Models for scaling nature-related investments

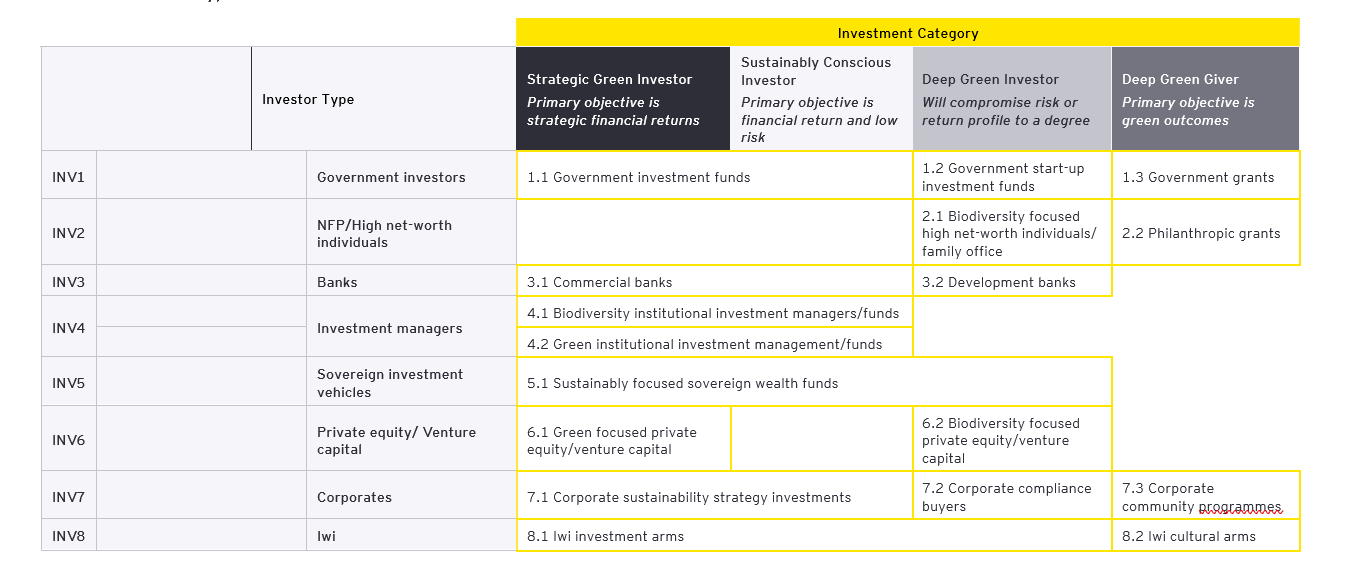

The report identifies that to increase available capital and attract a more diverse range of investors, projects must provide a return on investment. Four ‘investment models’ were identified through our research that could support nature-related investments and provide a financial return: 1) payment for ecosystem services 2) nature-positive companies 3) including nature-based solutions into carbon markets and 4) establishing biodiversity crediting markets. The report presents nature-related decision-making trees for these models to identify potential types of investors depending on the characteristics of a project.

Company Investment models

1. Valuing Ecosystem Service Improvements: Companies dependent on ecosystem services see shared value in enhancing these services. They undertake nature-related projects directly or pay a company to do so on their behalf, making the project investable. Additional Investor Types can fund this through debt or equity investments with the company.

2. Nature-Positive Companies: Companies adopt nature-positive strategies for perceived strategic advantages, such as branding, financial benefits, or social responsibility, allowing them to charge a premium for their products. Nature-related projects become investable as companies invest in projects to fulfil their nature-positive goals and reap the benefits.

Crediting models

3. Expanding the NZ Emissions Trading Scheme (ETS): Integrating high-integrity nature-based projects, such as wetlands, into the NZ ETS by “stapling” biodiversity outcomes to carbon units and expanding the carbon credit market. Nature-related projects become investable through attaching the revenue stream associated with carbon sequestration.

4. Establishing Biodiversity Credit Markets: Creating a market for biodiversity credits, which can be voluntary or linked to legal requirements, supporting some level of regulated demand. Nature-related projects become investable through providing a revenue stream to a volume of nature-related outcomes.

Creating an investor-friendly environment for nature

New government policies will be required to protect, enhance and restore New Zealand’s biodiversity and ecosystem services. Achieving this will require a combination of policy instruments, including standards, regulations, market-based incentives and government grant funding. A selection of policy recommendations from the report are:

- Match projects with suitable investors through a survey capturing investor preferences for environmental impact and investment strategies.

- Aggregate smaller nature-based projects into diversified portfolios to meet investor size criteria and attract a broader range of investors.

- Develop high-integrity methodologies for nature-related investments to enhance credibility and investor confidence.

- Establish a market for biodiversity. Biodiversity credit markets can be voluntary with no regulated demand, or they can be linked to consent requirements or other legal requirement which supports some level of regulated demand.

- Mandate nature disclosures and uptake of the Taskforce for Nature-related Financial Disclosures (TNFD) reporting. This would drive heightened corporate awareness of the value of nature, and increase the uptake of nature-positive business practices.

- Foster the development of a green taxonomy to define environmentally suitable economic activities, enhancing market transparency and directing capital towards green projects.

- Create blended finance investment vehicles to mitigate risks and attract private investors by absorbing higher-risk positions.

- Develop grant programs or private/public partnerships to fund pre-feasibility studies, aiding the initiation of projects and innovation in nascent markets.