EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

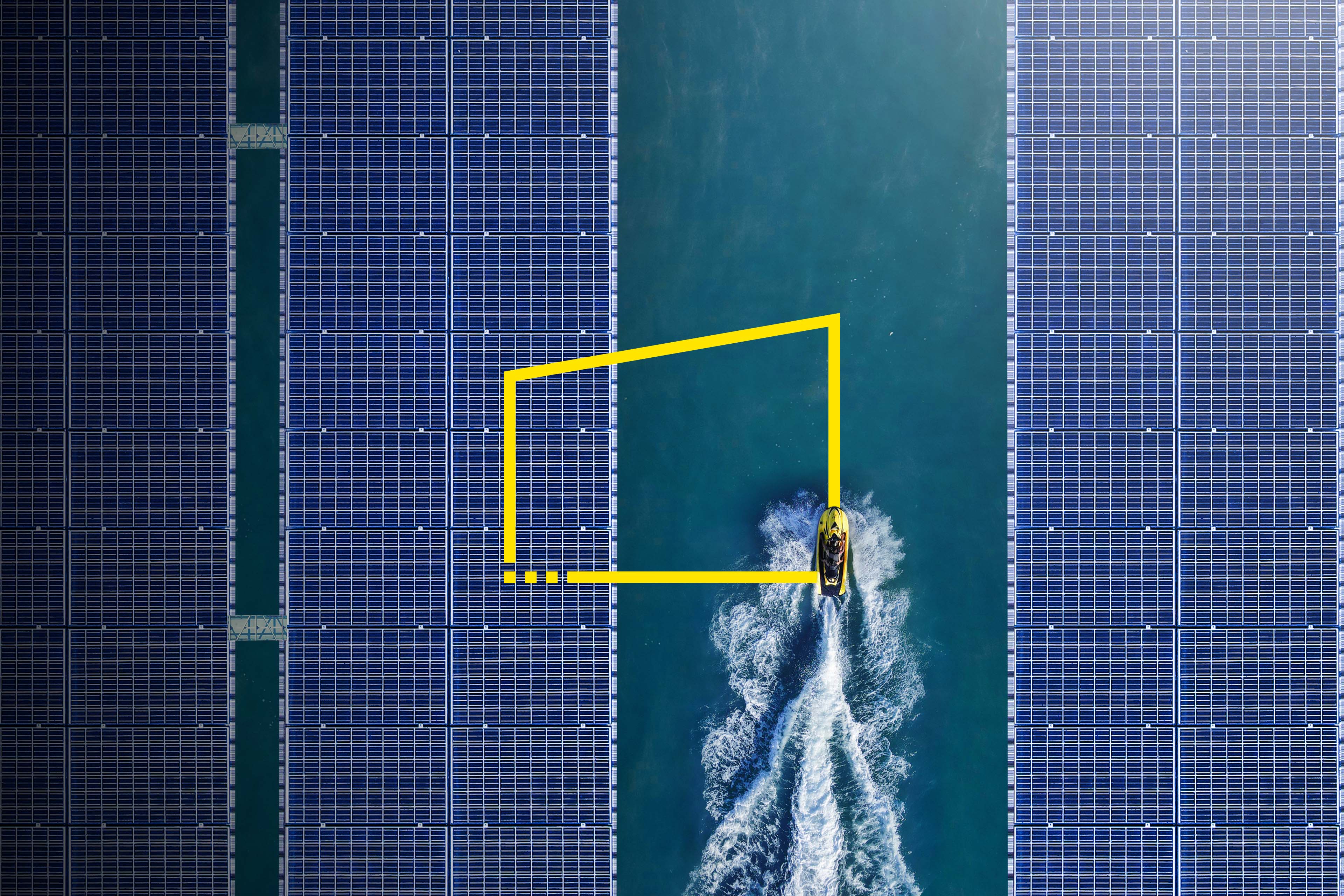

Global Renewables

What EY can do for you

A global renewables industry is emerging quickly, shaped by new technologies, new business models and new ecosystems. Opportunities are growing, but so is complexity, which creates uncertainty, risk and delay. For organisations intent on playing a leading role in renewables, the ability to move quickly and decisively will become more valuable but also more difficult.

EY Global Renewables combines our experience, capabilities and technology to help you find better answers, take decisive action and move forward faster. Our teams work with yours to:

- Define the right long-term strategy to lead your organisation’s transition to renewables

- Develop effective market entry strategies that mitigate risks

- Help deliver and operate generation assets powered by existing and emerging renewable energy sources, including storage

- Improve financing and tax structures

- Scale up and commercialise innovative energy technologies to accelerate decarbonisation

- Achieve carbon neutral or carbon negative targets by innovating ways of sourcing renewables, such as power purchase agreements

- Meet higher stakeholder expectations around clean energy

EY Power Price Forecasts (PPF)

EY teams can help minimise risk when defining your renewables business strategy with our new Power Price Forecasts (PPF) service.

High inflation, uncertain supply chains and fluctuating power prices are pushing up the cost of renewables projects. This has wide-ranging impacts on:

- Energy companies affected by volatile market prices

- Organisations operating within energy-intensive sectors

- Entities with significant exposure to the energy sector, such as:

- Large industrial and chemical players

- Banks, funds and asset managers

- Telecommunications companies

- Data centers

The PPF service projects future energy prices and can also model the impact of different pricing scenarios. Based on a wide-ranging set of assumptions and data about past, present and future electricity demand and supply and their drivers, the PPF service includes two offerings:

- Standardised power price modeled curves that project how electricity prices will develop in specific countries over time.

- Bespoke price projections integrating clients’ assumptions on a number of pre-defined inputs to produce specific pricing forecasts and scenarios that inform better capital and strategy decisions.

The PPF service can be integrated with other EY services, covering all your needs in the context of a transaction or a valuation. This connected approach also unlocks insights and data that help identify opportunities to add more value across the business.

With EY Global Renewables, you’ll be ready to lead your organisation through the transition to renewables – and play your role in building the decarbonised, sustainable economy that creates measurable long-term value for everyone.

The team

Our latest thinking

Four factors to guide investment in battery storage

RECAI 63: Demand for battery energy storage is growing amid grid volatility. The EY ranking of investment hotspots highlights opportunities. Learn more.

Will local ambition fast-track or frustrate the global energy transition?

The Inflation Reduction Act has triggered competition in renewables, but could unbalance international capital allocation. Read more in RECAI 61.

Can decentralized energy get good enough, fast enough?

The integration of rising amounts of renewables into grids must improve significantly if markets are to meet their net-zero goals. Read more in RECAI 60.

Does the need for energy security challenge the quest for net zero?

The power market is in flux and gas prices are high, but can green technologies and alternative fuels offer energy security? Read more in RECAI 59.

Are the global winds of change sending offshore in a new direction?

Turbulent times in the offshore wind sector could change the way large-scale energy projects are built and funded in future. Read more in RECAI 62.