Orphan drugs are another area of specialized drug products. Based on the small pool of potential patients, such products are typically expensive to produce, putting greater onus on managing VAT and customs costs. Several items impact the VAT and customs treatment of the supply chain, which are applicable to all drug products, but they are particularly important for orphan drugs, given the high costs of development and production. From a customs valuation perspective, often orphan drugs are not subject to a sale when moving cross-border. This creates an additional compliance burden to the importer to determine the appropriate method of customs valuation. Given the high value of many orphan drugs coupled with high duty and VAT rates imposed in certain jurisdictions, determining a defensible, compliant value to assign to the goods becomes increasingly important.

Impact of cost and pricing under VAT and customs

The high value of drug products or their components should be considered by life sciences companies when moved cross-border for further manufacturing, storage, packaging or clinical trials (i.e., transactions without a sale). Moving drugs cross-border without a sale can result in additional customs valuation considerations. The general method of customs valuation and transaction value — the transaction value method — becomes inapplicable.

Applying another method of customs valuation not only creates additional administrative burdens but also creates the challenge of determining a defensible, yet reasonable customs value. Customs values are required for customs declarations and serve as the basis for the applicable customs duty and import VAT. Because customs values are based on cost only and nominal values are not accepted, customs valuation for drugs can become complex. Without sufficient planning, additional costs may be incurred, including penalties and interest.

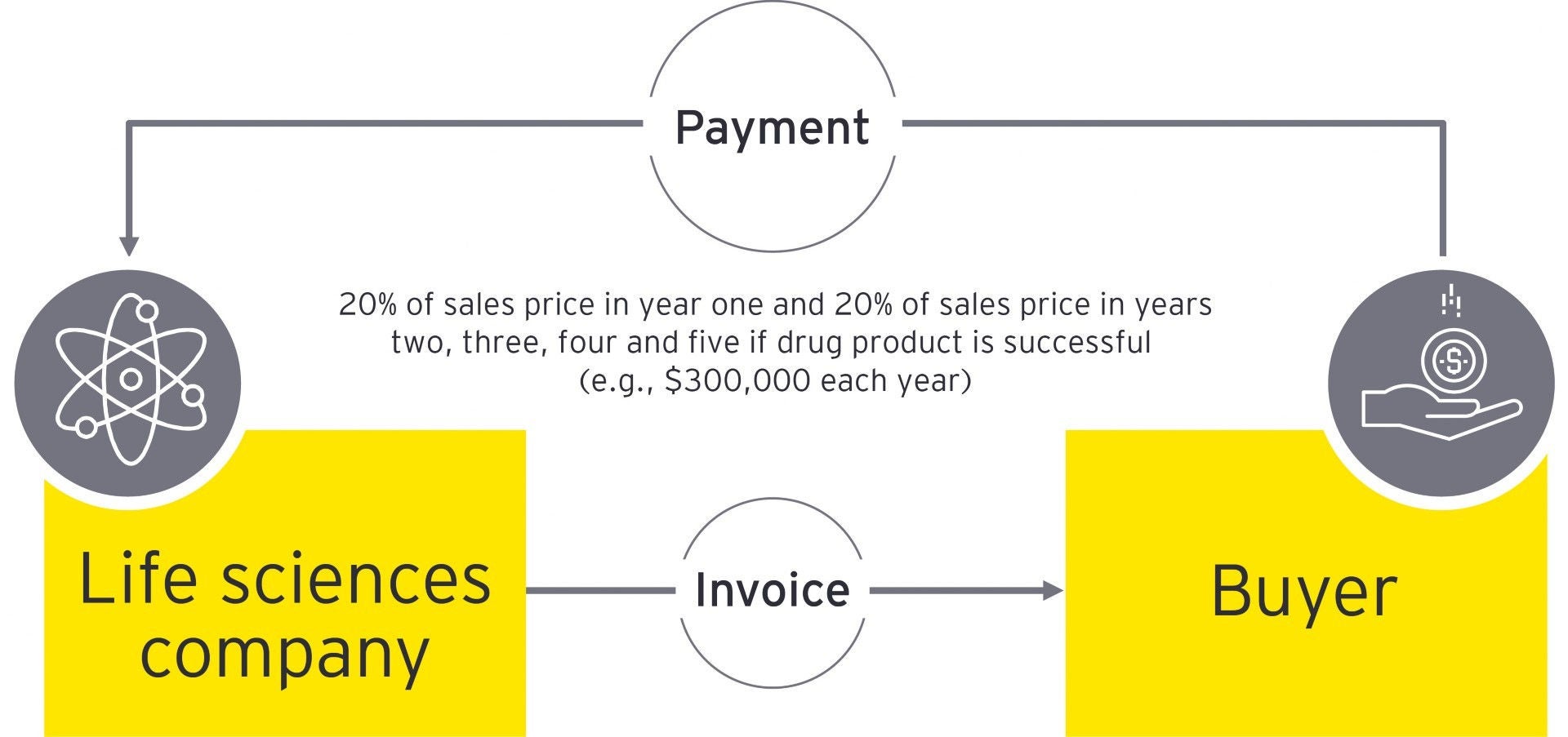

Conditional payments under VAT

For high-value drug products, buyers may insist on payment plans or conditions rather than full payment (e.g., splitting the payment over five years with payment for each year being conditional on a certain outcome or payment depends on successful treatment). This is specifically relevant for VAT when the drug product is administered in a single, up-front treatment. VAT may need to be paid when the drug product is administered on the full price agreed vs. when payment is collected. This can create a cash flow issue where VAT is to be paid up front on the full contractual price even though only a portion of the payment has been received. This also gives rise to the question of whether any VAT can be clawed back should payments in subsequent years not be made (e.g., where the conditions for successful treatment are not fulfilled). See example below.