The pandemic has indeed accelerated many preexisting trends, and supply chain is no exception: Our 2020 survey found that 64% of surveyed supply chain executives say digital transformation will accelerate due to the pandemic. And our 2022 research report shows the race is on for digital enablement and automation: by 2035, 45% of supply chains are expected to be mostly autonomous (e.g., robots in warehouses and stores, driverless forklifts and trucks, delivery drones and fully automated planning).

However, simply utilizing digital technologies does not equate to creating a digitized, autonomous supply chain — it also needs connected supply chain technologies across planning, procurement, manufacturing and logistics that work beyond the organization’s four walls. It’s the difference between “doing digital” and “being digital.”

We can think about autonomous operations in terms of “lights-out,” “hands-free” and “self-driving,” where organizations use AI technologies across the end-to-end supply chain to help make predictive and prescriptive decisions. An example is responding to a change in customer demand, seen instantly by the entire value chain (the organizations, its suppliers and their suppliers’ suppliers) so they can collectively adjust supply plans and production schedules immediately. Ultimately digital and autonomous technologies will help make people’s jobs easier and the supply chain more efficient and optimized.

What comes next?

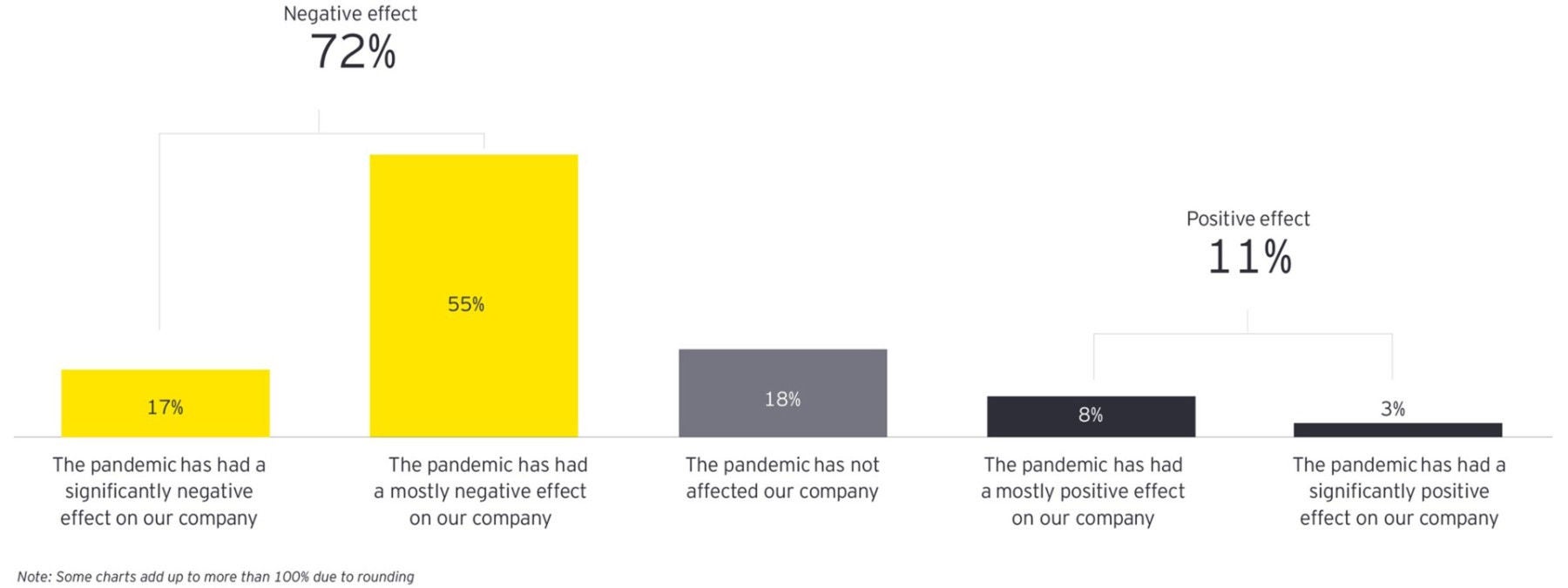

From the 2020 research, we see that 60% of executives say the pandemic has increased their supply chain’s strategic importance. Accordingly, enterprises urgently need to design a supply chain organization that will fit the new digital and autonomous-focused era.

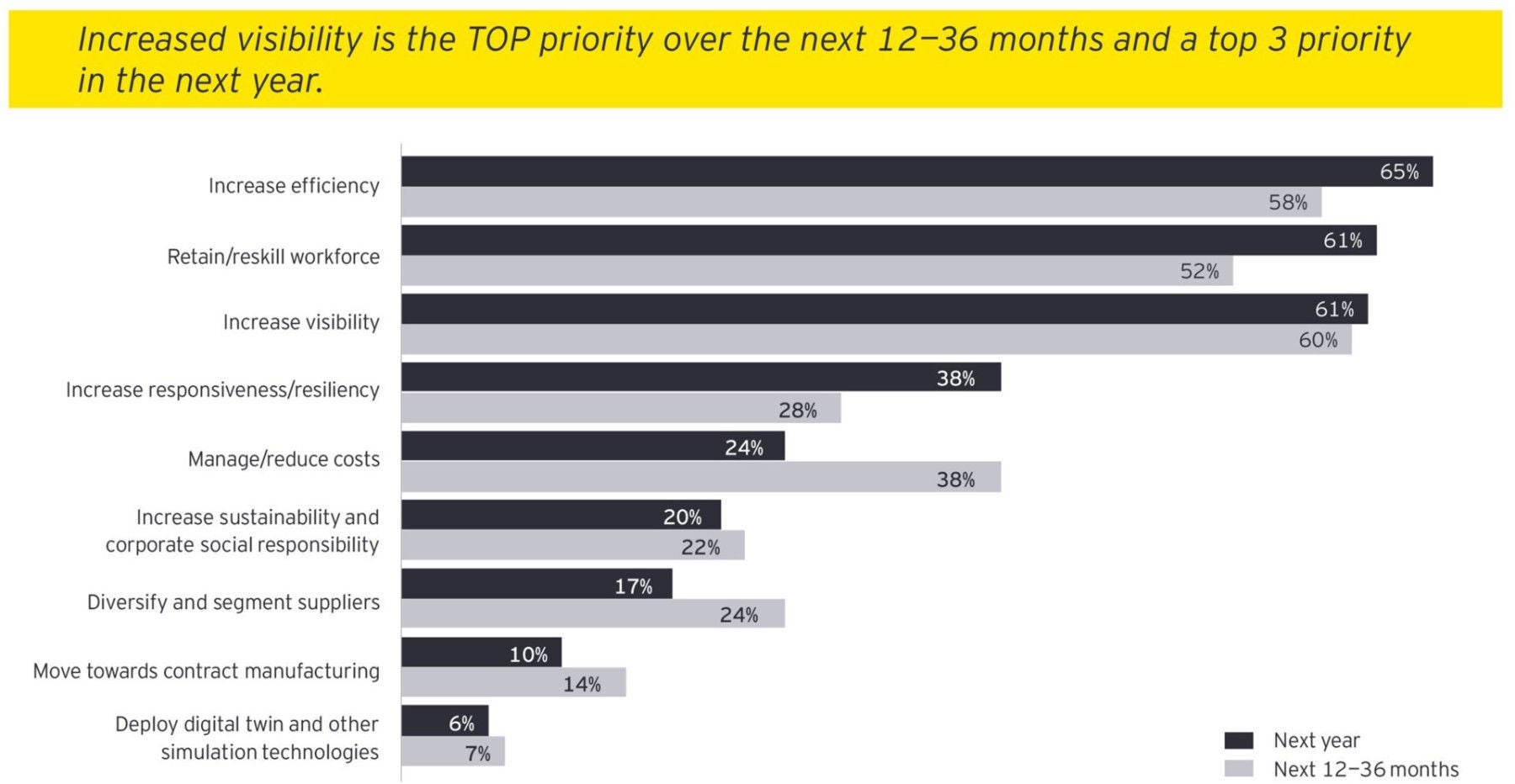

Looking forward, multiple disruptions are happening more quickly and factors such as geopolitical risks, cyber threats and economic instability are continuing to put pressure on supply chains. So the supply chain of the future will need to be agile, flexible, efficient, resilient and digitally networked for improved visibility. Organizations, therefore, should focus on five priorities for recovery and beyond.

1. Reimagine the strategic architecture of your supply chain

- Continue to invest upfront in your supply chain strategy, architecture and operating model to increase flexibility and effectiveness.

- Rapidly redefine your supply chain strategy and alter global trade flows, considering new trade agreements, country incentives and omnichannel acceleration.

- Reimagine your supply chain operating model — what work should get done locally, regionally and globally, including warehouses and manufacturing sites. There are considerable tax implications here, and a new model can also help you prepare for future disruption.

2. Build transparency and resiliency

- Improve disruption response with real-time visibility and monitoring of your end-to-end supply chain, as well as performing scenario planning and simulations.

- Deploy technological capabilities that enable Tier-n transparency and communicate with stakeholders through broader data sharing agreements.

- Review your supply chain footprint. Our 2022 research shows that 54% of companies are looking to add suppliers. Do you have alternate sources of supply established? Are you confirming you do not have vendor or geographic concentration? Considering factors including geopolitical risk and cyber threats, should you reshore or reposition parts of your supply chain?

3. Extract cash and cost from your supply chain

- Achieve cost reductions strategically by reinvigorating and rethinking your overall ecosystem to better leverage suppliers, and pursuing more dynamic network optimization.

- Drive a step change in your supply chain cost structure and working capital profile by focusing on SKU rationalization, procurement spend reduction, logistics and warehouse optimization, and manufacturing productivity.

- Reduce working capital via supply chain segmentation, refreshed inventory planning parameters and changes in payment terms.

4. Create a competitive advantage with sustainability

- The future is a circular economy where there is no waste in your products or manufacturing.

- Explore ways to redesign and engineer new products to achieve this circular economy and monitor third-party risk with supplier sustainability assessments across tiers 1-3.

5. Drive agility and opportunities for growth through a digital supply chain

- Harness demand-sensing signals from consumer sentiment to influence production, enabled by fast changeovers for smaller batches and true collaboration with suppliers for real-time decision making.

- Work towards implementing the digital and end-to-end supply chain across planning, procurement, manufacturing and logistics. This can drive efficiencies and also open new revenue streams.

- Realize that companies are using supply chains as an engine for growth and a key differentiator versus competitors.

Many executives are hoping that the COVID-19 pandemic is a once-in-a-lifetime event. However, as the adage goes, “hope is not a strategy.” There are ways to stand out and better navigate the storms of the next inevitable disruption. These include reimaging your supply chain strategies for risk and resilience and finding ways to include operational excellence and standard work to help enable continual supply chain cost reduction. Invest in digital technologies such as cloud-based collaboration platforms, automation, and data analytics and AI at speed. It also is important to continually put humans at the center of your efforts and empower them to do extraordinary things – for example, in digital manufacturing, it’s essential to invest in both process excellence and the culture on the shopfloor for organizations to get the most from new digital capabilities. And with scarcity in truly skilled resources, think carefully about where to leverage expertise and where automate the tactical. In the past, supply chain did not always have a seat at the table to provide input to the overall strategy, now more than ever supply chain is seen as a strategic differentiator, and we don’t see that changing any time soon. So instilling supply chain employees with empowerment, ownership and accountability can incentivize them to achieve more capabilities than they, or the organization, ever thought possible.

Finally, innovate with customers in mind through a truly sustainable supply chain — one that is designed with circularity and the environment in mind. Following this path, your enterprise will be better prepared to manage whatever crises come next — turning potential disruptions into tremendous opportunities.