EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How treasury technology helps navigate today’s financial landscape

This article is the first in a series of publications that focus on the rapidly evolving treasury technology space.

In brief

- New technology solutions backed by machine learning, Artificial Intelligence, data analytics and blockchain are revolutionizing the treasury function.

- Advanced data analytics and big data will enable more precise liquidity management and risk assessment, allowing treasurers to proactively navigate through the financial landscape.

As organizations expand and financial transactions grow in complexity, the demand for efficient, secure and scalable treasury management solutions has never been more critical. Treasury Management Systems (TMS) stand at the forefront of this evolution, offering sophisticated tools that enable companies to effectively manage cash, liquidity and financial risks, ensuring stability and growth in challenging market conditions.

In an era where financial landscapes are constantly shifting, the role of treasury technology has become increasingly pivotal for businesses striving to optimize their operations. These technologies provide real-time financial insights and decision support, allowing treasurers to navigate complex financial landscapes with greater precision and agility.

To harness these technologies, organizations must invest in the right infrastructure, skills and technology framework, including state-of-the-art treasury management systems, skill development in data analytics, AI, blockchain and robust governance frameworks to ensure ethical and secure technology use.

Modular treasury technology architecture

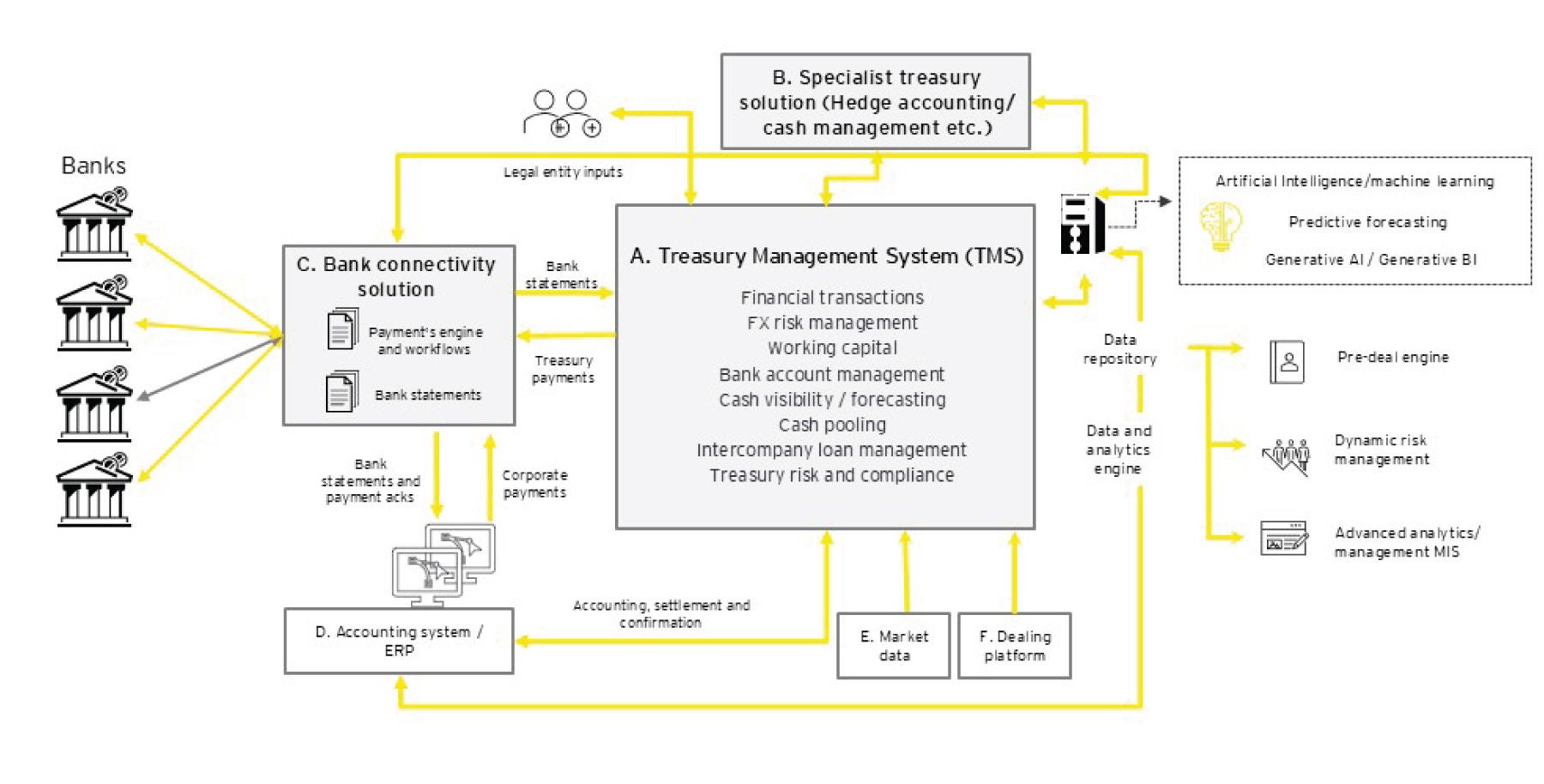

In today’s fast-paced technological landscape and increasingly complex environment, traditional treasury management systems fall short of meeting the evolving demands of modern organizations. More and more treasuries across sectors and industries are adopting modular treasury technology architectures. This approach allows for seamless integration of different systems and processes, enhancing flexibility to adapt to changing needs. By utilizing specialized solutions tailored to specific functions, treasuries can achieve unparalleled efficiency, streamline operations, and respond more swiftly to market dynamics. This modular design ensures that organizations can scale their capabilities effectively and stay ahead in a rapidly evolving financial environment. A fully integrated treasury technology architecture would look like:

In this advanced framework, TMS will act as the central hub, where banks provide real-time statements and payment information, and legal entities contribute forecasts and treasury inputs. It seamlessly integrates with market data and dealing platforms for processing treasury transactions. This setup enables real-time data access for informed strategic decisions and allows other organizational teams to utilize treasury data.

Traditional roadmap vs. future-focused roadmap

To drive efficiency and strategic value through the utilization of technology, organizations must prioritize the development of a well-structured roadmap for the implementation of a treasury technology framework.

The traditional approach to implementing treasury technology involves planning in detail upfront, customizing extensively, and working with longer timelines. In contrast, the new approach leverages agile methodologies, emphasizes rapid prototyping and focuses on minimal customization with SaaS solutions. While the traditional approach offers stability and thoroughness, the new approach provides flexibility, speed and better alignment with evolving business needs. Organizations must assess their specific requirements, risk tolerance and desired outcomes to determine the most suitable approach for their treasury technology implementation.

Way forward

The ‘treasury of tomorrow’ is not a distant vision, but an imminent reality. Organizations that proactively embrace innovation and technology will have a better position to navigate the complexities of the modern financial landscape. By transforming the treasury function into a strategic partner, businesses can enhance their financial resilience, drive growth and create sustainable value.

Prateek Chaturvedi, Partner – Financial Services Risk Management and Kriya Bhansali, Manager – Financial Services Risk Management, EY India have contributed to the article.

Download the full pdf

Summary

Building the treasury of tomorrow requires a holistic approach that integrates advanced technologies, fosters a culture of innovation and aligns with broader business objectives.

How EY can help

-

DigiTreasury, EY’s treasury analytics platform, helps organizations optimize costs, modernize processes & enhance tech to transform the treasury function.

Read more -

EY Treasury Consulting services help treasury teams & CFOs take steps to strengthen performance of their treasury function by transparency & internal controls.

Read more -

Drive business growth with technology transformation solutions at EY - integrating tech, operations & architecture to build agile, data-driven organizations

Read more

Our latest thinking

Data 4.0: how to make your enterprise data AI-ready

AI and Data: Data 4.0 approach at EY helps organizations modernize data, improve governance, and build AI-ready foundations for analytics & GenAI success.

Transforming India's mining sector through sustainability and innovation

Explore how India's mining industry pioneers sustainable practices and tech advancements for a greener future. Join the eco-innovation revolution!

Tech Trend 06: Unleashing next-gen employee experience with digital and AI

Discover how AI is revolutionizing the workplace with EY's insights on next-gen employee experiences. Learn strategies to enhance engagement & productivity in our Tech Trend 06 update.