EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

The EY Net Zero Centre brings together EY’s intellectual property, strategic insight, expertise and deep knowledge in energy and climate change leadership to solve the big problems ahead as we move towards net zero emissions by 2050.

Read more

Three findings for every business leader to consider

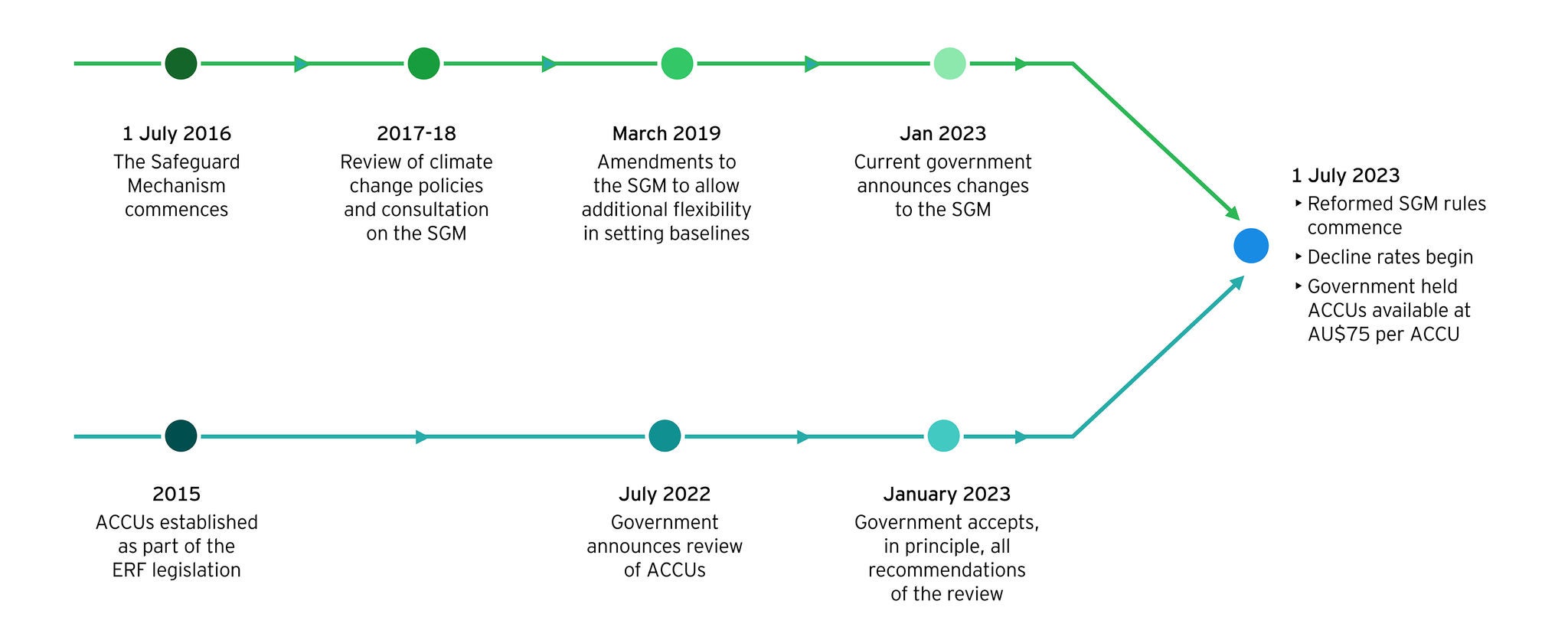

In June, we noted that the price of Australian Carbon Credit Units could double before 2035, coming in just below the Australian Government’s cost containment measure.

Since then, the EY Net Zero Centre has undertaken additional scenario modelling and analysis to understand the impact of this policy on Australia’s carbon credit market. We find Australia’s carbon market could deliver an additional 20 million units annually by 2035, up from 17 million units in 2022.

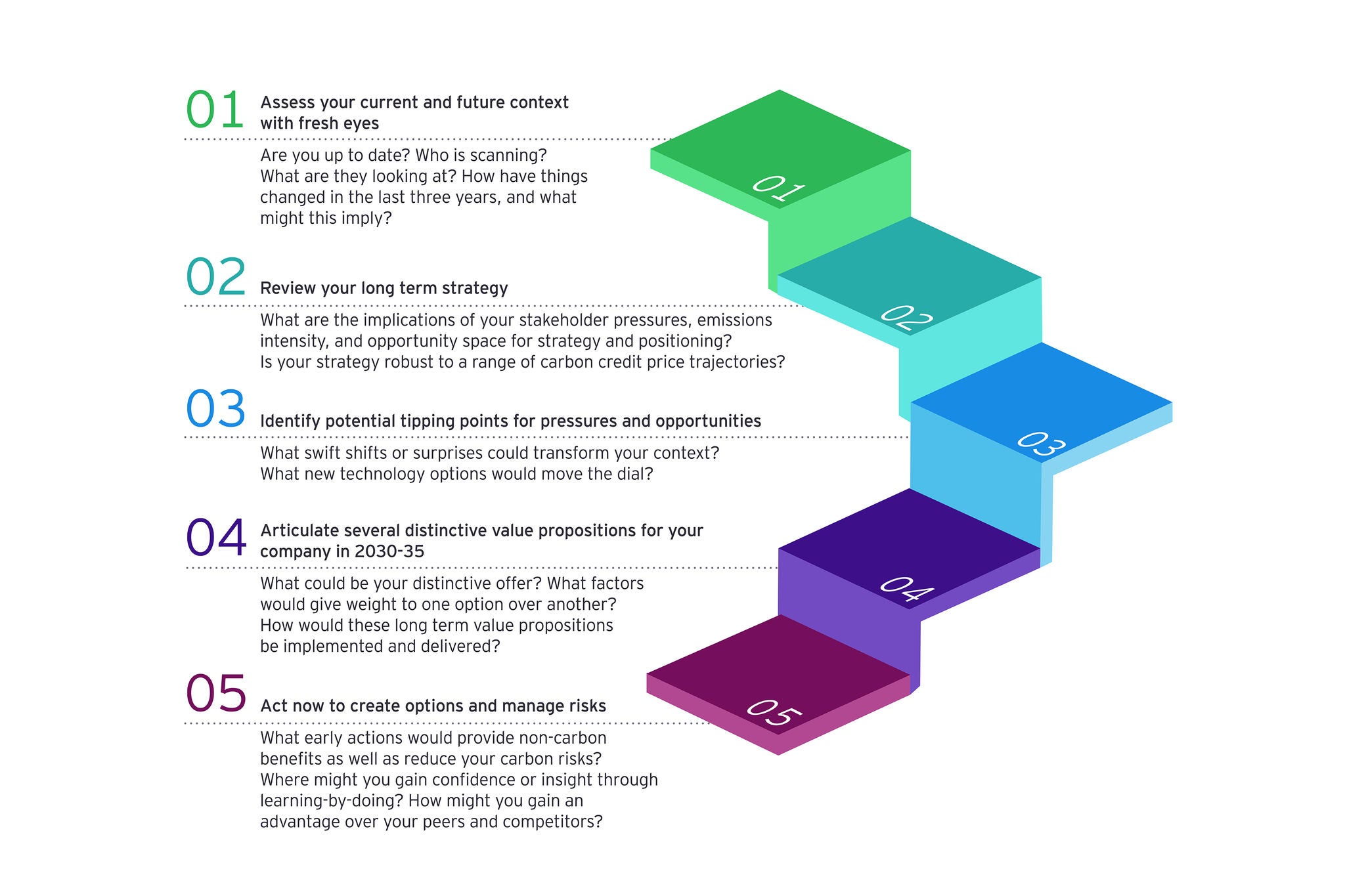

Our new report, Changing Gears: Australia’s Carbon Market Outlook 2023 , dives deep into the possibilities out to 2050 – but there are three findings that every business leader should consider.

1. SGM reforms will drive real abatement

Our central estimate finds abatement will rise to 43 million tonnes per year by 2035, accounting for around 50% of compliance requirements under the SGM. Oil, gas and coal projects are likely to do much of the heavy lifting and deliver around 90% of emissions reductions in the short-term.