EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How curating ecosystems enables self-disruption

Nationwide Insurance required a new brand and a new technology platform to access a customer segment that may otherwise have been unobtainable.

The better the question

Should established companies fear disruptors, or partner with them?

When Nationwide’s Innovation team wanted to rapidly launch new products, they were constrained by legacy systems – and turned to EY to help.

Everyone knows that staying afloat in today’s fast-moving, transformative business environment means using technology to enable increased agility. It’s not enough to adapt to what’s happening now; the key is to be prepared to adapt to what comes next – and beyond.

The difficulty is not in acknowledging the need to embrace the new technologies – it’s doing something about it.

For insurers, self-initated transformational change does not often come easily. Most insurance companies have histories going back decades, in which time they have accrued vast amounts of historical data – a potential source of invaluable insight for developing new products and services.

But carriers also tend to have complex legacy systems that can be burdensome and expensive to update or replace – and face significant regulatory pressures. If new solutions are unsuitable or improperly implemented, the financial and reputational implications could be catastrophic.

“We wanted to prove to ourselves that we could move fast,” says Scott Liles, Lead Executive, Innovation Leader at Nationwide and President of Spire – a Nationwide company. “We put a stake in the ground and said, ‘Within this calendar year, we're going to get something new to market.’”

This ambitious target reflected the urgency of a changing market – but proved a significant challenge for a large insurer with a number of inflexible legacy systems and processes, and a culture that sometimes resisted change.

“When approached in early 2019, the IT folks at Nationwide said that they could not prioritize the implementation work on a new insurance product, as they were already doing a massive core systems transformation,” says David Connolly, EY Global Insurance Technology Leader. “The Nationwide Innovation team said that an alternate approach would need to be explored, and EY Nexus for Insurance proved to be the platform to deliver a new product in just 7 months."

Designing for digital-first consumers

Nationwide was founded in 1926 to provide automobile insurance to farmers. While the company’s offerings have evolved over the years, by early 2019 Nationwide was looking to launch an entirely new kind of product; one that would connect with a new generation of drivers with a digital-first mindset.

Roughly 50% of the US population is now comprised of millennials and Gen Z (defined collectively as those born between 1981 and 2012). Failure to keep up with the expectations of these increasingly influential, digitally-minded generations is not an option that companies can afford to take.

But rather than make assumptions, the team knew they first had to define what a good insurance product looked like in the eyes of these target customers. Taking a Design Thinking approach, a consumer persona called Tonika soon became central to the project’s development.

“Tonika was a woman we interviewed who so embodied everything we were hearing from the cohort that we just used her as our persona to capture what we were hearing from everybody else,” says Liles.

Tonika is in the 25- 37 adulting range, she’s coming off her parents’ cell phone plan, and she’s starting to seek value. She wants to engage via a mobile experience. She doesn’t think things are quick enough, she doesn’t think things are fair and transparent, and she doesn't see the value.

Pursuing speed and simplicity

“These younger consumers don’t understand why insurers need so much information,” explains Kunal Kochhar, a member of EY Digital Innovation team. “Why does it matter if I am married? It really should just be based on what I drive, how I drive, and when I drive.”

Thanks to their customer research, Nationwide realized not only that they needed to create a digital-first platform, but one that radically simplified the insurance-buying experience for customers like Tonika.

“This customer wants transparency. They want to be able to trust,” Kochhar continues. “They want to understand what they’re paying for and why – and they want to be rewarded.”

In the end, Nationwide decided that what Tonika wanted was a radically different insurance product. “She wanted an insurance experience that was delightful for the customer via every interaction,” says Connolly. “A quick quote and policy issuance, and a claims experience where the status details are shared proactively.”

A typical insurance product uses up to 60 rating variables: Gender, martial stats, credit scores, for example. For Spire, only the bare essentials are required

With just a scan of the drivers’ license and the response to four questions, customers are able to get an auto policy issued, within 60 seconds.

Aiming for hard targets

Not only did Nationwide want a radical, disruptive product, they wanted to get it to market fast. Really fast. Within seven months – in time for a December 2019 launch.

However, insurance companies in general, and incumbents in particular, can be seen as slow to adapt. To avoid being slowed down by legacy systems and cultural constraints, Nationwide decided to set up Spire as an entirely new, separate company, and run it on an outsourced technology platform.

This presented its own challenges – not least in building the right digital infrastructure and operating models to support ambitious plans without excessive risk and expense.

What the Spire team needed was a way to adopt plug-and-play approaches to innovation. Via its EY Nexus for Insurance platform, EY teams were able to solve that problem for Spire – and help create a brand-new insurance company in the process.

Ask most insurance companies, and they will agree that it typically takes between 18-24 months to get a new product to market – already a longer period than Nationwide could normally afford. But the company was also in the middle of a core operations transformation process. Getting a new product to market could have taken as much five years.

When we were brought in on the Spire project, we had seven months to hit the target launch date. But with EY Nexus for Insurance, between three-nine months is the usual range to delivery.

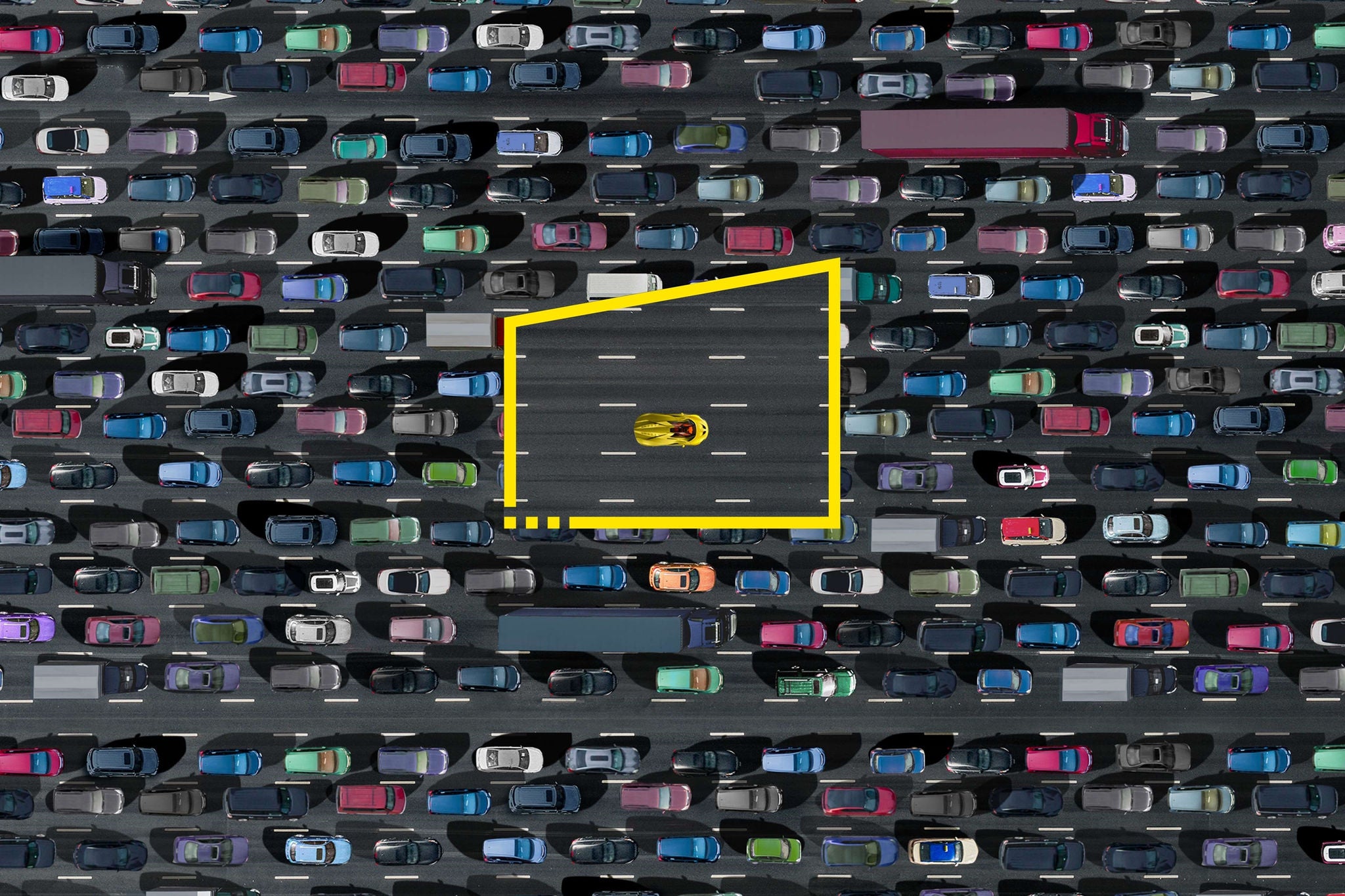

Nationwide was fully aware they may be cannibalizing their existing market with Spire. But they believed that strategically, they were better off cannibalizing themselves rather than waiting for someone else to do it to them

The better the answers

Leveraging EY Nexus to enable innovation at speed

EY Nexus allowed Nationwide to rapidly set up and scale an innovative new company, Spire, via a curated ecosystem of partners.

A combination of talent, technology and trust led Nationwide to turn to EY teams and our EY Nexus platform.

“We knew the technical stuff was going to be really hard, and we knew EY had a massive jumpstart on everybody else with Nexus being in production to support other carriers for over five years,” says Liles. “They have also been a long-term partner of Nationwide, so they knew how to operate with us. That combination of a market lead and a prior relationship, and operational talent, was a good starting point.”

Breaking down walls

The first step towards building a truly disruptive product was learning to act like a disruptor – staying firmly focused on the end-customer’s needs. In Spire’s case, this also involved setting up a work site that was physically separated from Nationwide’s headquarters, where a start-up-inspired atmosphere would be cultivated – t-shirts and sneakers and pizza-fueled hackathons included.

“It helps cultivate a different mindset, with smaller teams leveraging technology and more outside thinking such as that brought by the EY organization,” says David Connolly. “We had teams located in five different locations around the world to serve the Spire incubator, bringing quality results, working seamlessly to gain 16 hours of productivity per day.”

This meant that as well as a small dedicated Spire team, the project involved a combination of EY’s user experience (UX), digital marketing, functional, actuarial, technical development, testing and production support professionals.

This additional in-house expertise and experience that EY teams were able to bring quickly proved invaluable when EY was challenged to find a way to price policies with only four questions and a driver’s license – the core proposition at the heart of the Spire project. “We were able to provide actuary services and pricing expertise. In six weeks, we figured it out,” Connolly says.

During the process, there were few distinctions between EY and Spire. “It really became just one team,” Connolly says. “Everyone backed up each other, and when leadership would ask questions, EY and Spire could respond with one voice. There were no walls –figuratively or literally.”

Taking a modular, ecosystem approach through Nexus

The foundational technology behind Spire’s speed and success is housed in EY Nexus – a powerful platform that enables the rapid, modular construction of sophisticated insurance products, whether these are to replace existing core operations, or to introduce brand new products.

EY Nexus for Insurance utilizes many established and emerging technologies, all sitting on Microsoft Azure – but the key to its adaptability is that it does not limit EY teams or clients to specific technology providers. The EY Nexus platform has been developed to be fully compatible with commercial technologies built for other cloud providers, off-the-peg, or custom-made bespoke solutions. “Azure is cloud infrastructure – essentially the table on which we put our dinner,” says Kochhar. “Every dish on that table is a modular element you can bring in. We build or buy exactly those elements that the client needs.”

Central to the success of Nexus is EY teams seeking to understand individual clients’ needs, and then identifying the right modular elements to help deliver the desired results. It allows us to quickly create an ecosystem of software, whether this means partnering with a third-party software provider, or developing in-house, bespoke applications.

“The brilliant thing about Nexus is that it's a platform, not a single solution. It’s not a piece of software with specific business functionality”, says Greg Sarafin, EY Global Alliance and Ecosystem Leader. “Nexus helps us identify capabilities from an ecosystem that we curate, and then cultivate them into new products and services for our clients. Crucially, it's also been designed to handle change on the back-end systems without disrupting the front-end engagement systems for our clients and their customers. It can continually adapt and evolve over time, as needs change and new capabilities become available.”

Making insurance more agile

This flexibility became increasingly important as Spire moved closer to completion, and the EY teams and Nationwide teams moved into a period of continuous testing, with Nexus allowing the product to be refined on the go.

One of the reasons that we chose EY was their proven platform, and ability to swap in newer technologies. We can make changes very quickly, in a matter of weeks. That’s lightning fast

We didn’t have time for reworks, says Nash, EY Americas Digital Insurance and User Experience Leader “so we ran two different pods. We took a look at the work and created specs and sprints that would allow us to develop the product with a logic of flexibility.”

This approach will add benefits beyond the design process, well into the rest of Spire’s life cycle – ensuring that Spire can continue to adapt as its customers’ needs and expectations shift. This technological flexibility is paired with a commitment by EY to use their sector knowledge and actively curate the future life of the product, watching for any future developments in the field and implementing them where appropriate.

“We have a three-year production support contract with Spire,” says Shekhar Mahadevan, EY Chief Solution Architect. “Let's say in the second year, a great digital payments capability comes along. We tell Spire leadership that we want to make the change. There is minimal or no system downtime required to perform the swap out/in, and little effort.”

Through a combination of the EY Nexus platform’s modular digital architecture and flexible, agile working strategies, EY teams provided Spire with the technologies and capabilities needed to get a truly leading-edge product out to the market at speed.

Our mantra was to create insurance that people want, not just what they need. We managed to create it because we executed it differently – and EY was a critical piece of that partnership

The better the world works

Integrating ecosystems to enable rapid innovation at scale

Integrating ecosystems via curated platforms like EY Nexus could change not just insurance, but every industry.

The end result was a mobile-first platform that, as promised, lets prospective customers get a quote in 60 seconds, after simply scanning their drivers’ license and answering four questions, with no need for intervening agents.

From there, the platform continues to provide transparency to customers and helps them further improve their insurance. For example, telematics allow the Spire app to continually monitor drivers’ performance and offer them advice or reward them with better insurance premiums based on that behavior.

“It’s working really well, and we're getting superb feedback,” Liles says. “People are seeing that Spire is highly differentiated in the market, particularly as a mobile-first platform. Around 98% of shopping and activity is being done on mobile, which is exactly what we wanted. We're really delighted that this new rate plan is working. It's differentiating risk, it's pricing well, and people really, really understand it.”

Integrating ecosystems to help all companies be more agile

Spire is a textbook example of how large companies can innovate purposefully, and at speed. Within months, a giant legacy firm managed to put out a radically redesigned, disruptive insurance product thanks to a flexible platform that could harness a carefully curated digital ecosystem of capabilities.

This is not just an insurance issue. Every company and every industry on the planet faces the same problems with disruption

Few companies have enough capital or enough in-house capability to create enough innovation to self-disrupt,” says Sarafin. “That means you need to be able to find disruptors to work with.”

“After finding potential partners, you need to be able to determine which ones you can work with and which ones you can't – especially as some could be competitors. Then you need a way of dealing with the operational risk of working with these disruptors – some of whom may be small and short-lived.”

“What firms need is an intermediary platform like EY Nexus that enables these connections to take place without any risk to their own front-end operations, and seamlessly swapping in and out different innovative technology and software providers. I call it ecosystems integration.”

“This is the thing that makes EY Nexus different – EY doesn’t just find potential partners and make introductions; we cover the operational risk of setting up and integrating those partners, along with their tools and technologies. We don’t just make introductions. Instead, Nexus gives EY clients new ways to collaborate and innovate.”

NextWave Insurance

We explore the trends that are changing insurance – and how

the industry’s business models and thinking need to change

for the NextWave.

How EY can help

-

A transformative solution that helps accelerate innovation, unlocks value in your ecosystem and powers frictionless business. Learn more.

Read more -

We collaborate with insurers on technology transformation programs and the deployment of digital tools. From concept to implementation, we work with you to develop strategies that optimize performance, drive efficiency and enhance quality.

Read more