EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

How EY can help

-

Discover how EY's digital transformation teams can help your business evolve quickly to seize opportunities and mitigate risks. Find out more.

Read more

CGM devices have been shown to enhance patient experience and quality of life, but the technology is still developing and facing both technological and market challenges. A key challenge is posed by the recent success of Glucagon-like peptide 1 (GLP-1) in diabetes intervention, the impact of which on the CGM device market is also yet to be understood.

While CGM manufacturers argue that patients on GLP-1 medication exhibit increased usage of their glucose monitors,12, 13 consumer anxiety over the new medication led to a 20% decline in three months in the MedTech stocks index, as reported in October 2023.14 Analysts’ projections align with those of MedTech companies, foreseeing heightened CGM adoption and improved outcomes following GLP-1 initiation for type 2 diabetes patients. However, there is a potential 20%-25% reduction in the portion of patients using insulin over the next five years due to the impact of GLP-1.1 Cultivating a thorough understanding of the effects of GLP-1 on patient demographics, treatment paradigms, and clinician communication can empower MedTech companies to make sound strategic decisions in the future.

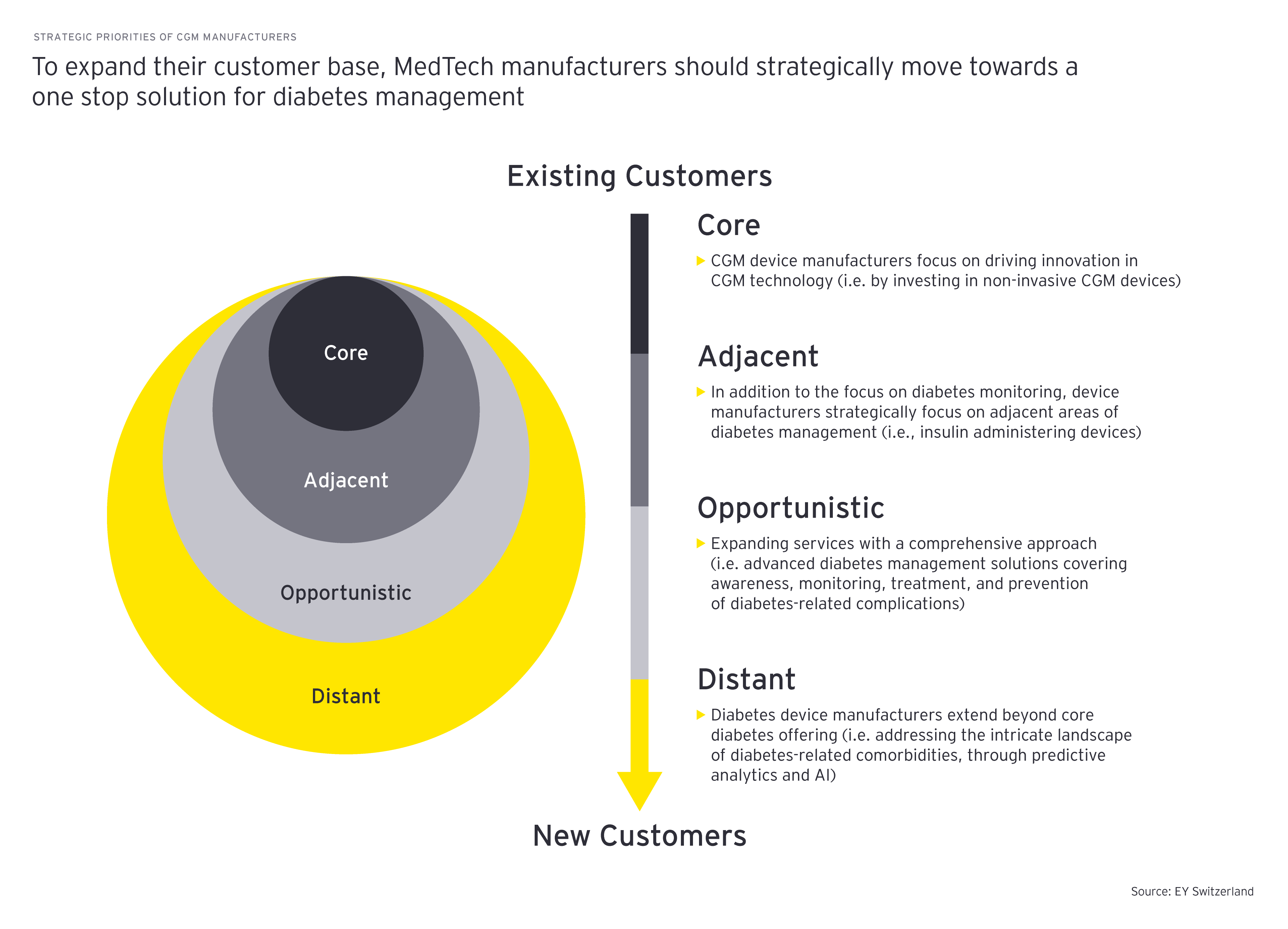

Another challenge for CGM manufacturers has laid in device distribution channels. Traditionally, CGM supplies in the US could be bought only from the manufacturer or third-party vendors. From the mid-2010s, CGM device manufacturers started collaborating with insurance providers to provide CGMs directly to patients via prescription in pharmacies. This has reaped great benefits for players, significantly contributing to the growth of sales observed in the last years. To further strengthen their outreach to patients, CGM device manufacturers should invest in e-commerce capabilities, offering their supplies, apps supporting disease management, as well as healthcare management advice online. To enable this, the players should foster and strengthen ties with healthcare professionals (HCPs), payors and manufacturers of other devices used in diabetes care (i.e., insulin pumps, pens and medical software developers).

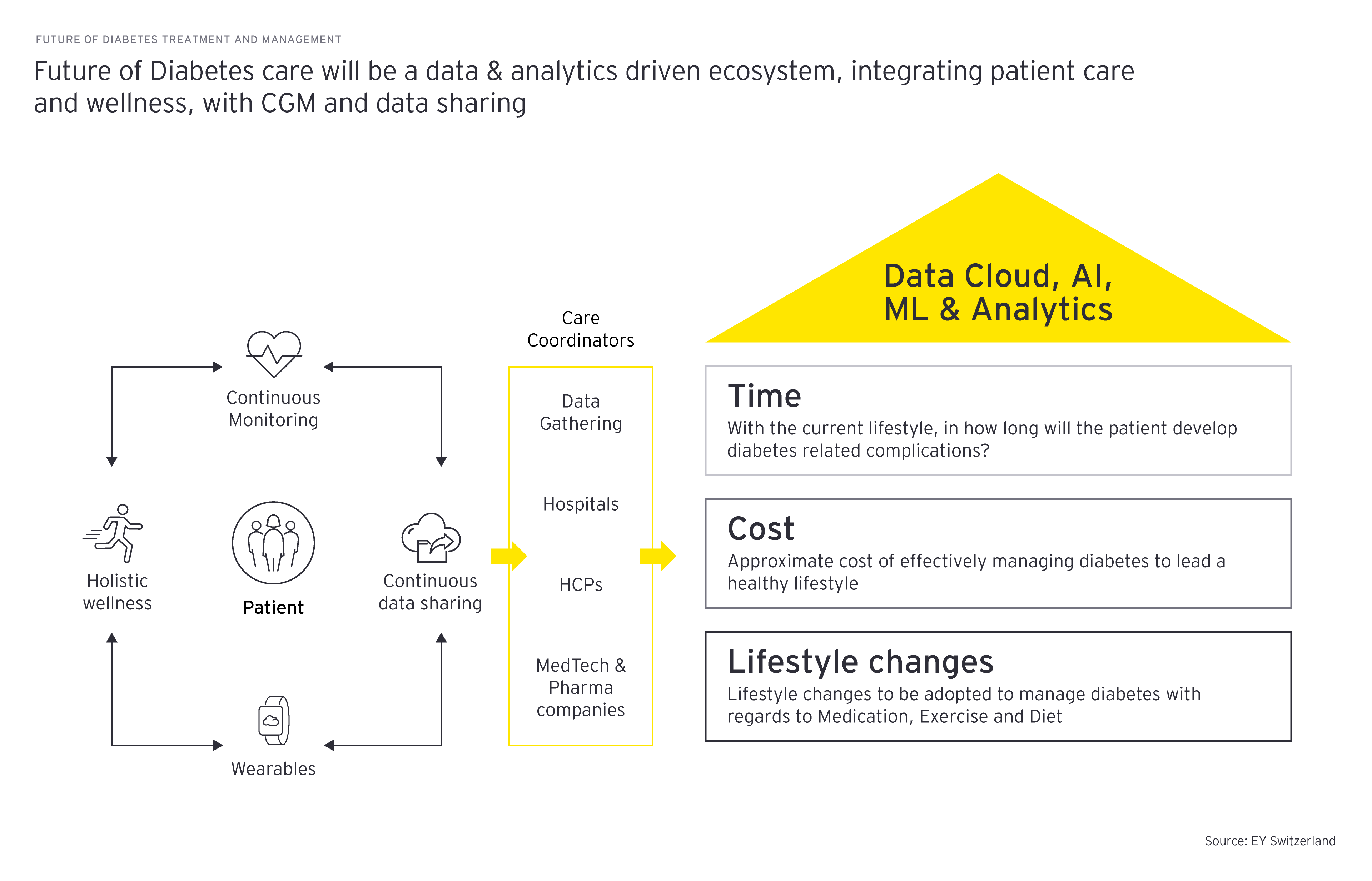

Finally, to be able to better understand and leverage the unique preferences of different patient groups, segregated by disease type, demographics (i.e., age, gender, healthcare expenditure) or established channels (government, HCPs, pharmacies, community health), companies must invest in and develop significant data and analytics capabilities. This can be done through collaboration with tech companies, allowing them to generate insights for each patient group and enabling more informed market and treatment decisions.