EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

HGV growth faces challenges amid complex regulatory environment – EY comments

Mark Main, EY UK Transport Lead, said:

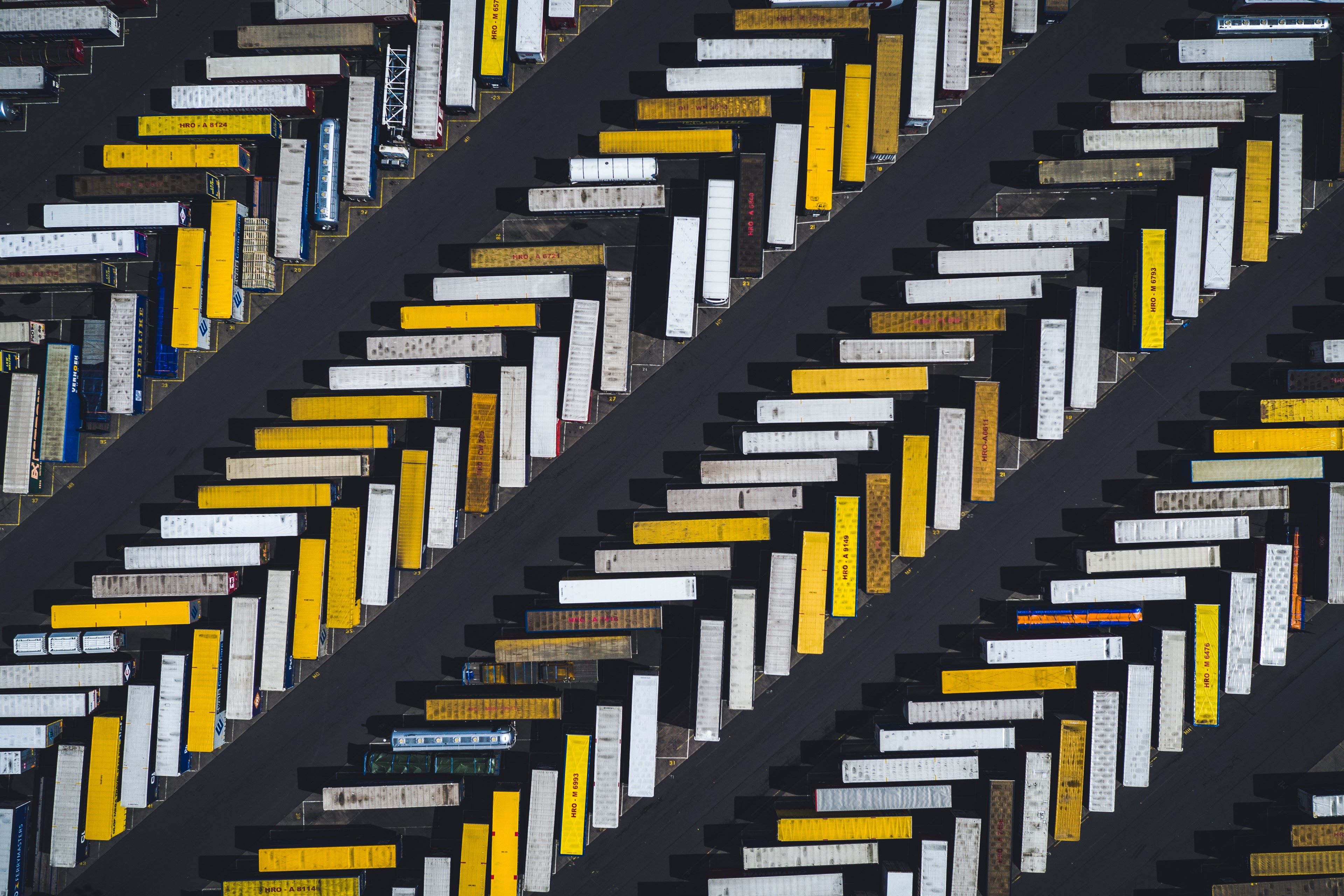

“Sales of Heavy Goods Vehicles (HGVs) saw modest growth in Q2 2024, with registrations up 2.6% year-on-year to 11,469 units, albeit half year results were broadly flat (-0.7%) with sales of 22,537 in H1 2024 down slightly from 22,691 in the first half of last year, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

“While these figures demonstrate the automotive sector’s continued resilience following two years of consistent growth in overall new car registrations against a complex and constantly evolving economic and regulatory backdrop, there is also no denying that they highlight ongoing challenges.

“Within the top 5 vehicle body types, 4 out of the 5 categories saw growth, with only tractor units experiencing a decline, reflecting the challenges some players in long haul and parcel delivery services are experiencing post-COVID.”

“Financial challenges for some Original Equipment Manufacturers (OEMs) of Electric Vehicles (EVs) have continued to hinder the industry’s progress towards cleaner and greener HGVs and Light Commercial Vehicles (LCVs). Indeed, it is well-documented that several significant players have recently either gone through restructuring or ceased trading altogether.

“Zero emissions HGVs (or “eHGVs”) sales in Q2 2024 increased, albeit only to a subdued total of 65 units. The SMMT has reported that eHGVs still only represented 0.56% of the UK’s overall market in Q2 2024, up slightly from 0.44% in the same quarter last year. While this growth is a small step in the right direction there remains a complex road ahead and a steep uphill task to electrify the Heavy Commercial Vehicle (HCV) sector.

“Progression for eHGVs continues to trail significantly behind the inroads made in relation to electric cars, with stubborn challenges limiting growth on a consistent basis. For example, there remains a substantial gap between the infrastructure for eHGVs compared to electric cars. However, £200m of government funding was announced in late 2023 to decarbonise freight, with plans to roll out up to 370 zero emission trucks across the country, representing some signs of promise. Certain companies have already started to take advantage of this funding and are beginning to roll out trial fleets and infrastructure.

“Indeed, the scale of the task that lies ahead in relation to increasing the volume and proportion of eHGVs enough to align with the UK’s 2040 eHCV transition goals remains highly significant.”

Challenges mount for LCVs despite year-to-date sales growth

Mark Main added:

“Overall, Light Commercial Vehicle (LCV) sales remain robust following modest growth in July, with registrations up 2.7% year-on-year, according to SMMT data. However, July registrations were down -8.5%. There remain challenges for the UK’s EV transition in the commercial vehicle sector. Battery Electric van (or “eLCV”) registrations fell by -7.1% year-on-year, with eLCVs only accounting for a 4.96% market share this year-to-date, down from 5.5% at the same point in 2023. As is the case for consumers, businesses continue to be deterred from making the switch to Zero Emissions Vehicles (ZEVs) due to concerns around pricing, range, charger availability and vehicle capability in heavier applications.

“With the ZEV Mandate now in place, LCV OEMs are some way off the target of 10% ZEV sales for 2024, and the subsequent 2025 target of 16% looks even more challenging. Faster and more meaningful progress in the growth of eLCV sales will be critical to regulatory compliance and the avoidance of heavy fines, said to be £18,000 per vehicle according to reports. Infrastructure challenges continue to persist, but with the Internal Combustion Engine (ICE) sales ban being reverted to 2030 for cars, there could be renewed urgency among businesses if the same change is made in respect of LCVs. Competitive pricing and new models may provide a compelling buyer proposition to drive increased demand for eLCV sales.

“There are also increasing reports of OEMs now mandating fleets to buy a certain proportion of eLCVs as part of new orders in pursuit of regulatory compliance, adding a further layer of complexity for fleet operators.”

Related News

HGV growth faces challenges amid complex regulatory environment – EY comments

Mark Main, UK Transport Lead at EY, comments on SMMT HGV registration figures for H1 2024 and LCV figures for this year to date.

Two consecutive years of growth in new car registrations

EY’s David Borland and Edwin Kemp comment on the SMMT new car registration figures for July 2024.

Auto industry sentiment challenged despite sales growth

EY’s David Borland comments on the SMMT new car registration figures for June 2024.

Automotive sector continues to grow, but concerns remain about 2024

David Borland, EY UK & Ireland Automotive Leader, comments on SMMT new car registration figures for January 2024.

EY’s latest Mobility Consumer Index reveals that Electric Vehicle (EV) buying intent is growing in the UK.

UK’s EV success hinges on six essentials as growing demand highlights infrastructure gaps

A recent study by EY and Eurelectric has highlighted that the EV transition in the UK and around the world hinges on six essentials.