EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

What MNEs need to know

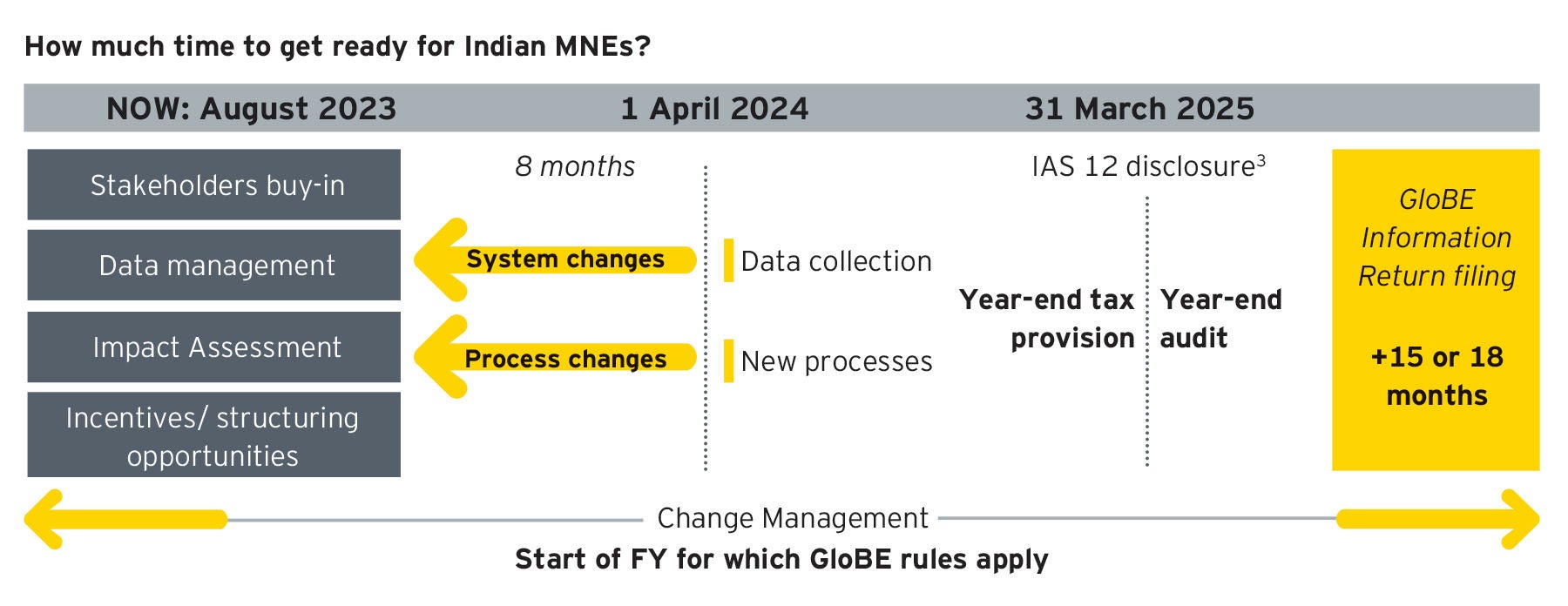

MNEs need to keep pace with the continuous changes that are unfolding to be able to adapt quickly. Below are some of the aspects to be considered to ensure better preparedness for GloBE implementation:

Educating relevant stakeholders:

These rules will have a comprehensive impact, not solely on the tax teams but also on Finance and Information Technology teams. It is essential to educate the senior management on the evolving regulations, emphasizing the risks associated with potential additional tax outflows. It would be equally important to engage with auditors for appropriate provisioning and disclosure to be made in books of accounts.

Assessing the impact:

As a start, MNEs need to evaluate the Effective Tax Rates (‘ETRs’) as per the GloBE Rules for each jurisdiction and assess any additional tax liability, which will help them to identify risk areas which needs attention. MNE groups to review their operating/ business/ holding structures in lieu of the changing regulations.

Be compliance ready with technology support:

The changing landscape is giving rise to new set of compliances. Considering the mammoth data requirements, leveraging on advanced technology becomes imperative to efficiently collate, analyze, and ensure data is audit-ready and consistently aligned with other filings.