EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Digital Tax life cycle management platform (DigiLiM+™)*

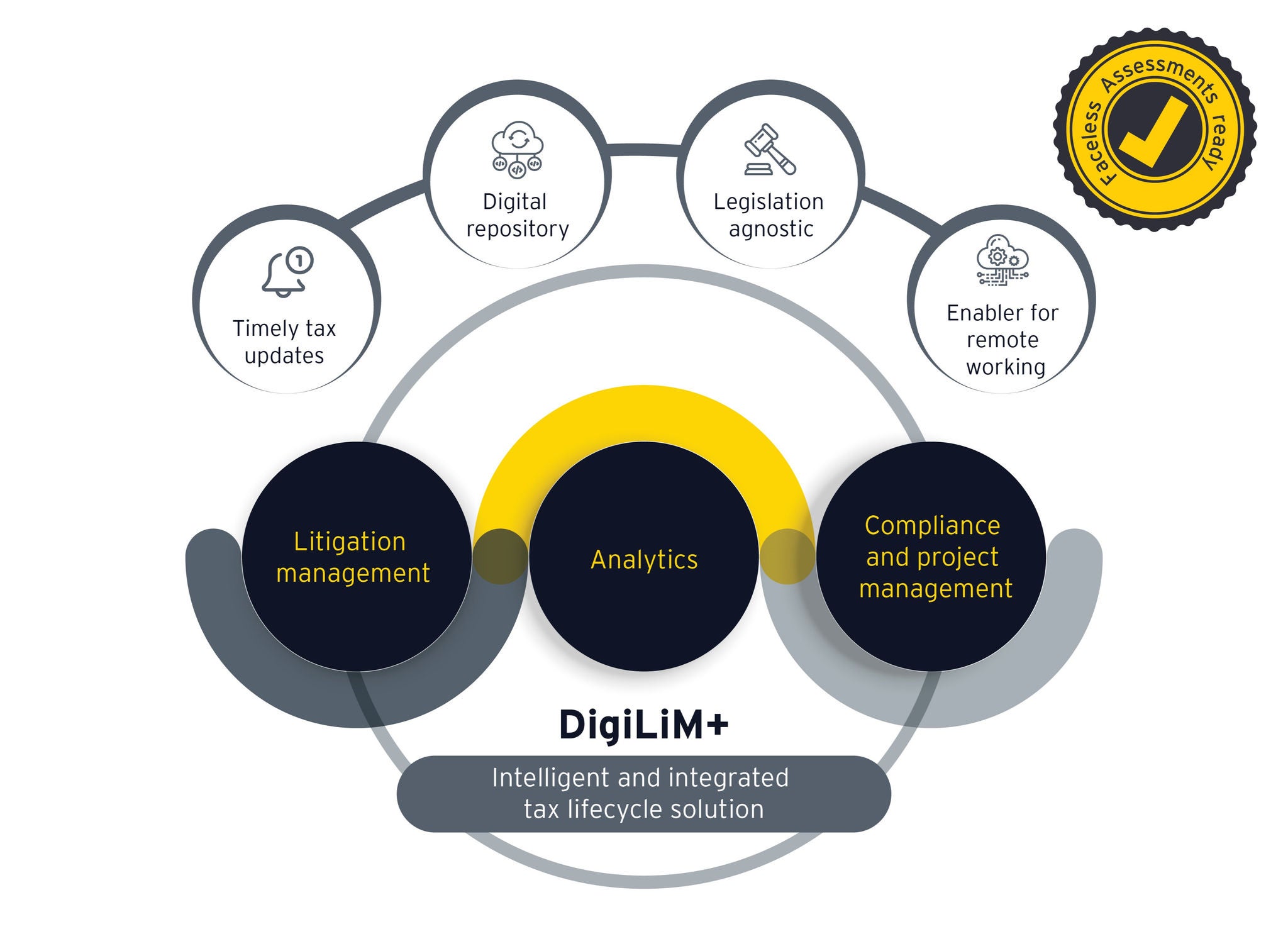

Developed by EY in India, DigiLiM+™ is an interactive tax life cycle platform which acts as a litigation management solution enabling organizations to track their tax litigations while also supporting smart handling of the newly introduced faceless assessments. It helps in administering tasks and projects pertaining to various compliances and other key organizational projects. DigiLiM+™ also provides data analytics enabled insights for effective decision-making.

The new avatar of DigiLiM+ is divided into three modules:

- Litigation management solution: This module enables digitization of a company’s tax litigation life cycle, including due dates, reminders and documentation, and enables intuitive dashboards and risk categorization for audit purposes. It has computational capabilities for income and taxes along with interest charged through the tax litigation lifecycle. DigiLiM+ is now powered by Taxsutra to provide timely and relevant tax updates on specific client issues under tax litigation and other topics of interest. With cutting edge features such as notice tracking and submission handling, DigiLiM+ is a robust litigation management solution to assist organizations with the new faceless audit regime.

- Compliance and project administration: This module transforms task and project management activities. It aids remote working by tracking various compliances (statutory and organization specific) with alerts, reminders; providing dashboards for singular overview of the compliances; database of key conversations for tasks within the module thereby, obviating the need for email exchanges. It also enables complete visibility of sequence of events in various tasks/ projects by providing a workflow trail. It is integrated with other EY digital solutions to align the tasks to be performed under different legislations and helps in ensuring consistency across filings by using a single data source thereby mitigating risks involved in tax litigation.

- Analytics: As part of a holistic litigation management and tracking solution, this module enables insightful dashboards covering income-tax returns, tax audits and transfer pricing reports, past litigation cases and GST filings, thereby giving a 360-degree view of tax numbers.

With a robust platform and integration of the above three modules, we assist organizations in mitigating their financial, resource and reputational risks, while driving efficiencies through transparent case management and advanced analytical insights.

Our latest thinking

Budget 2025: Insights on macro-fiscal implications

Uncover FY26's macro-economic outlook, tax reforms, and policy impacts on India's growth in our post-Budget 2025 podcast. Will GDP exceed 7%? Listen in.

Budget 2025: Insights on expectations for the manufacturing sector

Explore Union Budget 2025 insights with Ajit Krishnan, EY India Tax Partner, on manufacturing growth, tax incentives, MSME support, and sustainability goals. Tune in now.

Budget 2025: Macroeconomic expectations and policy priorities for FY26

Explore Union Budget 2526 insights with Dr. D.K. Srivastava as he analyzes India's fiscal strategies, tax reforms, and infrastructure priorities. Tune in now!

How EY can help

-

EY GTA is an intelligent technology platform supporting comprehensive global trade transactions and is a one stop solution for Customs and Foreign Trade Policy compliance.

Read more -

Explore EY India Tax Platform – a cutting-edge digital tax platform delivering streamlined tax solutions, advanced technology, and seamless DST compliance.

Read more -

EY DigiCorporateTax is a pathbreaking solution transforming the entire gamut of corporate tax compliances.

Read more -

Be part of a secure and fully automated GST Invoice Registration Portal (IRP) for a swift, simple, and secure e-invoice authentication.

Read more -

EY DigiLiM+™ Tax Litigation Management Solution is a digital platform that streamlines tax life cycle management through integrated modules, ensuring efficient and compliant processes.

Read more -

Tax Collected at Source automation solution enables businesses to gear up for the expanded TCS provisions regime by using technology.

Read more -

Our digital tax transformation and tax technology practice in can help you navigate the digital agenda in the tax domain.

Read more -

With respect to Intelligent Automation, EY has a large repository of use cases in direct and indirect tax in India and these solutions collaborate with people while improving speed, accuracy and output.

Read more

Meet Our DigiLiM+™ team

Direct to your inbox

Stay up to date with our Editor's picks newsletter.