EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Short version of the article has neen published at Forbes Ukraine

Authors:

Kostiantyn Taranets, Oleh Krasniuk, Serhii Zimenko,

Climate Change and Sustainability team of EY Ukraine

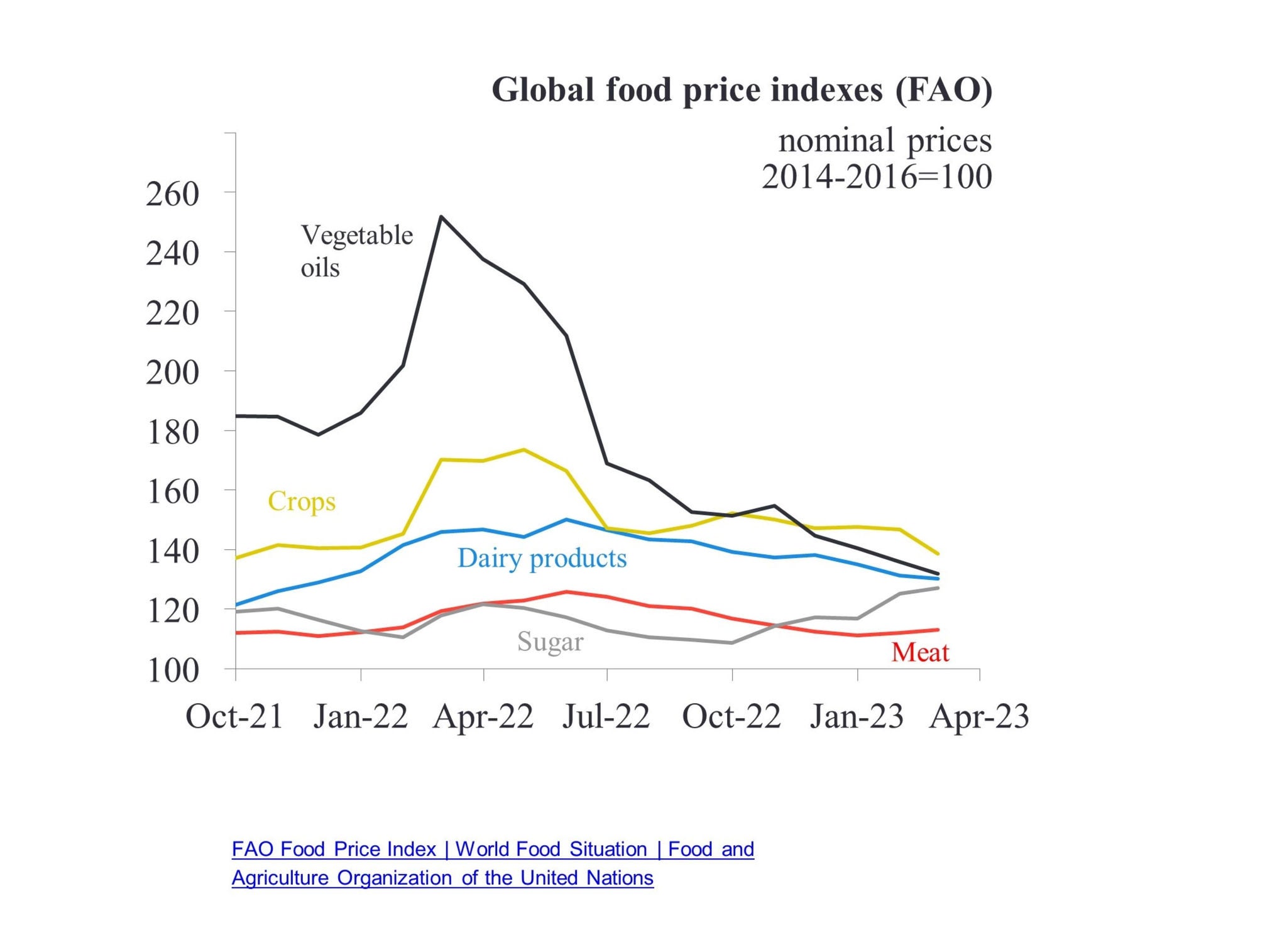

Shockwaves in agricultural markets associated with russian invasion of Ukraine and global political instability have raised many questions about security and continuity of supply chains.

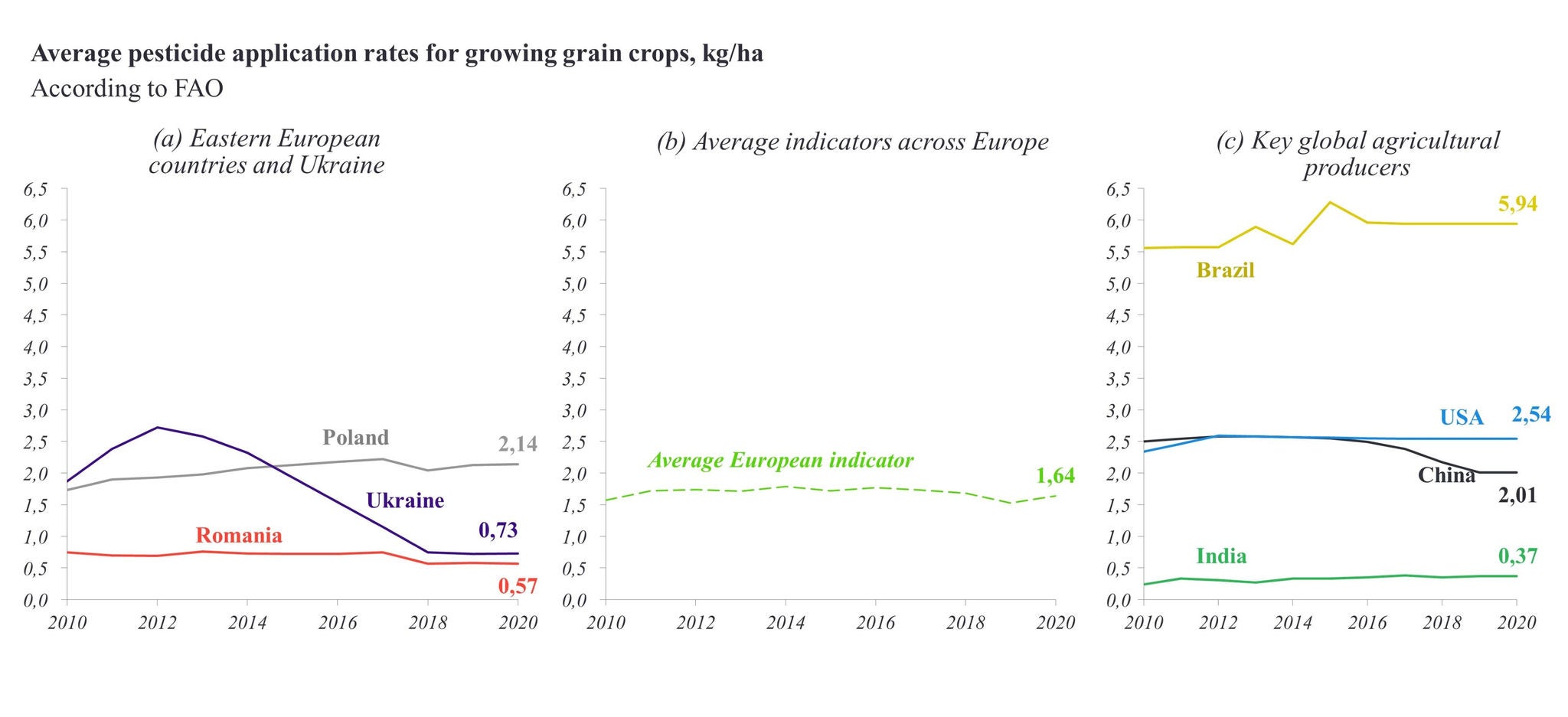

During April 2023, several Eastern European countries introduced a temporary ban on the supply of grains, dairy products, sugar, meat, honey and other products to solve the problem of "bottlenecks" of local supply routes. The recent Decision of the EU dated May 2, 2023, regarding exceptional measures and a temporary ban on the import of Ukrainian grain by a number of Eastern European countries in order to protect their own market backed with finding unauthorized pesticide in imported wheat indicates the need to fundamentally rethink Ukraine’s national approaches in addressing criteria of economic and agronomic sustainability.

The team of EY experts studied existing criteria for sustainable agricultural raw materials, requirements of investors and other stakeholders for sustainable development of the sector. The purpose of this study is to shed light on the existing factors of unlocking investments in the sustainable development of the Ukrainian agricultural sector to achieve specific environmental and social goals, including in post-war recovery.

After analyzing the applicability of existing initiatives and standards for sustainable agricultural raw materials in international markets, the EU regulatory framework, the position of leading Ukrainian agricultural holdings, the results of benchmarking on nitrogen and pesticide application rates, as well as specific greenhouse gas emissions (tCO2e/ha), we came to the conclusion that it is necessary to develop a national criterion for sustainable agricultural production, taking into account the specifics of the industry and Ukrainian agroclimatic conditions.

What investors focus on when it comes to sustainable financing of agricultural sector?

When implementing sustainable finance criteria in agricultural sector, investors and key market players are currently focusing on applied issues related to supply chain transformation and dissemination of universal banking standards:

1) Financing the transformation of supply chains through commitments of producers of palm oil, wood, protein, meat products, soybeans to increase production volumes while reducing deforestation.

2) Dissemination of universal banking standards for agricommodities market players – adaptation of own policies and processes of compliance; reporting with simultaneous development of sustainable project and trade finance products, as well as related banking services, to stimulate sustainable practices throughout the supply chain of agricultural raw materials.

Alexandre Tchesnakoff, Credit Agricole Ukraine Board member

“Credit Agricole is one of the leaders of the financing market in the agricultural sector, and we help Ukrainian agribusiness attract sustainable financing in every possible way. As a socially responsible bank, we implement the best practices in sustainable business development. We reduce the bank's carbon footprint, develop a culture of responsible consumption in the team, implement assessment according to ESG criteria and, with the help of a wide range of banking products, promote the development of agricultural production in Ukraine. In addition, we share our expertise in sustainable business development with clients and have special loyalty programs in our portfolio that motivate agricultural clients towards responsible consumption and sustainable production. In particular, Credit Agricole has an agreement with the EBRD and, as part of the "EU4Business-EBRD Credit Line" program, offers clients a grant (cashback) of up to 10% of the financing of equipment for leasing. The agreement includes a list of eligible objects of financing - this is modern agricultural machinery, which has less harmful impact on the environment.”

What initiatives for sustainable products of the agricultural sector currently exist?

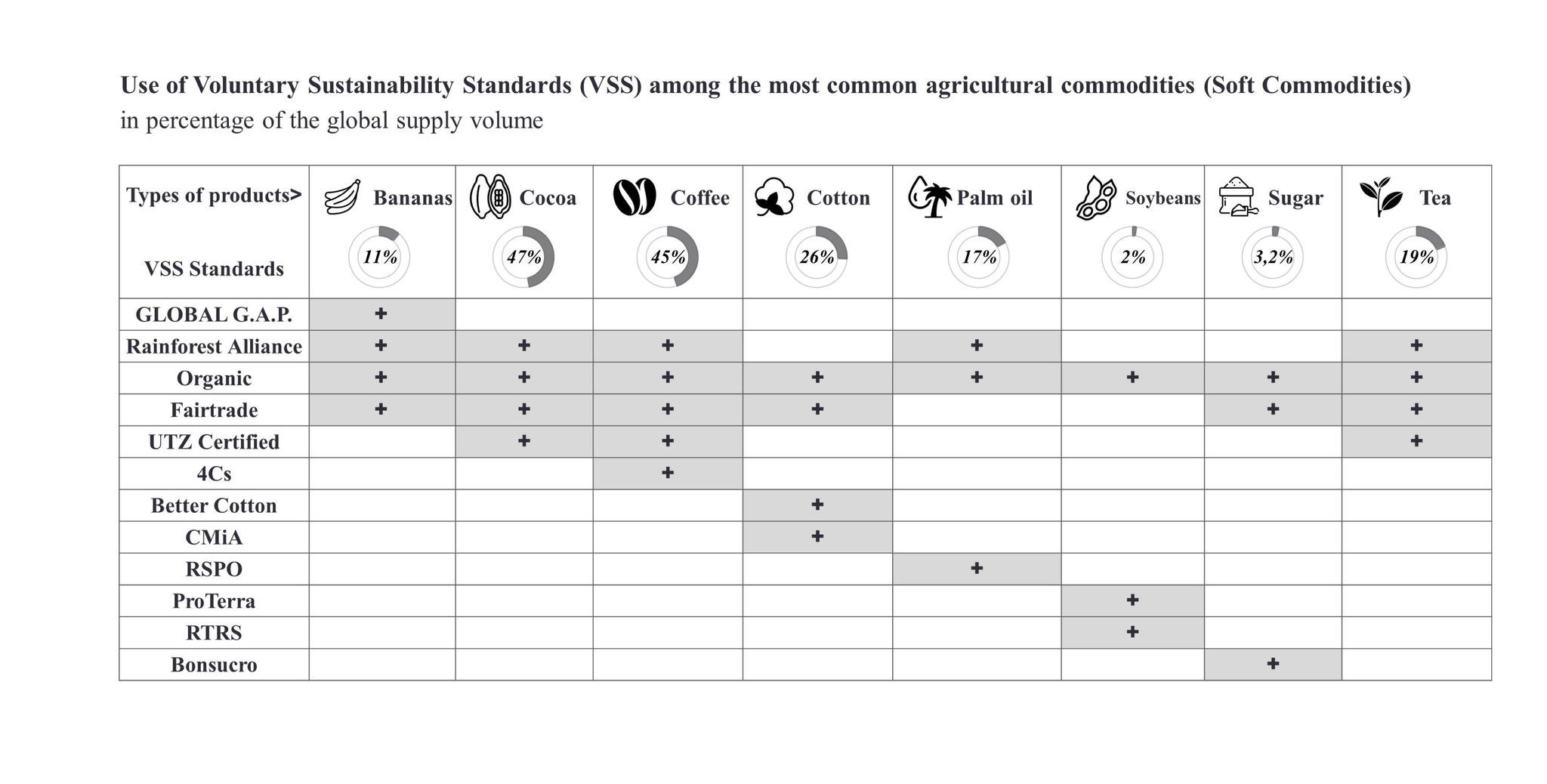

The idea of establishing a criterion of stability and sustainability improvement of agricultural production to meet the challenges of climate change is not new. For example, the distribution of Voluntary Sustainability Standards (VSS) for the most common agricultural raw materials began in the early 1970s. VSS defines several requirements that product suppliers must adhere to, encouraging farmers to adopt sustainable agricultural production practices. For example, all relevant schemes in banana industry, such as GLOBAL G.A.P., Rainforest Alliance, Fairtrade International and Organic, require farmers to take measures to preserve the soil, maintaining its moisture and fertility. In exchange, farmers can label their products as VSS compliant or compliant with other standards to improve their trading positions.

Sustainability standards are most widely used in cocoa and coffee industries: the share of VSS-certified cocoa increased from 27% in 2008 to 47% of total global supply in 2019. The share of coffee – from 21% to 45% for the same period (As of IISD, International Institute for Sustainable Development).

The largest amount of VSS compliant cotton is produced in countries such as India, China and Turkey, whereas the smallest amount of such raw materials comes to global markets from Burkina Faso, Mali, Sudan, Chad and Ethiopia.

Palm oil market players are also increasingly paying attention to meeting the criteria for sustainable raw materials due to growing pressure from relevant stakeholder. Indeed, in 2006, sustainably classified palm oil was not represented on global markets at all, while today its share is about 17% of the trading volume.

A great example is the cane sugar market, where the most significant is the Bonsucro industry platform aimed at ensuring more sustainable sugarcane production. In 2016, at least 60 million tons of sugarcane met the requirements of Bonsucro, as well as other common standards in the industry including Fairtrade, Organic and Rainforest Alliance. The market volume of such sustainable raw materials was estimated at $1.5 billion.

Why do investors pay attention to environmental impact and decarbonization?

Historically, investors have viewed financing of commodity transactions as a method of portfolio diversification and protection against inflation. During 2021-2022, the trend towards decarbonization and increasing climate resilience began to materialize. As a result, bidders have increasingly begun to integrate environmental impact reduction targets as a criterion for supporting transactions in commodity markets.

According to the analytical agency S&P Global, key players on commodity markets currently seek to assess the financial risks and opportunities associated with holding an asset, or to include indicators of changes in demand, associated with trends in decarbonization and energy transition, in the design of their trading portfolios (Incorporating Environmental Considerations into Commodity Indices - Research | S&P Dow Jones Indices (spglobal.com). Some of them are already relying on specific metrics to measure and mitigate their impact on the environment – this in turn leads to the definition of specific sustainability commitments within investment strategies while maintaining the desired portfolio diversification.

Why generally accepted initiatives of sustainable agricultural production are not applicable for Ukraine?

The most common criterion for sustainable agricultural production in the world is evidence of zero deforestation. This has gained particular importance amid increased rates of global deforestation by 43% from 2014 to 2019, which led to the loss of about 12 million hectares of tropical forests during this period.

Ukraine is historically an agricultural country. According to national statistics, the size of the land bank of arable land in Ukraine during 1990-2020 remained generally unchanged and amounted to about 35 million hectares, whereas the area of hayfields and pastures was about 7.5 million hectares. At the same time, the level of conversion of forest land into agricultural land is less than 1% annually. Therefore, generally accepted standards of sustainability of agricultural production, which are based purely on the criteria of preventing deforestation, are not indicative for Ukrainian agricultural products limiting the potential of its contribution to the development of best world agricultural practices.

Another criterion for sustainable agricultural production is compliance with minimum standards of environmental and social sustainability. Several platforms operate in line with this principle, such as the Global Sustainable Agriculture Initiative (GSAI), the Sustainable Production Principles, the International Federation of Organic Agricultural Producers (IFOAM - Organics International) and others. Nevertheless, as a candidate for EU membership, maintaining in-depth cooperation with the OECD, Ukraine is generally perceived by stakeholders as a country in which minimum standards of sustainable development are ensured. Therefore, agriculture products are usually defined as being compliant with such principles.

Why existing sustainable agricultural initiatives are not working as they should?

The experience of the Soft Commodities Compact (SCC) initiative, in which 12 signatory banks integrated top-tier policies and focused only on available sustainable certification schemes, showed no progress in slowing deforestation during 2014-2020 (BankTrack – Six years of the Soft Commodities Compact failed to slow bank finance for deforestation).

Learning lessons from this case, industry experts believe that it is necessary to ensure clear monitoring of relevant environmental performance and sustainability indicators to develop a successful case of investing in natural capital. In practice, this means creating a universal sustainable criterion and a system of pre-investment audit, ensuring traceability and transparency throughout the land and forest use chain.

The ISCC standard is a possible option that needs specification

Today, many players in Ukrainian agricultural raw materials market are guided by International Sustainability and Carbon Certification (ISCC), the certification of sustainable raw materials. It can guarantee a price premium for various products including corn, rapeseed, soybeans, sugar beet, as well as waste and side products of processing. The ISCC Register today includes more than 260 valid Ukrainian certificates.

Being on the market for more than 10 years, ISCC Plus approach is generally mature, adapted to different points of origin of agricultural raw materials (field level, first harvesting point/elevator, processing); it has several digital indicators in a form of minimum acceptable threshold, which is usually not disclosed in a certificate (for example, greenhouse gas (GHG) emissions assessed according to the ISCC 205 methodology) and provides for a system of inspections. However, having a historical focus on the criteria of the EU Renewable Energy Directive for the production of biofuels (RED and RED II), the ISCC standard has become a statement of compliance with a certain criterion over time (similar to ISO, GMP+ and other standardized certificates). In other words, the certificate according to this standard serves solely as confirmation that the cultivation and processing of products are aligned with a certain set of practices. At the same time, this approach does not encourage continuous improvement of operational and management practices. For that reason, it is difficult to form targets for environmental and social sustainability and assess the appropriate effectiveness of investing in agricultural technologies.

Feasibility of incorporating FAO guidelines on responsible agricultural supply chains

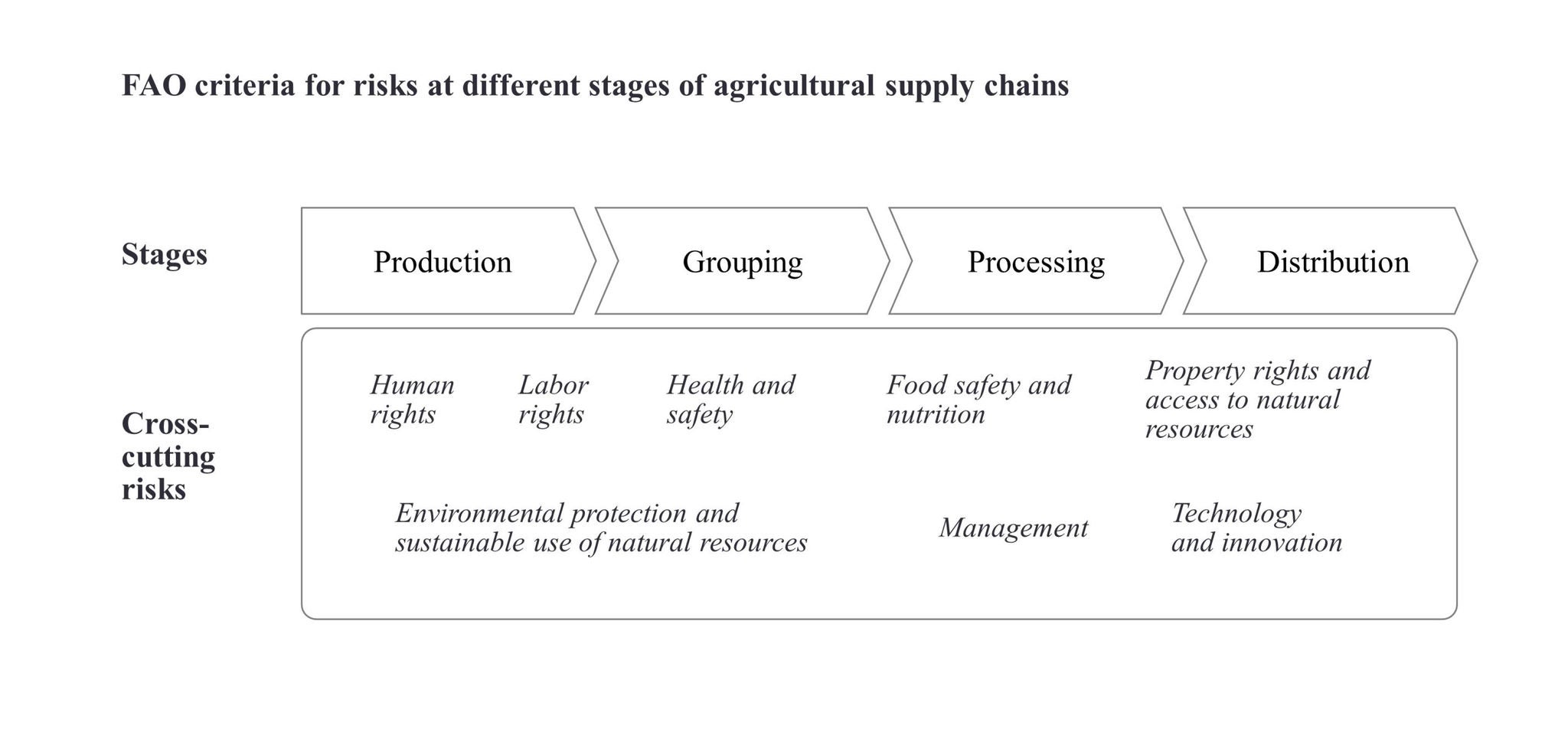

In the publication "OECD-FAO Guidelines for Responsible Agricultural Supply Chains", FAO experts note that investing in agriculture, for the purposes of meeting growing demand, should take into account the principles of responsibility (OECD-FAO Guidelines for Responsible Agricultural Supply Chains (fao.org).

The FAO Standards for Responsible Business Practices in Agricultural Supply Chains are based on assessment of cross-cutting risks with a focus on those that are significant for maintaining food security, poverty reduction and economic growth. Given the importance of FAO expertise for agricultural commodity markets, Ukrainian criterion for sustainable agricultural production must undoubtedly meet these standards.

EU regulatory framework and criteria for sustainable agribusiness activity regulated by the EU Taxonomy

Another direction, which certainly serves as a benchmark for aligning sustainable practices of Ukrainian agricultural production, is the EU regulatory system in the field of sustainable development of agricultural production and rural areas (Common Agriculture Policy), as well as a package of legislative initiatives aimed to reduce the impact of operational activities on the environment – the EU Green Deal. The Farm to Fork strategy, which is an integral part of the Green Deal, envisages the transformation of agriculture production considering the principles of sustainable development. The criteria for responsible investment are detailed on an industry basis (including for agriculture, namely crop production and animal husbandry segments).

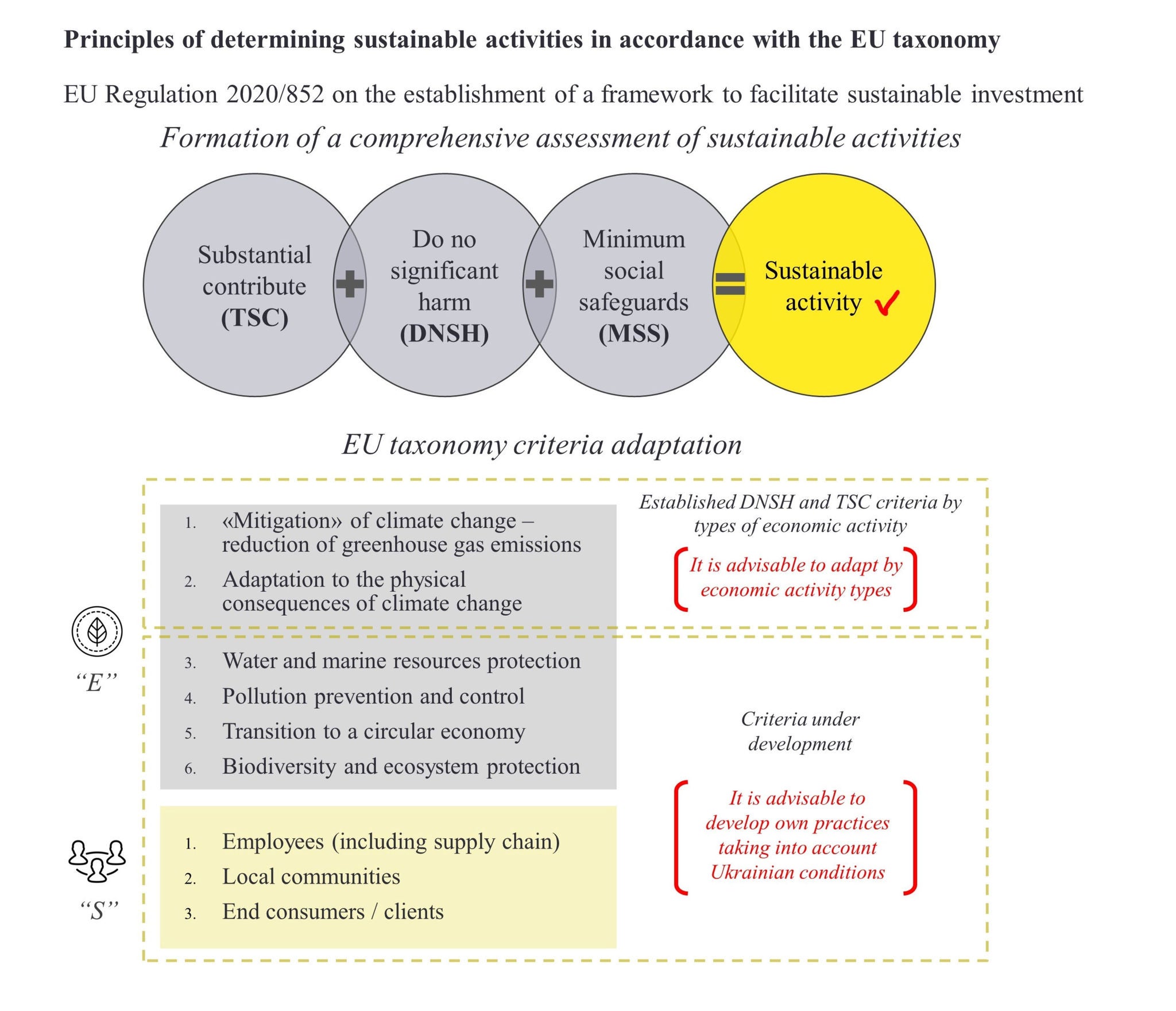

The EU Taxonomy for Sustainable Performance is a classification system created to determine which investments are environmentally sustainable in the context of the Green Deal. This system defines criteria for assessing sustainable activity by types of economic activity (NACE, an analogue of ‘KVED’ in the EU statistics system), thus establishing clear guidelines for environmental and social capitalization for investors. Sustainability is measured by a combination of factors of significant environmental or social contribution (TSC = Technical Screening Criteria), checks for compliance in line with non-significant harm criteria (DNSH = Do No Significant Harm) and ensuring minimum social safeguards (MSS = Minimum Social Safeguards).

As of today, two out of six environmental parameters in line with the TSC criterion have been formalized within the EU, namely metrics of climate change "mitigation" (reduction of GHG emissions) and adaptation to the physical consequences of climate change. Overall, the most significant and formalized criteria in the EU Taxonomy in terms of its numerical analytics and structure is the parameter of GHG emissions (in crop production it is measured as tCO2e/ha field or tCO2e/t of a particular crop by accounted weight), as well as a company’s specific plans to reduce carbon footprint.

In terms of applying the criterion of adaptation to physical climate change impacts (annual increase in temperature, change in the amount of precipitation, increase in the frequency and probability of negative climatic events - drought, storms, etc.) in Ukrainian conditions, granularity can be included for (1) parameters of adaptation of technology and hybrids of crops to the shift of natural zones of Ukraine (steppe, forest-steppe, polissia) towards the northeast, which has been observed over the last decade; as well as for (2) restoration or construction of new irrigation systems and field drainage systems.

Criteria for Environmental Impact Reduction from Agricultural Technology (TSC) set by the EU Taxonomy

According to EU Taxonomy, the criterion of environmental impact reduction for the crop sector revolves around practices that contribute to reduction of GHG emissions from agricultural production (tCO2e/ha), including practices of sequestration (absorption from the atmosphere) and accumulation of organic carbon in soil (tC/ha). In addition, relevant activities should be carried out on lands classified by designation. In Ukrainian context, this means that main operational activities should not trigger conversion of water fund or forestry lands into cultivated lands.

In case of the livestock sector, it is key to consider full carbon footprint cycle needs, which includes both agricultural production and preparation of forage crops, as well as sustainable practices for improving animal health, animal nutrition and waste management.

Management practices in crop production – annual crops

- Accounting for GHG emissions at the farm level, determination of basic performance targets (tCO2/ha, carbon accumulation in the soil, nitrogen application rates, NUE indicator, etc.);

- Management of agrotechnology and planning of crop rotations, considering parameters of the amount of organic matter in soil and an increase of area under cover crops;

- Soil health management to prevent erosion and carbon loss from soils, systemic optimization of soil cultivation methods;

- Optimization of nitrogen application rates, application of nitrification inhibitors (chemical compounds that suppress the action of microbes in the soil and ensure the preservation of nitrogen in the soil and fertilizers in ammonium form, contributing to the reduction of nitrous oxide emissions into the atmosphere), cooperation with nitrogen fertilizer producers on disclosure and further reduction of carbon footprint of products (tCO2/t fertilizer or tCO2/t nitrogen);

- Management of agricultural residues and wastes;

- Improvement of energy efficiency (agricultural machinery, stationary installations, transport) and purchase of green electricity, considering capabilities of the Ukrainian energy market.

DNSH criterion (Do No Significant Harm) of the EU taxonomy

The DNSH criterion is similar in nature to existing minimum environmental compliance practices applied by responsible investors. For agricultural production in Ukrainian conditions, verification may take place taking into account the following provisions stipulated by the EU Taxonomy:

- Sustainability of farming systems and adaptation to climate change – application of appropriate tillage techniques, maintenance of a certain number of areas of permanent pastures, prevention of soil erosion;

- Minimization of negative impacts on aquatic ecosystems – for example, based on the results of surface water monitoring by the State Agency of Water Resources of Ukraine (‘DAVR’);

- Integration of principles of circular economy – resource efficiency and reduction of nutrient loss, focus on the usage of residues and side products to reduce resource needs (including development of bioenergy capacity, biochar production etc.);

- Controlled impact on air quality – reduction of methane leaks from livestock;

- Maintaining efficiency of the production system, including nutrient management – efficient use of nitrogen fertilizers and compliance with the NUE indicator (Nitrogen Use Efficiency is an indicator of nitrogen efficiency);

- Prevention of runoff and leaching of pollutants and nutrients – compliance with relevant regulations, allowed list, and adherence to optimal application techniques of plant protection products;

- Controlled impact on natural habitats and species – management of biodiversity parameters in accordance with the conditions within the area of main activities.

Leading positions of the Ukrainian agricultural sector according to environmental criteria

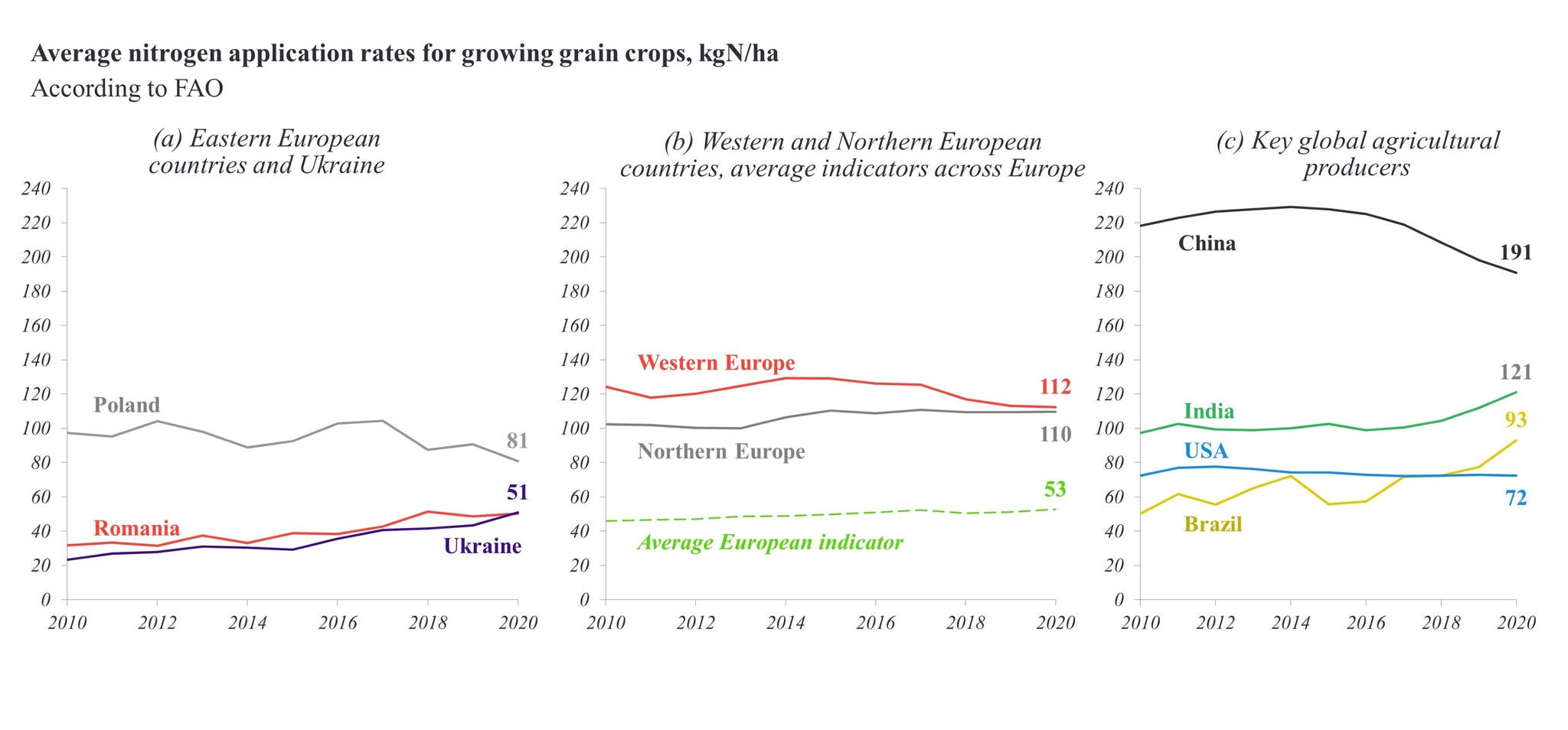

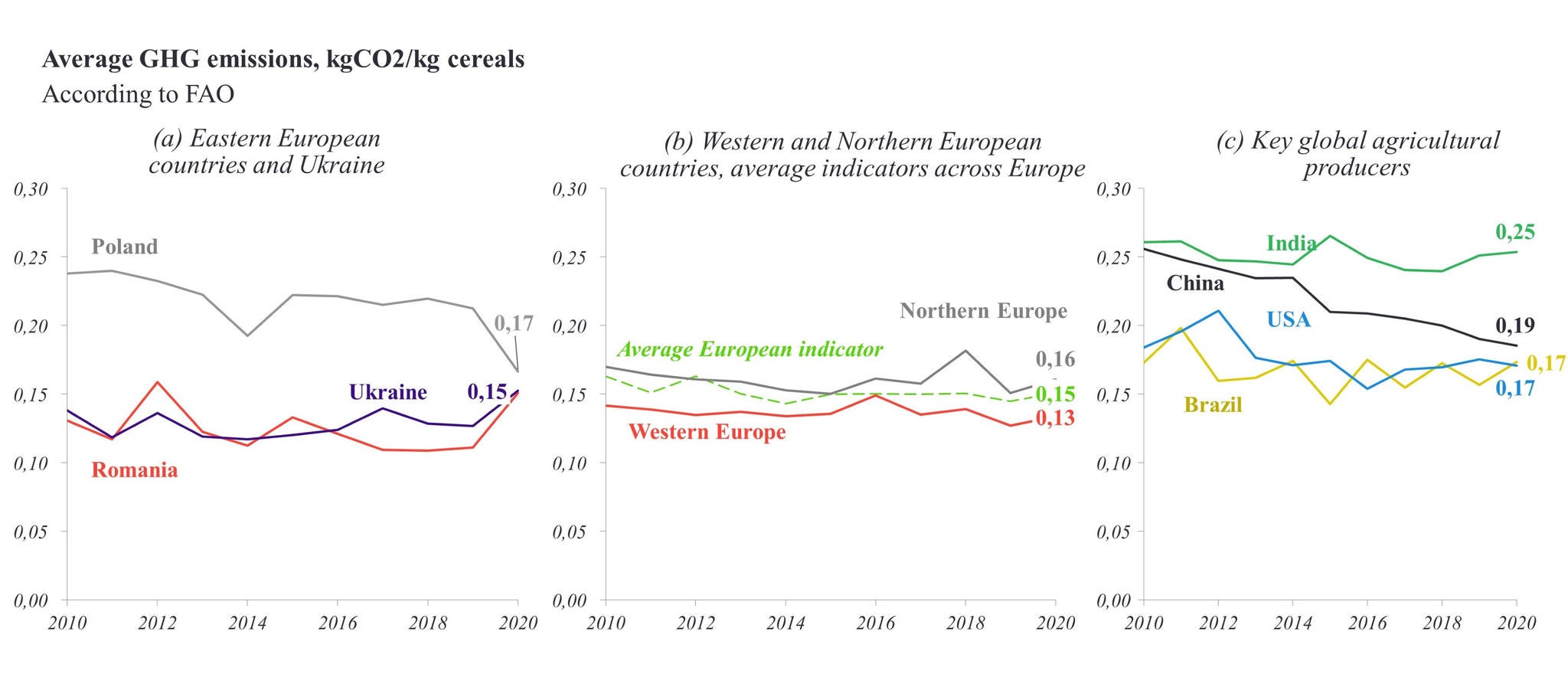

Considering characteristics of agroclimatic conditions for growing key crops (grains, legumes, oilseeds, technical crops), Ukrainian producers, in principle, have a better position in terms of plant protection products and nitrogen application, while also demonstrating lower levels of GHG emissions into the atmosphere generated by agricultural production.

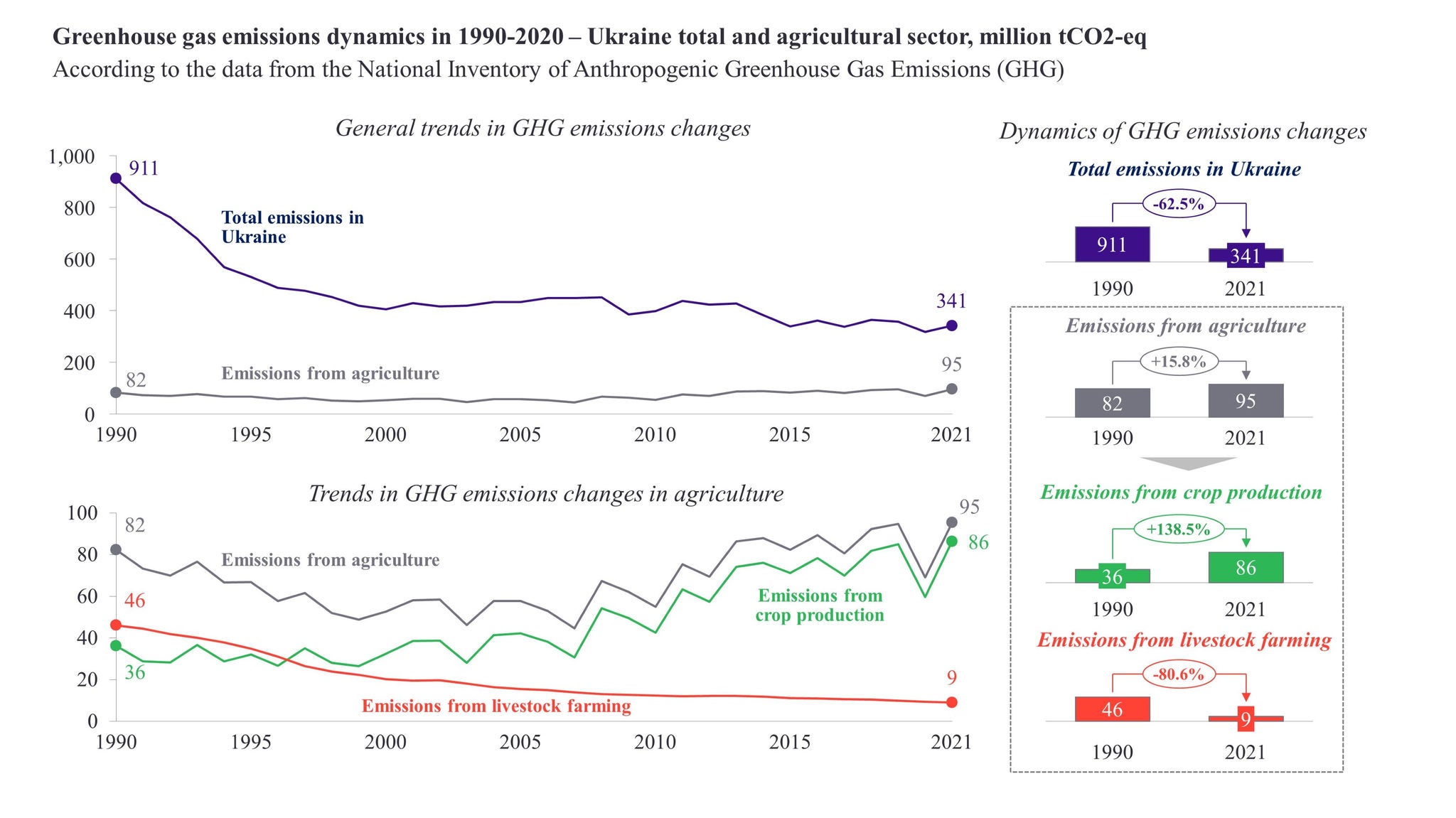

Significance of GHG emissions of the Ukrainian agricultural sector

The trend of national GHG emissions in 1990-2021 in Ukraine demonstrates a significant decrease amid several crises and the overall economic decline. Due to current military events and the loss of significant assets that are significant emitters of emissions (metallurgical enterprises, coal-fired thermal power plants), the downward dynamics is expected. It is anticipated that the post-war recovery will consider principles of the green economy, avoiding a significant increase in GHG emissions compared to pre-war levels.

Nevertheless, such assumptions are not entirely applicable to the agricultural industry, where the nature and dynamics of GHG emissions are different.

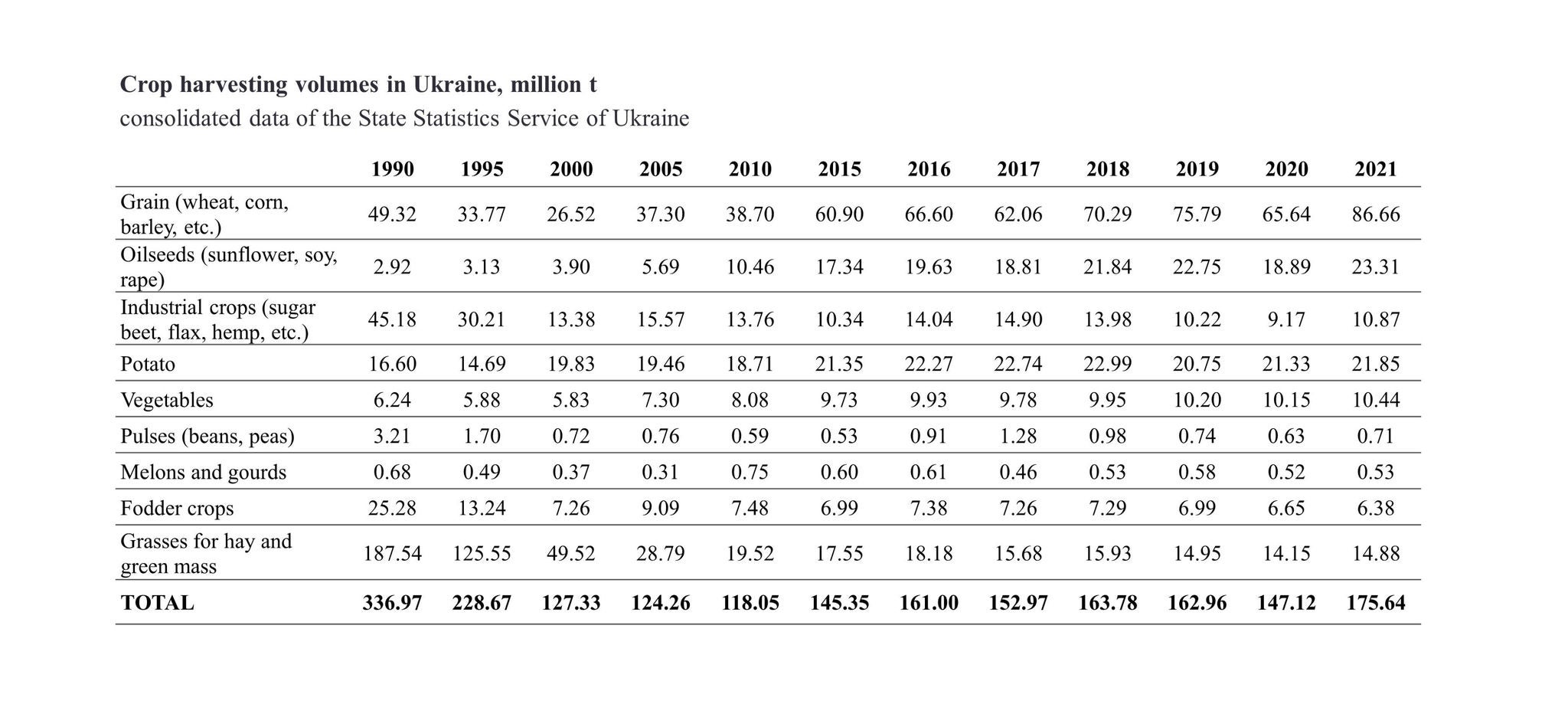

Key causes of the growing GHG emissions in agribusiness are increasing production of grains and oilseeds, as well as a significant decrease in hay harvesting. Indeed, the cultivation of perennial crops allows accumulation of carbon in soil, therefore, putting a field in the mode of CO2 emissions sequestration.

GHG emissions from agriculture in Ukraine are comparable to total emissions from the economies of Romania (66.1 million tCO2-eq), Austria (67.1 million tCO2-eq), Portugal (50.3 million tCO2-eq), Ireland (69.5 million tCO2-eq). (National Inventory Submissions 2023, UNFCCC).Therefore, the issue of reducing these emissions is an essential aspect of the low-carbon development of Ukraine's economy and an object of attracting relevant foreign investment.

Reduction of environmental impacts of Ukrainian agricultural sector should be integrated into the industry development policies, leading to the establishment of appropriate targets and systemic conditions for encouraging relevant practices for all types of agricultural enterprises.

Key Ukrainian agricultural companies are already integrating relevant organic and low-carbon farming practices into their business models. At the same time, for the majority of small agricultural enterprises, this topic is relevantly new and requires detailed study with the involvement of relevant industry experts.

To implement such practices there should be the introduction of a universal, understandable and user-friendly system for accounting relevant environmental impacts. A good example of such a development is the COMET-Farm carbon and GHG emission accounting system developed by the US Department of Agriculture. This platform is built on the basis of an open accounting methodology, integrated with the data of the national soil cadastre and geographic information systems, allowing farmers to consider the dynamics of climatic indicators in the scenario planning of their own activities. In addition, there is a system of support and training for farmers on the principles of this accounting and the use of appropriate tools at the national level.

Position of Ukrainian agribusiness

Marta Trofimova, Sustainability manager at Kernel

"Kernel became the first agricultural company in Ukraine that undertook an in-depth study of cliate corporate governance topic in collaboration with EBRD and EY. This included, among others, analysis of climate scenarios, evaluation of climate physical and transitional risks, as well as overview of potential business opportunities, associated with low-carbon development. Additionally, this months-long “brainstorm” had given a better understanding of climate-related priorities on the global market and levels of involvement in this area, demonstrated by the ABCD players. Currently, it is understandable that agriculture is not perceived as a full-fledged player at the international climate arena, as almost all attention is dedicated to the energy sector and industry. Indeed, during annual climate negotiations out of hundreds of sessions, only a few are devoted to the agricultural sector, although it is the second largest emitter of greenhouse gases in the world. For that reason, any low-carbon development strategy should be based on a clear understanding of a company’s role and possible contribution to achieving climate change mitigation goals. In the agricultural sector, this potential is quite high, especially in Ukraine. To realize this potential at the national level, we should first start by harmonizing approaches and strategy of decarbonization of agricultural production, with the support of competent international organizations, academic community and civil society".

Yuliya Bereshchenko, Sustainable Business Development and IR Director at Astarta

“Agriculture is recognised as one of key potential tools for decarbonising the economy. However, reduction of the carbon footprint is only half of the story. The key benefit of carbon sequestration in soil is increasing its health - retention of productivity, moisture and biodiversity for the long-term. This is why Astarta entered into several pilot projects with international partners focusing on regenerative agriculture the key elements of which are diverse crop rotation, precision farming, reduced tillage and cover cropping. By changing our agricultural practices we adapt our business to the climate change, reduce own carbon footprint and help our international off-takers to meet their decarbonisation goals which would not be possible without covering their entire supply chain.”

"Sustainable development for us is an issue that goes beyond environmental protection and is based on all components of the business environment - environmental, social and managerial sustainability, i.e. ESG criteria. Since MHP is an international company that cooperates with global importers, it is logical that the entire production and supply chain must comply with the principles of sustainable development.

The company introduces a number of measures aimed at protecting the environment. This is an increase in the share of no-till soil cultivation and plant residue management, and the use of cover crops and the introduction and adaptation of Verti-till and Strip-till technologies in some regions of the company's operations. Over the past five years, MHP has been actively expanding the application program of organic fertilizers and working on the formulation and quality composition of the final product to meet the individual needs of fields characterized by different levels of nutrient supply. We also use microbiological preparations, because we realize that this improves the quality of the soil and contributes to the improvement of the phytosanitary condition, allows us to build useful symbiotic ties between microorganisms and crops. We apply mineral fertilizers quite rationally and sparingly - we practice local tape application, pop-up technology, we pay attention to nitrogen stabilization. In addition, the

Lessons learned: examples of existing solutions and approaches

Differentiation of specialized "green" raw materials on trading exchanges is a relatively new direction, in the early stages of development and attraction of stakeholders. One exception is markets for biofuels and biofuels feedstock, such as used cooked oil (UCO), which is a raw material for second generation biodiesel (HVO) and sustainable aviation fuel (SAF). Other than that, the agricultural segment retains a focus on the compliance criteria for sustainable raw materials as was described earlier.

Nevertheless, recently there have been some initiatives to differentiate contracts for supply of raw materials with confirmed numerical indicators of sustainable production on the Chicago Board of Trade (CBOT) and Intercontinental exchange (ICE). This takes place mainly in the form of separate trading initiatives between involved market participants. In February 2023, the US Grains Council launched its own Corn Sustainability Assurance Protocol (CSAP) and web-platform of sustainable export (SCE - Sustainable Corn Exports). This platform allows buyers on the international markets to receive quantitative information on products made in the United States in accordance with this protocol, including corn, barley, sorghum, and side products (DDGS, ethanol).

The CSAP protocol criterion is structured on a series of indicators of sustainable agriculture and allows to further track compliance with specific sustainability goals of the National Maize Producers Association, for example a 12% increase in productivity, a 13% reduction in energy consumption, GHG emissions and soil erosion, and a 15% increase in water supply efficiency in irrigation systems by 2030.

On the SCE platform, grain buyers from the United States can generate the specified numerical information, Record of Sustainability (ROS) regarding a constant criterion under the CSAP protocol, which is related to the cargo of a particular vessel and is based on generally accepted principles of mass balancing. Farmers, exporters, and international importers of corn in the United States can apply the SCE web platform free of charge. The end goal of this initiative is to promote global trade in U.S. corn by helping stakeholders across the international supply chain to better understand the sustainability practices of local agricultural production. We need such a case to promote the marketing of Ukrainian agricultural products in global markets and attract sustainable investments in the natural capital of Ukraine.

Conclusions and recommendations

Given the importance of the topic of sustainable development of Ukrainian agribusiness, the existing interest on the part of industry players, national and international financial institutions to create such a criterion should be addressed with the involvement of a wide range of experts in agricultural technology, digitalization and accounting, logistics, sustainable finance and related areas.

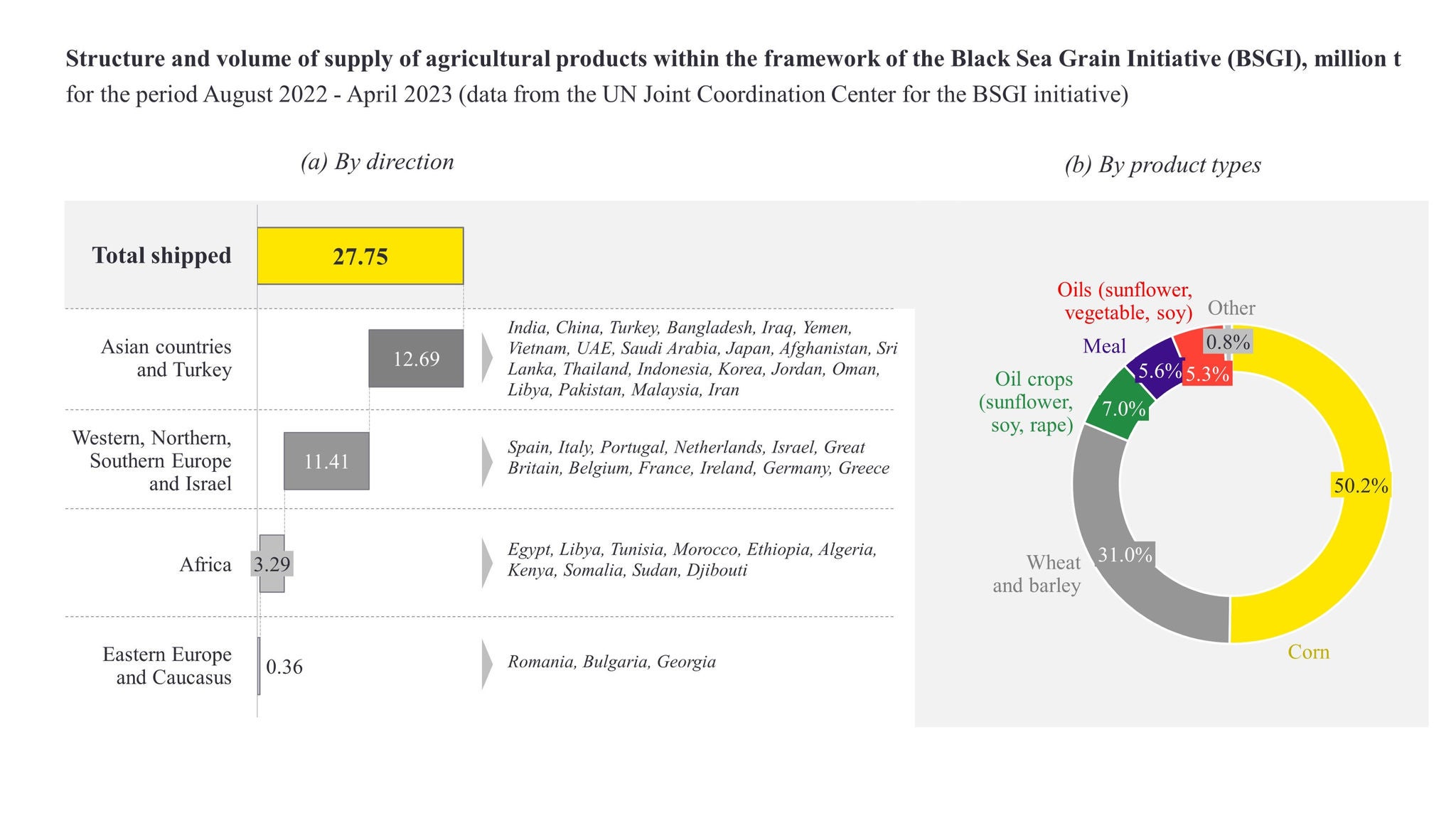

The piloting can be organized within the framework of the Black Sea Grain Initiative (BSGI), which has already attracted the attention of the world community.

Summary

Specific implementation steps can be articulated as following:

- Formation of a cross-cutting criterion of sustainable agricultural production for all types of agricultural enterprises in Ukraine, considering regional peculiarities and agroclimatic conditions of business, as well as current progress of improving the efficiency of basic technology.

- Definition of concepts of "basic" and "progressive" agricultural technology, establishment of principles of scenario modeling and accounting of organic carbon accumulated in soils, considering the urgency of post-war restoration of soils.

- Establishment of specific targets on environmental and climate efficiency in the agricultural sector – medium-term (2030) and long-term (2050), which would contribute to early achievement of carbon neutrality status (Net Zero) at the country level.

- Adaptation and clarification of the EU Taxonomy considering the agroclimatic conditions of Ukraine, their coordination at the level of the Ministry of Agrarian Policy of Ukraine with the involvement of international experts from FAO and other specialized organizations.

- Establishment of principles of differentiation of Ukrainian products in trade contracts and their tokenization – a system of unified codes of a field, cluster, elevator, transshipment, port or cross-border point for the purpose of providing numerical information on shipments by road, rail, river or sea.

- Development of a system of national accreditation and verification of data on performance in line with a sustainable criterion to ensure their reliability.

- Proactive communication of the criterion following achievement of specific sustainable development goals with stakeholders to promote sustainable finance of the agricultural sector.