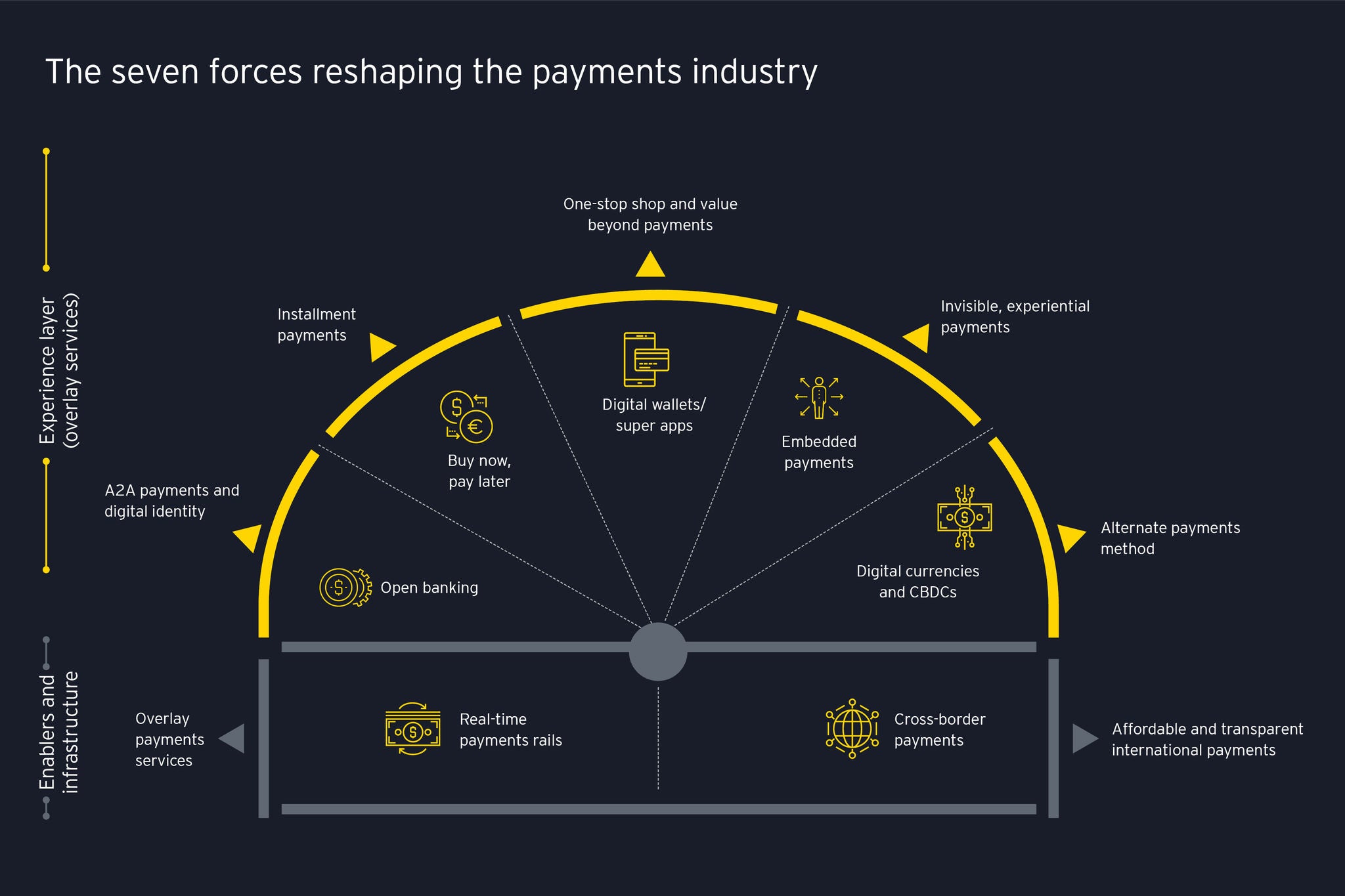

The seven forces driving the future of payments

Open banking: a turning point for the financial ecosystem

Open banking has created a new bank payment method and a framework for payments innovation. Although it does not provide a new set of payment rails, open banking creates a new mechanism for payment initiation, in effect, open payments. Application programming interfaces (APIs) can be used to easily trigger single payments, but also give greater flexibility, such as creating a mandate for VRPs.

The APIs that exist alongside open banking have also unshackled the potential of A2A payments by removing the barriers created by fragmented banking rails, forming an effective “pay by bank” option. This makes it easier to access payments clearing systems and embed an A2A payment at the point of purchase. As a result, customers and merchants have far more options.

The open banking movement is building momentum globally, radically changing the way banks approach business models, customer engagement and service delivery. With digital experiences becoming increasingly important, open banking offers opportunities for organizations to serve customers in more innovative and intuitive ways.

Real-time payments: unlocking the power of RTP with value-added services

RTPs use modern payment rails to move money from end-to-end in real-time. While RTP infrastructure has essentially changed the payments landscape, the true value of RTP is only realized when surrounded by value-added services. For example, in Australia, the first value-added service launched from the New Payment Platform (NPP) is Osko by BPAY. It allows consumers to use an alias – like an email or mobile number – in place of an account number to initiate payments on the NPP. Such services have proven to be effective at helping RTP networks scale and deliver on their value propositions.

The adoption of real-time rails unlocks tremendous innovation across overlay services, enabling all PSPs to serve customers better through A2A, which is further reinforced and accelerated by open banking.

Financial institutions, PSPs, PayTechs and FinTechs would benefit from providing these “overlays,” to not only increase their bottom lines via new sources of high margin revenue, but also to increase transactional volumes on the rail itself. It’s a win-win for all parties in the ecosystem.

The future of cross-border payments is faster, cheaper and more efficient

Wholesale cross-border payments tend to be slow, generate high transaction charges, and are considerably less transparent than domestic payments. However, with regulators laying the groundwork for these payments to be modernized, PayTechs are moving at pace to transform the cross-border payments business model (both wholesale and retail) and customer experience.

Notably, all payments providers are starting to recognize the potential of digital assets, cryptocurrencies and DLT technology to help improve and transform clearing and settlement processes.

The G20 endorsed a roadmap, developed by the Financial Stability Board (FSB), in coordination with the Committee on Payments and Market Infrastructure (CPMI) and other relevant organizations, to enhance cross-border payments. It lays out a comprehensive set of actions covering 19 "building blocks" identified by the CPMI across five focus areas.

With immediate focus on the ISO 20022 migration, we will see greater adoption of enhanced and rich data that will drive better quality of outgoing messaging and improve cross-border payments.

By staying up to date with new technologies and regulations, PSPs can improve their strategic offerings around cross-border payments.