EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Tax controversy update vol. 7‐Introduction to DCF

The tax reforms of 2019 added the discounted cash flow (DCF) method as an additional method available for calculating an arm's length price. The DCF method is a method used to derive the present value of a business by discounting the future profits (free cash flow) of a company using a discount rate which attempts to quantify the future uncertainties associated with said future profits. Many are of the opinion that the DCF method is incompatible for tax matters as it introduces a high level of arbitrariness across the board through its reliance on estimates of free cash flows, risk assessments, and other areas. This is why we believe the inclusion of an explicit provision for the DCF method in the 2019 tax reforms had significant implications for tax services.

In addition, while the DCF method has become widely accepted as a standard valuation method used in everyday tax practices, many taxpayers are still concerned as to whether it will be an acceptable method to use on valuations for tax purposes or whether valuations using this method will be rejected by the relevant authorities as inappropriate.

With these and other questions in mind, we will dedicate the next three issues (beginning with this one) to examining published case law in an attempt to summarize the various situations in which the tax authorities use the DCF approach (hereinafter simply referred to as “DCF”).

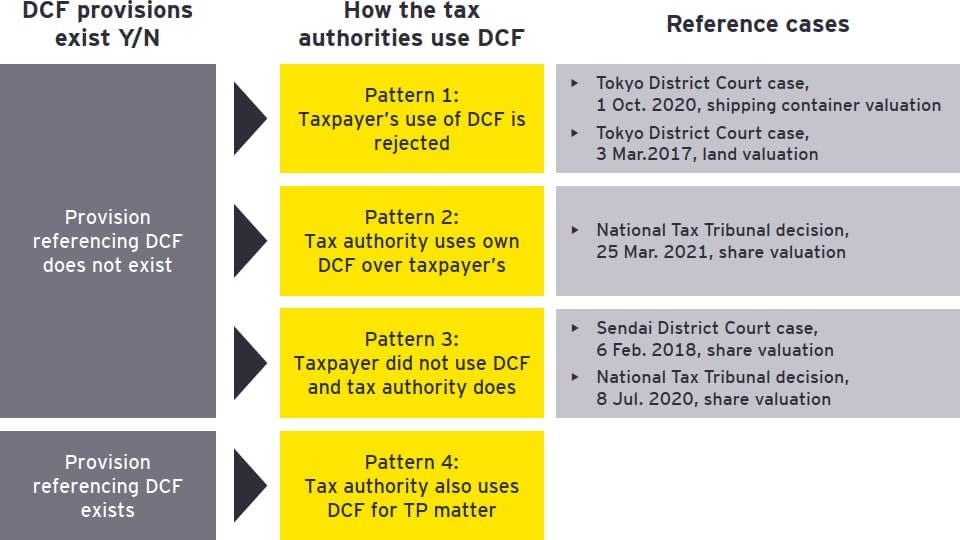

The situations in which the tax authority uses DCF may be roughly categorized as depicted in the diagram below.

The first question is whether an explicit provision for DCF exists in the first place. As mentioned earlier, a codified provision regarding DCF did not exist before the transfer pricing provision added with the 2019 tax reforms. The very existence of this provision makes it clear that even the tax authorities are, in a sense, actively using DCF in areas they deem it to be appropriate.

On the other hand, no explicit reference to DCF exists in the text of Corporate Tax Law other than the provision we are currently discussing. The section of the diagram entitled “How the tax authorities use DCF” categorizes the uses or rejections of DCF by the tax authorities within conventional tax practices that do not have provisions.

First, there were cases in which even though taxpayers valued assets using DCF as the valuation method, the tax authorities insisted that DCF cannot be used under such circumstances and that other valuation methods should be relied upon instead (Pattern 1).

Next, there were cases in which taxpayers valued assets using DCF as a valuation method and the tax authorities did not necessarily claim that DCF could not be used altogether, but rather insisted on a valuation amount based on a different DCF calculation than the original (Pattern 2). This approach essentially rejected the value assessed by the taxpayer on the grounds that the taxpayer’s calculation was flawed in its logic and assumptions.

Finally, there were cases in which the tax authorities used DCF to value assets when the taxpayer used a method other than DCF (Pattern 3). Of the three patterns of situations we identified, this situation can be considered the one in which the tax authorities used DCF most actively.

This concludes our summary of the three patterns of responses we saw from the tax authorities in areas which have no codified provisions regarding DCF. Which leads us to another question - under what circumstances can we expect to see each of these responses? If we are forced to draw a conclusion, it depends on how valuation methods are stipulated in relevant laws and regulations, as well as circulars published by the tax authorities. In our subsequent articles, we will cite facts from the specific cases listed in the “Reference cases” section of the diagram to discuss with greater specificity the circumstances in which we see each of the three patterns described above.

Contact

EY Tax controversy team

Direct to your inbox

Stay up to date with our Editor's picks newsletter.

Tax

Our tax professionals offer services across all tax disciplines to help you thrive in this era of rapid change.