EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

While semiconductors are fundamental components of today’s technology, supply chain vulnerabilities can impact economic security. Redefining and diversifying supply chains are urgent and critical factors to achieving sustainable growth.

In brief

- Importance of semiconductors but vulnerability of supply chains

- Heightened risk of supply disruption due to geopolitical tension

- Enhancing economic security through diversification and greater independence

- Staying competitive by leveraging technological advancements and fostering global partnerships

The semiconductor industry today and its importance to the world

The semiconductor industry is a technological backbone of the modern world. From smartphones and computers to automobiles and medical devices, semiconductors are essential to technological innovation. These tiny chips drive the information age forward, while contributing to economic growth and spurring innovation. However, COVID-19 and escalating geopolitical tensions have exposed vulnerabilities in semiconductor supply chains with associated delays impacting a wide swath of industries, including automobile and consumer electronics manufacturers, and leading to widespread economic disruption. More recently, lead times in the automobile industry have improved thanks to the easing of the chip shortage but there is a need to monitor whether this is due to improvements in supply chain management (SCM) or whether it is the result of a rebalancing of market supply and demand. If there are positive outcomes emerging from enhancements to supply chain management, the industry is probably achieving some success in addressing its current difficulties.

With markets constantly evolving, businesses must adapt their semiconductor supply chains to sustain growth and maintain competitiveness. Semiconductors are integral to all cutting-edge technology, playing an instrumental role in the development of new smartphones, automobiles and medical devices. Given this role, building efficient and resilient semiconductor supply chains is key to market success. If we are to safeguard our modern way of life, supply chains for semiconductors must be resilient and function reliably. In recent years, semiconductor production has been clustered in a select group of countries and regions, which has been recognized as a supply chain risk. Geopolitical conflicts and natural disasters have the potential to cause production stoppages, which could result in global shortages of semiconductors. For these reasons, diversifying supply chains and bolstering domestic production capacity are essential components of enhancing economic security.

In addition, advances in semiconductor technology have a significant impact on market competition. Companies capable of developing and producing cutting-edge semiconductors have the potential to establish new markets and create added value for their businesses. Strategic investment in R&D and the cultivation of technical expertise are essential for ensuring sustainable growth and long-term success.

Beyond this, semiconductor supply chains are also becoming increasingly important in terms of cybersecurity. Secure chips are the foundation of data protection, ensuring privacy and have an impact on national security. There is a need, therefore, for a supply of semiconductors from reliable sources.

As semiconductors are the foundation of corporate stability and growth, strategies to strengthen and safeguard semiconductor supply chains are now a crucial aspect of how to derisk those supply chains. Our examination of the present state of the semiconductor sector provides practical approaches to support sustainable growth. From a global perspective, we also highlight the intrinsic value of semiconductors for both business and consumers and underscore their role as a fundamental component that drives our modern world.

Supply chain vulnerabilities and the impact on economic security

This vulnerability may have a direct impact on maintaining economic security.

For context, the manufacturing of semiconductors requires both sophisticated technology and employees with specialized knowledge, as well as substantial capital investment in production facilities. For this reason, production bases are clustered in a limited number of locations, particularly Taiwan, South Korea and China, which currently dominate global chip markets. The concentration of supply chains in specific regions exposes them to potential risks, such as natural disasters, geopolitical tension and trade friction.

As an example, geopolitical tension in the Taiwan Strait could precipitate global supply uncertainties, given that Taiwan is responsible for the majority of the world's most advanced semiconductor manufacturing capacity. Global crises like the COVID-19 pandemic have also disrupted supply networks, severely impacting a number of sectors such as the automobile and electronics industries.

Hideki Wakabayashi, Professor, Graduate School of Management, Department of Management of Technology, Tokyo University of Science has expressed concerns about key vulnerabilities in the current semiconductor supply chain. He notes that the supply chain in Japan has shifted from the relatively closed, vertically integrated model of 40 to 50 years ago to the current model with horizontal division of labor centered on logic semiconductors. He highlights the heavy dependence on Taiwan and strong connections with countries such as China, the Philippines, and Indonesia, and emphasizes that this has led to a more complicated manufacturing process, with takt time increasing from about one and a half to two months has now extended to approximately six months. He illustrates a specific example of this complexity with TSMC's state-of-the-art products which involve nearly 1,000 processes and an increasing number of masks. He also describes the process of back surface polishing for power semiconductors manufactured in Japan, which can involve shipping semiconductors either to a domestic location or to outside Japan for polishing before they return to their point of origin.

As a result, the semiconductor manufacturing process involves multiple steps spanning numerous locations, from securing raw materials to assembling the final product. Problems that occur at each stage of this process can give rise to delays in product delivery and to degradation in quality.

SEMI Japan president Masahiko Hamajima has stated that semiconductors have become a key facet of economic security, particularly due to the COVID-19 pandemic and US-China tension. He explains that the global semiconductor supply chain has been characterized by a clear division of roles, with the United States focusing on design, production being led by Taiwanese foundries like TSMC, while Japan, the US, and the Netherlands provide manufacturing equipment. Japanese companies also supply materials and parts, while Silicon Valley serves as a hub for talent. He also notes the limited availability of materials for semiconductors, and the expertise and manufacturing capabilities required for advanced semiconductor production are not universally available. He stresses that the manufacture of sophisticated semiconductors hinges on the worldwide integration of state-of-the-art technology while cautioning that the movement towards economic protectionism and increasing divisions present obstacles to global integration has the potential to result in a number of issues.

The semiconductor industry is also characterized by swift and frequent technological advancements, compelling businesses to seek and adopt cutting-edge technologies. This requires sustained investment in R&D while, at the same time, increases the risk of technological obsolescence.

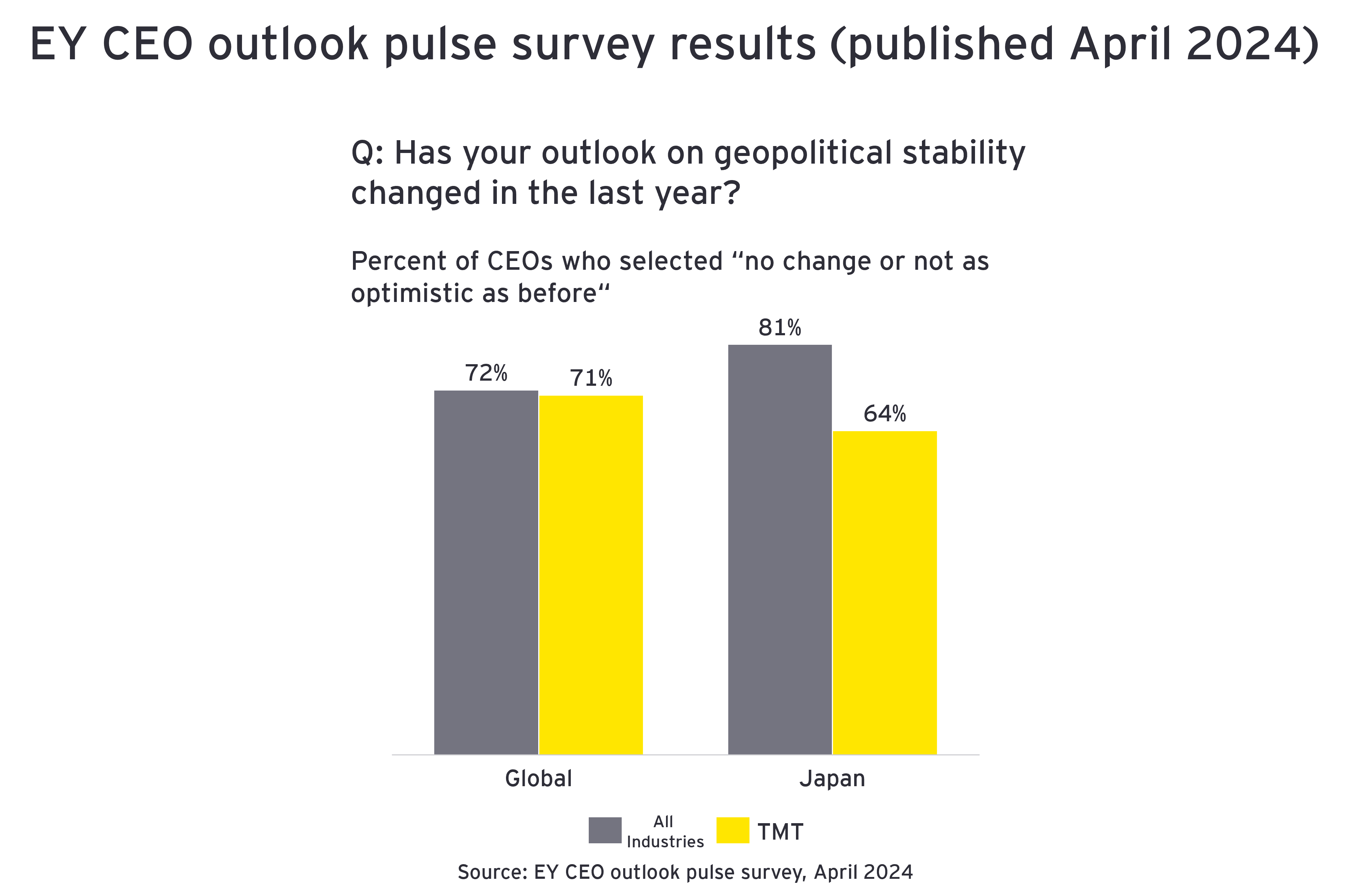

Figure 1

The data in Figure 1 is derived from a worldwide survey of 70 CEOs conducted by EY in April 2024. The optimistic outlook of CEOs in Japan's technology, media & entertainment, telecommunications (TMT) sector may be based on near-term market stability but, from a global perspective, the possibility of geopolitical risk remains elevated. More specifically, the semiconductor industry faces a number of uncertainties, including global tensions and trade frictions, and vulnerability due to the clustering of supply chains. Any revised strategies for the semiconductor supply chain must take concrete steps to mitigate risks instead of relying on optimism.

Hamajima believes that addressing certain risks would lead to changes in the silicon cycle due to the capital-intensive nature of the semiconductor industry. He emphasizes that the yield rate is a crucial factor that differentiating the semiconductor industry, while also noting that at the start of a plant operations, the yield rate is typically between 20 to 30% whereas industry competition can raise this to nearer 90%. He underlines also that output can vary greatly, even when using identical equipment with the same level of investment. He also mentions that the risk associated with introducing new production equipment could double if the equipment is located within a specific region. Similarly, if a globally optimized process needs to be completed in the region, this would also impact the silicon cycle.

How can businesses ensure the resilience of the semiconductor supply chain and respond to uncertainty in the face of escalating geopolitical tensions?

To address vulnerabilities in the semiconductor supply chain, consideration should be given to the following measures:

1. Diversification of manufacturing operations: Mitigate geopolitical risks by spreading semiconductor production across multiple countries.

(a) The US is providing tens of billions of dollars in incentives to bolster domestic semiconductor manufacturing operations. In addition, leading semiconductor companies such as Intel and TSMC are pushing to expand their manufacturing facilities in the US.

(b) India has introduced a range of initiatives, such as granting incentives and tax credits to foreign-affiliated semiconductor manufacturers, with the aim of strengthening domestic operations. While R&D in semiconductor manufacturing is also gaining momentum, Professor Wakabayashi stresses the importance of making strategic decisions about relocating manufacturing to India with the example of Foxconn which is exploring shifting part of its manufacturing capacity from China to new facilities in India. If India is able to leverage its highly skilled talent pool, he believes that it has the potential to become a significant player in semiconductor manufacturing. However, he also recognizes that India faces several infrastructure challenges, including its road network, power supply and logistics systems. He cautions that becoming over dependent on India could result in extended supply chains for certain processes and standard chips, further increasing geopolitical risks which include shipping through the Straits of Malacca and air freight from India.

(c) The Japanese government also earmarked JPY1.98 trillion in its supplementary fiscal 2023 budget to boost domestic capacity to make and secure semiconductors.*

Shozo Saito, president and chairman of the Japan Electronic Device Industries Association, adopts a geopolitical perspective in his views on the semiconductor supply chain. He suggests that the supply chain currently crosses too many borders, raising concerns about international dependence. He emphasizes the importance of security and affirms that globalization is acceptable as long as there is a firm guarantee of product availability e.g. if a product is manufactured in the US but there is an assurance of interrupted supply. However, as such guarantees seldom reflect reality, this leads him to believe that it would be wiser to reduce international dependence.

2. Securing stocks: It is crucial to maintain an ample supply of semiconductors to respond to fluctuations in market demand and potential disruptions in the supply chain.

3. Leveraging predictive modeling: Predictive modeling facilitates the identification of geopolitical shifts and fast responses to emerging risks.

Models driven by data analytics, artificial intelligence (AI) and machine learning are able to analyze factors like market movements, political statements and social unrest to forecast potential interruptions in the supply chain. This allows companies to make strategic decisions which mitigate risks and enhance the resilience of their supply chain.

4. Greater transparency in supply chains: Sharing information and ensuring transparency are essential for assessing and mitigating risks throughout the supply chain.

Saito comments that while it is not feasible to shift from a decentralized supply chain and return to a model dominated by integrated device manufacturers (IDMs), potential solutions for closer alignment could include cooperation between companies, the formation of consortiums or company mergers. He acknowledges that this complex issue cannot be resolved by a single entity and accepts that the industry in Japan is reorganizing under the guidance of the Ministry of Economy, Trade and Industry. He believes that these collaborative efforts are an effective way to tackle the challenges posed by the diversification of the semiconductor supply chain, semiconductor products and final products containing semiconductors.

5. Investment in technological innovation: Investment is crucial to sustaining a leading position in technology and raising the competitiveness of industries through continued R&D and innovation

Saito has also commented on the subject of technological innovation within the semiconductor industry, highlighting the two primary types of technological advancements being observed. Firstly, he notes the significant role of AI in semiconductor manufacturing, where it is utilized to manage the vast amounts of data produced during various stages of production. AI can now determine the most efficient processes and integrate them into the manufacturing workflow. While the previous objective was to expedite wafer delivery, the focus has now shifted to minimizing energy consumption and machines at idle by using AI-driven process design. He emphasizes the importance of minimizing waste, including temporary pausing of equipment, by leveraging computer automation over manual control for programming robots to transport wafers via the shortest possible route to improve efficiency. This practice involves creating digital twins, simulating processes and employing the most energy-efficient methods. Saito’s second observation relating to designing semiconductors capable of handling increasing hardware demands, particularly with the expanding use of AI, also raises the question of how the semiconductor industry will respond to the expanding AI market.

To strengthen the economy, government and business must address the vulnerability of the semiconductor supply chain in order enhance its robustness. The semiconductor industry must embrace continuous evolution and be confident about new challenges to ensure that its innovation and development are sustainable. Exploring technology, developing human resources and creating a culture of risk taking are key elements for the industry's long-term success. Our expectation is that the industry will continue to overcome these challenges and foster continued prosperity.

Reference:

*World Economic Forum “How Japan’s semiconductor industry is leaping into the future” https://www.weforum.org/stories/2023/11/how-japan-s-semiconductor-industry-is-leaping-into-the-future/ (Accessed 10 September 2024)

【Authors】

EY Strategy and Consulting Co., Ltd.

Technology, Media & Entertainment, and Telecommunications (TMT)

Itaru Inoue (Partner)

Yoshio Takechi (Director)

Tetsuo Kan (Senior Consultant)

Yuuno Sekimoto (Consultant)

Summary

Semiconductors are essential components of modern society. At the same time, the vulnerability of their supply chains presents economic challenges. Given escalating geopolitical tensions, addressing supply risks, diversifying production bases and boosting manufacturing capacity in Japan are urgent and critical challenges. Enhancing economic resilience and fostering sustainable growth are crucial objectives that can be achieved by sustained investment in technological innovation and by building collaborative international relationships.

Related article

The future of semiconductor procurement - The changing semiconductor supply chain

What are the key factors for stable semiconductor procurement?