EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Related article

-

CFOs are rethinking capital allocation strategy in order to remain agile as well as focus on long-term value. Read our report.

Read more

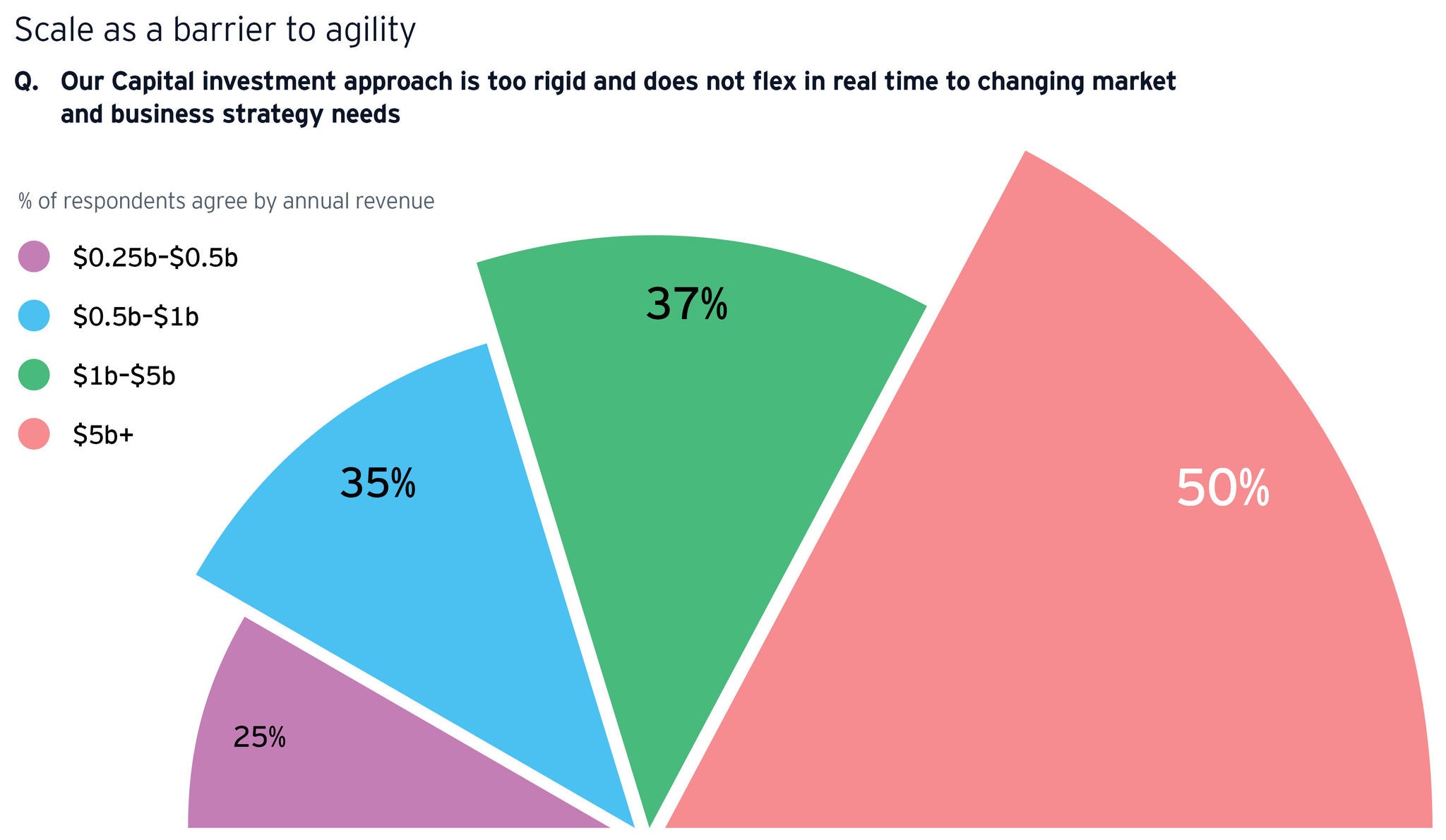

Their greater maturity gives leaders more confidence in their post-pandemic recovery. Eighty-nine percent of leaders are optimistic about their prospects for growth compared to only 59% of laggards. As recovery gains momentum 87% of leaders and 69% of laggards believe the success of their own recovery will depend on maintaining their levels of capital investment. Comparing these metrics with the EY Global Capital Allocation survey, TMT appears to have a more structured planning process suggesting more maturity across the end-to-end capital lifecycle.

The challenge is that too many TMT companies struggle to hit their capital investment objectives. Sixty three percent admit they fail to achieve the kind of returns that were forecast and planned for. Pinpointing a single reason is not easy, instead it reflects shortcomings throughout the capital lifecycle. For example, 66% of all TMT companies agree that the costs of their capital programs escalate and timeframes lapse.

In their defense, predicting where to place investment bets, is not easy for TMT executives. In many ways, they are not the masters of their own destiny. This is an industry characterized by continuous disruption. At one extreme, there are exceptional events, and few are bigger than a global pandemic. It catalyzed demand for TMT services, impacted supply chains and irrevocably changed every aspect of consumers digital life — work, retail, education, entertainment and more besides. Such events are rare although not unprecedented.