EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

In our fourth edition of the annual survey, we compiled responses from 140+ companies across 20+ industries on their tax transformation journey.

Take a self-assessment

Want to self-assess the current state of your tax function and understand how to future-proof it?

Key findings of the report are as follows:

- Impact of legislative reforms

- Changing role of tax function

- Talent demand and skills

- Data Management

- Optimal Tax Function

- Future-proofing

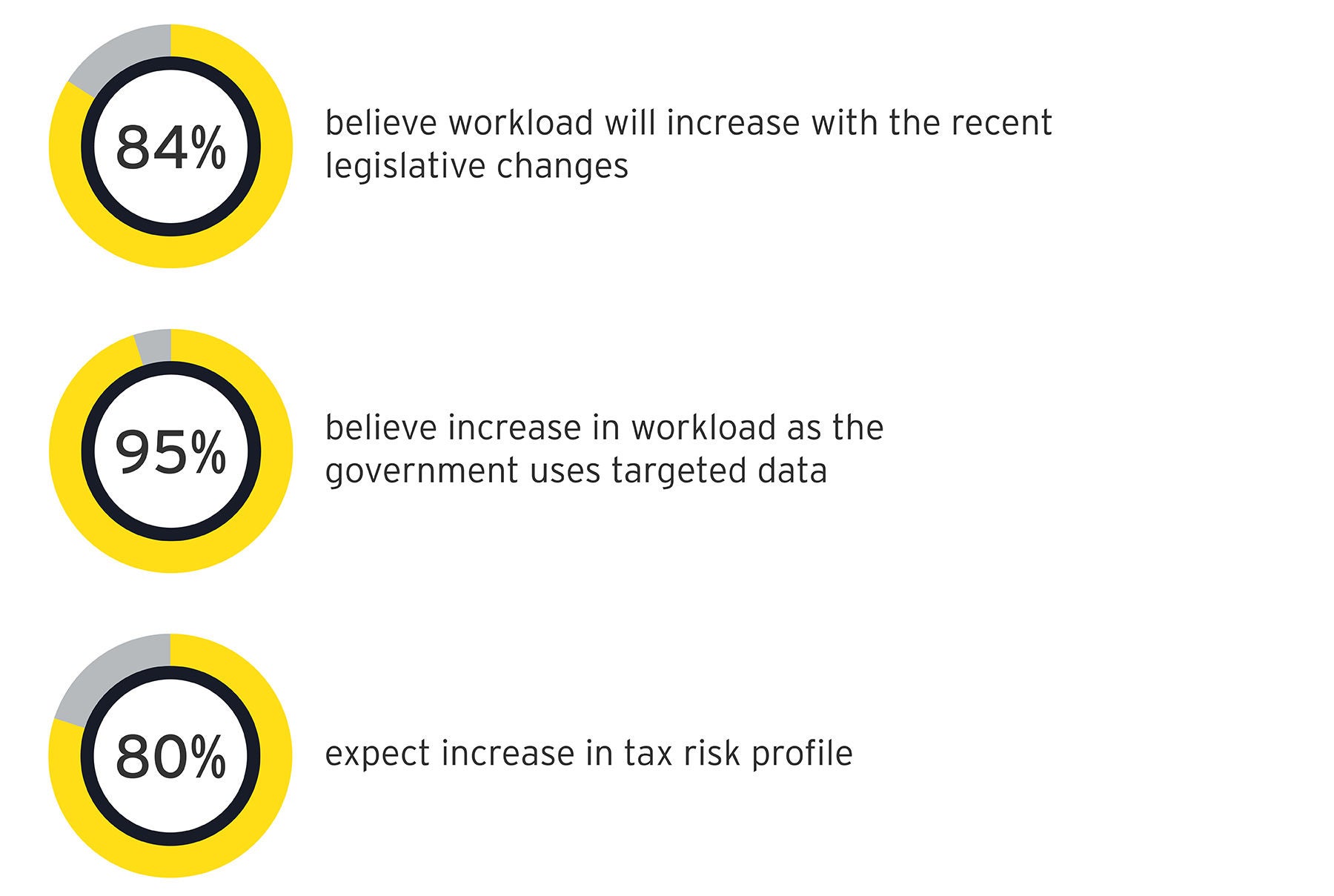

Impact of legislative reforms

A multitude of legislative and technological amendments have been introduced by the Indian Government to bring in more transparency and simplification.

While workload increases, budgets continue to be stretched and is increasingly getting diverted to more strategic/value-adding activities.

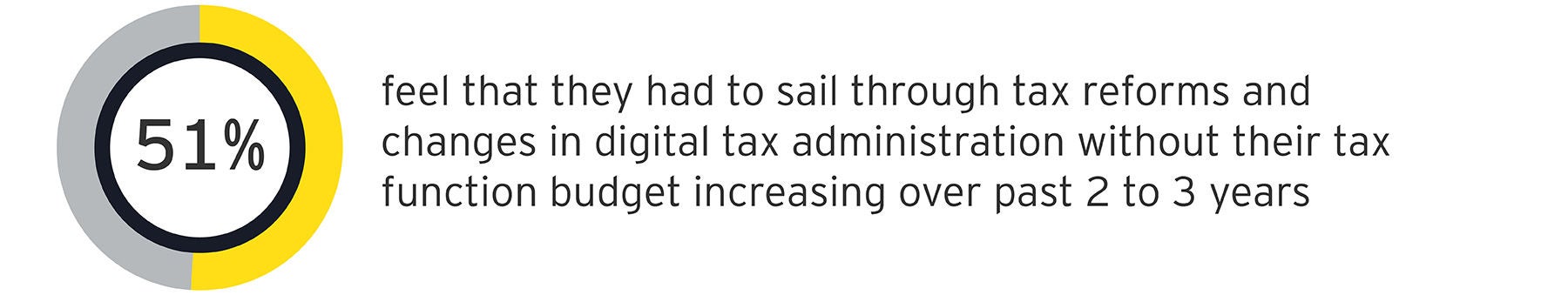

Changing role of tax function

In today’s evolving tax space, tax functions are assuming a critical position in driving business decisions.

Having identified the need for increased business collaboration as a key focus area, tax functions have also ranked “adding value to business” as their top challenge. Hence, it is critical to reimagine the current operating model to achieve the desired future state where tax function spends most of its time on value-added activities.

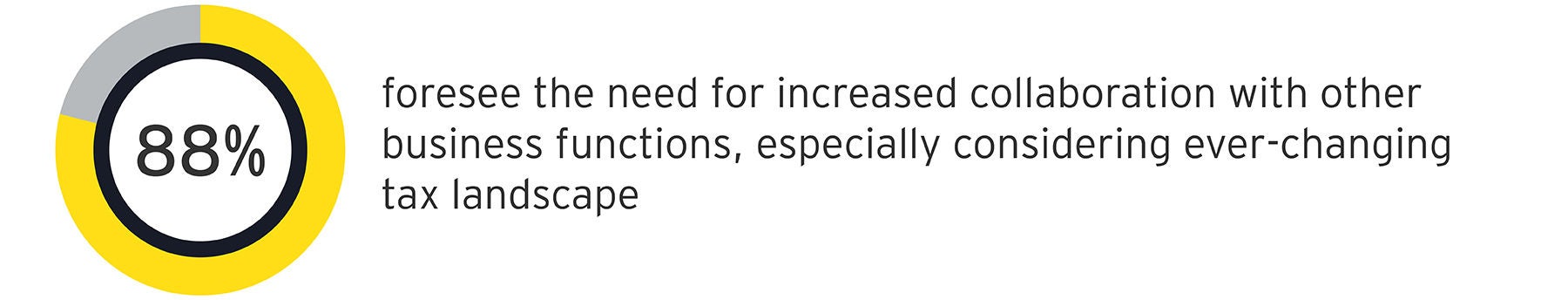

Talent demand and skills

The need for tax functions to carry specialized knowledge and in-depth expertise in all the domains is increasing in recent times. One person single-handedly specializing across all facets of tax does not seem realistic.

This clearly implies the need to reconsider talent strategy specifically in these times of ‘Great Resignation’.

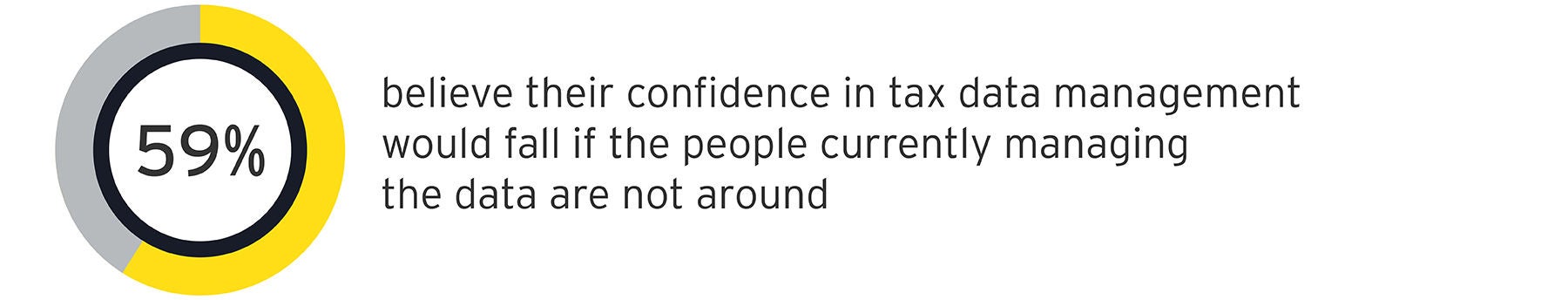

Data Management

It is crucial for organizations to understand the importance of data management during all stages of data lifecycle

Thus, it is important that the tax functions move ahead of traditional methods, and stay one step ahead around how they collect, analyze, use, report, and store data.

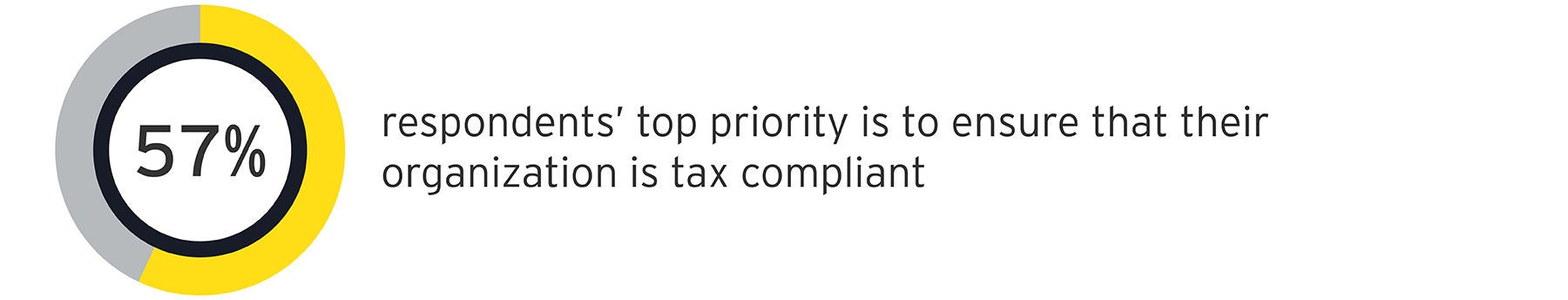

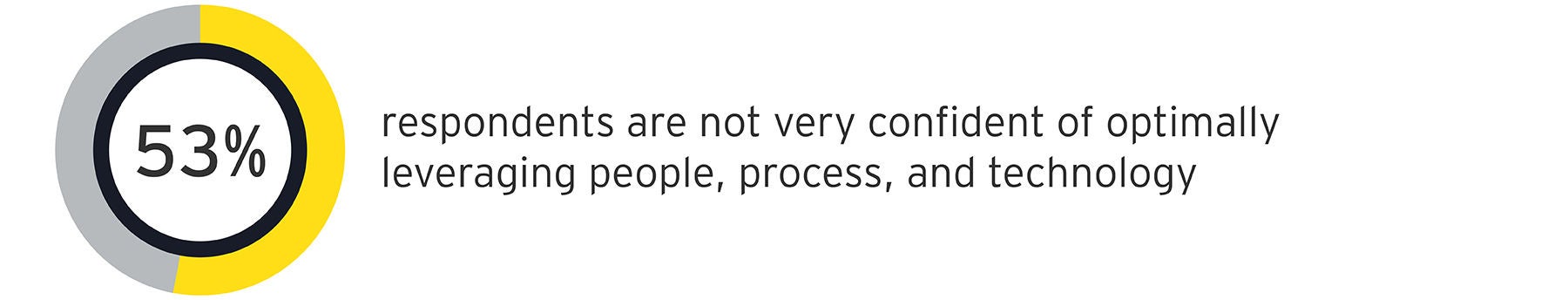

Optimal Tax Function

Optimum utilization of three important components — people, processes, and technology are quintessential to be able to achieve an optimal tax function.

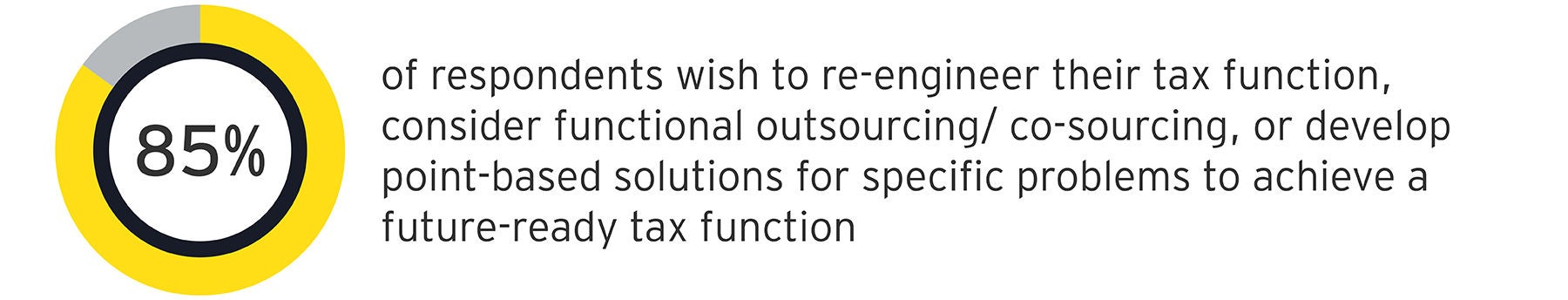

Future-proofing

Various approaches are being adopted to achieve a best-in-class tax function. Parameters, such as value creation, risk management, time and capital investment, resource availability, responsibility, institutionalization, transparency, and accountability, are to be kept in mind while choosing the best approach.

Our latest thinking

Union Budget 2026-27 highlights

Get the latest insights on the Union Budget 2026-27, including tax updates, policy changes and sector-wise impacts. Explore insights and analysis from EY India on budget reforms and growth.

20th Annual EY India Tax Workshop 2025

Register for India Tax Workshop 2025. Learn more about the tax function.

Navigating international tax compliance for Indian multinationals

Read how EY helps Indian multinationals with global tax complexity transfer pricing, BEPS 2.0, permanent establishments and technology-enabled compliance.

Understanding India’s Employment-Linked Incentive (ELI) Schemes

Explore India’s new employment-linked incentive schemes and their impact on hiring, compliance, and cost benefits for employers and employees.

Understanding minimum disclosure requirements for related party transactions

In this webcast, our panel of EY experts shares insights on the recent SEBI circular and its impact on related party transaction (RPT) disclosure requirements and industry standards.

Decoding the new Employment Linked Incentive (ELI) Schemes

In this webcast, panelists discussed the new Employment Linked Incentive (ELI) Schemes, benefits available to employers and employees and action planning for employers.

As Trump tariffs reshape global trade, India must adapt fast

Amid global trade shifts from US reciprocal tariffs, India must diversify exports, address trade imbalances, and boost manufacturing competitiveness.

How EY can help

-

Transform your tax function with EY India AI Tax Hubenterprise-grade Agentic AI for Tax to enable faster research, automated compliance and smarter litigation management.

Read more -

Transform export-import operations with EY Global Trade Automation software, AI powered automation for customs and foreign trade policy compliances, duty savings, incentive optimization, logistics visibility and faster global trade decisions.

Read more -

Our Automated Corporate Tax Compliance Solution transforms and simplifies the entire spectrum of corporate tax processes and compliance for growth.

Read more -

Be part of a secure and fully automated GST Invoice Registration Portal (IRP) for a swift, simple, and secure e-invoice authentication.

Read more -

Streamline tax litigation with EY India’s Litigation Management Solution. Track cases, manage compliance, and gain real-time visibility.

Read more -

Tax Collected at Source automation solution enables businesses to gear up for the expanded TCS provisions regime by using technology.

Read more -

Tax and Finance Operate services at EY help transform the tax and finance operations, manage regulatory risk, adopt the latest technology & ensure compliance.

Read more -

Ensure seamless GST compliance with EY DigiGST. Simplify GST reconciliation with our advanced GST compliance solution & tool for accurate tax reporting.

Read more -

Our digital tax transformation and tax technology practice in can help you navigate the digital agenda in the tax domain.

Read more -

EY Intelligent Automation solutions in Tax help businesses streamline tax processes, reduce risk, & improve compliance using innovative digital solutions.

Read more -

Agile Tax is a complete tax approach to address client's business transformation, enabled by SAP, provided by EY in India.

Read more -

Tax Data Analytics - Our big data analytics in tax services help you in new era of tax planning and tax compliance. Learn more about business data analytics in tax.

Read more -

DigiRev™ is an automated transfer pricing solution that streamlines documentation review to support intra-group services and royalty transactions effectively.

Read more -

EY Digi India Personal Tax™ is an online platform to manage individual and corporate taxes.

Read more -

EY Digital Tax Advisor is an online service helping mid-market firms & new entrants access expert, on-call advisory on Indian tax & exchange control laws.

Read more - Read more

-

EY DigiTDS is a cloud-based dividend withholding tax and TDS return solution that streamlines processes, boosts efficiency, and ensures tax compliance.

Read more - Read more

Meet our Digital Tax Transformation solutions team

Direct to your inbox

Stay up to date with our Editor's picks newsletter.