru’s coastal waters provide excellent fishing grounds.

Mining is the dominant sector of the Peruvian economy. Substantial additional investment has flowed to the sector over the past 20 years. As a result, there has been an increase in exploration and development activities. Peru is among the major producers of mineral commodities in the world. They account for nearly 60% of the country’s total exports. Copper and gold are the most important mineral exports by value.

Foreign investment legislation and trends in Peru

The Peruvian government is committed to pursuing an investor-friendly policy climate. It actively seeks to attract both foreign and domestic investment in all sectors of the economy. It has therefore taken the necessary steps to establish a consistent investment policy which eliminates all obstacles for foreign investors, with the result that now Peru is considered to have one of the most open investment regimes in the world.

To reduce the political risk perception of the country, Peru has adopted a legal framework for investments which offers automatic investment authorization and establishes the necessary economic stability rules to protect private investors from arbitrary changes in the legal terms and conditions of their ventures and reduces government interference with economic activities.

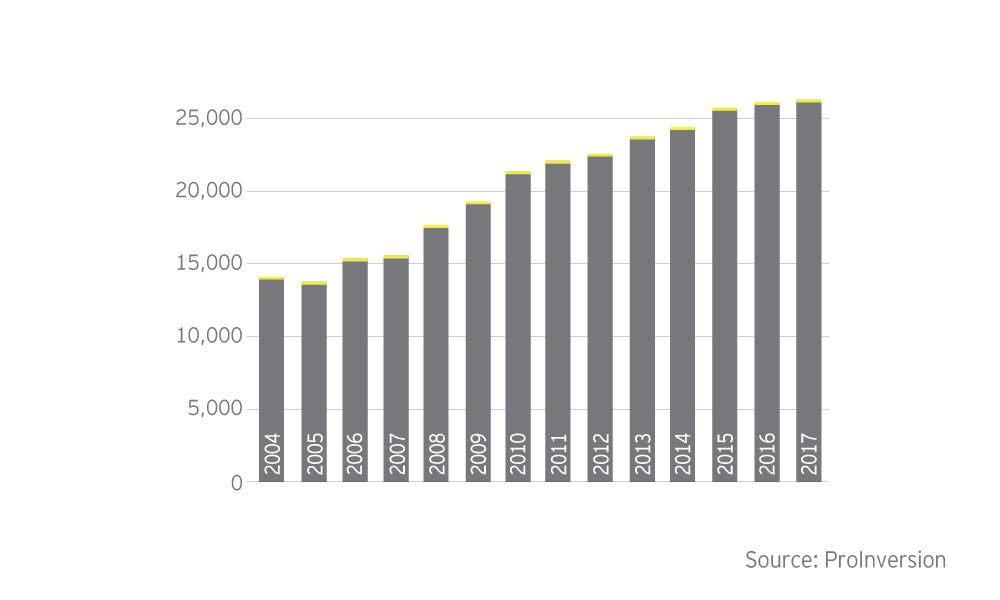

Foreign direct investment in USD millions

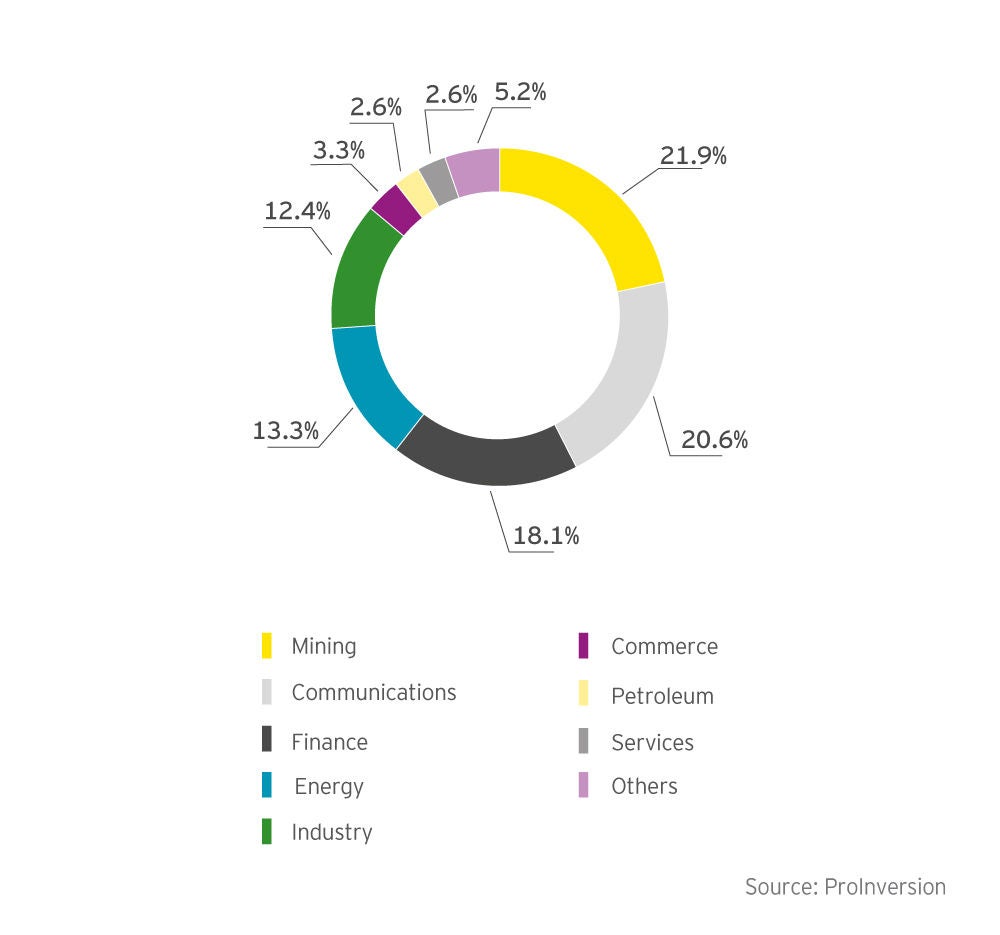

Foreign direct investment by industry (2017)

Mining potential

Increasingly, Peru is being targeted for inbound investment and is perceived by international mining and metals companies as a global player. This is partly due to the scale of opportunity where most of its territory is yet to be subjected to vast exploration and partly because of its attractive legislation and regulatory environment.

Although Peru is endowed with large deposits of a variety of mineral resources, it is estimated that only 0.30% of the country’s total territory is being explored. Likewise, only a small percentage of Peru’s mineral reserves are being exploited. It is estimated that only 1% of its territory is under exploitation. According to recent mining statistics, Peru’s production rates are minimal with regards to the country’s mineral potential. However, through modern techniques and equipment, a vast potential of diverse marketable minerals is increasingly becoming available from previously inaccessible regions.

Peru has numerous mineralized belts and mineral provinces, a wide variety of world-class ore deposits and a very dynamic mining community. It is regarded as one of the countries with largest and diversified mineral resources in the world. In addition, Peru has an excellent geographical location, in the center of South America, with easy access to the Asian and North American markets.

Within Latin America, Peru has, perhaps, the greatest untapped potential for new discoveries and production. Peru’s clear and simple mining law and excellent geological potential has helped the country to attract one of the largest budgets for minerals explorations and development in the world. However, it is believed that Peru has the capacity to double or triple current level of output, especially in base metals.

Foreign direct investment by industry (2017)

|

Metal |

Metric Tons |

|

|---|---|---|

|

Copper (in thousands) |

81,000 |

|

|

Gold |

|

|

|

Zinc (in thousands) |

|

|

|

Silver |

93,000 |

|

|

Lead (in thousands) |

|

|

|

Tin |

105,000 |

|

|

Molybdenum (in thousands) |

2,200 |

Source: U.S. Geological Survey

Peru is a global leader in the mining industry, which makes it a natural choice for international investors. It is one of the world’s biggest producers of base and precious metals. Currently, it is the second largest producer of copper in the world and stands amongst the top four producers for silver, lead, zinc, tin and molybdenum. International investors are a crucial part of the growth and success of Peru’s exploration and mining industry. Peru welcomes foreign investment with an open and stable mining regulatory environment. A foreign investment law guarantees the security of foreign and domestic investments. Furthermore, Peru is consistently undertaking measures to improve its business climate to attract more investment. We invite you to contact us with your questions and we wish you all the best with your mining investment opportunities in Peru.

Marcial García

Transfer Pricing and Tax Services Partner, Mining & Metals Leader, EY Peru

Peru Mining Metals Investment Guide 2019/2020

Resumen

Peru is growing rapidly, creating new and better business opportunities. This changing environment requires stakeholders to keep updated with recent data to make better decisions, it is for this reason that we present this Mining & Metals Investment Guide.