EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

Related article

Carbon Border Adjustment Mechanism (CBAM) update and its impact on the EU cross-border imports

Understand the Carbon Border Adjustment Mechanism and its tax implications. Stay informed and proactive in aligning with environmental policies.

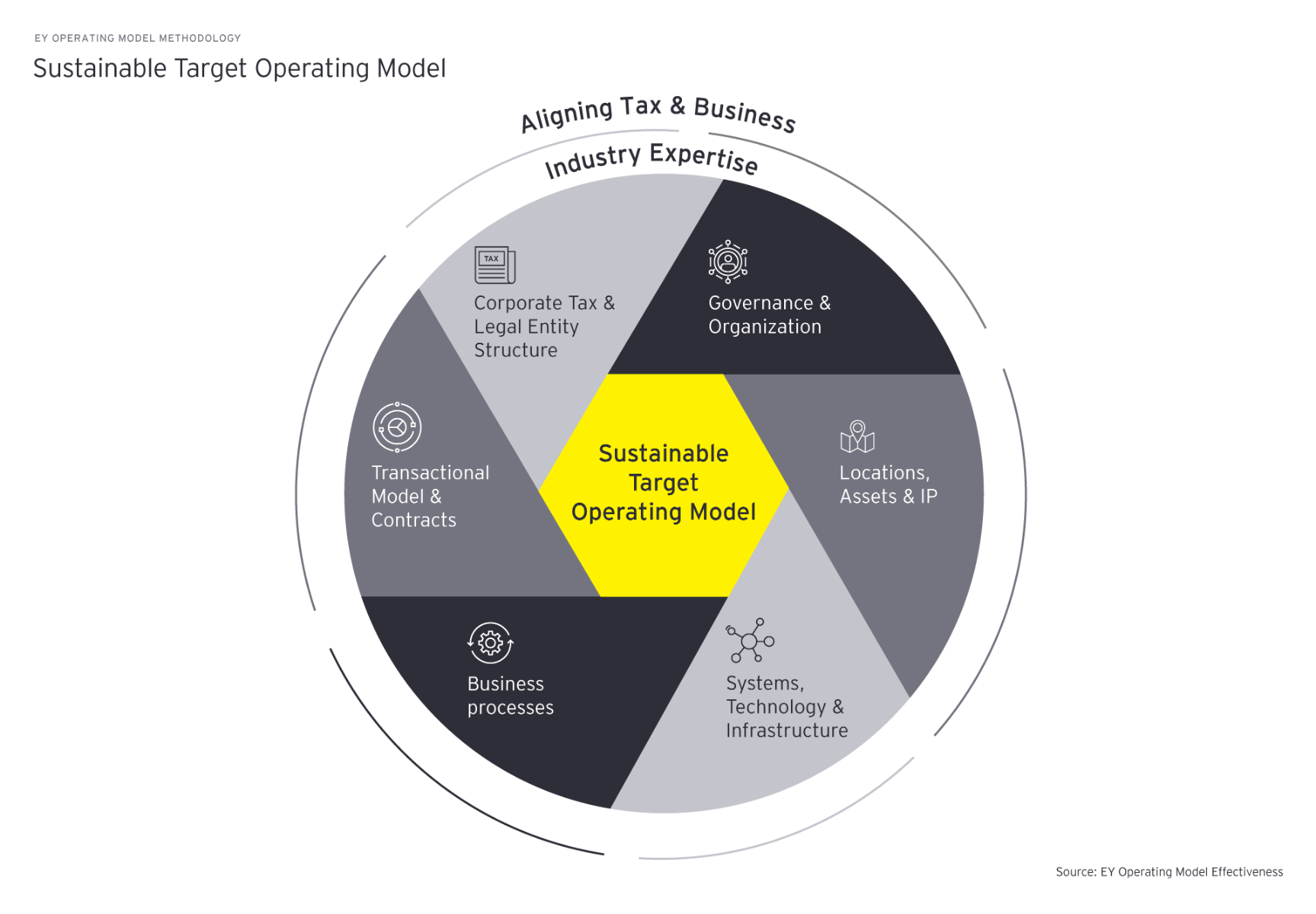

1. Locations, Assets and IP

The design of the future state operating model will likely change the way a company operates from a location and asset perspective.

- Embedding environmental, social, and governance (ESG) and establishing a future-proof business model may entail a change in value drivers and a shift in the role and significance of intangible assets. The hydrogen transformation can create new brand value, provide exemptions for – or limit the financial impact of – carbon taxes and increase companies’ ESG ratings. The functions supporting the creation of these new value drivers will further affect the transfer pricing remuneration setup, and decisions on the locations, functionality and reporting lines for such functionality.

- The generation of new intellectual property (IP) related to supporting a clean hydrogen economy will open up the possibilities for (tax) incentives and funding opportunities. Calls for public tenders generally relate to project development and may require ecosystem collaboration and incite a need for clear IP ownership delineation. The variety in financial support available among jurisdictions will significantly impact decisions on location for the creation and ownership of new IP which will in turn again pose implications for the transfer pricing setup.

- Particularly for the clean hydrogen journey, significant investments may be required to develop hydrogen production technologies and to integrate hydrogen production, storage, and transportation into existing infrastructure and supply chains. Companies will need to decide in which market they want to operate given the incentives and regulatory obligations. Additionally, due to the infrastructure required, proximity to customers and suppliers or a viable existing infrastructure network may weigh significantly in the decision-making process. Besides analyzing incentives and CAPEX criteria, companies should invest in tailored location services to integrate strategic and financial analysis of operating costs and requirements, business landscape criteria, and local and regional taxes.

Any creation of new IP should be aligned with the existing operating and tax model. Many companies operate under a centralized operating model that assumes IP is controlled and owned by the respective centralized entity. Any incentive application should therefore also be closely monitored and aligned with the tax and operating model. Also, the introduction of OECD’s 15% minimum corporate income taxation rules should be assessed as depending on the nature of the incentives the foregoing tax revenue could be effectively recaptured by another country, meaning that the envisaged financial benefit of the respective incentive could be (partially) neutralized from an overall group perspective.

2. Transactional model and contracts

The integration of hydrogen in the existing supply chain network impacts the transaction flows and has various key considerations.

- International trade and indirect tax flows need to be considered in light of the envisaged incoterms, the need for VAT registrations, deductibility of input VAT, importing and export requirements, amongst others.

- The transport of hydrogen can vary according to form (e.g., hydrogen or a vector like ammonia) and mode (e.g., pipeline, ship or truck). As maritime transport will be part of the EU Emission Trading System (ETS) and road transport will be part of a separate ETS system, these logistical choices will also have carbon tax and financial consequences.

- The EU is set to impede the expansion of carbon-intensive hydrogen by integrating hydrogen into the EU ETS, subjecting any residual emissions from hydrogen production to the carbon pricing of the internal market. Notably, CBAM extends this requirement to imported hydrogen (e.g., from the Middle East or Australia), therefore, diminishing the appeal of non-renewable hydrogen. The impact and reporting obligations as a consequence of the introduction of CBAM should be monitored and accounted for. However, it is crucial to recognize that only hydrogen and ammonia are included, while other hydrogen derivatives such as methanol and liquid organic hydrogen carriers (LOHC) are (for now) excluded. This poses important considerations for the decision on how to store and transport hydrogen.

All these elements should be considered when designing the future transactional flows and the contracting for transport in order to mitigate financial impacts and sustainability tax exposure.

3. Legal entity structure

The expansions in the hydrogen business will result in significant investments, whereby organic and inorganic growth outside the core domestic markets will require a careful upfront design of the legal-organizational structure.

- Location factors are vital for this upfront design, driven by key tax implications such as the ability to mitigate leakage on intercompany flows (e.g., dividends, royalties, interest) and to impair and create a tax-deductible expense for high-risk investments.

- Other considerations such as the legal requirements to reduce overall group emissions need to be embedded in the location selection procedure. An example in this regard is various court cases that force companies to be more ambitious with their ESG strategy.

- Depending on the long-term strategy of a company, such as investment with the aim to kick-start the decarbonization of a specific industry (e.g., shipping) and the ambition to carve-out the investment in the short-medium term, may necessitate the legal organizational structure be fit-for-purpose in light of potential future taxation on amongst others capital gains.

Obviously, other considerations with regard to the legal entity structure and other dimensions of the operating model need to be considered as well.