EY se refiere a la organización global, y puede referirse a una o más, de las firmas miembro de Ernst & Young Global Limited, cada una de las cuales es una entidad legal independiente. Ernst & Young Global Limited, una compañía británica limitada por garantía, no brinda servicios a los clientes.

Publication of EY Peru, ProInversión and the Peruvian Ministry of Foreign Affairs for the promotion of investment in infrastructure in Peru for the year 2022/2023.

We are living challenging times for everyone, not only in Peru but in the entire world. Times that requires, probably more than ever, promoting public and private investment in infrastructure in all countries but even more in emerging ones, such as Peru, to close the infrastructure gap and provide quality and adequate service to our citizens.

This is the main purpose of the Guide to investing in infrastructure projects in Peru 2022/2023 that we have prepared, aimed as being as useful tool for any private investors, banks and other financial institutions, multilateral organizations and governmental entities interested in exploring and assessing Peruvian investment opportunities in infrastructure. It is the result of a joint effort from a diverse team, with different background experiences and perspectives, but mostly with the same passion for promoting Peruvian investment opportunities.

At a time when the world is going through political instability due to international conflicts and a slow post-pandemic recovery, it is well known that public investment is a great driving force to stimulate the market, in terms of providing rapidly private companies new options to offer their goods and services, as well as creating new jobs opportunities.

It should be highlighted that the focus is not developing public infrastructure itself. There is an extremely large gap in essential services, deeply emphasized with the pandemic. Thus, each project is a step toward improving quality of life for citizens. With this clear purpose in mind, all the endeavor should be driven to deliver high quality public services. Even though great works are expected, operation and maintenance with the highest standard possible, are also necessary to assure increasing living conditions.

We hope this guide would provide an holistic panorama of Peruvian investment climate and would help as a starting point for canalizing your interest in our country. We invite you to enjoy this guide and contact us should you have questions or need special assistance.

Infrastructure Investment

It is expected that Peru will realize its full economic potential after reducing its infrastructure gap and bottlenecks. In the last decade, Peru has begun to take the necessary measures to improve its infrastructure in transport facilities, electricity, water and communications in order to promote new investments which will contribute to the development of the productive sectors of the country.

Peru is focused on promoting the development of the infrastructure for its positive impact in the GDP through the production of transport services, the supply of water, sanitation and electricity, health, telecommunications, among others. Infrastructure investments generate positive externalities within the country that will accelerate long-term growth. Additionally, the investment in infrastructure indirectly influence the productivity of the companies and all the supply chain in the economy so that all productive factors increase their productivity. In this sense, companies will benefit from the increase of competitiveness by the reduction of costs, increase of economies of scale, efficiency on supply chain, extension of storage and facility of distribution. Not only companies will benefit but also the population will increase their quality of life by covering their basic needs and accessing better public services, necessary to get out of poverty permanently. Further, the developing of infrastructure has a positive impact on human capital and its competitiveness in the medium and long term.

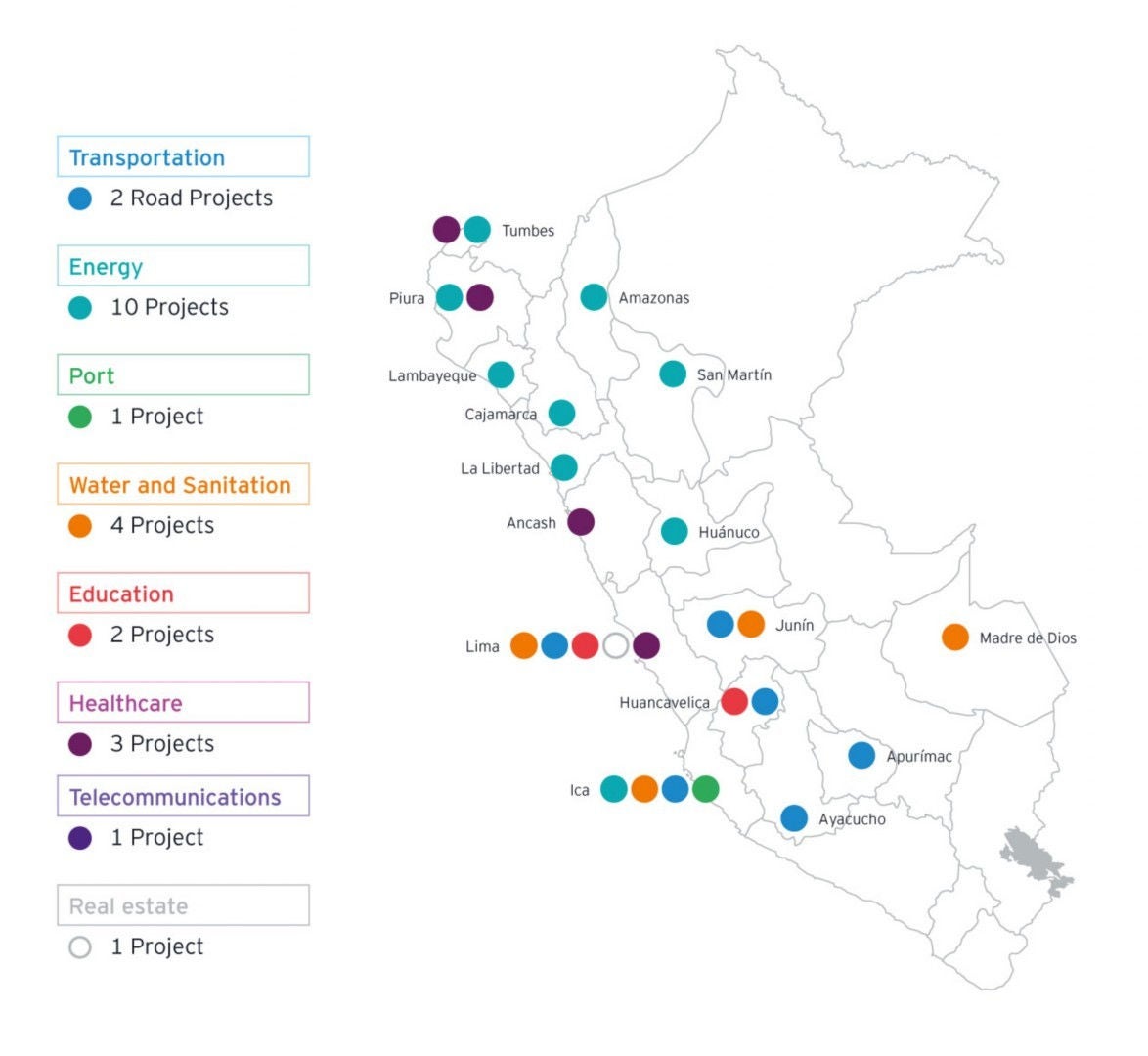

The Project Pipeline (2022 – 2023) under the Public Private Partnerships mechanism includes a total of 24 projects distributed in different sectors with a total estimated investment of USD 7.3 billion. The main sectors by investment amount are Transportation (2 project), Energy (10 projects), Port (1 project), Water and Sanitation (4 projects), Education (2 projects), Healthcare (3 projects), Telecommunications (1 project) and Real Estate (1 project).

The government is working to increase public and private investment in infrastructure and creating the mechanisms to give continuity to its policies. To close the infrastructure gap, different investment mechanisms might be used: traditional Public Works, Public-Private Partnerships (PPPs), Work for Taxes (WT), and Government-to-Government (G2G) agreements.

Both the public and private sectors are involved in the economic development and social welfare of the country. Peru is recognized in the international community for providing favorable conditions to take advantage of the opportunities in the development of its infrastructure.

Investment Promotion Conditions

a. Foreign Investment legislation and trends in Peru

Peru seeks to attract both domestic and foreign investment in all sectors of the economy. To achieve this, it has taken the necessary steps to establish a consistent investment policy that eliminates any barriers that foreign investors may face. As a result, Peru is considered a country with one of the most open investment systems in the world.

Peru has adopted a legal framework for investments that requires no previous authorization for foreign investment. In this regard, foreign investments are allowed without restrictions in the large majority of economic activities. The activities with restrictions are very specific, such as air transportation, sea transportation, private safety and surveillance and the manufacture of war weaponry. Additionally, Peru has a legal framework to protect the economic stability of investors and to reduce government interference in economic activities.

The Peruvian government guarantees legal stability to national and foreign investors with regard to the legislation governing income tax and specifically, distribution of dividends. Foreign investors with the right to obtain legal and tax stability are those willing to invest in Peru for a period of no less than two years and for a minimum amount of USD10 million in the Mining and/or Oil & Gas sectors, or USD 5 million in any other economic activity.

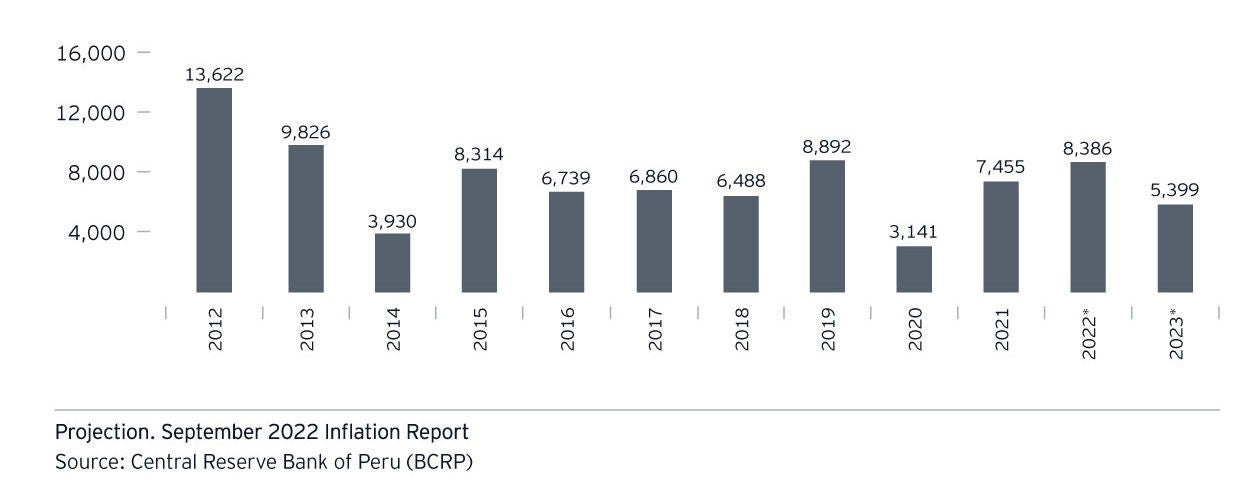

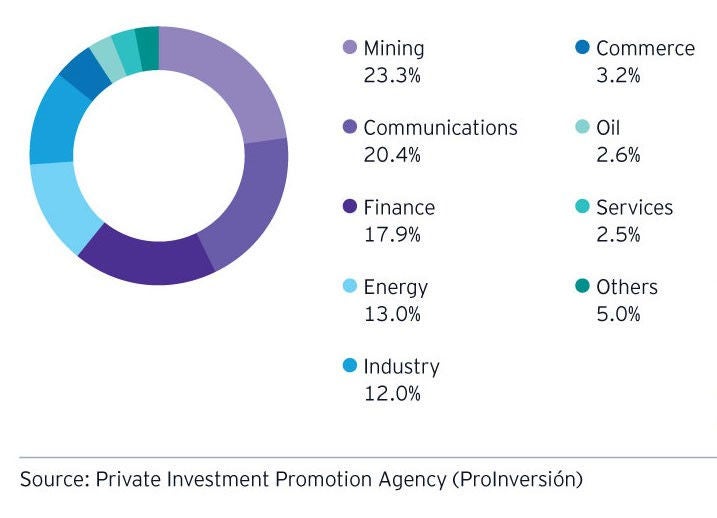

As a result, the Central Reserve Bank of Peru (BCRP) reported that the stock of Foreign Direct Investment (FDI) inflow reached USD7.5 billion in 2021. FDI is concentrated in mining, finance, communications, energy and industry.

Foreign Direct Investment (in US$ millions)

b. Recognition of favorable investment climate

According to the last Competitiveness Index of the World Economic Forum, Peru is among the top countries in Latin America in terms of macroeconomic environment, market size, financial market development, labor market efficiency, goods market efficiency, and technological preparation, among others.

Foreign Direct Investment by Industry 2021

c. Trade agreements

Peru's development strategy is based on an economy opened to the world and competitive in its export offer. It has been a successful strategy that has permitted the country to consolidate its foreign trade in goods and services as an instrument for economic development and the reduction of poverty.

Peru has a total of 22 free trade agreements and economic integration agreements (TLCs & EIAs) in force with the Andean Community, Mercosur, the Pacific Alliance, the European Free Trade Association (EFTA), Australia, Canada, Chile, China, South Korea, Costa Rica, Cuba, United States, Honduras, Japan, Mexico, Panama, United Kingdom, Singapore, Thailand, the European Union, Venezuela and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). With the CPTPP, it has been possible to have preferential access to four countries with which Peru did not have a trade agreement, including New Zealand, Vietnam, Brunei and Malaysia.

Infrastructure potential

a. Infrastructure gap

The National Infrastructure Plan for Competitiveness identifies a basic access infrastructure gap of USD 110 billion (S/363 billion) approximately. This estimate does not consider qualitative elements such as water quality, the number of hours of access to electricity, the schools' structures condition, among others. Therefore, this infrastructure gap would be underestimated assuming Peru aims to be a developed country.

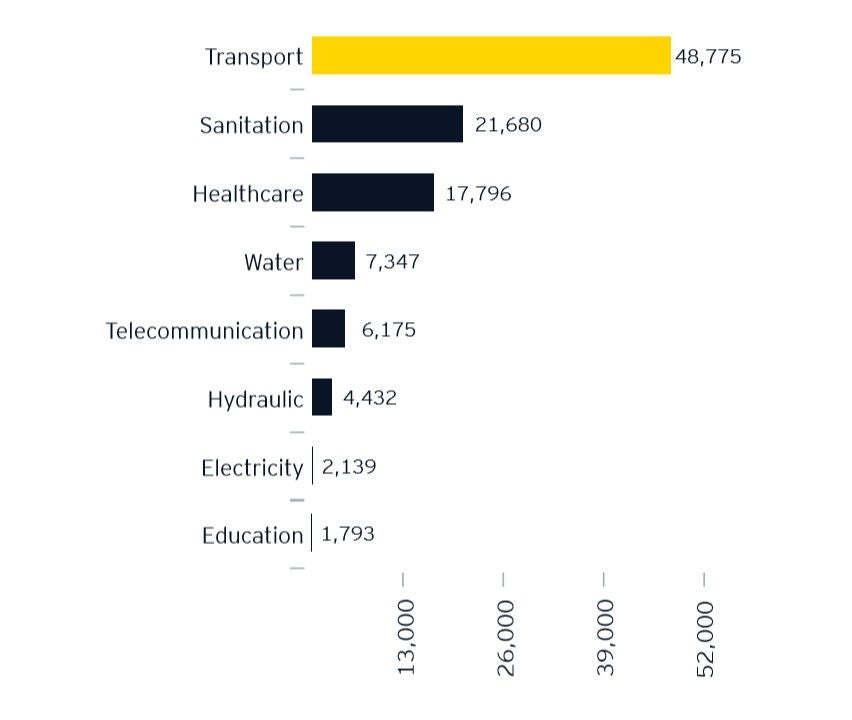

Infrastructure Gap – Short Term (in USD millions)

It has been calculated considering a five years horizon, at approximately US$35 billion, distributed among the following sectors: transport (31%), sanitation (25%), healthcare (24%), telecommunications (10%), hydraulic (6%) and water (5%).

Infrastructure Gap – Long Term (in USD millions)

This gap considered a twenty years horizon and is estimated at approximately US$110 billion, distributed among the following sectors: transport (44%), sanitation (20%), healthcare (16%), water (7%), telecommunications (6%), hydraulic (4%),electricity (2%) and education (2%).

b. Overview by sector

Guide to investing in infrastructure projects in Peru 2022/2023

Contacto

Resumen

The Guide to investing in infrastructure projects in Peru 2022/2023 was aimed as being as useful tool for any private investors, banks and other financial institutions, multilateral organizations and governmental entities interested in exploring and assessing Peruvian investment opportunities in infrastructure. It is the result of a joint effort from a diverse team, with different background experiences and perspectives, but mostly with the same passion for promoting Peruvian investment opportunities.