EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Renewable energy strategy and power purchase agreements

What EY can do for you

We can help you answer these questions:

- What is my opportunity within renewable energy?

- What is the right renewable energy strategy for my organization?

- How can I reach my organization’s ambitious renewable electricity targets, and at the same time achieve power price security and drive cost savings?

- How can I also increase the proportion of renewable heat while maintaining the quality of ambient and process heat?

A range of options: renewable energy opportunities will exist onsite and offsite across multiple technologies and countries. Companies typically need a portfolio of renewable options to reach strategic targets, achieve significant savings and mitigate various risks across heating and cooling, and electricity.

PPA implementation: long-term Power Purchase Agreements (PPAs) are an increasingly popular way for large corporates to reach ambitious renewable electricity targets, and at the same time achieve power price security and cost savings.

How EY can help

The EY approach to providing renewable energy advice:

EY provides global PPA services including strategy formulation, project origination, structuring and evaluation, all underpinned by robust financial and commercial analysis – and reflecting increasing corporate interest, we can now encompass heat and supply chain emissions in our advisory scope too.

EY has first-hand PPA experience (physical and virtual structures) in multiple countries across Europe, North America, Latin America, and Asia-Pacific, for companies in a wide range of industries: consumer products, manufacturing, retail, telecoms, technology, financial services and pharma, as well as some public sector organizations.

EY analysis reveals top 30 PPA markets

Download EY’s latest corporate PPA Index (pdf) published in RECAI – which uses key parameters from four pillars to analyse and rank the growth potential of a nation’s corporate PPA market.

The table below illustrates some of our renewable energy strategy and PPA implementation services through a typical corporate journey.

Renewables Strategy – 90 days |

PPA Implementation – 120 days |

||

|---|---|---|---|

Opportunity identification and strategy development |

Market test and business case development |

Competitive tender/ RfP process |

Contract negotiations and project implementation |

|

Benchmark current “baseline” energy state against peers |

Analyse short-listed countries/ technologies |

Non-Disclosure Agreements for short-list |

Work to draft contract with Legal Advisor |

|

Challenge existing targets and potentially set new ones |

Market sounding for prioritized market countries and contractual options |

Prepare RfP tender document |

Due diligence on commercial aspects of contract |

|

Assess countries across operating portfolio |

Issue teaser to market to assess developer appetite for corporate requirements |

Approach the market with competitive tender |

Negotiations with developer |

|

Evaluate various technologies |

Financial modelling of initial inputs to develop case for change against business as usual |

Evaluate bids |

For offsite physical PPA – negotiate sleeving arrangements with retail power supplier |

|

Appraise available contractual options |

Further Net Present Value modelling against business as usual |

Finalize contract documentation |

|

|

For offsite physical PPA – start discussions with licensed supplier |

The Team

Our latest thinking

Three ways to move energy consumers from interest to action

Consumers are more interested than ever in clean energy options but 70% say they won’t spend more of their time or money to take action. Read more.

How bold action can accelerate the world’s multiple energy transitions

Our energy system is reshaping at speed, but in different ways across different markets. Three accelerators can fast-track change. Learn more.

Are the global winds of change sending offshore in a new direction?

Turbulent times in the offshore wind sector could change the way large-scale energy projects are built and funded in future. Read more in RECAI 62.

Will local ambition fast-track or frustrate the global energy transition?

The Inflation Reduction Act has triggered competition in renewables, but could unbalance international capital allocation. Read more in RECAI 61.

Why wavering consumer confidence could stall the energy transition

The Energy Consumer Confidence Index reveals that the impact of the energy transition is hitting home. Discover more.

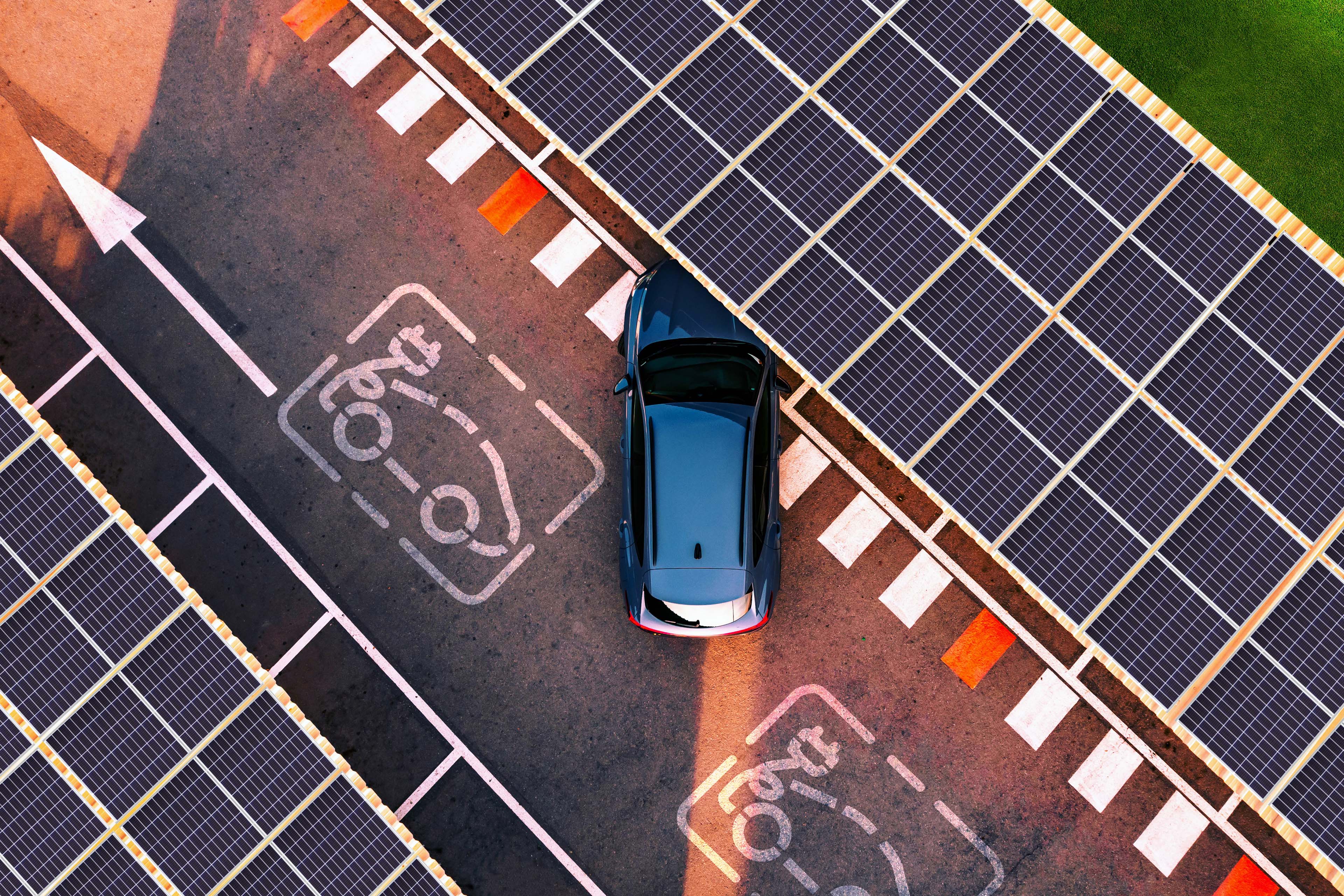

Six essentials for mainstream EV adoption

EV sales are booming, but the value chain is under pressure. The transition to eMobility depends on collaboration across the ecosystem. Learn more.

Why EV charging is powered by electricity but enabled by digital

As demand for EV charging intensifies, energy companies that enter the market must match their digital strategy to their business strategy. Read more.

Does the need for energy security challenge the quest for net zero?

The power market is in flux and gas prices are high, but can green technologies and alternative fuels offer energy security? Read more in RECAI 59.

Contact us

Contact us to find out more.