In a global environment rife with major challenges, including economic slowdown, high inflation, ongoing conflicts, and the increasing intensity of extreme weather events, the fourth edition of the EY Future Consumer Index for Greece highlights that consumers are seeking to build resilience.

Consumers express concerns about their personal finances, as well as their physical and mental health. To a lesser extent, they worry about the environmental and social impact of their purchasing decisions. Either out of necessity or out of choice, many consumers are changing their shopping habits, but not in a uniform way. While reducing spending is a common trend across all demographic groups, some consumers are purchasing less, while others are opting for less expensive alternatives. Brand loyalty is declining, while private label products are on the rise, though with some variations per product category. Additionally, the dynamic of loyalty or reward programs has curbed, as consumers expect tangible benefits in order to join.

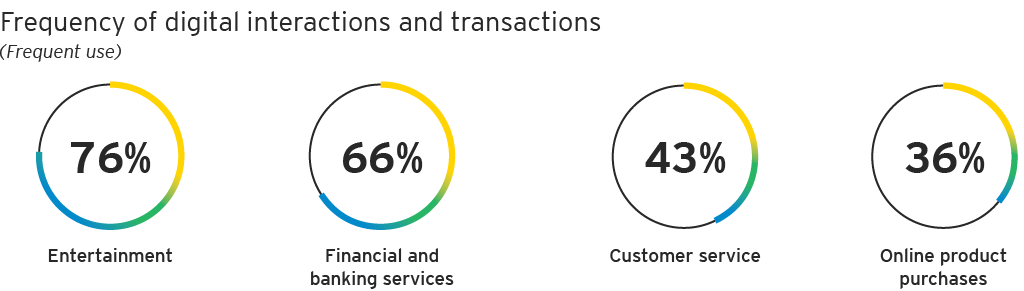

Despite the rise of online shopping, many people still prefer physical stores, seeking human interaction, while for others, their home is becoming increasingly important as the center of consumption. The majority of consumers demand high standards of environmental and social responsibility from brands and businesses. However, the shift toward sustainable products is still progressing slowly.

In this complex environment, artificial intelligence (AI) holds the promise of enhancing the shopping experience while offering new opportunities for businesses. Nevertheless, consumers remain wary of many AI-generated solutions.

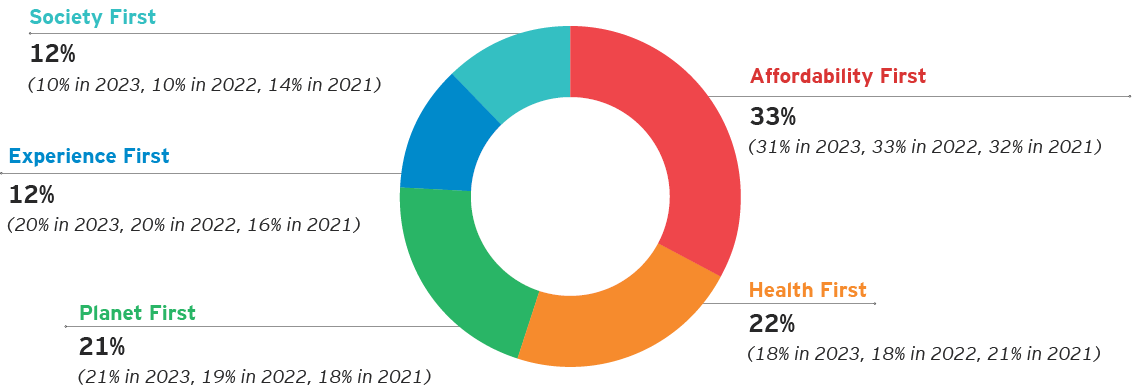

The five key consumer groups examined in the Index clearly illustrate the general trends in the Greek market, though they are fluid. They include consumers with different preferences, different expectations from brands, and different purchasing behaviors. Therefore, businesses are called to approach consumers as unique individuals with personalized - and often - conflicting needs, shaping multidimensional and tailored strategies.