EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

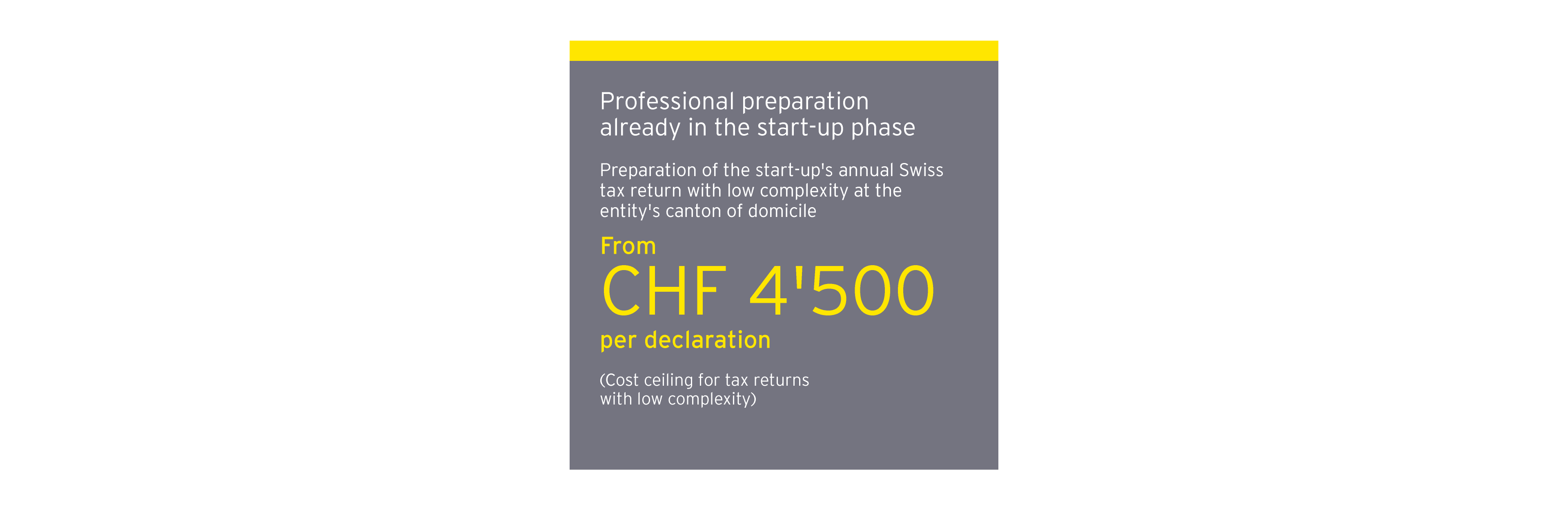

Startup Solution Store | Tax return

Streamline your startup's tax return process with key insights. Simplify filing, reduce errors, and optimize deductions for financial success.

Challenges for startups

It is in the early stages of a company's life that important decisions are made about how to deal with tax issues. As the business grows and becomes more international, the complexity of tax issues increases. EY’s startup specialists will be with you from the start, freeing you up to focus on your business.

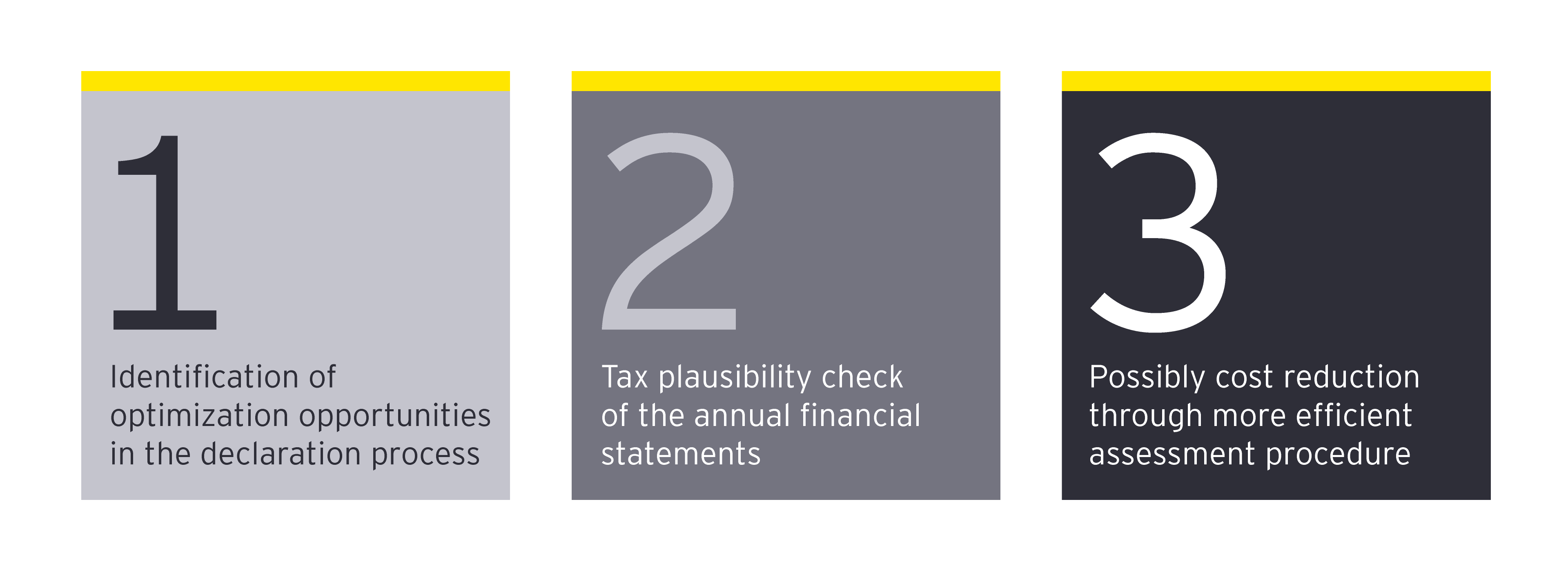

Three advantages

Professional guidance in the preparation of tax returns serves as a cockpit for tax planning and optimization.

Thomas Fisler

Partner, Head Private Client Tax Services | EY Switzerland

Packages