EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

Revamping operating models is crucial for companies to stay competitive. Read on to discover why and how it can be accomplished.

In brief

- Multinational wealth management companies often have complex operating models due to their size, scale, and broad range of services offered.

- Relying on outdated technology lowers operational efficiency, limits innovation, and exposes companies to higher compliance risk, which may lead them to lose their competitive edge.

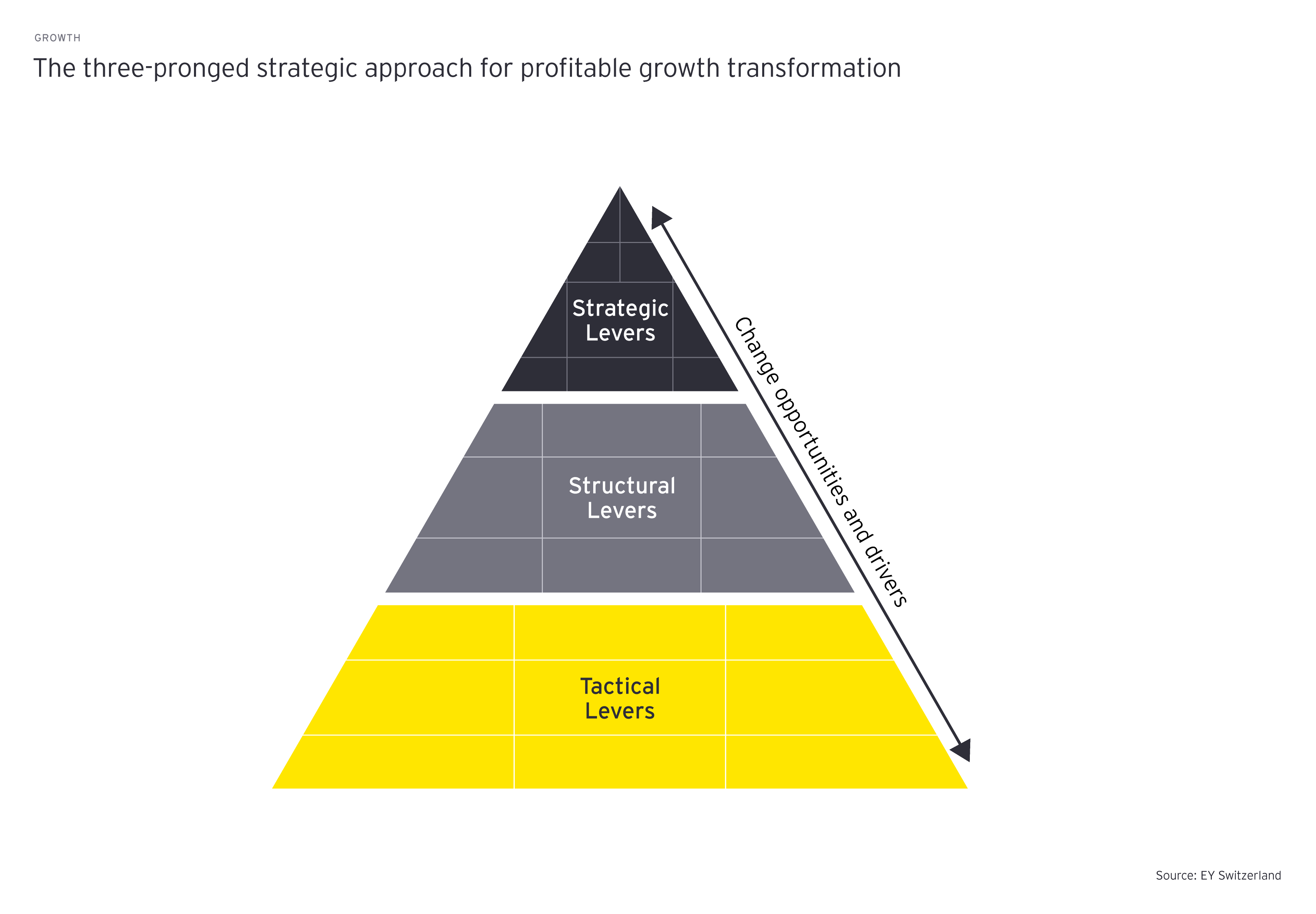

- EY can help companies to drive sustainable profitable growth, by implementing three layers of transformation (Strategic, Structural, and Tactical).

Aholistic transformation approach for driving profitable growth efficiently

Streamlining wealth management operational infrastructure is critical to enable success

Wealth management is a complex business owing to the nature of products, services, clients and capabilities needed to service these clients, whose needs are unique and not straight forward. In addition to organic growth, wealth managers have also grown inorganically through acquisitions due to which their operating infrastructure has grown in complexity with different technologies, systems and operating models being brought together. Large wealth managers with global footprint operate in multiple markets, manage a vast array of financial instruments, and are subject to multiple regulatory jurisdictions and tax codes. Their extensive network of offices and investment professionals provide them with access to a broad range of investment opportunities and the ability to provide localized services to clients. Their operating model is also complex given the size and the range of services offered to clients. Typically, operational infrastructure at a global financial services organization is a combination of hundreds of business applications, each developed for a specific need over a period of time. It is not without a reason that large financial services organizations are compared with being a technology organization.

Their technology that often pre-dates open architecture and API connectivity rarely lends itself to fast-paced innovation and therefore contrasts with new digital solutions that offer interoperability, automation, data consolidation and administration flexibility and reporting. Change fatigue is a major roadblock that can delay retiring legacy systems. Moreover, there are cost pressures from expensive tech transformation, especially in the current operating environment, with challenges around finding and retaining the talent to run large-scale transformation programs.

Legacy systems adversely impact wealth managers’ competitive position

Reliance on legacy systems and tech does not only lead to higher costs, inefficiencies and operational drag but also increases exposure to operational and compliance risks. For instance, when different systems are used to manage different aspects of wealth management, data can become siloed and inconsistent. If this data is not properly recorded or tracked across systems, it could result into data errors, inaccurate client reporting and non-compliance. Failing to keep pace with technology innovation costs organizations their competitive edge and business. A 2022 Advisor360° survey of 300 financial advisors and wealth management executives revealed that 65% advisors lost business from clients and prospects due to outdated technology since clients expect the same capabilities and ease-of-use from advisors as they do in other life aspects.1

2022 was one of only three years since 1926, in which both stock and bond markets saw significant wealth erosion, driven by high inflation, rising interest rates, geopolitical uncertainties and economic slowdown.2 With record high inflation rates, it will be a significant challenge for wealth managers to preserve clients’ wealth. At the same time, weak market conditions will continue to pressurize asset growth and margins for the industry. During the period of mounting uncertainty, operational efficiency will be critically important to drive growth and profitability, by making the right investments to transforming operations.

A multi-layered approach to streamlined operations for profitable growth

A strategic and structured approach is needed for operating model transformation to enable sustainable profitable growth efficiently, as opposed to the rip-and-replace approach. Wealth managers need to focus on the three layers of transformation:

Strategic – what are the strategic objectives your organization wants to achieve?

Structural – in light of the strategy, how can the organization be structured to support the strategy and transformation?

Tactical – how can the operations and processes be optimized based on the defined strategy and structure?

The three-pronged approach helps organizations transform the operating model efficiently for sustainable profitable growth by removing operational friction, reducing costs, adding flexibility to the cost structure and enabling scalability. Leading organizations look at transformation programs through a holistic lens and leverage advanced technologies while continuing to run the business without taking unnecessary risks and disruptions. A strategic mindset is a pre-requisite to implement transformation programs effectively because it lays the foundation for the strategic, structural and tactical prioritisation and decision-making to derive long-term value.

Transformation in action

A leading global financial services organization was looking to streamline client lifecycle management workflows across banking and wealth management divisions, running on legacy systems. With a proven track record in delivering end-to-end integrated business and technology solutions, EY teams were engaged to conduct an operating model simplification program. EY teams successfully implemented the program by leveraging the tactical levers including end-to-end process redesign, change management, intelligent automation and digitization, resulting in:

- Front office process automation enabling over 100,000 hour time savings per annum

- Enhanced user experience by streaming the existing front office task management tool

- Digital onboarding rate from 30% to 73% in 15 months

Industry participants across the board are confronted with emerging risks and challenges exacerbated by the current macroeconomic factors and disruption. Are you prepared to successfully transform operations to lead your organization through uncertainty?

Summary

To stay competitive in today's fast-paced environment, wealth management companies need to transform their complex operating models for efficiency and growth. EY has implemented a program to simplify client management workflows on legacy systems, resulting in over 100,000 hours of time savings and high levels of adoption. Industry participants face emerging risks and challenges from macroeconomic factors and disruption, highlighting the need for leaders to navigate through uncertainty successfully.

Acknowledgments

We would like to thank Rohit Kataria, Azra Begulic and Melanie Veloso for their valuable contributions to this article.