EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Link Area Header

-

Explore the future of mobility with the EY Mobility Lens Suite, a proprietary automotive and transportation research toolset. Learn more.

Read more

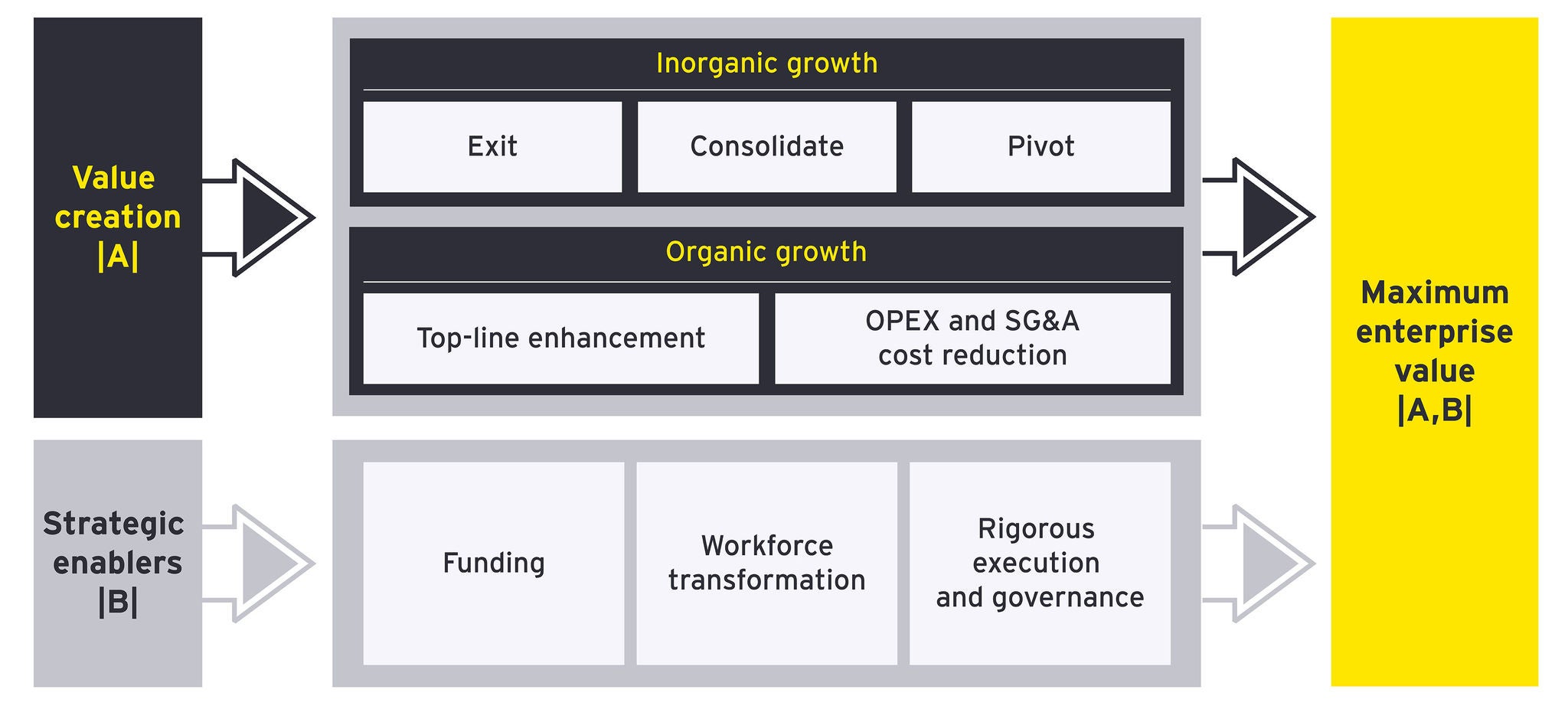

Rigorous execution and governance

Governance will need to be reviewed and adjusted to allow the business to manage both a rapidly growing, subscale, new business and another in slow decline. Many larger companies are opting to carve out their legacy EV business into a separate division.

Cash flow must be tightly monitored as, given the likely scale of costs, budgeting can be extremely sensitive to small changes in assumptions. Robust short-term and medium-term forecasting processes should be implemented during the transition period where cash flow may be tight.

Active portfolio management is equally critical, so that only products with profit potential continue to receive investment. Governance must be tiered to match the investment and uncertainty levels and to ensure appropriate controls are maintained. Care should be taken to avoid excessive reporting and bureaucracy, which can steal oxygen from innovative new ventures.

Detailed planning will be required to manage the wind-down and eventual closure of any legacy business, covering people, operations, assets, and the financial and legal aspects. The scale of the activity means dedicated program management will likely be required, either from within the organization or externally. KPIs for both the legacy and new business will need to be set and carefully tracked to spot and rectify any issues early.

Workforce transformation

Staff who will be transferred to new products will need retraining. Key staff from the legacy business will need to be retained, potentially beyond natural retirement ages, requiring creative solutions. In cases where new skills are needed, but are hard to find within the sector, companies can recruit from adjacent industries for transferable skills.

Care needs to be taken to minimize the impact on employees. Open and transparent communication and change management are important, as communication vacuums tend to be swiftly filled with rumors and uncertainty and that can raise stress levels and harm operations. Employees should have the option of transitioning to new business roles, where possible. A clear engagement strategy for unions should be developed and activated early in the process.

Funding

Once a strategy has been set it needs to be funded, and change can be costly. New products will require expensive capital equipment purchases, and the new business is likely to lose money at first. Legacy machinery and obsolete stock will need to be written down and care should be taken to avoid large customer and supplier claims.

Cost control will also be critical during this period, particularly given the long timeframes involved. It is important to understand the combined costs of legacy products being ramped down and new products being ramped up. Sensitivity analysis should be done to stress-test this requirement, identify budgets and fund them appropriately. Companies should establish and implement their strategy soon to avoid facing simultaneous closure and set-up costs.

An increasingly common vehicle for unlocking funding is to set up joint ventures with a strategic partner with expertise in an adjacent segment in the value chain. This serves the twin purpose of providing an injection of capital alongside access to new capabilities, reducing the risk of the growth strategy. Companies that apply various levers to increase enterprise value are also likely to find it easier to obtain third-party funding as the business will be seen as having “done its homework” and willing to make tough decisions.

A special thank you to Natalie Smith, Pravi Dubey, Matthieu Popesco, Jason Taylor, Jonathan Moore and Anselm Karitter who contributed to this article.