EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

The Swiss Federal Tax Administration (SFTA) has published new 2023 safe-harbor interest rates for loans in CHF and in foreign currencies.

In brief

- Publication of new 2023 safe-harbor interest rates

- Rates for CHF and foreign currencies

- Comparison with fluctuations of market rates

On 7 February 2023, the SFTA has published the Circular Letters No 203 and No 204 defining the applicable safe-harbor interest rates for intercompany (IC) advances and loans denominated in Swiss Francs (CHF) and in foreign currencies. In line with the market trend, all interest rates increased significantly in 2023.

Minimum and maximum safe-harbor interest rates applicable in 2023

At the beginning of each year, the SFTA updates the list of applicable safe-harbor interest rates. This is an important exercise since many companies rely on this guidance to set the prices of many of their intragroup financing transactions for the year. This is particularly relevant this year given the volatile interest rate environment since Q3 2022, with drastic increases in rates in most major markets globally.

In line with these market trends, the published safe-harbor rates increased significantly for all currencies. The minimum lending rate in CHF is now at 1.5% (0.25% for 2022), and for EUR the safe-harbor minimum lending rate has increased from 0.5% in 2022 to 3.00% in 2023. The minimum lending rate has also increased from 2.00% in 2022 to 3.75% for USD. To avoid any doubts, the previously mentioned safe-harbor minimum lending rates apply to transactions financed entirely by equity.

For debt-financed loans made by Swiss entities, the minimum rate is set at the respective debt interest rate plus a margin of 0.50% (0.25% for the portion of loans above CHF 10 million only). The final interest rate should however not be lower than the minimum safe-harbor lending rate in the published currency.

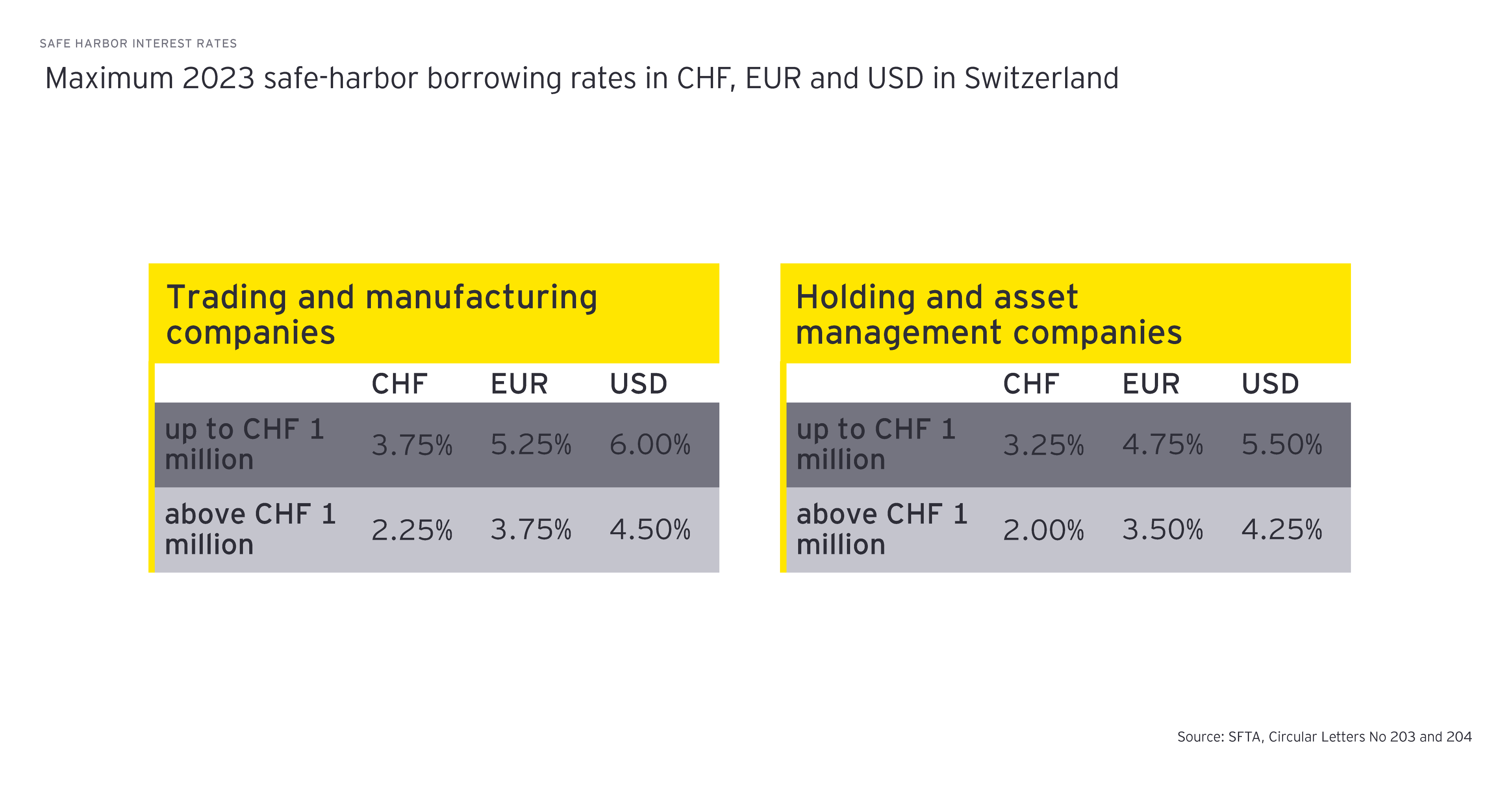

For the determination of the maximum interest rate payable by Swiss entities under the safe-harbor rules, a spread is to be added. The spread stipulated in the Circular Letter No. 204 for CHF (Digit. 2.2) also applies on IC advances and loans denominated in foreign currencies. For example, for operating loans received by trading and manufacturing companies, a spread of 2.25% can be added to determine the safe-harbor maximum allowable rate for the portion of loan up to the equivalent of CHF 1 Mio., and this spread is then reduced to 0.75% for the portion above. In the case of holding and asset management companies, the applicable spreads are 1.75% and 0.5%, respectively. It should be noted that the spreads applicable to calculate the maximum borrowing rates for the portion of loans up to CHF 1 Mio. (or equivalent) have been reduced by 0.5% compared to prior years.

Consequently, the maximum borrowing rates for loans from related parties denominated in CHF, EUR and USD can be summarized as follows:

Comparison with market rates

Every year, the applicable safe-harbor rates are determined by SFTA based on several market references, including swap rates and long-term bonds. Therefore, it can be noted that Swiss safe-harbor published rates generally show a correlation with market rates, for instance in the case of loans having a credit rating of around BBB and a tenor of five years.

However, given the tremendously changing (rising) interest rates especially in the last months of 2022, there was a huge difference between the 2022 applicable safe-harbor rates, published end of January, and the actual market rates, which is shown in the following chart:

Last year was a good example of such discrepancies, also depending on the rating, where substantial differences were observed, e.g., the market rate for BB, 5-year, EUR denominated loans was around 6% in the second part of the year, i.e., significantly higher than the safe-harbor maximum borrowing rate applicable for the same year (2.75% until 1 million and 1.25% above).

These differences could lead to conflicts in an international context when other countries only accept interest rates calculated based on the market approach. Concretely, this would mean that if a Swiss company with a BB rating borrowed from a foreign related entity in Q3 of 2022, the foreign tax authorities might have required an interest rate which would have been much higher than the maximum borrowing rate allowed by the SFTA.

The significant increase of the published safe-harbor rates for 2023 will remedy these differences, at least partially, but the current market volatility is highlighting the limits of the application of safe-harbor rates for intercompany loans implemented by Swiss entities in an international environment.

Conclusion and recommendations

Nowadays, differences between market and safe-harbor rates are often increasing due to higher volatility and changes in the markets, and this puts more pressure on multinational companies which are relying on the safe-harbor rates to defend their position in Switzerland.

The Circular Letters specify that interest rates deviating from the safe-harbor guidance are acceptable if it can be shown that the applied rates adhere to the arm’s length principle. In practice, such deviations are generally accepted by the Swiss tax authorities when taxpayers provide supporting evidence of such deviation. Appropriate transfer pricing analyses and corresponding documentation should be available to deliver this proof.

In addition, depending on the materiality of the transaction, it is recommended to enter into a ruling with the Swiss tax authorities (SFTA and/or at cantonal level) in order to confirm upfront the arm’s length nature of interest rates in cases of deviations from those published in the circulars.

Download the corresponding article on this topic and gain deeper insights on the comparison between OECD Guidelines and the practice of SFTA on safe-harbor interest rates.

Articles were first published in EXPERT FOCUS 2020/6-7 and 2020/8

Summary

To avoid negative tax consequences in Switzerland, we strongly recommend reviewing and adjusting your interest rates on intercompany financing transactions – payable as well as receivable – to ensure their compliance with the new safe-harbor interest rates. If you decide to apply differente rates, ensure appropriate transfer pricing analyses are in place to support the chosen interest rates.

Please do not hesitate to reach out to us at EY if you have any questions.

Acknowledgement

We thank Victor Denekamp for his valuable contribution to this article.