EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Industrial inflation could reach 13% by the end of the year, even as consumer inflation falls

Inflation facing producing businesses (PPI) looks set to diverge from consumer inflation, according to latest projections by EY-Parthenon

PPI forecast to remain at 10.2% by the end of the year – and could reach 13% if there is further pressure on commodities

Between 2020 and 2023, PPI inflation is likely to make it 50% more expensive for some businesses to produce goods in the UK compared to pre-pandemic

EY-Parthenon Managing the trilemmas: understanding and responding to industrial inflation

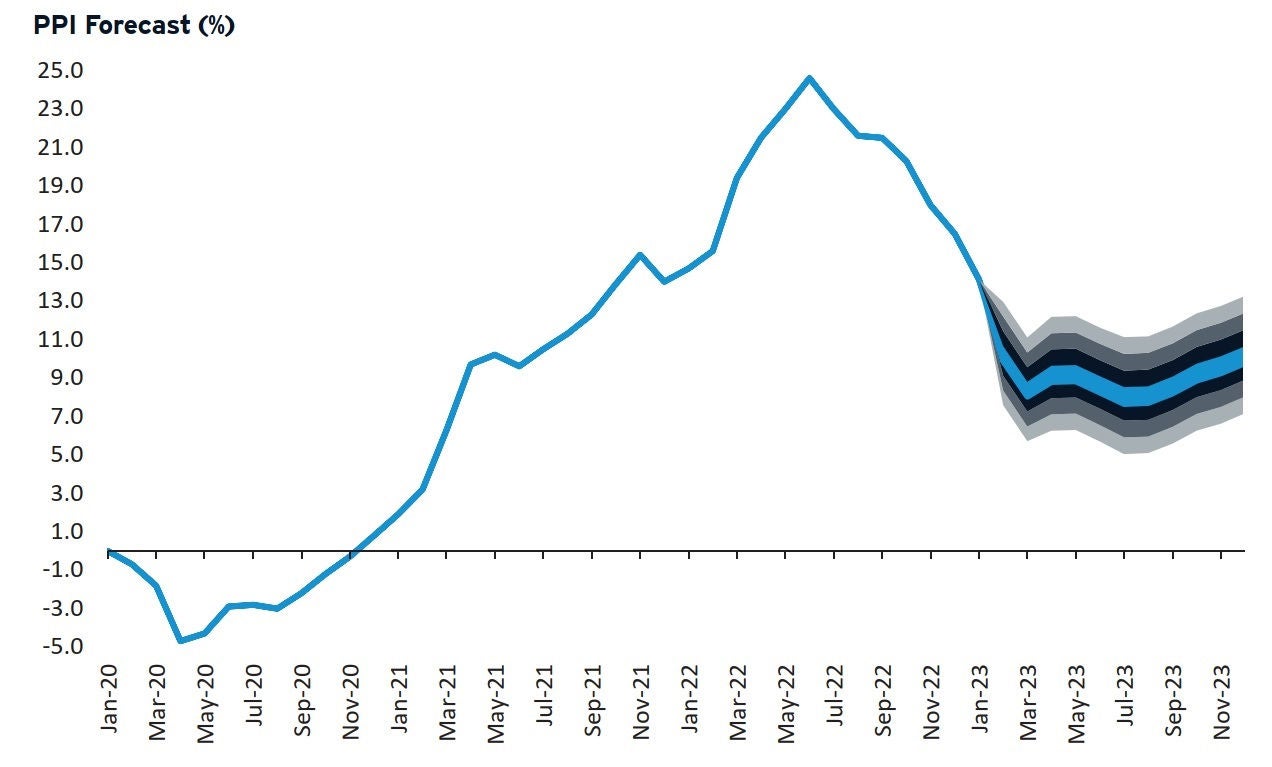

Although the outlook for consumer inflation and interest rates is stabilising, industrial inflation could remain in double digits until the end of 2023, according to new projections from EY-Parthenon.

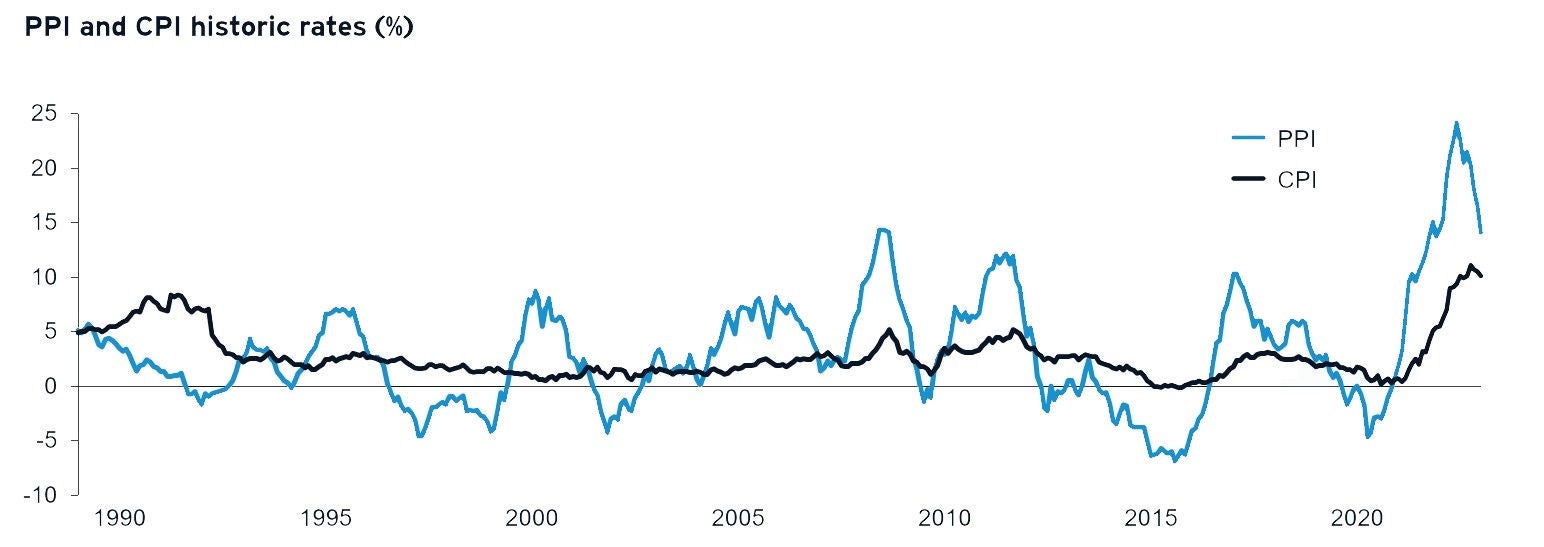

EY-Parthenon’s latest research finds that, although consumer price index (CPI) inflation could fall to around 4% by the end of 2023, producer price index (PPI) inflation is likely to remain at 10.2% until the end of the year and could reach 13% if there is further pressure on commodities, including energy.

PPI inflation is the manufacturing equivalent of CPI inflation, and monitors the price changes of goods bought and sold by UK manufacturers by measuring a weighted basket of goods, including gas, oil, metals, food and chemicals.

Between 2020 and the end of 2023, PPI inflation is expected to have increased to such an extent that, it will, on average, be 50% more expensive from some businesses to produce goods in the UK than pre-pandemic.

Mats Persson, EY-Parthenon Partner, said: “Whereas CPI inflation takes the headlines, PPI inflation in many cases provides a better insight into businesses’ cost exposures, but it remains a poorly understood measure.

“The cost base rising as demand is falling will make will increasingly difficult for many businesses to pass on their cost increases to consumers, which will impact margins and earnings.

“To avoid margin erosion, businesses need to get better at understanding their tailored inflation exposure and take actions across cost-control, procurement, optimisation, portfolio prioritsation and pricing strategies.”

Last year saw CPI and PPI inflation reach decade highs. In the UK, consumer inflation peaked at 11.1% in October, while industrial inflation peaked at 24.6% in June.

The projections come as the EY ITEM Club downgraded its UK GDP growth projections for the next three years, with warnings that a recession is likely to prove deeper than previously expected. A combination of high inflation, falling real incomes, rising interest rates, and tighter fiscal policy are expected to be the primary drags on growth.

Related news

EY comments on Q4 2023 company insolvency data

insolvencies in 2023 reached their highest annual total in 30 years reflecting the difficult business environment that companies have faced over the last 12 months.

Profit warnings from UK-listed companies with a DB pension scheme reach highest level since 2021

The number of profit warnings issued by UK-listed companies with a Defined Benefit (DB) pension scheme increased 18% year-on-year in Q3 2023

EY comments on today’s Insolvency Service Q3 2023 company insolvency data

EY comments on today’s Insolvency Service Q3 2023 company insolvency data

Industrial inflation could reach 13% by the end of the year, even as consumer inflation falls

Latest projections from EY-Parthenon reveal industrial inflation could reach 13% by end of 2023

EY-Parthenon announces three new Partner appointments

New appointments for EY-Parthenon Strategy’s team