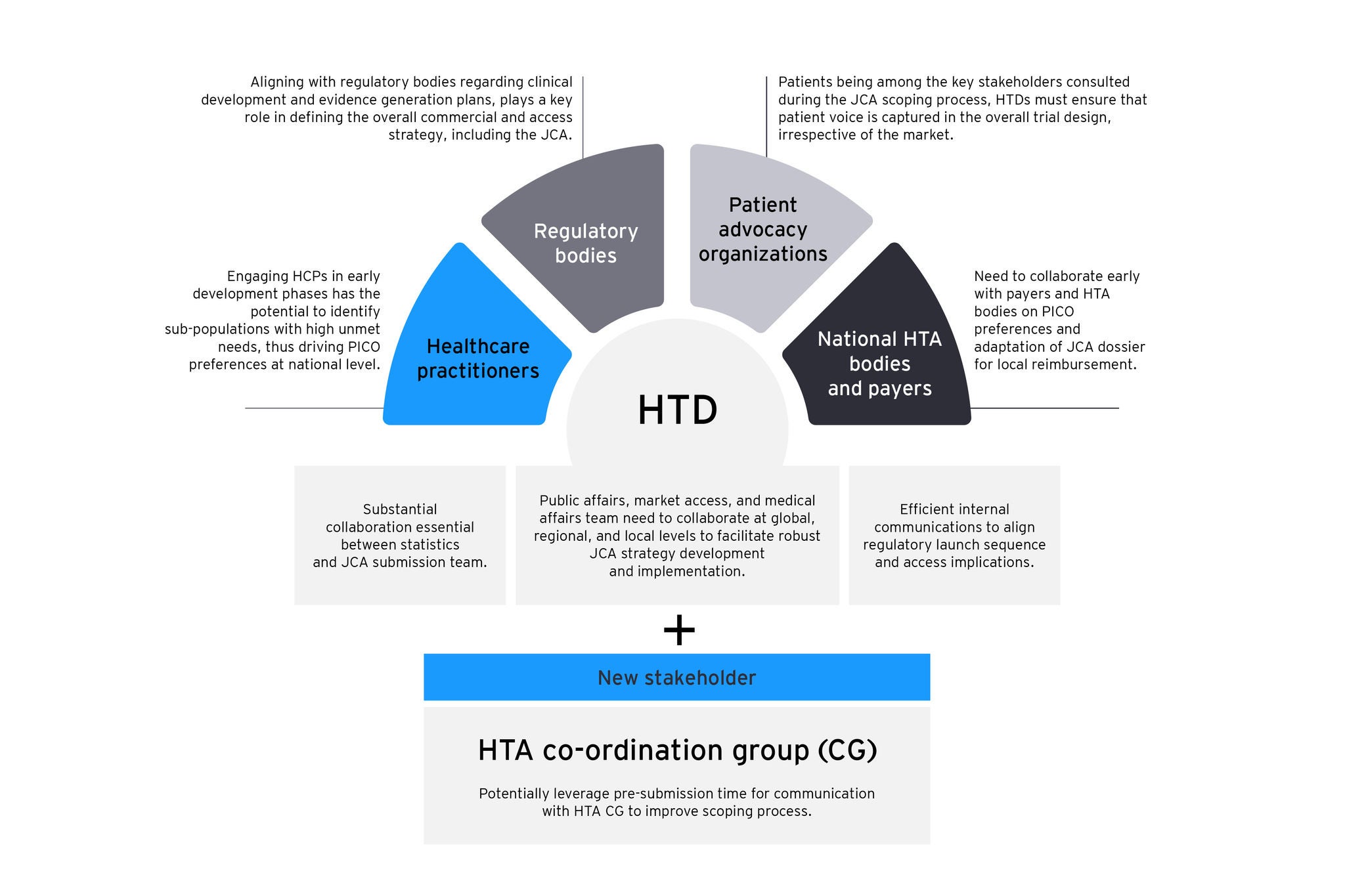

The figure shows key stakeholders influencing the JCA process, underlining the need to collaborate with regulators and include patient feedback in trial design for successful market access. Early engagement with HCPs identifies patient needs, informing national PICO strategies. HTDs should also utilize pre-submission talks with HTA CG to improve scoping.

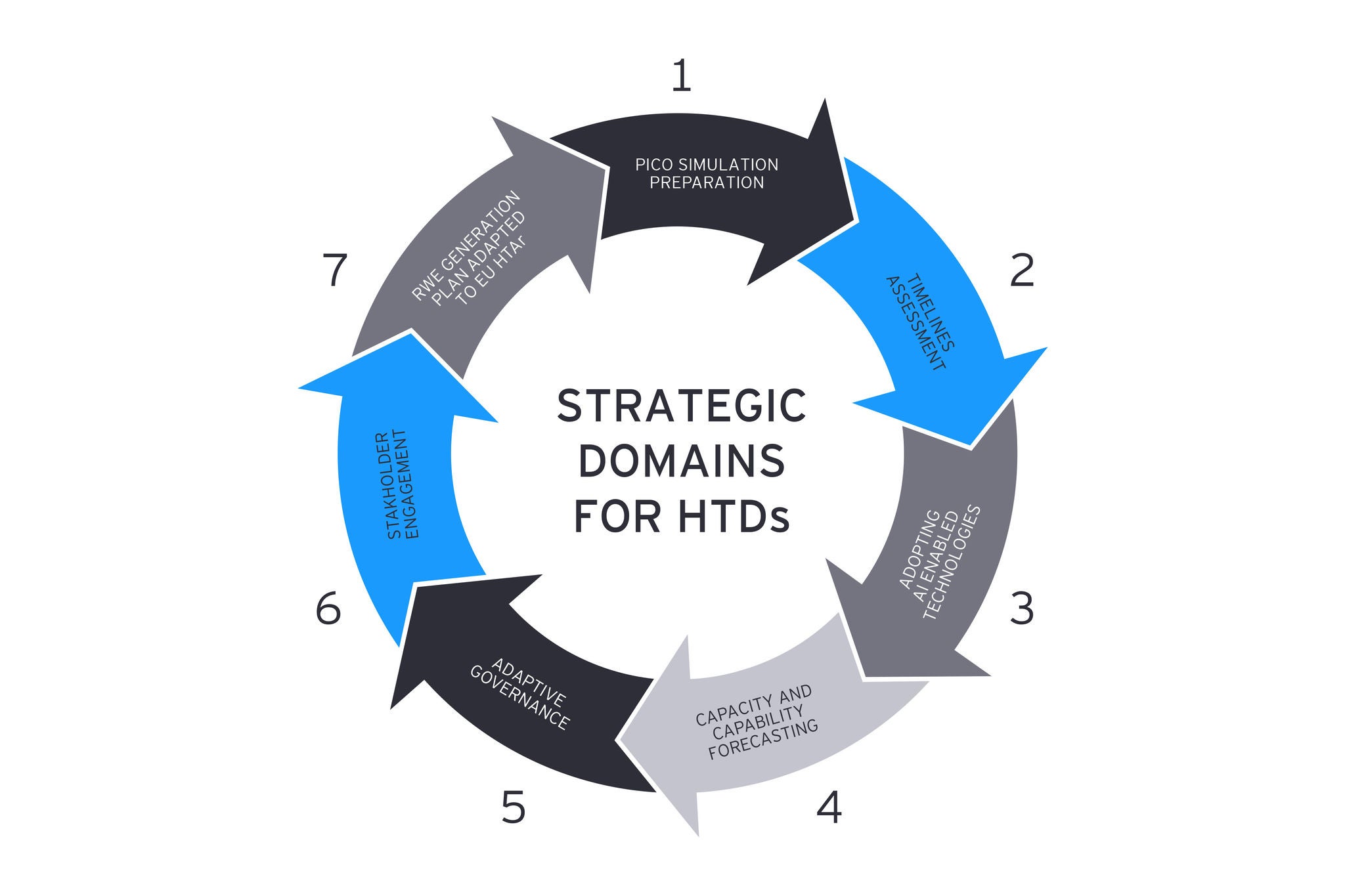

7. Real-World-Evidence (RWE) generation plan adapted to EU HTAR: The scope of RWE generation must expand to incorporate the needs of both larger EU markets and smaller territories into comprehensive evidence plans. Supporting and unifying PICO simulation results will guide evidence accumulation, assist in identifying gaps for both JCA and national HTA filings, and facilitate risk assessments.

By focusing on these vital areas, organisations can prepare for the imminent JCA landscape, enhancing adaptability and improving the prospect of sustained success in the rapidly evolving European health technology assessment environment.

Big Pharma vs. SMEs: Charting the JCA ocean with the power of tankers and the agility of speedboats

The impact of JCAs on large pharmaceutical companies, which launch multiple products annually, and small and medium-sized enterprises (SMEs) that generally introduce one asset at a time, varies significantly. The former can capitalise on their established presence across various Member States and, as a result, are better positioned to pre-empt PICO requirements. Moreover, they can marshal a wealth of resources to form specialised, cross-functional groups proficient in drafting high-calibre submissions.

In contrast, SMEs often struggle as they may lack local presence in the Member State. This hinders their ability to gather specific local knowledge on clinical practices and epidemiology. Additionally, SMEs have smaller teams that may find it challenging to take on the extra work imposed by HTAR obligations. Nevertheless, SMEs can adopt a nimbler approach by collaborating with industry associations such as the EFPIA and the European Confederation of Pharmaceutical Entrepreneurs (EUCOPE) to stay abreast of regulatory developments and bridge any internal gaps in expertise and resources.

Regardless of company scale, the dynamic nature of HTAR demands that businesses reassess their current processes for HTA preparation. A focus on enhancing the scalability and robustness of workflows for multiple product submissions in parallel and across diverse therapeutic areas will be key. Establishing a comprehensive JCA-centric approach will be essential for fostering synergies between market access, regulatory affairs, medical, clinical development, and biostatistics departments to ensure streamlined dossier development, and workflow continuity. As organisations venture into this redefined landscape, they must not only adapt, but also adopt a forward-thinking strategy that accommodates agility, flexibility, and innovation in organisational practices and processes.

In conclusion, manufacturers are at a critical juncture where they must either adapt or face the consequences. While HTAR presents a promising commercial opportunity and the prospect of wider and quicker patient access, the stakes are high. There is a significant risk of revenue loss and market leadership erosion for organisations that are unprepared or unable to effectively implement JCA.