EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Tax policy advisory services by EY India offers insights & strategies to navigate complex tax regulations, driving business growth and compliance.

Read more

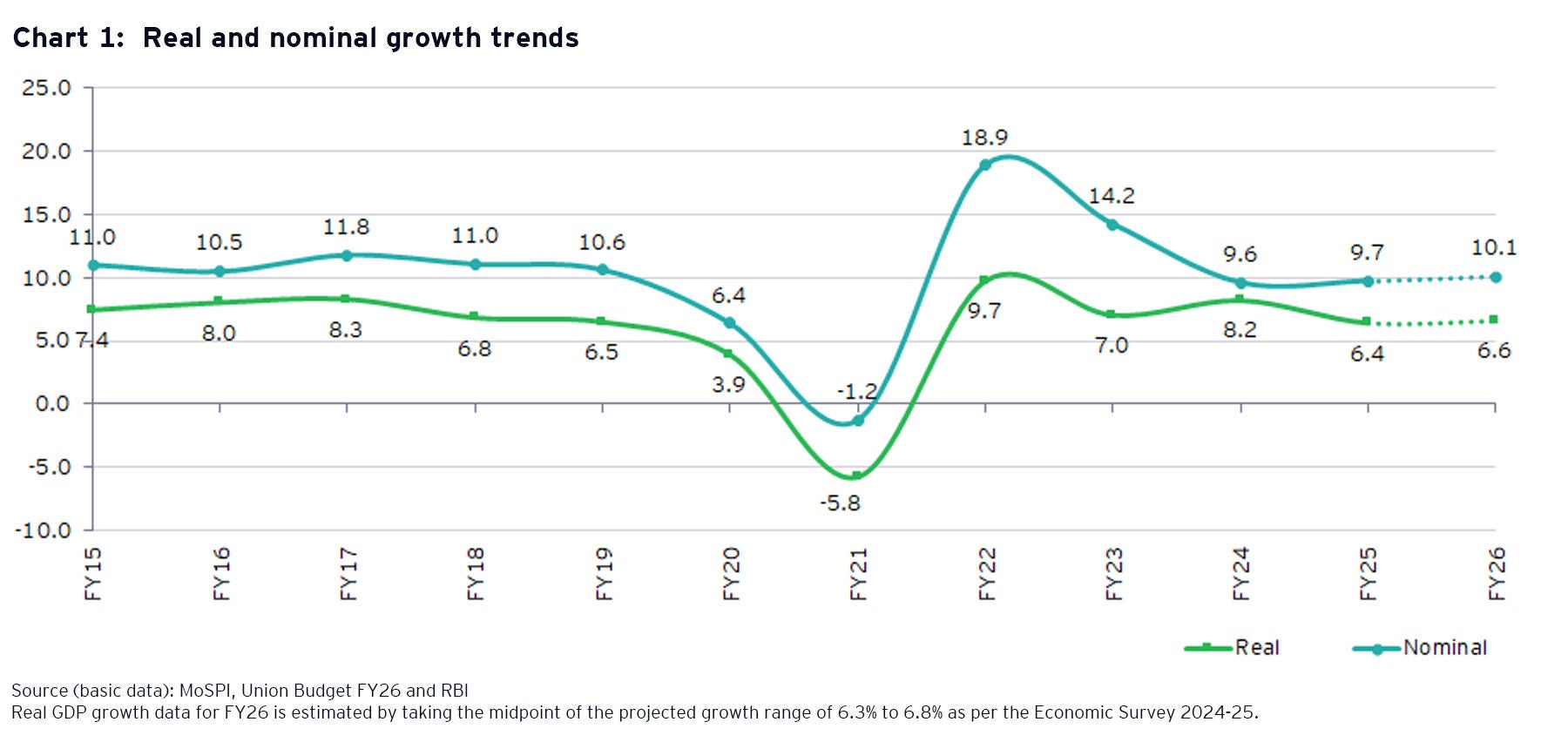

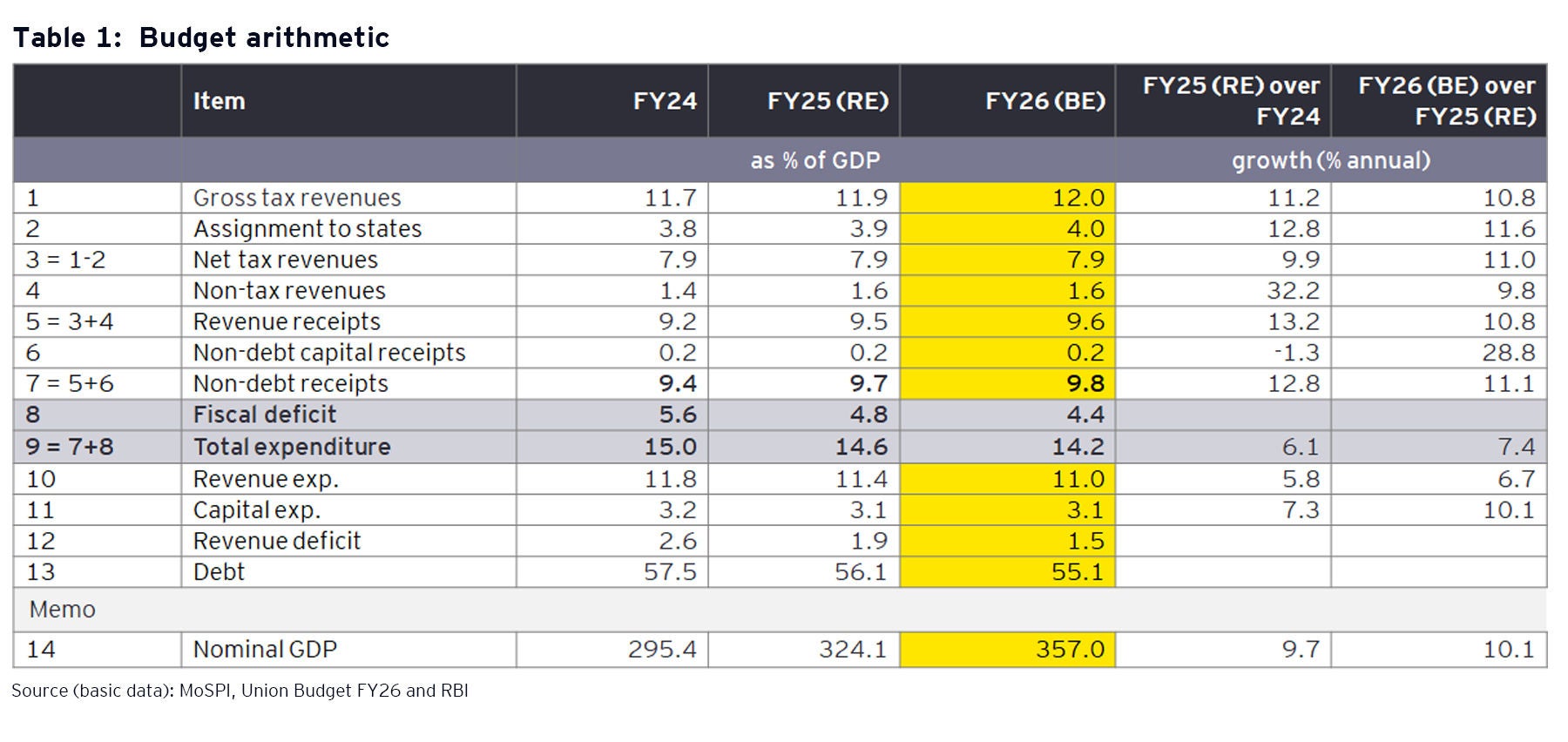

The fiscal deficit should be determined by assessing the sectoral balance between investment demand and supply of surplus investible resources. Considering recent trends and the GoI’s shift to a debt reducing target, fiscal deficit of the central and state governments together may remain more than 7% of GDP for several years. As per the RBI, the households’ surplus savings kept in financial form have fallen to a level of 5.0% and 5.3% of GDP, respectively, in FY23 and FY243. Adding to this, about 1.5% to 2% of GDP as net inflow of capital, the total investible surplus of about 7 to 7.5% of GDP would be nearly fully exhausted by governments’ borrowing requirements. This would amount to crowding out the private corporate sector and non-government public sector from accessing the available investible surplus. They will have to rely largely on the net inflow of capital, taking it much above sustainable levels.