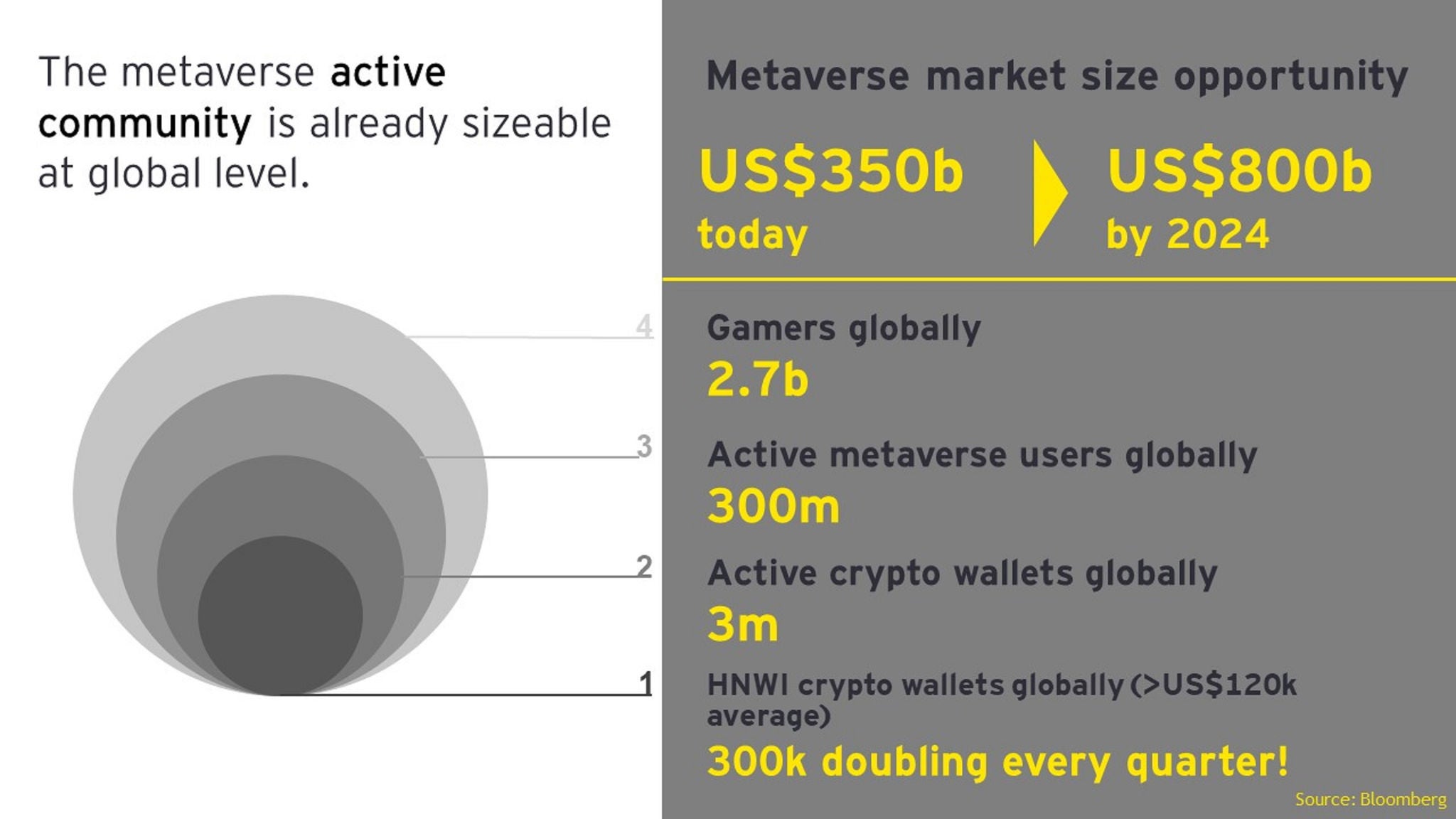

The power of the metaverse is not in the technology behind it, but the social revolution it is creating. It's empowering people at all levels of the organisation, to create content, shared content, transact and monetise and create an economy.

This presents some fundamental challenges and opportunities for banks. Their customers are going to have some sort of experience in these communities. And banks need to ask themselves, do we understand the metaverse and its impact on our customers? Do we know how they create value? Do we know how they are going to live in these virtual worlds? What are going to be the life events in this virtual world?

There is a real risk that if banks don`t engage they become disintermediated. As we saw in chapter four, attracting talent with digital skills will be vital in the future, so a credible and visible metaverse presence will also be important for recruitment.

Banks will need to fight for the right to finance within the metaverse

The risk to banking being side-lined in the metaverse is very real. Decentralised finance, using blockchain, removes the need for intermediaries such as banks. There will be more collaborative peer-to-peer lending, and commerce through blockchain and cryptocurrency.

Banks who develop solutions that serve the metaverse, working with government regulations and a secure system, can be front and centre financing the needs of this new world.

Innovation in customer engagement – instant virtual engagement will recapture intimacy and trust

Banks in 2030 will use augmented reality or virtual reality to reimagine how they connect with customers. It will restore trust and intimacy back in banking, after the mainly transactional nature of digital and mobile banking. The metaverse can place humanity back in ways that are not possible in app alerts or text messages.

Digital and mobile banking have removed the opportunity for banks to build positive personal relationships with their customers. Chatbots or overworked call centres can sometimes be a frustrating channel for customers when they want to speak to their bank.

The metaverse could allow small businesses to show their relationship manager their new product or machinery, to help fast track a loan application or asset financing request. But banks will still need other channels (such as call centres) for those who are slower to adapt.

For the next generation of bank customers, who have grown up with gaming, the metaverse will be a natural habitat to engage with their banks. But it can also help banks to increase financial literacy. This can be scaled up and made much more interactive and accessible.

Banks can be a beacon of safety in a sea of uncertainty

One common fear about the metaverse is how to manage fraud prevention or financial crime. The risks will be very different to the real world, given people can trade in unregulated forms.

Banks can be part of the answer. They can help with validation, fraud prevention, financial crimes – creating a trust layer between consumers and this brand-new world. Instead of trying to build controls to fix problems (as in the real world), banks who engage early can build the controls up front, as the metaverse develops.

Banks will also need new credit and risk models to deal with emergence of new metaverse native businesses that are run automatically using computer code, smart contracts and blockchain.

What should banks do now

Stay close to any new disruptors - that are impacting their customers. Banks will need to understand all the different channels or environments that their customers may care about. Banks will have to rethink how they engage with these new environments, including:

- Workforce: whether it's talent development, onboarding, or recruiting, employee experience.

- Product development: understand and build propositions relevant to customer’s lifestyle.

- Customer experience: leverage the potential offered by developers to redefine the customer journey, customer experience, and even how they're going to engage with new customer segments.

- The metaverse: should be seen as an emerging market for banks. To be credible to gamers and current users of the metaverse, banks will need to develop a strong brand within the virtual world. This will differ from the real world, and could prove a competitive advantage for those banks that are seen to be credible in the metaverse.

- Wealth and private banking teams: should be looking at the opportunities to gain customers, with many high-net-worth cryptocurrency individuals likely to be fully immersed in the metaverse.

Jeeva Moni, Partner, Ernst & Young LLP and Ebony Smallman, Senior Manager, Ernst & Young LLP have contributed to this chapter.

Special thanks go to Nina Driscoll, Director, Ernst & Young S.A., for her contribution to this report.