EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY India provides expert tax policy advisory services, offering insights and strategies to navigate complex tax regulations and drive business growth.

Read more

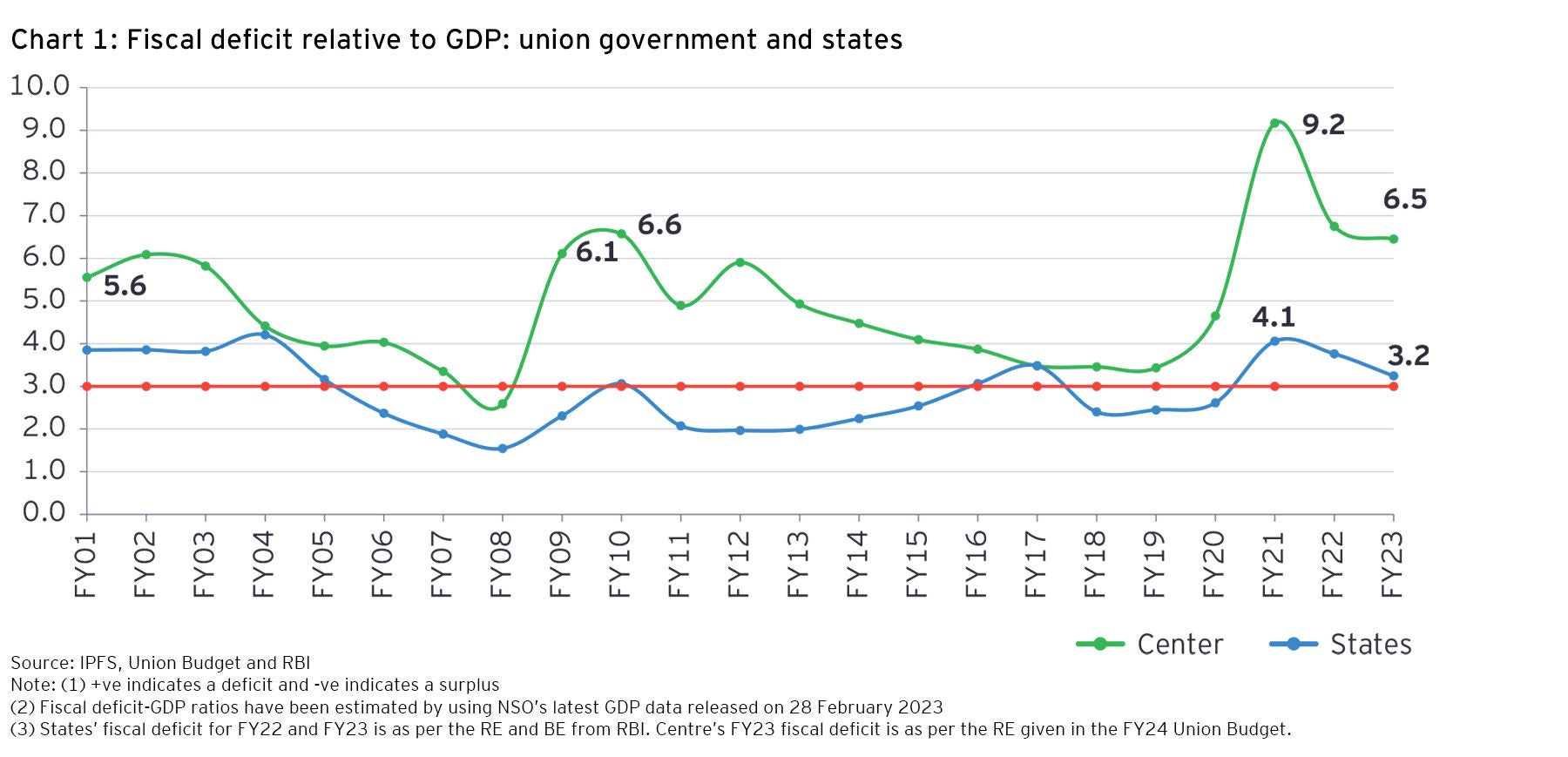

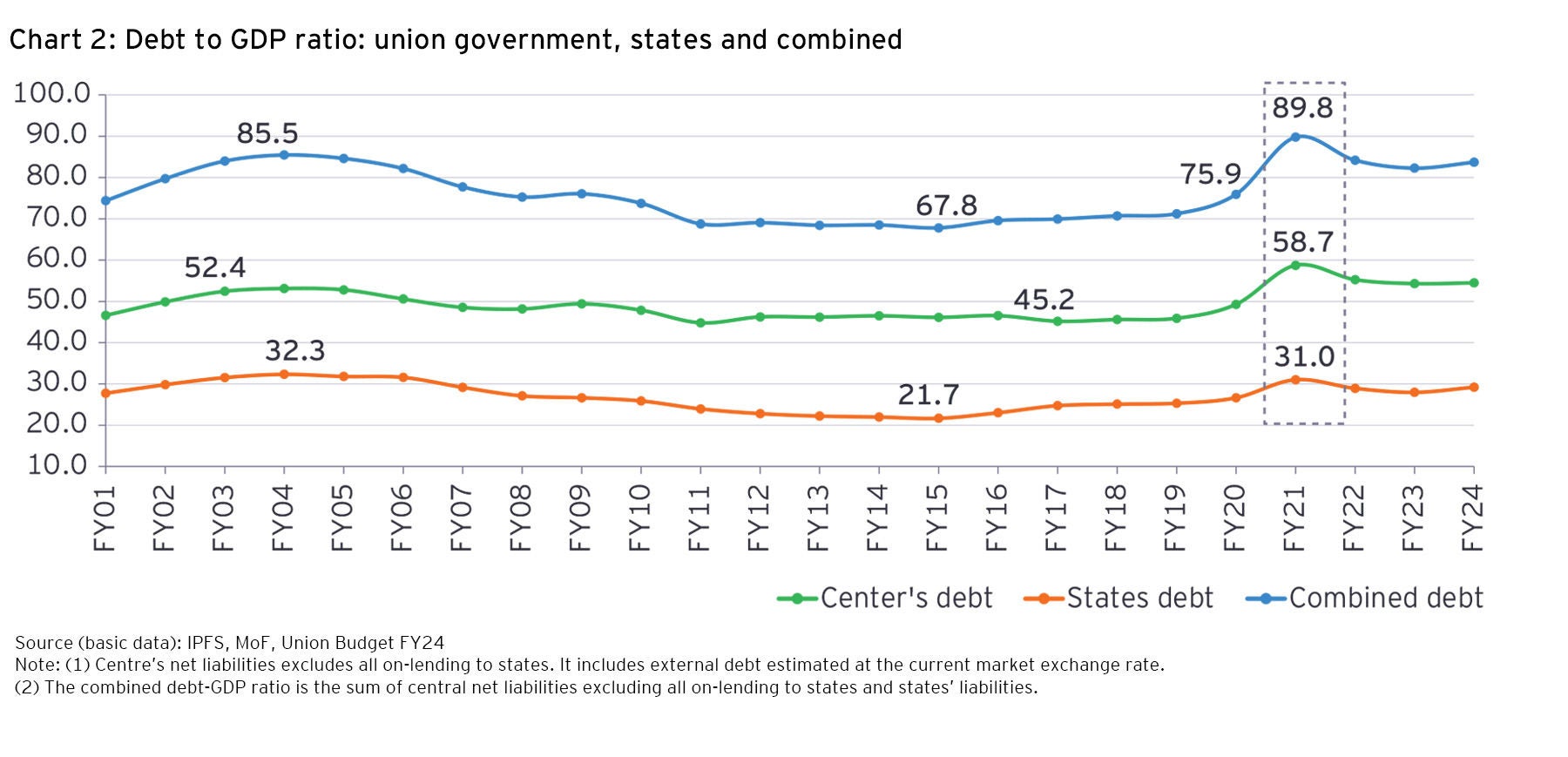

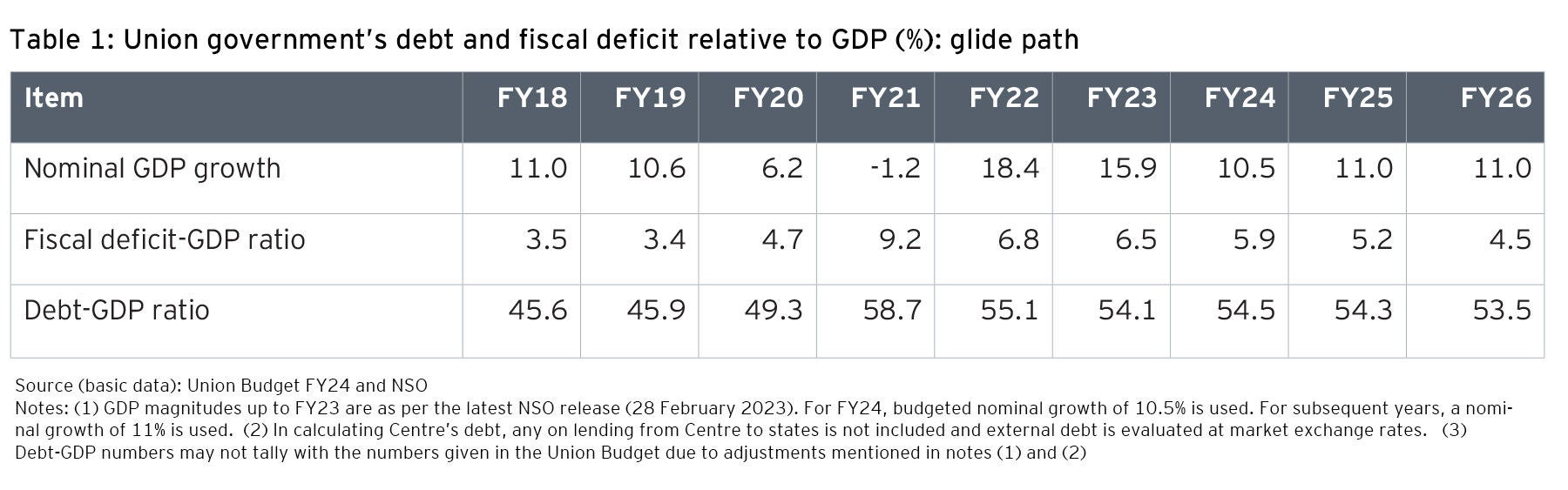

Government borrowing is a pre-emptive claim on the economy’s available investible resources. In India, it is only the household sector which has an investible surplus in the form of financial savings which presently amount to 8% of GDP. Supplementing this by a net capital inflow from abroad of nearly 2.5% of GDP, total investible resources add to 10.5% of GDP. In FY24, the combined fiscal deficit of central and state governments may amount to 9.4% of GDP, leaving limited scope for borrowing by the private sector and the PSUs. As combined fiscal deficit is brought down, progressively more investible resources would become available for the private sector. In the years after FY26, union government’s fiscal deficit may be allowed to fall by higher margins of say 0.75% points of GDP per year with a view to reaching the FRBM target in the next two years.

By FY28, a fiscal deficit-GDP ratio of 3% would be reached, but according to our estimates, assuming a nominal growth of 11%, the debt-GDP ratio would be close to 50%, 10% points above the FRBM target. Continuing with an 11% nominal growth and retaining a fiscal deficit-GDP level of 3%, the debt-GDP ratio is expected to reach 40% by FY35. As government debt as a proportion of GDP falls, the effective interest rate on government debt would also fall, reducing the interest payment to revenue receipts ratio, thereby facilitating the accelerated pace of reduction in fiscal deficit for reaching the desired target. If the implicit price deflator-based inflation is kept at 4%, a real GDP growth of 6.7% would be required over this period. Sustaining a growth rate at this level would require a suitable growth in private investment. It is only achieving the FRBM norms and adherence to these over a long period that would leave enough investible resources for the private sector to contribute to growth.

This article is co-authored by C.Rangarajan, Former Chairman, Prime Minister’s Economic Advisory Council and Former Governor, Reserve Bank of India, and D.K.Srivastava, Chief Policy Advisor, EY India and Former Director, Madras School of Economics.