EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Wealth & Asset Management

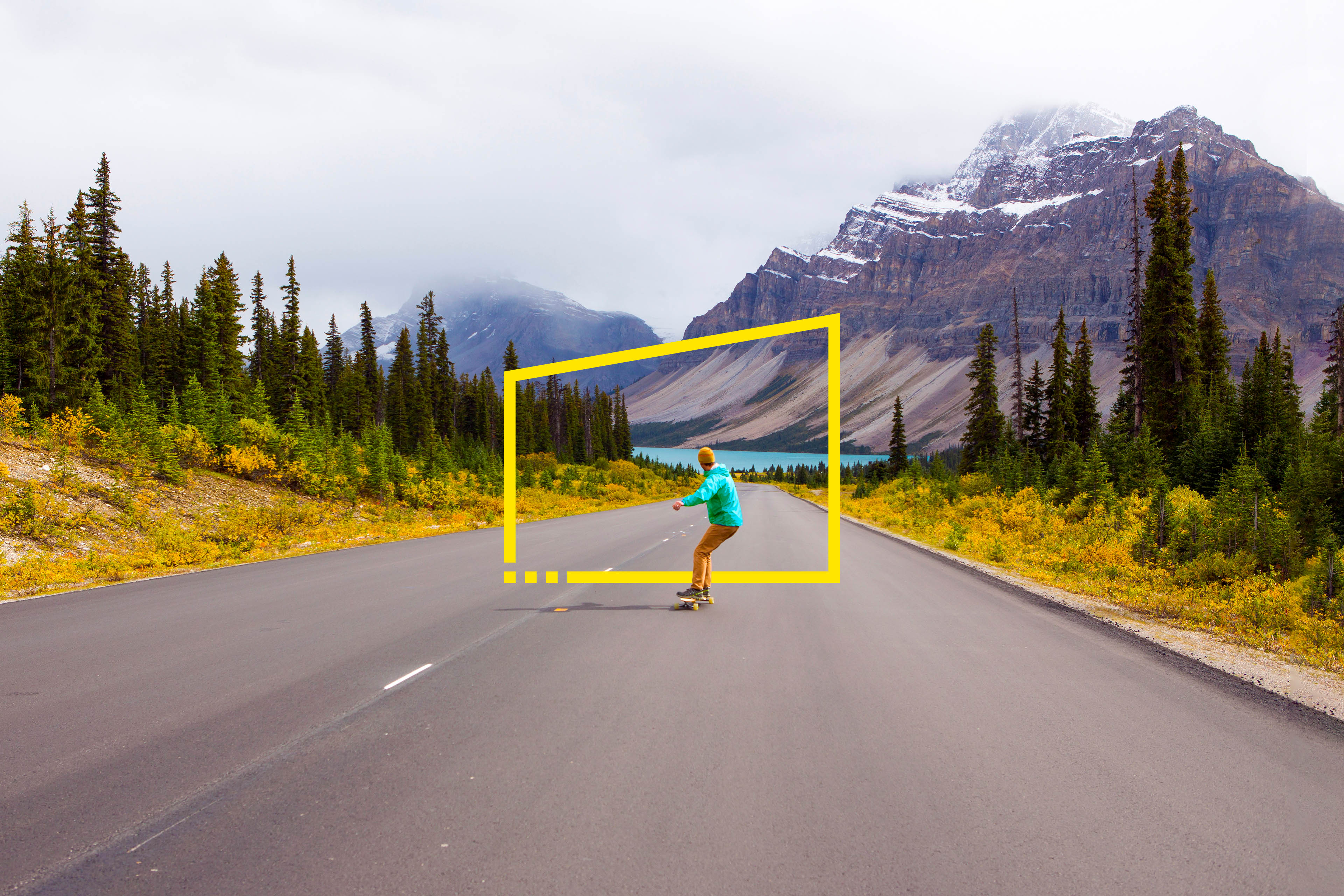

We help investment firms anticipate what’s after what’s next.

Our latest thinking

What UK financial services regulation means for firms in 2026

UK financial services regulation balances growth and stability. Firms must focus on financial crime, operational resilience, AI and volatility. Learn more.

Why strategic partnerships are key for wealth managers in 2025

Discover how strategic partnerships are transforming WAM, driving growth, agility, and innovation through collaboration, specialization and tech adoption.

How data-driven strategies are transforming asset management

Discover how data-driven strategies are transforming asset management through secure data sharing and marketplace models in our latest whitepaper.

Why wealth and asset managers are transforming their data approaches

By implementing strategies that harness the power of data, wealth and asset managers can improve performance and efficiency. Find out more.

How to navigate the growth agenda of UK financial services regulation

Learn how UK financial firms can navigate regulatory compliance in 2025, focussing on the FCA, PRA, growth, AI, Consumer Duty and outcomes-based approaches.

Five priorities for winning with GenAI in wealth and asset management

Wealth and asset managers have the opportunity to reimagine their business models and transform their operations with GenAI.

Top 10 resolutions for wealth and asset management success in 2024

Wealth and asset management firms should aim to be “the best versions of themselves” in what promises to be another challenging year. Read more.

Are you reframing the future of asset management or is it reframing you?

AI can help unlock the transformational change that asset managers need to remain relevant in a radically different future. Learn more.

How will wealth managers deliver personal service in a virtual world?

The 2023 EY Global Wealth Research Report imagines the next generation of hybrid engagement. How can wealth managers harness the potential benefits?

How can today’s millennial investors drive tomorrow’s business growth?

The 2023 EY Global Wealth Research shines a light on unique features of younger investors. How can wealth managers build trust with this vital group?

Why the UK must act to continue leading European financial investment

Although the UK maintains its 20-year position as Europe’s top financial services investment destination, its lead has closed significantly. Know more

How the UK impact investing sector measures up

Impact investing opens opportunities for growth. Read more.

Why confidence in the UK’s financial sector has hit a five-year high

Confidence in the UK’s financial services sector has hit a five-year high. Find out more.

How can sustainable finance transform 2050 pledges into real-world impact?

Financial institutions need a framework that allows them to anticipate seismic economic transformation and adapt their strategy accordingly. Learn more.

Explore our case studies

Transforming a private bank for customer centricity and innovation

EY teams helped a leading private bank blend a high-touch and high-tech visionary approach. Learn more in this case study.

How data modernization can benefit advisors and clients

Creating a modern data architecture has enabled a wealth manager to provide a consistent digital experience. Learn more in this case study.

How wealth managers transform service models efficiently

EY helped a global wealth manager create innovative services and initiate a digital transformation to support its client-first ambition. Learn more.

How standardization can build a platform for growth

Across three continents, a leading asset manager bridged the gap by building a truly global operating model.

How EY can help

-

EY-Parthenon Financial Services Strategy Consulting can help create value for banking and capital markets, wealth and asset management, and insurance firms.

Read more -

A platform to help wealth and asset managers harness data and technology to generate client- centric advice. Learn more.

Read more -

Our team can help wealth managers and private banks transform and grow their business. Find out more.

Read more -

Our strategic cost transformation team can help wealth and asset managers transform costs while sustaining cost management practices across the value chain.

Read more -

We help you effectively harness the power of technology to simplify, rationalize and centralize your firm’s operations, clearing the way to improve efficiency and extend product capabilities to attract new investments.

Read more -

We help you implement strategies to improve efficiency across your firm’s value chain, increasing margins while reducing long-term costs and risk.

Read more -

We help you forge stronger client relationships built on performance, engagement and trust.

Read more -

WAMapps is a single, secure platform that enhances risk management across audit, reporting and tax for asset management and wealth management firms. It leads to sharper insights, more flexible reporting and smoother workflows.

Read more -

EY Cloud Data IQ is a cloud-based investment management data lake, supported by a managed service.

Read more -

EY sustainable finance teams helps financial services companies define sustainability goals that create value and make a measurable difference. Learn more.

Read more

Direct to your inbox

Stay up to date with our Editor‘s picks newsletter.