EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

In this webcast, our speakers preview the latest EY ITEM Club Winter Forecast and discuss the implications for the UK’s economic recovery amidst rising inflation and energy prices.

Hopes that the UK economy would start 2022 closer to pre-pandemic normality have been dashed by the rapid spread of Omicron. The health effects of the latest strain appear to be mercifully much milder than previous variants, but evidence indicates increased consumer hesitancy and a growing number of people isolating, which held back activity at the close of 2021 and January 2022.

Inflation coupled with tax rises due to take effect in April pose some challenges to the economy, but existing tailwinds such as a robust jobs market and an expected strong rebound in business sentiment means it's not all bad news.

Our speakers Peter Arnold, EY UK Chief Economist, and Martin Beck, Chief Economic Advisor to EY ITEM Club, review the forecast and discuss the implications for the UK’s economic recovery.

Topics discussed include:

- How serious a threat to the UK’s recovery are the economic headwinds likely to be?

- To what extent will the negatives confronting the economy be offset by positive factors? Including low unemployment, signs of an easing in supply chain bottlenecks and very strong household and corporate balance sheets.

The full forecast is available to download here.

Direct to your inbox

Stay up to date with the latest economic insights.

Webcast

Time

your local time

Related Webcasts

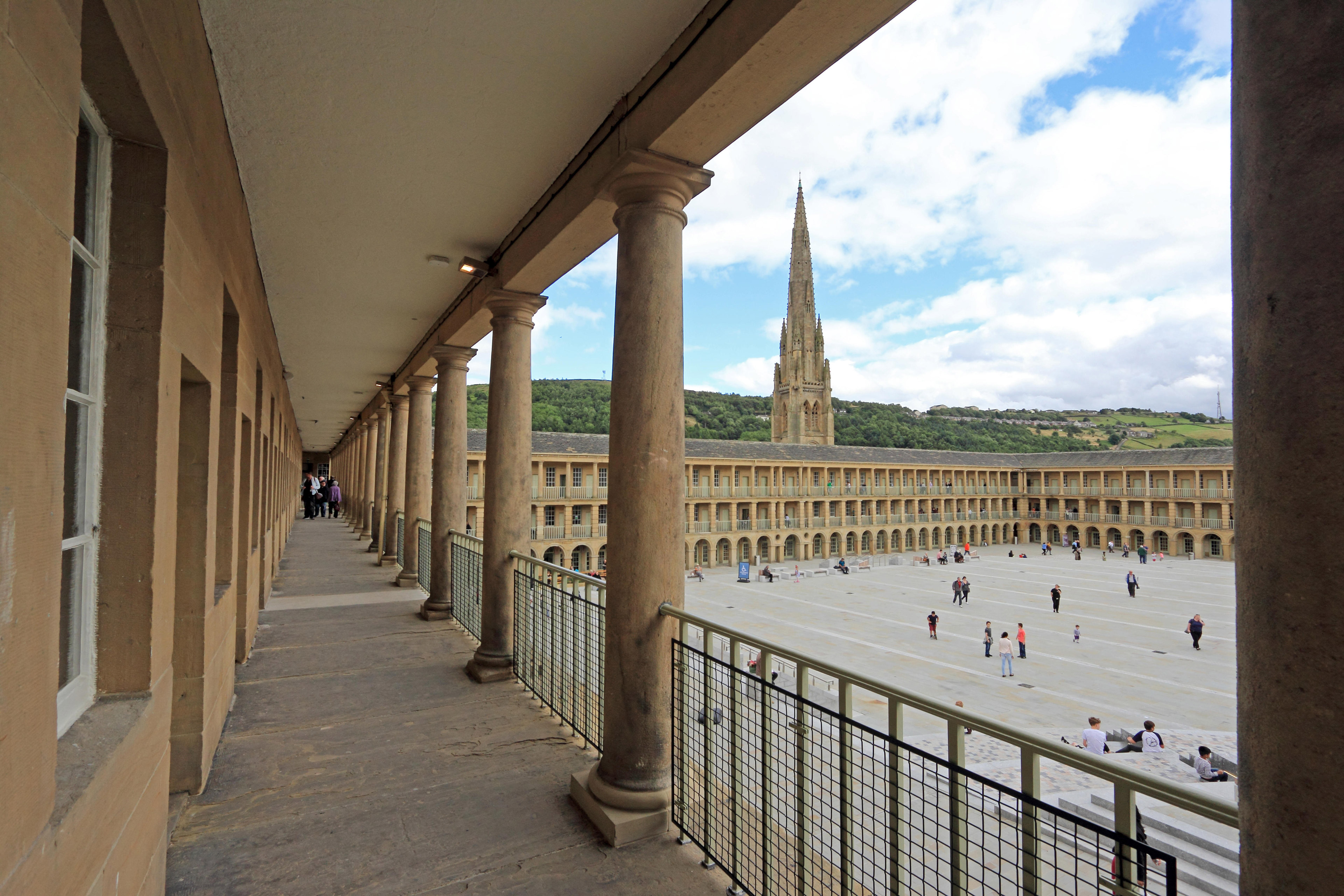

How England’s regions can map out a sustainable recovery

In this webcast, our speakers preview our latest regional economic forecast and discuss the impact of the pandemic on England’s regions, cities and towns, and the prospects for levelling up.