EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Tax Alert 2022 No. 41, 11 October 2022

On 9 August 2022, the Department of Finance released for public comments draft legislative proposals to the Income Tax Act (the Act) and the Income Tax Regulations (the Regulations) related to the investment tax credit for carbon capture, utilization and storage (CCUS) previously announced as a part of the 2021 federal budget and updated as a part of the 2022 federal budget. The initial draft proposals were outlined in EY Tax Alert 2022 Issue No. 31, Proposed federal investment tax credit for carbon capture, utilization and storage.

Interested parties were invited to provide comments on the draft legislative proposals by 30 September 2022; as such, the proposals described below may undergo further amendments before they are tabled in a bill.

In addition, the Department of Finance also released on 9 August 2022 an accompanying backgrounder, Additional Design Features of the Investment Tax Credit for Carbon Capture, Utilization and Storage: Recovery Mechanism, Climate Risk Disclosure, and Knowledge Sharing, which outlines specific design features with respect to the CCUS tax credit. Legislation to implement the proposed design features will necessitate consequential legislative amendments to the draft legislative proposals mentioned above.

The following provides an overview of the draft legislative proposals under the Act and the Regulations, and the specific design features detailed in the backgrounder.

Overview

The CCUS investment tax credit draft legislative proposals are generally consistent with the previous announcements by the federal government. The investment tax credit will be refundable and available to businesses that incur qualified CCUS expenditures after 2021 and before 2040. The tax credit rates are outlined below (see CCUS investment tax credit rates).

Qualified CCUS expenditures will include the cost of acquiring eligible equipment used in qualified CCUS projects. Eligible equipment, as described below, will include equipment that is used solely to capture, transport, store or use carbon dioxide (CO2) as part of a qualified CCUS project and is situated in Canada. This equipment will be included in new capital cost allowance (CCA) Classes 57 and 58, which will have 8% and 20% declining-balance-basis CCA rates, respectively, and will be eligible for enhanced first-year depreciation under the accelerated investment incentive.

The legislative proposals include several definitions that are relevant for the purposes of determining the CCUS investment tax credit of a taxpayer.

Qualified CCUS project

Broadly speaking, a qualified CCUS project is a project that supports one or more parts of a CCUS process by capturing CO2 that would otherwise be released in the atmosphere, or from ambient air, transporting the captured carbon, or storing or using the captured carbon.

To be eligible for the CCUS investment tax credit, a qualified CCUS project must meet the following conditions:

- It is expected to support the capture of CO2 in Canada that would otherwise be released into the atmosphere or is captured directly from ambient air;

- An initial project evaluation has been completed by the Minister of Natural Resources based on a submitted CCUS project plan. This project plan must generally include a front‑end engineering study for the project, an estimate of the quantity of captured carbon that will be used for eligible and ineligible uses by calendar year, and any additional information required by the Minister of Natural Resources, which has not yet been confirmed;

- In each of the first 20 years of the project, at least 10% of the quantity of captured carbon is utilized in an “eligible use”. Broadly speaking, an “eligible use” is currently defined as captured CO2 that is stored in, or otherwise used for, dedicated geological storage or for producing concrete where at least 60% of the CO2 injected into the concrete is expected to be mineralized and permanently stored in the concrete.

- The project complies with all federal, provincial and municipal environmental laws, by‑laws and regulations; and

- If the project is undertaken on a facility that existed prior to 7 April 2022, the project was not undertaken for the purpose of complying with emission standards regulations that apply to coal-fired energy generation facilities.

A CCUS project can support the capture of CO2 in Canada by incorporating one or more parts of a CCUS process, such as:

- Capturing CO2 from a single site and transporting it up to the point it connects to a transportation hub;

- Transporting carbon captured from multiple sites (i.e., a transportation hub);

- Storing or using captured carbon;

- Capturing CO2 from a single site, transporting the captured carbon, and storing or using the captured carbon; and

- Transporting and storing or using carbon captured from a transportation and storage hub.

Qualified CCUS expenditures

The definitions of the different types of qualified expenditures are relevant in computing the amount of CCUS investment tax credit a taxpayer may claim since the type of expenditures will determine the rate of the CCUS investment tax credit.

CCUS expenditures are considered to be qualified expenditures for the purposes of the CCUS investment tax credit if they are incurred after 1 January 2022 and qualify under one of the four following categories:

- Qualified carbon capture expenditure

- Property included in paragraph (a) of CCA Class 57, including property described in paragraphs (d), (e) or (f) if related to equipment in paragraph (a) (see New CCA classes below for further details).

- The portion of qualified carbon capture expenditures is determined by the proportion of captured carbon that the qualified CCUS project is expected to support for storage or use in eligible uses compared to ineligible uses during the first 20 years of the project based on the project plan, determined in five-year assessment periods.

- Qualified carbon transportation expenditure

- Property included in paragraph (b) of CCA Class 57, including property described in paragraphs (d), (e) or (f) if related to equipment in paragraph (b) (see New CCA classes below for further details).

- The portion of qualified carbon transportation expenditures is determined by the proportion of captured carbon that the CCUS project is expected to support for storage or use in eligible uses compared to ineligible uses during the first 20 years of the project based on the project plan, determined in five-year assessment periods.

- Qualified carbon storage expenditure

- Property included in paragraph (c) of CCA Class 57, including property described in paragraphs (d), (e) or (f) if related to equipment in paragraph (c) (see New CCA classes below for further details).

- The property must also be expected, based on the qualified CCUS project’s plan, to support storage of captured carbon solely in a dedicated geological storage. Initially, the CCUS investment tax credit earned on qualified carbon storage expenditures will only be available to CCUS projects that store the CO2 in Saskatchewan or Alberta.

- Qualified carbon use expenditure

- Property included in CCA Class 58 (see New CCA classes below for further details) and is expected, based on the qualified CCUS project’s plan, to support storage or use of captured carbon solely to produce concrete in a qualified concrete storage process. A qualified concrete storage process is a process that demonstrates that at least 60% of the captured carbon that is injected into concrete is expected to be mineralized and permanently stored in the concrete.

In all cases, the property must be situated in Canada and verified in writing as a qualified CCUS expenditure by the Minister of Natural Resources.

Qualified CCUS expenditures are further reduced for any amount in respect of an expenditure that:

- Is incurred by the taxpayer before 2022 or after 2040;

- Is incurred to acquire property that was previously used by any person or partnership, or for which a CCUS tax credit was previously deducted or claimed (or sought to be deducted or claimed) by any person in respect of the property to which the expenditure relates;

- Represents a pre-feasibility or feasibility study, or a front-end engineering study;

- Is capitalized in respect of the cost of borrowed money under section 21 of the Act; or

- Remains unpaid 180 days after the end of the taxation year in which the expenditure was incurred.1

In addition, qualified CCUS expenditures are reduced by any non-government assistance amounts received or receivable in respect of the qualified CCUS expenditures for the year.

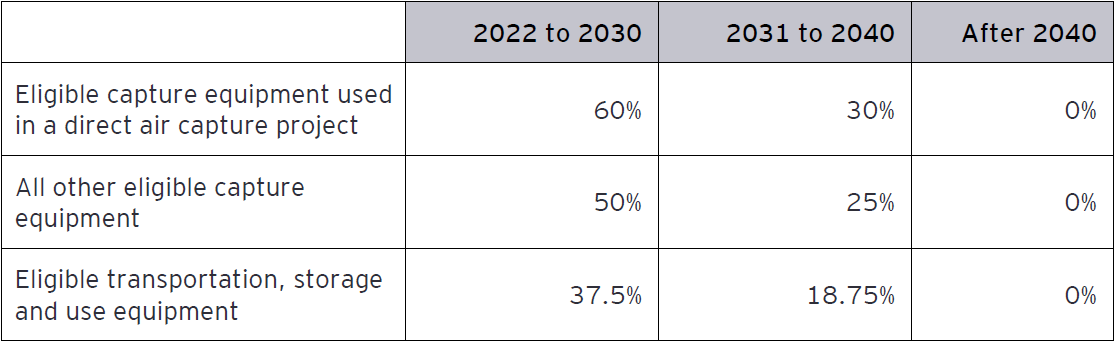

CCUS investment tax credit rates

Qualified CCUS expenditures are eligible for the investment tax credit at the following rates, depending on the type and timing of the expenditure:

The investment tax credit will be able to be claimed in respect of the taxation year in which qualified CCUS expenditures are incurred, regardless of when the related equipment becomes available for use.

New CCA classes

Four CCA classes have been created as a part of the CCUS legislative proposals.

CCA Classes 57 and 58 are relevant for purposes of determining a taxpayer’s qualified CCUS expenditures, as described above.

- Class 57 (8% declining balance CCA rate) includes:

- Paragraph (a): property used solely for capturing CO2 that would otherwise be released into atmosphere or is captured from ambient air, and that is not required for hydrogen production, natural gas processing or acid gas injection

- Paragraph (b): equipment used solely for transportation of captured carbon

- Paragraph (c): equipment used solely for storage of captured carbon in a geological formation

- Paragraph (d): monitoring and control equipment used solely for equipment in paragraphs (a) to (c)

- Paragraph (e): a building or structure of which 90% or more is used for the installation or operation of equipment in paragraphs (a) to (d)

- Class 58 (20% declining balance CCA rate) includes:

- Paragraph (a): equipment to be used solely for using CO2 in industrial production

- Paragraph (b): monitoring and control equipment used solely for equipment in paragraph (a)

- Paragraph (c): a building or structure of which 90% or more is used for the installation or operation of equipment in (a) to (b)

The draft legislative proposals also introduce Classes 59 and 60, which relate to intangible exploration expenses and development expenses related to CCUS.

The asset classifications for the new CCA classes are not segregated in the same manner as those for the CCUS investment tax credit rates, and, as such, certain properties in Classes 57 and 58 could result in varying rates of investment tax credits depending on the type of property that is acquired.

For depreciable property acquired that qualifies for the CCUS investment tax credit rate, the draft legislative proposals provide that the amount of the CCUS investment tax credits will reduce the capital cost of the relevant CCA class(es) in the taxation year following the taxation year in which the CCUS investment tax credit is claimed.

Additional design features included in the Department of Finance backgrounder

The backgrounder proposes specific design features with respect to the recovery mechanism, climate risk disclosures and knowledge sharing requirements associated with the CCUS investment tax credit.

Recovery mechanism

Upon commencement of operations of a CCUS project, a taxpayer will be assessed every five years for the first 20 years of the project to determine if a recovery of CCUS investment tax credit is needed. Taxpayers will be required to provide information on the actual amount of CO2 going to eligible and ineligible uses for each year. As of the date of writing, only dedicated geological storage and storage in concrete are proposed to be eligible uses.

If there has been a reduction in CO2 captured for eligible uses in excess of 5% during any five-year period, a taxpayer is required to file a new project plan and is subject to recapture of the investment tax credit based on actual CO2 attributable to eligible versus ineligible uses.

If a project does not maintain an eligible use ratio of at least 10% in each year during the five-year assessment period, all investment tax credits related to that five-year period and all other remaining five-year periods will be recovered. Any recovery amount required for a five-year assessment period will need to be repaid equally over the following five years.

If extraordinary circumstances impact the eligible use ratio, these time periods may be excluded from a five-year assessment period at the discretion of the Minister of National Revenue. An example of extraordinary circumstances may include the breakdown of transportation or storage equipment that results in a reduction in the eligible CO2 stored in eligible uses.

Examples of the recovery mechanism have been provided by the Department of Finance in the backgrounder.

Climate risk disclosures

For projects with eligible expenditures of $20 million or more, corporations will be required to prepare an annual Climate Risk Disclosure (CRD) report beginning in respect of the first tax year in which an investment tax credit is claimed and continuing through the first 20 years of operations. All corporate partners of a partnership would also be required to produce this report. Reports will be due nine months after the taxpayer’s year-end and will need to be made publicly available by the taxpayer (e.g., on their website).

This CRD report must cover governance, strategy, risk management, and metrics and targets related to the project and set out how corporate governance and policies are contributing to achieving Canada’s commitments under the Paris Agreement and a goal of being net zero by 2050.

If a filing requirement is not met in any year, a penalty will be assessed as the lesser of 4% of the total amount of investment tax credits claimed to date or $1 million.

Knowledge sharing requirements

Projects with cumulative eligible expenses of $250 million or greater based on the project plan are required to contribute to public knowledge sharing in Canada. A knowledge sharing report would be required following the commissioning of the facility and for the following five years. Details of the content requirements of the reports are being developed and will be provided by Natural Resources Canada.

A penalty of $2 million will apply for each required knowledge sharing report that is not produced.

Conclusion

The rules related to the CCUS investment tax credit continue to evolve as more information is released by the Department of Finance. We will continue to monitor the changes to keep you informed with respect to these rules.

Learn more

For more information, contact your EY or EY Law tax advisor, or one of the following professionals:

Calgary

Greg Boone

+1 403 206 5306 | greg.boone@ca.ey.com

Montreal

Krista Robinson

+1 514 879 2783 | krista.robinson@ca.ey.com

___________________________________

1. Such an expenditure would be deemed to be incurred at the time it is paid.

Download this tax alert

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.