EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The tech titans are on the hunt for low-cost, low-emissions data centres to fuel the world’s insatiable demand for AI. New Zealand can help.

In brief :

- New Zealand has abundant renewable energy and water resources, making it an attractive option for tech companies striving to meet ambitious net zero targets.

- Positioned as a green data centre hub, the nation can grow jobs, and attract capital to fund next generation energy and water infrastructure projects.

- The main barrier for this opportunity being realised at the moment are high power prices, which reflect years of power generation under-investment in the face of substantial demand uncertainties.

This article provides a high-level overview of this topic, as we continue to explore in more detail we will delve into NZ’s energy strategy; the skills & training required; data sovereignty; the funding & finance and regulatory regime.

With the right strategy, New Zealand can become a sustainable computing superpower.

Artificial intelligence is driving exponential demand for data centres. Energy-hungry data centres are on track to consume 4% of the world’s total global electricity by 2026. The International Energy Agency says this represents a doubling of AI’s energy consumption in just four years.

It is estimated that training a single large language model can require on the order of 10 GWh of electricity. This is roughly the amount of electricity consumed by 1000 households over an entire year. A ChatGPT text search consumes around 10 times the power of a Google search, while creating just two GenAI images can soak up as much energy as a full smartphone charge.

Consequently, global AI-related electricity consumption is predicted to top 134 TWh a year by 2027, equivalent to the annual electricity consumption of Argentina, the Netherlands or Sweden. The technology that is used to generate this electricity will be hugely important. Returning to our estimate of 10 GWh to train a large language model, if this electricity was generated by approximately 50% renewable energy it would emit around 2,900 tonnes of CO2 compared with almost zero emissions if the electricity was 100% renewable.

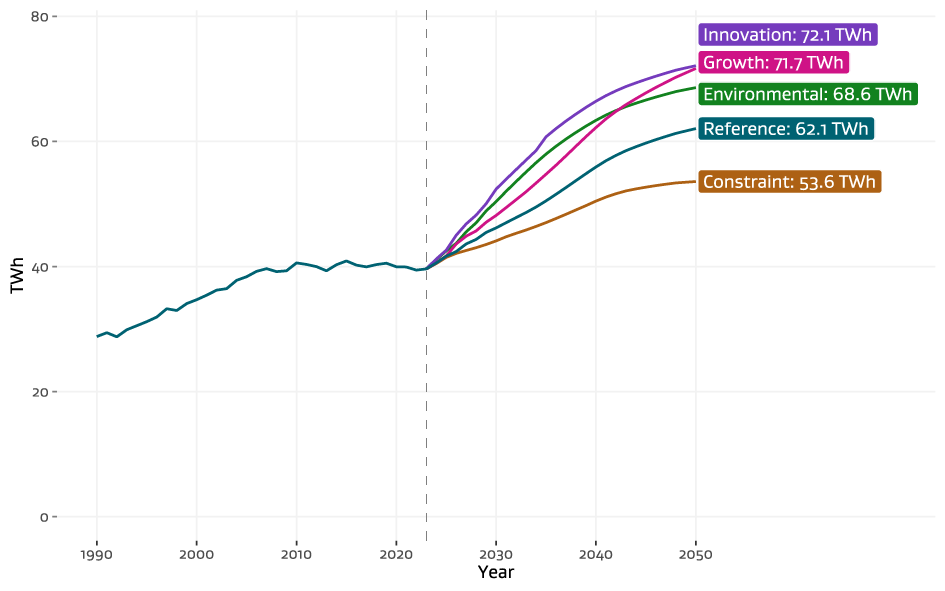

New Zealand’s electricity consumption currently sits around 40 TWh a year, so attracting even a small fraction of the global investment in AI computing will create a material increase in demand. This growth couldn’t come at a better time for an industry where demand has been stagnant for over 12 years, which has all but obliterated commitment to generation development. On top of this, much of our skilled workforce who were involved in the days of steady build-out are now approaching retirement and, without careful planning, will leave behind a critical skills gap in the industry.

At the same time, limited supply, construction delays and electricity constraints are slowing the expansion of data centres globally. Some markets are operating at 1% vacancy rates, according to analysis from CBRE.

The world needs more compute to meet the unbounded demand from AI, but the imperative to provide this sustainably is growing. Countries naturally rich in renewable energy, with cooler climates and an abundance of water – like New Zealand – are strategically advantaged.

Advancing AI with robust connectivity, renewable energy and efficient cooling

The optimal location for any data centre depends on several factors including access to data networks, electricity, water for cooling, and political and regulatory environment. In some cases, the need for extremely rapid response times will mean that data centres will need to be located close to demand customers to reduce latency. However, in many cases, such as in training AI models, this is not essential and data centres are able to be located wherever can provide the environment and resources reliably and affordably, while minimising ecological impacts. New Zealand's high renewable energy, cool environment with availability of water and political stability mean it could be a strong candidate for these applications.

New Zealand is connected through 4 distinct submarine fibre optic cable systems that provide robust and high-capacity connections to Australia, the United States, and other parts of the Asia-Pacific region.

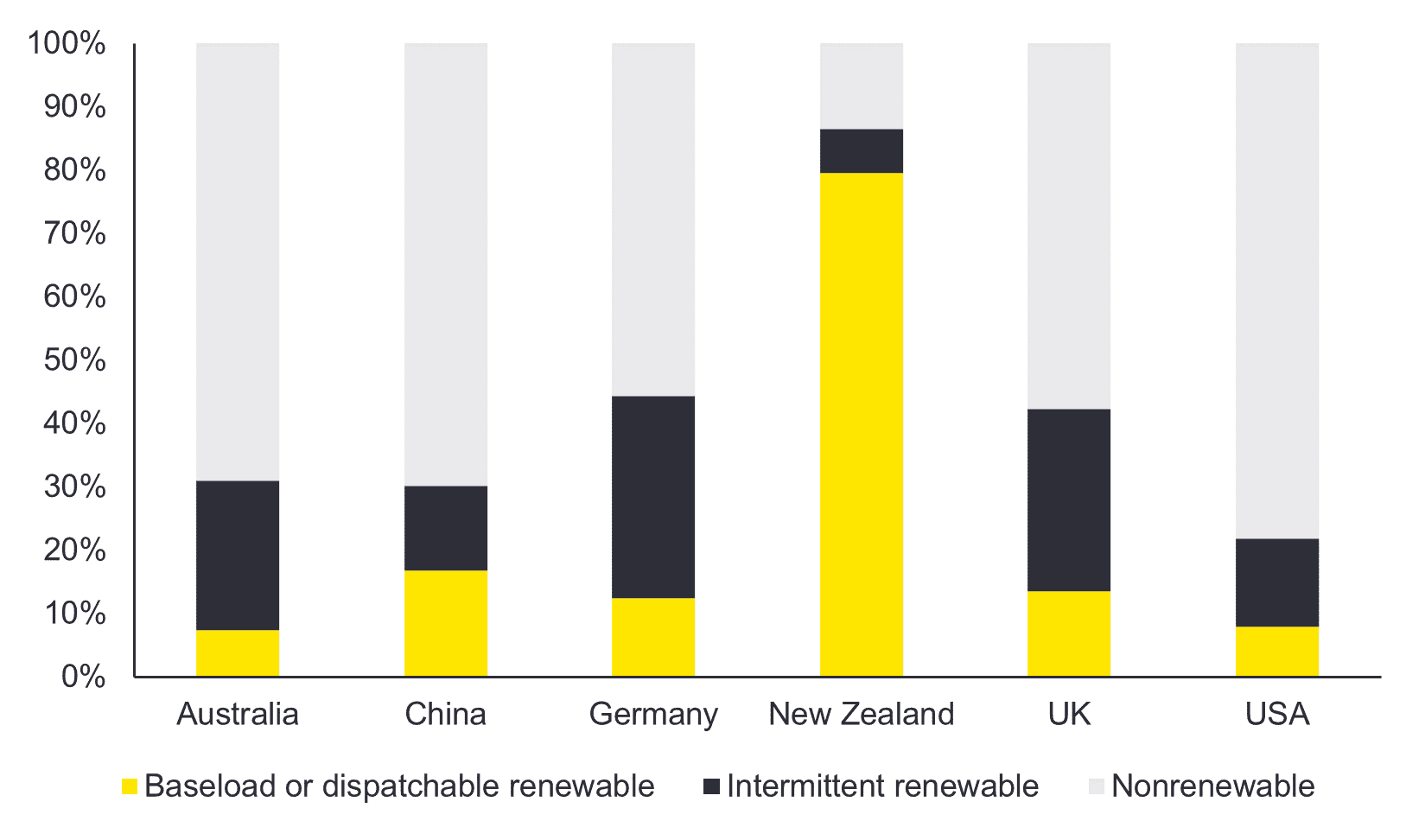

Figure 1. Renewable power generation, split between baseload/dispatchable generation and intermittent generation

How New Zealand compares to other countries

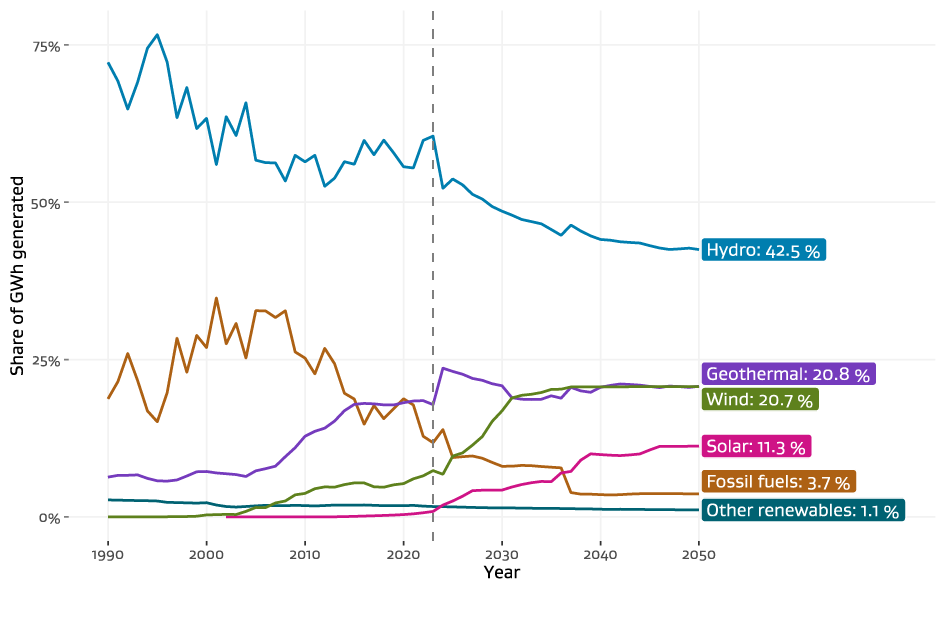

The country’s power generation mix, which relies heavily on renewable sources such as hydro, wind and geothermal, makes New Zealand a compelling choice. The electricity grid is already 87% renewable, and on current modelling undertaken by the New Zealand Government, this figure will be somewhere between 96.2% and 98.3% by 2050. These impressive figures are all the more compelling because New Zealand’s renewable energy is really dominated by baseload geothermal and dispatchable hydroelectric sources. This is exactly what the likes of large tech companies are needing to achieve their climate commitments. New Zealand’s cool climate and high average rainfall offer additional advantages that lower the energy consumption of data centres and provides a reliable water supply for cooling systems.

Figure 2. Share of electricity generation by commodity in Reference scenario

New Zealand’s abundant renewable energy could make it a sustainable data centre superpower

Figure 3. Total electricity demand

New Zealand’s abundant renewable energy could make it a sustainable data centre superpower

Obstacles and opportunities on the road to renewable energy expansion

While New Zealand’s electricity is clean, that doesn’t mean it is cheap.

New Zealand’s electricity market is a small ecosystem dominated by a handful of players. In recent years, uncertainty around the fate of New Zealand’s only aluminium smelter at Tiwai in Southland, which consumes around 13% of the nation’s electricity, has stifled market confidence and the enthusiasm of investors.

New Zealanders are paying the price for this lack of investment. Uncompetitive electricity costs have hurt consumers’ hip pockets and could potentially discourage large tech companies from growing their data centre footprints here.

But in May 2024 the owners of the aluminium smelter struck new agreements which secure energy supply from three generators until at least 2044. This provides demand certainty for the roughly 5 TWh of energy required annually to run the smelter and creates the long-term demand stability required for new investment into energy projects.

The Ministry of Business, Innovation and Employment has estimated the country’s data centre load could reach around 4.6 TWh annually by 2035 – roughly the same amount as the smelter. With the aluminium smelter’s energy consumption locked in for 20 years, New Zealand must rapidly expand its energy supply to seize the strategic advantage of its suitability for AI.

Addressing barriers to bridge the sustainable computing gap

New Zealand’s many natural advantages are tempered by a notable downside: the tyranny of distance. For certain AI applications, physical proximity is crucial. A user who is 10 kilometres away from an AI application’s servers, for example, will receive their search response much faster than one 1,000 kilometres away. However, we can address this challenge by assigning tasks where latency is less critical, such as in training large language models (LLMs). If LLMs need updating on a more regular basis in the future, New Zealand’s data centres could provide these services while large markets like North America and Europe are asleep.

Other barriers, such as the high cost of electricity and the lack of water infrastructure, are not as easily remedied. Infrastructure New Zealand estimates that up to $185 billion investment is required over the next 30 years to bring the country’s water infrastructure up to scratch.

For New Zealand to lower its energy costs and improve its water infrastructure, the country needs to attract international capital. If private investment into growth areas, such as AI and data centres, can be strategically structured, this could provide part of this much needed capital injection. Sustainable finance structures could support data centres to access the renewable energy profile they require, provided the data centres provide investment into New Zealand’s water and energy systems and create local demand for low-carbon construction products. In turn, this would provide broader economic benefits through lower-cost energy, improved water infrastructure and new low-carbon growth industries for New Zealanders.

Focussing on our strategy advantage can drive growth and jobs

Forecasting the future of AI is challenging, as it is hard to see where the upper limits of growth lie. Bloomberg has predicted generative AI alone could expand to US$1.3 trillion market by 2033, with a compound annual growth rate of 42%.

The AI explosion is an unmissable economic opportunity for every country that identifies and capitalises on their strategic advantage. New Zealand currently has data centres, mostly clustered around Auckland and Wellington. But there is no reason why we can’t strategically scale sustainable data centres around the country, creating jobs and stimulating economic growth during construction, securing highly specialised, high-paying jobs during operation and attracting international capital looking to invest in commercial real estate and infrastructure development.

As AI continues to advance, New Zealand’s strategy must focus on brawn and brains. We can build the physical data centres and foster an ecosystem of talent driving software and algorithm development.

Developing a strategic growth strategy for New Zealand to support AI growth, will provide the opportunity to consider how we incorporate education and attract AI software developers and tech start-ups, to provide the next generation of New Zealanders with exciting careers paths, without the need to relocate.

New Zealand has a lot to offer and a lot to gain. The next step is for government and industry to work collaboratively on a national energy strategy and innovative sustainable financing strategies that supports strategic growth and leadership in the fast-growing data centre sector.

Related articles

How can adopting regenerative principles unlock a sustainable future?

A sustainable future for all is within reach if we transition urgently toward a regenerative economy founded on five guiding principles. Find out how.

Summary

With the right strategy, New Zealand can become a sustainable computing superpower. By partnering to strategically expand energy and water infrastructure, and leveraging our education and business ecosystems, we can create jobs and economic opportunity, and power the AI juggernaut while the world sleeps.