Manage your tax audit efficiently with the digital collaboration platform EY Tax Audit Center.

All over the world, tax authorities are increasingly relying on analytical models and analyses for tax audits. The reasons for this are the increasing regulatory requirements, the complexity of the issues and the chronic shortage of personnel. Companies must be technically and organizationally capable of providing all the data required for analyses at any time - especially during tax audits.

In view of the increasingly strict legal regulations and requested information, as well as the increasingly global structure of large companies, tax audits are a real challenge for tax departments.

The EY Tax Audit Center digital collaboration platform helps your tax department quickly and easily manage and coordinate field audits with the best possible outcome.

With the help of the platform, you bring more transparency to the collaboration of all parties involved in the audit.

Duties become decision-making tools

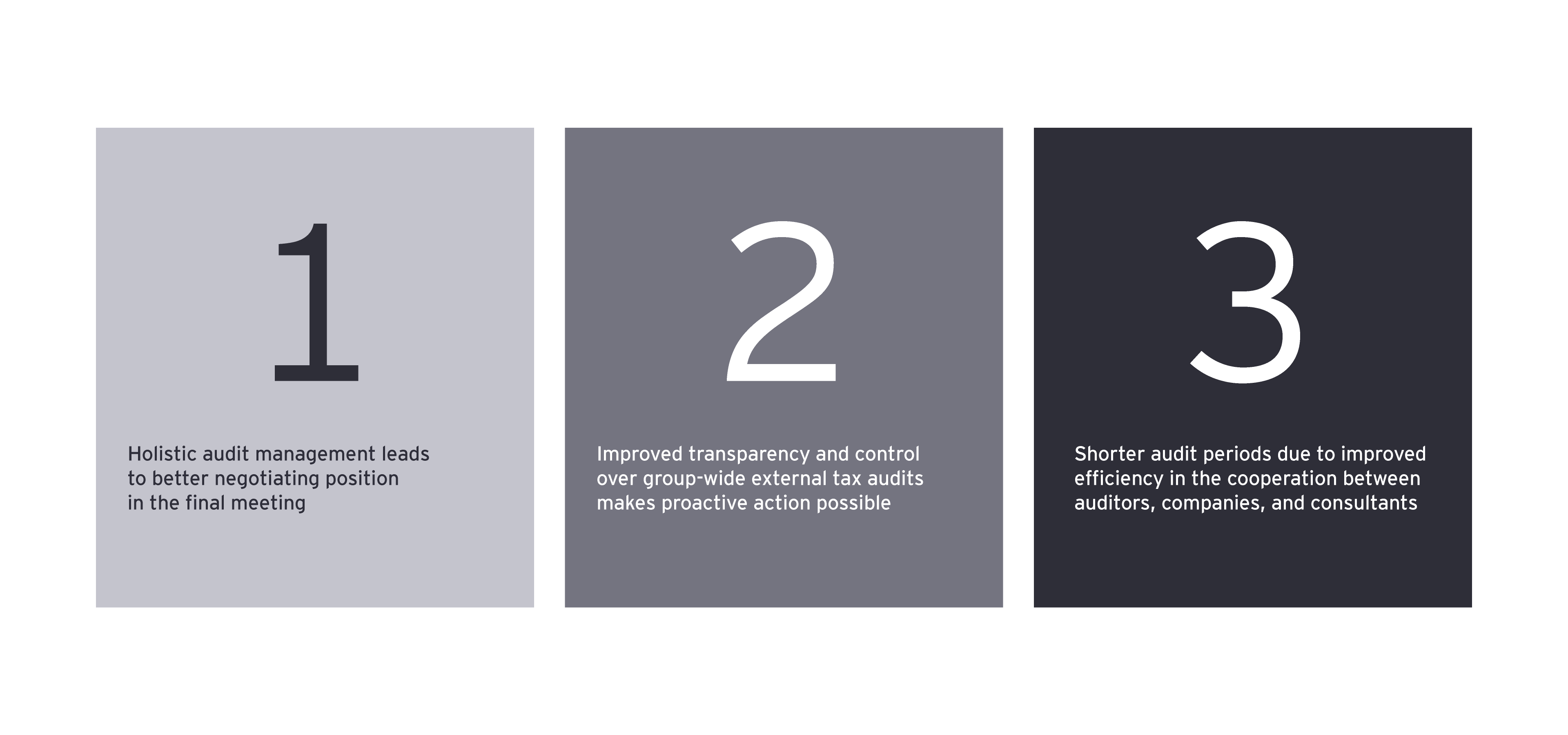

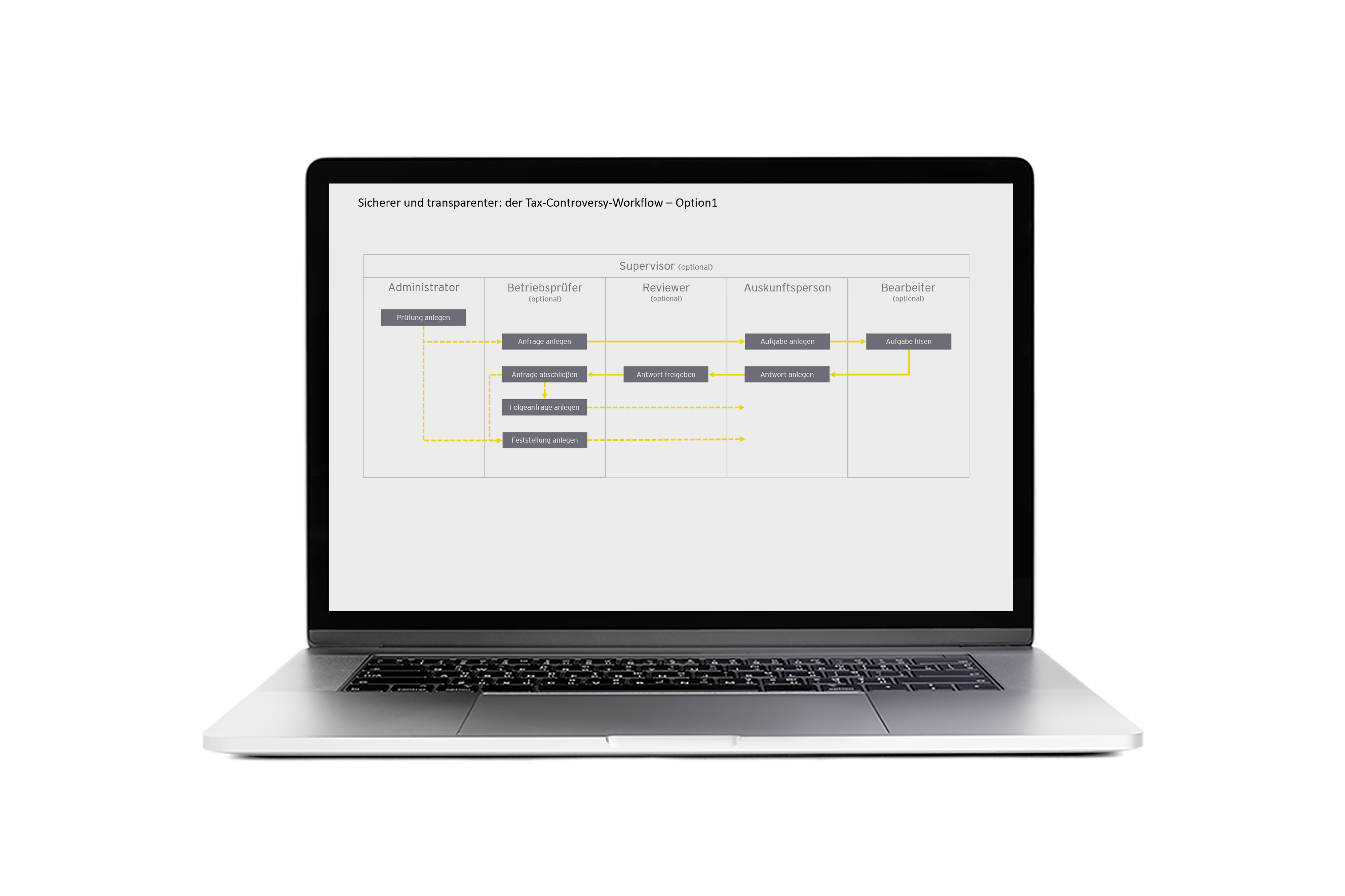

EY Tax Audit Center supports tax departments in meeting the authorities' increasing regulatory requirements for tax audits. Standardized workflows of the collaboration platform enable effective communication and cooperation between tax auditors, employees, and tax consultants. Dashboards and intelligent reports provide comprehensive operational and strategic reporting and analysis. Auditors only have access to the data relevant to their audit.

A collaboration platform for all stakeholders involved in the audit process

EY Tax Audit Center optimizes collaboration by connecting all stakeholders involved in the field audit, such as tax advisors, accountants, consultants, and tax auditors, on a common platform, thus reducing coordination efforts. Tasks and information are bundled in one place and communicated transparently. As a result, you avoid annoying "number crunching".

Ensure effective risk management and stay one step ahead of the financial administration!

The EY Tax Audit Center collaboration platform enables you to minimize risks and drive the digitalization of your company's tax department. Use the collected data and reports automatically also for the assessment of income tax risks according to HGB and IFRIC 23. Partially automated workflows as well as a variety of analysis functions increase the transparency of all processes and also make hidden risks visible at an early stage. Possible information gaps and the need for action can be identified in the EY Tax Audit Center in a timely manner so that lengthy legal disputes and criminal proceedings can be avoided.

Management also benefits from the platform

EY Tax Audit Center provides topic-based overviews and information on issues that arise across multiple audits and countries as part of tax compliance management. Thus, the collaboration platform enables reporting to the tax department in real time and at the push of a button.

Learn and prevent

Relevant findings from tax audits can be shared with your local tax teams. This minimizes the risk of errors across borders and speeds up tax audits. You are left with more time for other projects.

Improved data and information management through central documentation with search function

All documents relating to tax audits are clearly documented in the digital audit files. Thanks to the search function, the employees of your tax department and the tax auditors can find all information on the respective audit at a glance and no longer have to laboriously and time-consumingly work through stacks of paper/large quantities of paper.