EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

How EY can help

-

Our teams of experienced professionals can help you interpret the intent of tax authorities wherever you operate or intend to operate. Learn more.

Read more

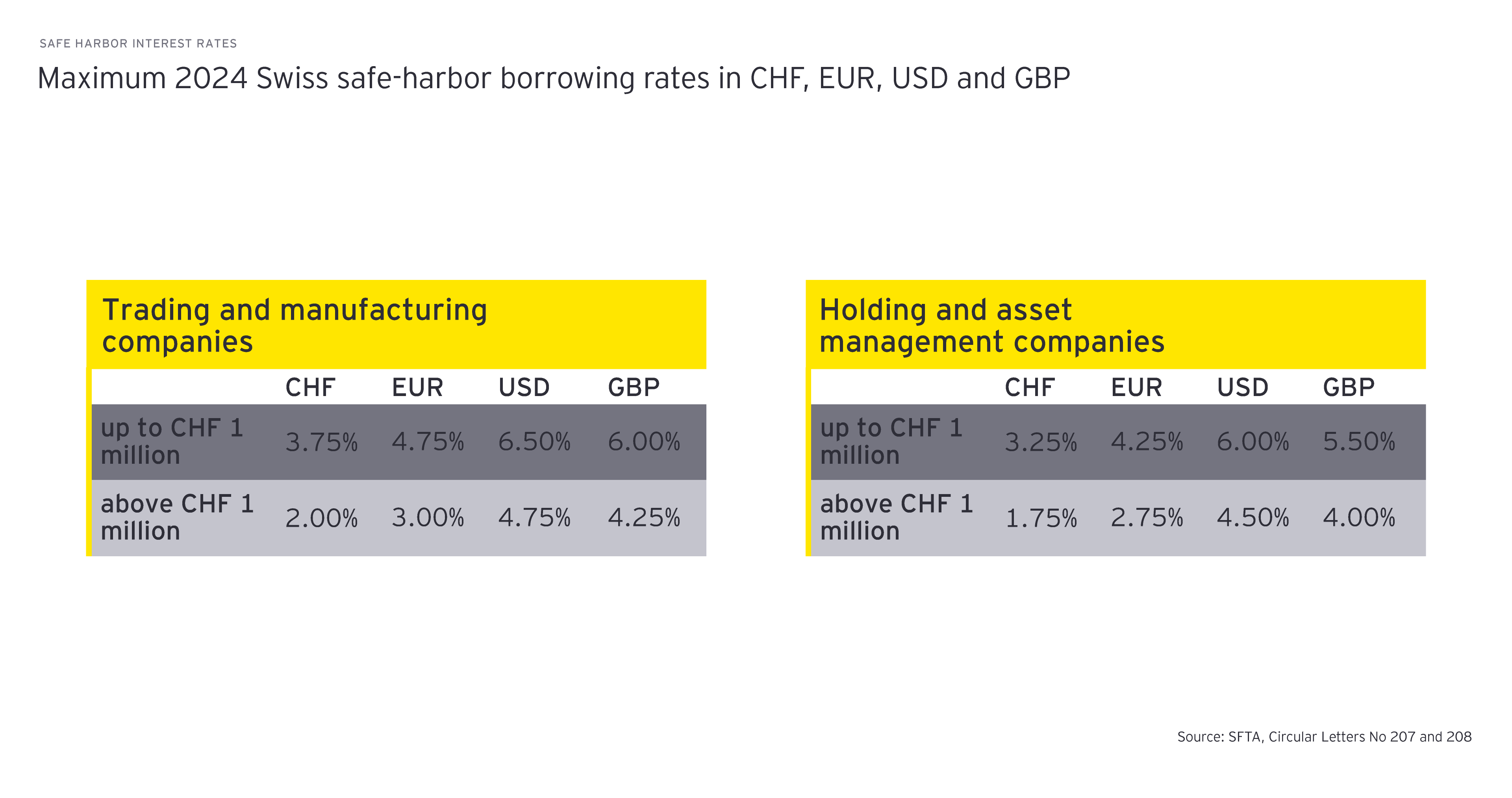

However, it remains clear that a single interest rate cannot capture all rating types. Therefore, even in years where interest rates remain relatively stable, the safe-harbor rates more or less resemble market rates for a very limited set of ratings. For instance, in the diagram above, for BB rated companies, the safe-harbor rates would never have provided a market rate throughout 2023, but these rates would have been significantly higher than the 2023 safe-harbor rates.

These differences could lead to conflicts in an international context, when other countries only admit interest rates calculated based on the market approach. For instance, this would mean that if a Swiss company with a BB rating borrowed from a foreign-related entity in Q1 of 2023 in EUR, the foreign tax authorities might have required an interest rate which would have been much higher than the maximum borrowing rate allowed by the SFTA.

Conclusion and recommendations

Nowadays, differences between market and safe-harbor rates are often increasing due to higher volatility and changes in the markets, and this puts more pressure on multinational companies which are relying on the safe-harbor rates to defend their position in Switzerland. However, even if the interest rate environment remains relatively stable as in 2023, the safe-harbor rates only resemble market rates for a very limited set of ratings.

The Circular Letters specify that interest rates deviating from the safe-harbor guidance are acceptable if it can be shown that the applied rates adhere to the arm’s length principle. In practice, such deviations are accepted by the Swiss tax authorities generally when taxpayers provide supporting evidence of such deviation. Appropriate transfer pricing analyses and corresponding documentation should be available to deliver this proof.

In addition, depending on the materiality of the transaction it is recommended to enter into a ruling with the Swiss tax authorities (SFTA and/or at cantonal level) in order to confirm upfront the arm’s length nature of interest rates in cases of deviations from those published in the Circulars.