EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Discover how EY's global renewables team can help your business transition to the world of renewable energy.

Read more

The world’s multiple energy transitions are gaining pace. But progress must significantly accelerate if the world is to meet climate goals, including the commitment made at COP28 to triple renewable energy capacity by 2030.

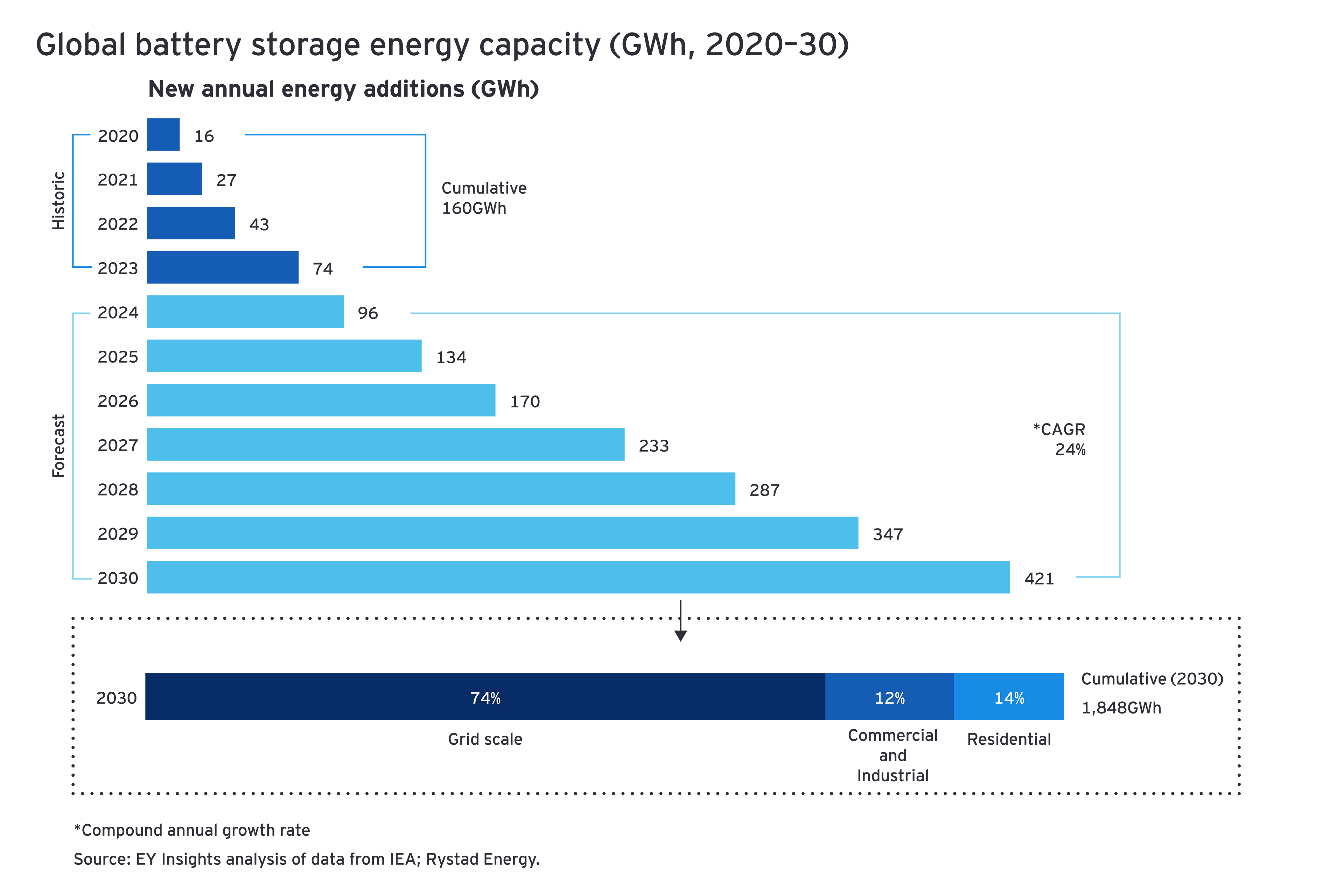

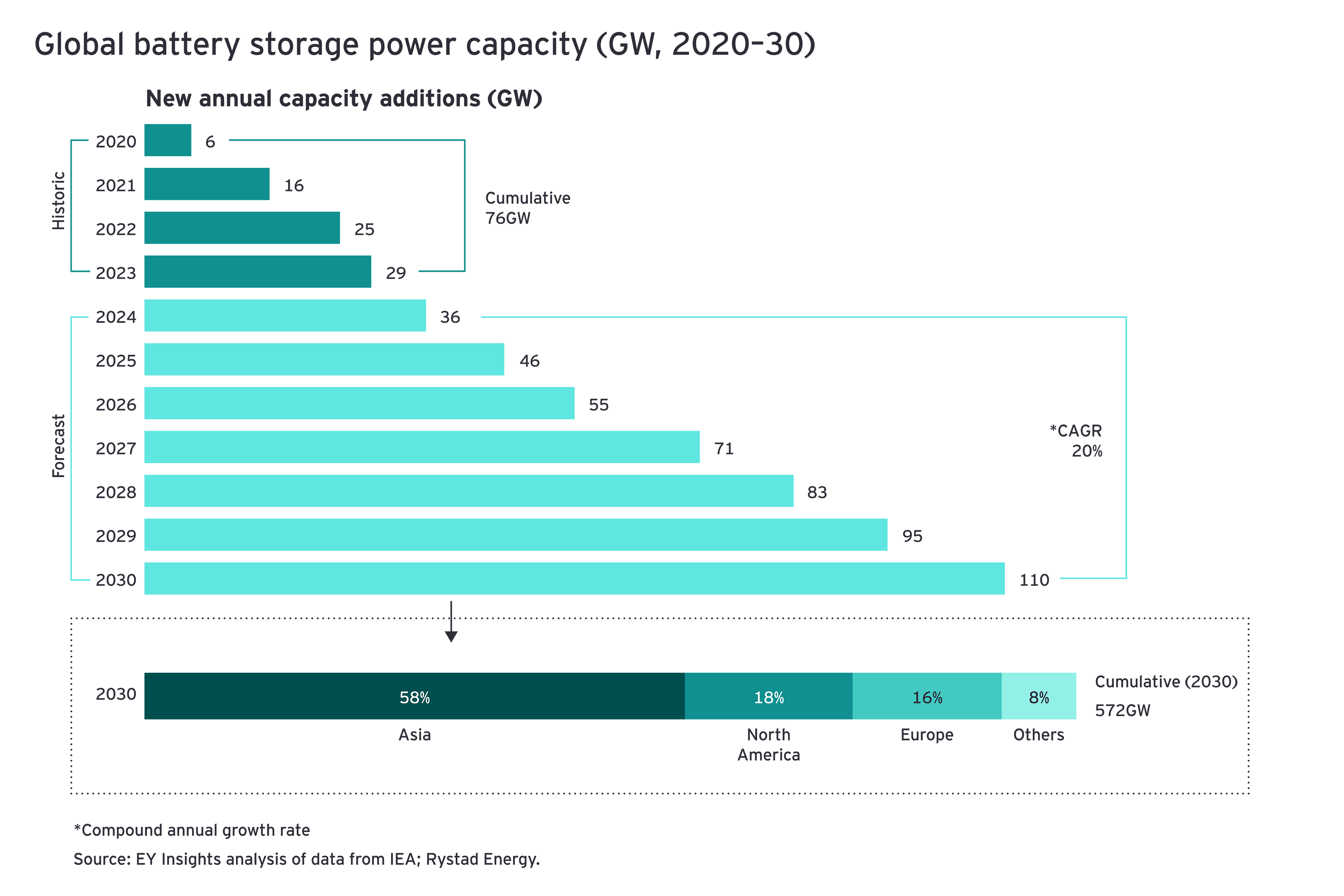

Rapid electrification, particularly in transport and heating, means that electricity will make up the majority of all energy demand by 2050, usurping gas and other fossil fuels — rising to 60% in Europe from around 20% today, for example.6 But this depends on a reliable, resilient electricity grid. Deploying BESS at grid scale can help achieve this, solving multiple energy system challenges. Specifically, BESS can decouple consumption from generation, reduce unnecessary energy exchange with the transmission grid and provide grid-serving operation. Demand for BESS is growing fast, with deployment forecast to quadruple to 572GW/1,848GWh by 2030, much of this adopted at grid scale.7