EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Banks’ ability to provide credit has improved

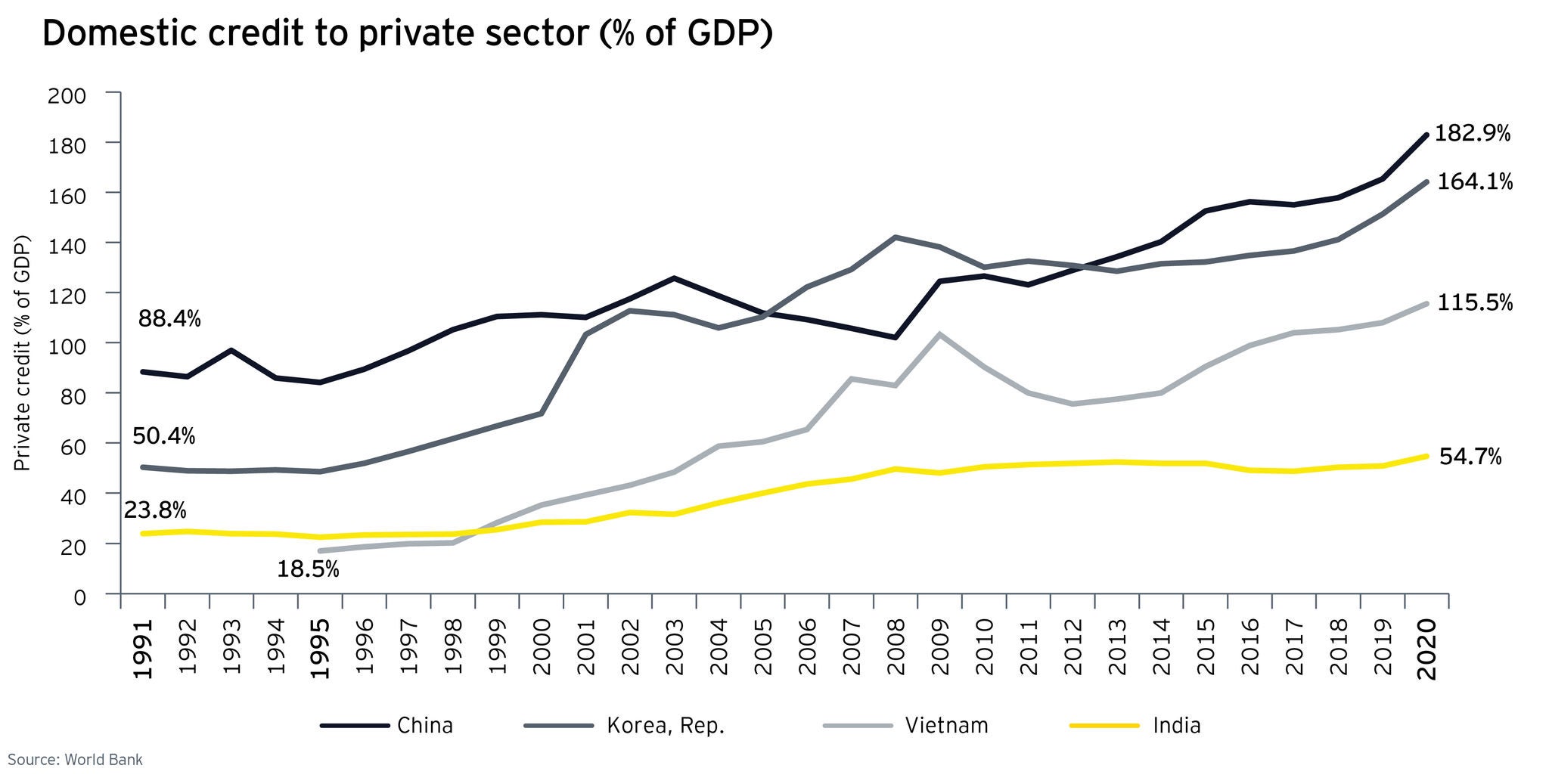

The Indian economy witnessed a bank credit boom during the period 2008 to 2014 with non-food credit registering a CAGR of 16.8%. However, in the subsequent years (2014 to 2021), credit growth decelerated to a CAGR of 8.3%. This was influenced by a weak industrial sector credit growth and banks being saddled with high levels of NPAs, which had skyrocketed due to the economic slowdown, overcapitalization of certain sectors, and certain other factors creating stress in corporate balance sheets, impacting the ability of banks to lend, and increasing credit gap, thereby exerting a negative drag on India’s growth.

The NPAs have since declined considerably with improved regulatory oversight, re-capitalization of banks by the government, implementation of the insolvency and bankruptcy code (IBC) and progressive deleveraging by some of the stressed firms. Despite the pandemic, gross NPAs, as of September 2022, have reached a seven-year low of 5%. Mortgage market is expected to double from US$300b to US$600b over the next five years in the backdrop of rising income levels, improved affordability and fiscal support and yet remain at 13% of GDP well below China (18%) or US (52%).

The most significant roadblock to growth in private debt was the lack of access and ability to assess creditworthiness, which therefore restricted banks and Non-Banking Financial Corporations (NBFCs) from growing their credit book to households. The digital infrastructure centered around a digital identity and a robust digital payments system has supported widespread financial inclusion. This has unleashed the potential to assess credit, underwrite risk and establish recovery mechanisms, reducing the friction in distributing credit.

Similarly, a critical issue in India’s credit market has been the burgeoning gap between the demand and supply of credit to Micro Small and Medium Enterprises (MSMEs), estimated at approximately US$250 to 300b. Outstanding bank credit to industry shows a share of medium enterprises steadily squeezed out, from 13.5% in 2007 to 4.3% in 2020. The government has recently changed the definition of MSMEs in 2020, a big move forward that has subsequently supported the flow of credit from banks to MSME.