EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Participating in the EY GCC Awards 2023 platform can offer several benefits to the GCCs across India.

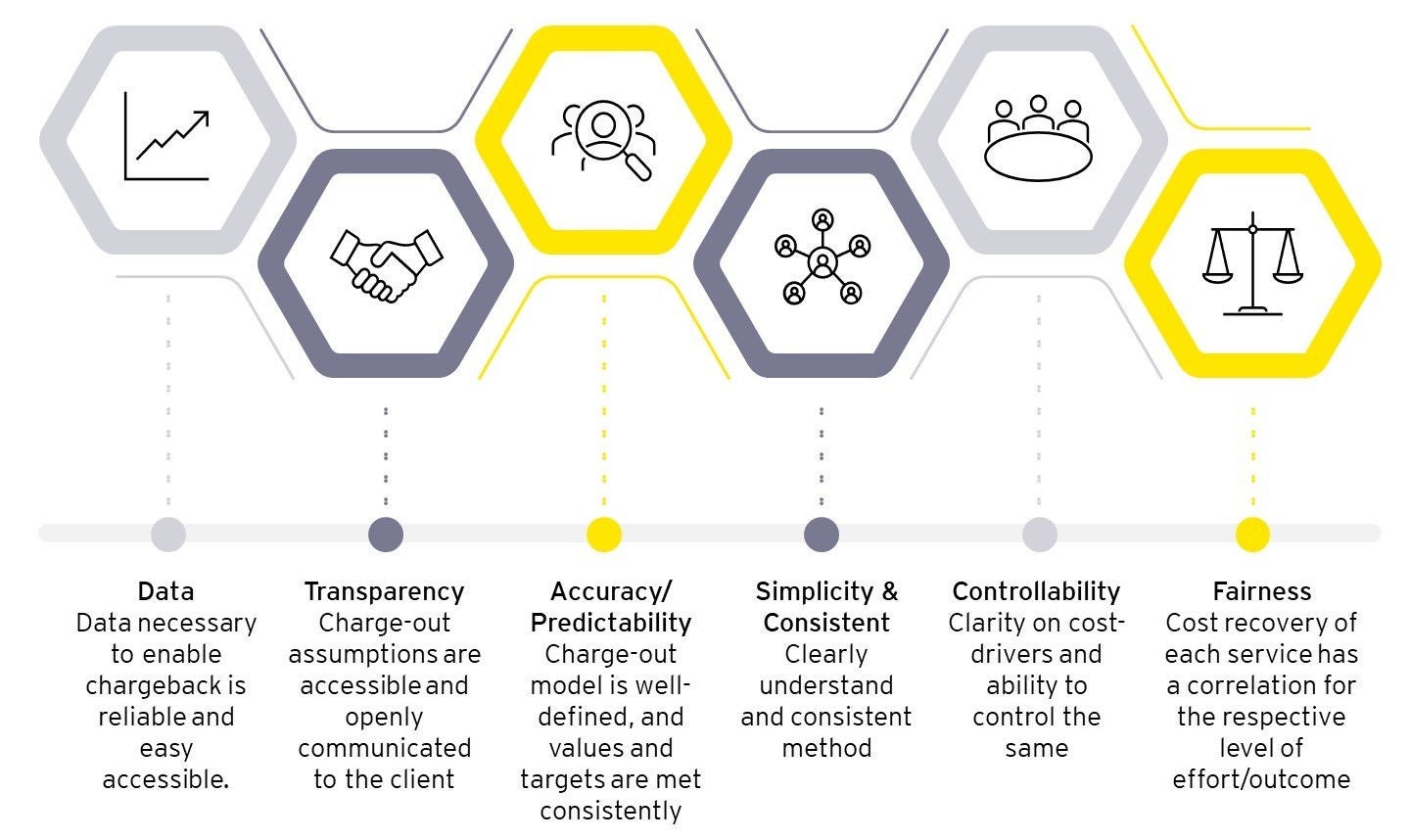

GCCs have adopted a variety of chargeback models, depending on the nature of services being delivered. These chargeback models have evolved to reflect business complexities.

Why chargeback?

- Creates ownership: The mechanism enables the GCC to operate independently as a business unit, where it is accountable for managing costs, meeting service demands and maintaining service levels. By providing them accountability, the GCC not only handles operations but also creates value for enterprise.

- Influences behavior: The mechanism also assists GCCs to allocate the right resources and drive behavior, focusing on cost optimization and efficient resource allocation.

Types of chargeback models

The evolution of chargeback models in GCCs is closely tied to the maturity level of the GCC organization. As the GCC organization grows and matures, the chargeback model needs to become more responsive to the vision of the organization while being in line with its strategic goals. The available choices for chargeback models are:

1. Cost plus margin: The model allows a fixed percentage markup to be added to the cost of delivering services. It is easy to understand and communicate to stakeholders and offers predictability and flexibility to accommodate changes in cost or market conditions. However, if the markup percentage is too high or if the cost is not accurately estimated, there is a risk of overcharging. Setting the appropriate margin can also be challenging, making this model suitable when costs are uncertain and cannot be accurately budgeted.

2. Fixed price: Here, a fixed fee is charged for the delivery regardless of the actual usage in each business unit. This model is easy to administer, as there is no need to track or measure actual usage of GCCs. It can also encourage GCCs to operate more efficiently, reducing unnecessary or wasteful usage. However, forecasting cost and usage for a future period can be challenging, and it may not provide accuracy in cost allocation due to unpredictability in the actual usage and costs. This model is suitable when the services provided have a well-defined scope, standardized processes, and predictable costs.

3. Peer benchmarking: This is another model, where similar sized GCCs with similar offerings are identified and benchmarking is performed against their value proposition and price. This model provides objective criteria for evaluating the performance of GCCs to avoid biased judgments. It helps organizations identify best practices and areas for improvement, leading to better performance. However, focusing on cost benchmarks may lead to a narrow focus on cost reduction instead of performance improvement. There is also a chance of inaccuracy if the peer group has different business models, locations, or regulatory environments. This model is suitable when the GCC seeks to follow industry-leading practices and standards.