EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

A culture and conduct analysis can help you strategically mitigate fraud risk – before it occurs.

In brief

- Various fraud scandals have rocked the financial sector in recent years, causing losses and eroding trust.

- Poor organizational culture is often at the root of misconduct.

- A culture and conduct analysis pinpoints vulnerable areas and enables cultural change to take root before fraudulent actions occur.

In recent years, we’ve witnessed many high-profile cases of corporate fraud that have destroyed companies, ruined reputations and devastated countless individuals who have invested their time, money and trust in these organizations. On closer inspection, we find that many of these fraud cases have something in common – a poor organizational culture and a questionable ethical climate. From the multi-billion dollar Enron scandal to other well-known cases, it seems that poor organizational culture provides fertile ground for increased misconduct. But how can we prevent this from happening? How can we create a healthy work environment that fosters good behavior and mitigates fraud? The answer lies in culture and conduct analysis.

What is culture and conduct analysis?

A culture and conduct analysis evaluate the ethical climate and culture of a company. Essentially, it aims to understand the attitudes and values of employees and how these influence their behavior. By analyzing patterns in organizational culture and employee behavior, we can identify areas of increased fraud risk and take strategic actions to prevent it from happening.

Such an analysis offers key insights into cultural deficits. When a company’s culture is deficient in key areas – whether that’s a lack of transparency, accountability or ethical leadership – employees may feel pressure to engage in misconduct or start justifying wrong or unethical behavior. By detecting cultural deficits, we can detect an area of increased fraud risk and enable strategic actions before it becomes a serious issue for the company. But even without a deficient culture, these insights can be used to drive positive changes in the company overall, such as improved employee engagement, lower employee turnover or a better company reputation.

How do we analyze culture and conduct?

EY has developed a tool based on the latest interdisciplinary research that enables such an analysis. Our Fraud Risk Radar allows us to assess various dimensions of culture and behavior within a company through a combination of surveys, interviews and data analysis.

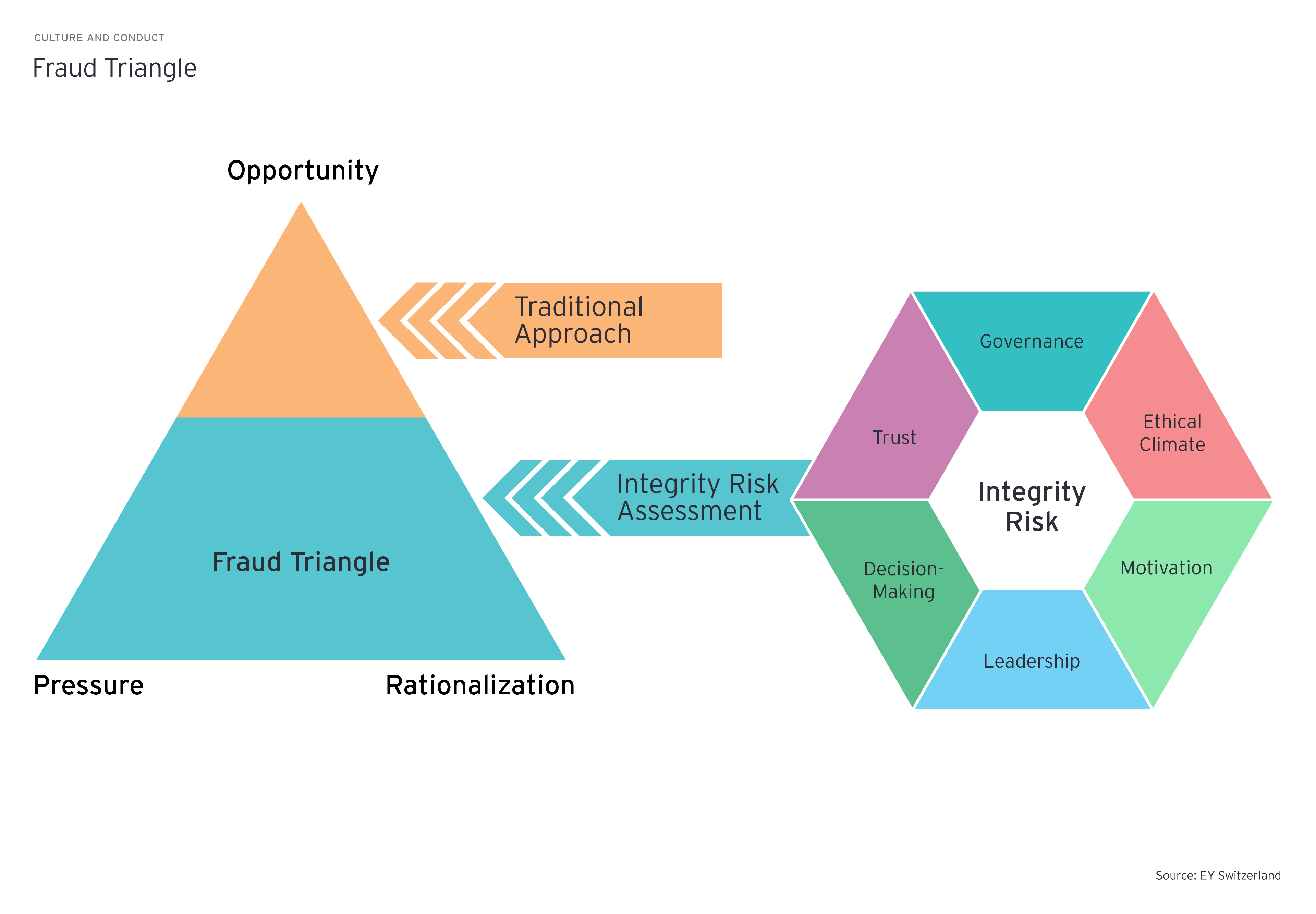

The Fraud Risk Radar methodology builds on the Fraud Triangle, which unites the three underlying factors that motivate individuals to commit fraud:

- A given opportunity

- Potential personal or financial pressures

- The extent to which the fraudulent behavior is rationalized

Traditional analytical approaches primarily cover the opportunity factor by examining the situations that enable people to commit fraud and focus on the control environment and strengthen it if required. The Fraud Risk Radar, however, represents a novel approach to proactively examine the other two factors not considered: the pressure and the rationalization of misbehavior. By examining factors such as leadership, motivation, governance, and decision-making processes, we can take a holistic look at the culture and behavior of the organization and identify areas of risk. This enables us to provide a risk score to guide further investigation and customized improvement strategies.

Conclusion

The importance of culture and conduct analysis cannot be overstated. By systematically analyzing patterns in organizational culture and employee behavior, we can identify areas of increased fraud risk and take strategic actions to prevent it from happening. By focusing on prevention rather than reactive measures, we can be one step ahead and proactively support the creation of a resilient work environment built on trust and transparency. This intrinsically discourages bad behavior and fosters ethical conduct.

Summary

The ethical climate and culture of a company is a strong predictor of its vulnerability to fraud. Understanding weak spots and taking action is an investment in financial crime prevention, both now and in the future. It also benefits the organization as a whole by driving positive changes that improve the employee experience and enhance trust.

Acknowledgement

We kindly thank Ava Dossi and Pavel Oborsky for their valuable contribution to this article.

Related articles

Do you see name screening as a journey or a destination?

Four questions to guide financial institutions on ongoing KYC that effectively – and continuously – mitigates the risk of financial crime.

When will you discover document analytics to uncover financial crime?

Discover how document analytics is helping to combat financial crime, including fraud and money laundering.