EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY DigiCorporateTax: Automate Your Corporate Tax Compliance

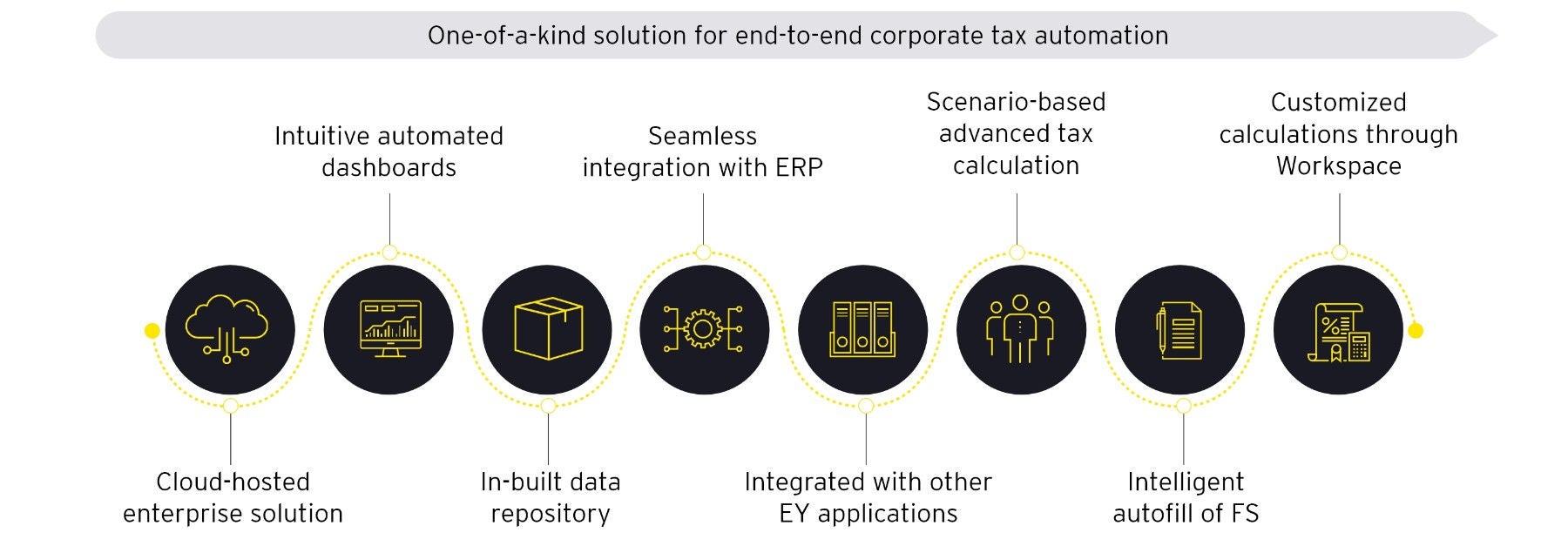

EY DigiCorporateTax - a modular, cloud based comprehensive enterprise-level solution designed to revolutionize and streamline varied aspects of corporate tax compliances, and reporting.

EY DigiCorporateTax – A path breaking solution transforming the gamut of corporate tax compliances

Progressively, corporate tax compliances have become data intensive and complex, triggering the need to collate large data sets and perform complex reconciliations across filings. All this needs to be completed within tight deadlines with an expectation of value added and error free filings. Yet, on the ground, Tax teams tend to struggle with manual processes and excel sheets due to lack of automation and limited configuration of Enterprise Resource Planning (ERP) for corporate tax reporting.

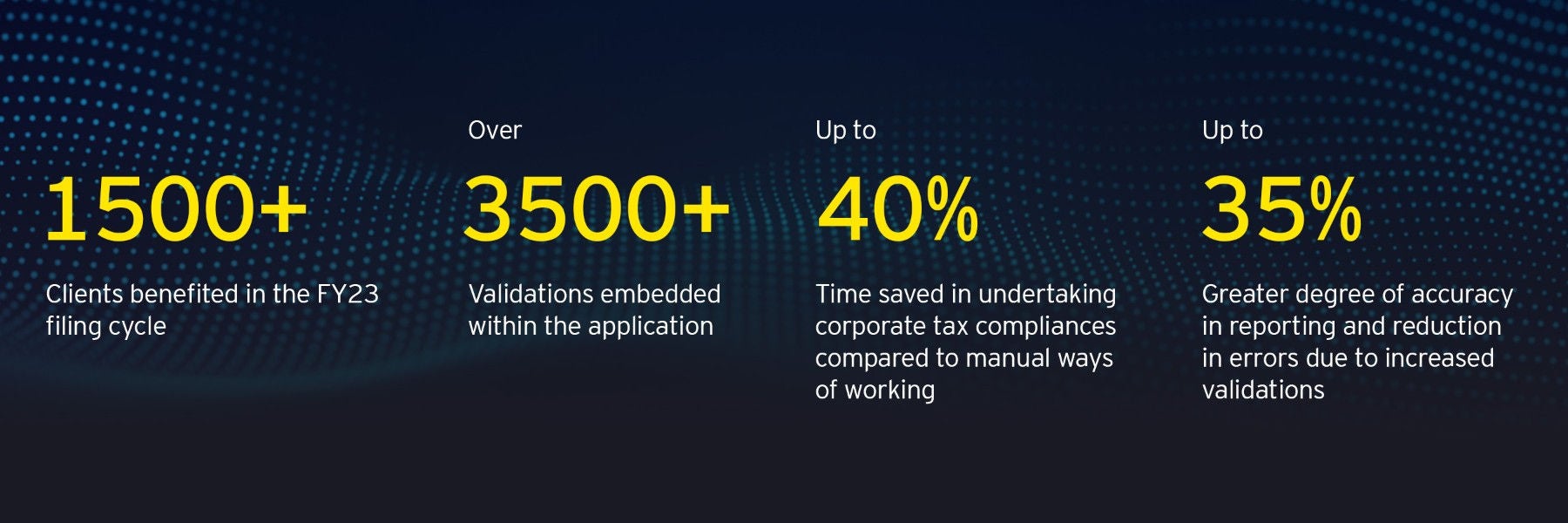

EY DigiCorporateTax is the first cloud-based enterprise level solution automating varied aspects of corporate tax compliance life cycle across multiple scenarios of advance tax calculation, tax provision computations, Tax Audit Report (TAR) preparation, and Income Tax Return (ITR) finalization.

Why choose EY DigiCorporateTax?

- Access from anywhere, anytime

- Reduced people dependency and overcome off-line ways of working

- Greater efficiency & accuracy in reporting (on account of features like autofill of financial statements, bulk upload of excel templates, consolidation of division / unit level data at an entity level, etc)

- Lesser chances of adjustments in 143(1) intimations due to in-built validations

- No fear of data loss / form refill efforts due to quick version and schema updates

- Ease of collation, consolidation and reporting of voluminous data across divisions/ units

- In-built workflow and audit trail for better governance, control and effective management reporting

Our latest thinking

Union Budget 2026-27 highlights

Get the latest insights on the Union Budget 2026-27, including tax updates, policy changes and sector-wise impacts. Explore insights and analysis from EY India on budget reforms and growth.

20th Annual EY India Tax Workshop 2025

Register for India Tax Workshop 2025. Learn more about the tax function.

Navigating international tax compliance for Indian multinationals

Read how EY helps Indian multinationals with global tax complexity transfer pricing, BEPS 2.0, permanent establishments and technology-enabled compliance.

Understanding India’s Employment-Linked Incentive (ELI) Schemes

Explore India’s new employment-linked incentive schemes and their impact on hiring, compliance, and cost benefits for employers and employees.

Understanding minimum disclosure requirements for related party transactions

In this webcast, our panel of EY experts shares insights on the recent SEBI circular and its impact on related party transaction (RPT) disclosure requirements and industry standards.

Decoding the new Employment Linked Incentive (ELI) Schemes

In this webcast, panelists discussed the new Employment Linked Incentive (ELI) Schemes, benefits available to employers and employees and action planning for employers.

As Trump tariffs reshape global trade, India must adapt fast

Amid global trade shifts from US reciprocal tariffs, India must diversify exports, address trade imbalances, and boost manufacturing competitiveness.

Budget 2025: Insights on macro-fiscal implications

Uncover FY26's macro-economic outlook, tax reforms, and policy impacts on India's growth in our post-Budget 2025 podcast. Will GDP exceed 7%? Listen in.

Budget 2025: Insights on expectations for the manufacturing sector

Explore Union Budget 2025 with Ajit Krishnan, EY India Tax Partner, discussing manufacturing growth, tax incentives, MSME support and sustainability goals.

Budget 2025: Macroeconomic expectations and policy priorities for FY26

Explore Union Budget 2526 insights with Dr. D.K. Srivastava as he analyzes India's fiscal strategies, tax reforms, and infrastructure priorities. Tune in now!

How EY can help

-

Transform your tax function with EY India AI Tax Hubenterprise-grade Agentic AI for Tax to enable faster research, automated compliance and smarter litigation management.

Read more -

Transform export-import operations with EY Global Trade Automation software, AI powered automation for customs and foreign trade policy compliances, duty savings, incentive optimization, logistics visibility and faster global trade decisions.

Read more -

Transform your tax functions with EY’s India Tax Platform - an AI-powered, cloud-based digital tax solution offering automation, insights, and unified dashboards.

Read more

The team

Direct to your inbox

Stay up to date with our Editor's picks newsletter.