EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

With memories of the decade of economic crisis still fresh, Greek CEOs feel pessimistic, but prepare to emerge stronger from a downturn.

In brief

- With the experience of the last decade’s economic crisis still recent, Greek CEOs seem more pessimistic than their global peers about the state of the global economy – however, the Greek economy appears resilient, showcasing solid fundamentals.

- To position their companies for strength in the short-term, they are focusing on the fundamentals. Longer term, investments focus on operations, talent and resilience.

- Greek CEOs signal a transaction preference for joint ventures (JVs) and alliances among friends in the next 12 months.

Having only recovered three years ago from the economic crisis that had plagued Greece for more than a decade, Greek executives are more sensitive than their European and global peers to the capriciousness of the global economy. Greece experienced the most severe economic crisis of all the countries in the European Union (EU). The negative effects of what was effectively a lost decade economically continues to reverberate as they see signs of more economic uncertainty ahead.

The latest Greek EY CEO Outlook Pulse finds that the totality of Greek executives anticipate some level of downturn in the global economy, while 97% expect the same in the markets in which they operate. Where they differ, is in the duration and severity of an anticipated global recession. Half of Greek CEOs (versus 36% of global CEOs) expect a moderate but persistent downturn in global markets, whereas 40% (versus 41% of global CEOs) are bracing for a severe but temporary downturn.

Whether severe but temporary or moderate but persistent, Greek CEOs agree that this downturn will be different. Yet, while 87% worry that few members of their senior leadership team have experience in managing a business through a downturn, 54% have confidence that fiscal and policy decisions will mitigate the worst of whatever downturn comes.

Despite the economic uncertainty, and the ongoing war in Ukraine, Greece was the only EU country to experience growth of 5.9% in 2022, with solid fundamentals priming the local economy for a positive trajectory. Direct investment, meanwhile, increased more than 35% between 2021 and 2022. Even inflation remains manageable at 6.1% (February 2023).

Interestingly, while economic uncertainty and geopolitical issues weigh heavily on the minds of Greek CEOs, they cite increasing cybersecurity threats as the greatest primary risk to the growth of their business. This is, in part, a result of the increase in cybersecurity incidents worldwide both in terms of volume and sophistication, as well as the adverse impact that a successful cyberattack could have in several business areas, spanning from financial damages and operations' breakdowns to reputational damages and loss of market trust.

Adapting to emerge stronger in the short-term and outpace the competition in the long-term

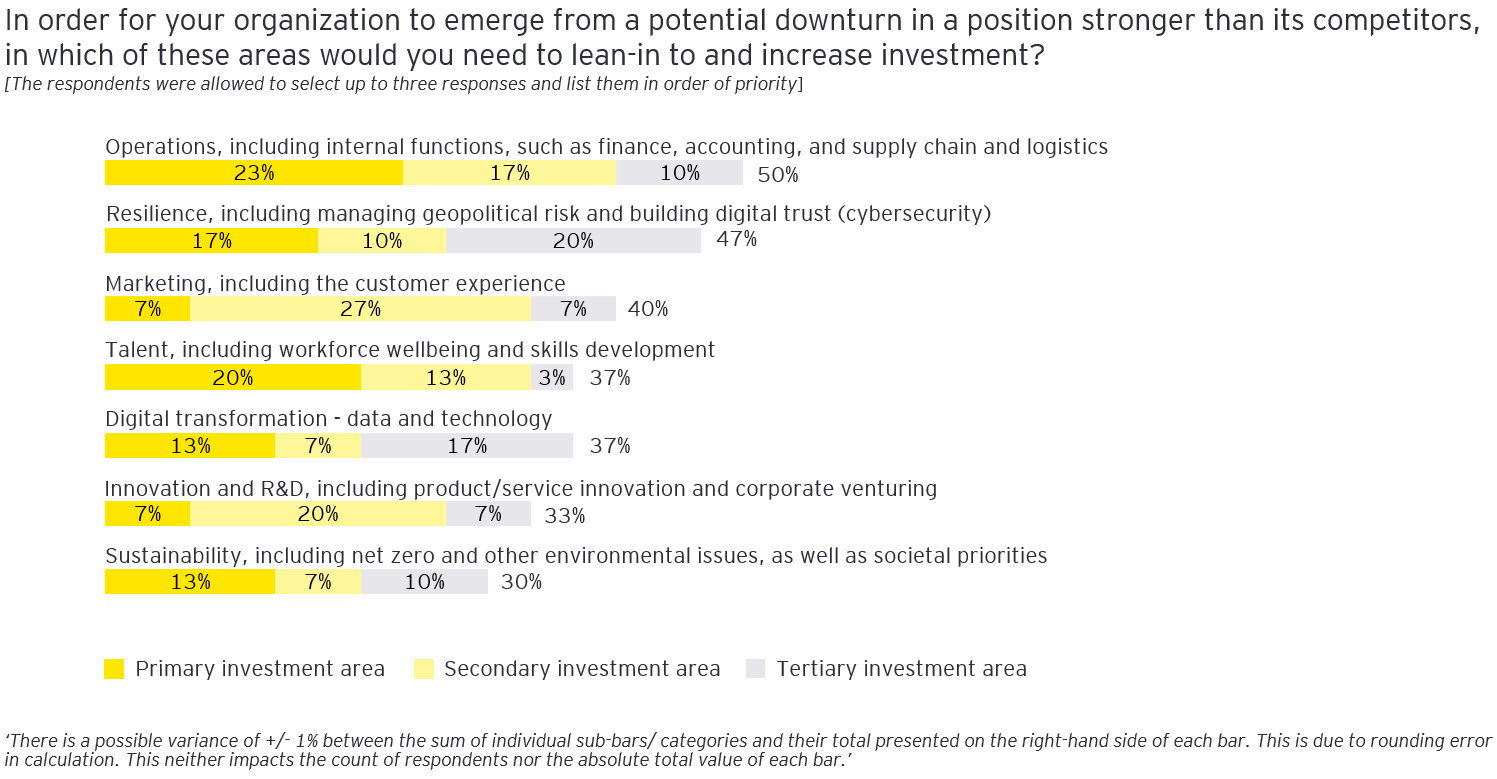

In the short-term, to position themselves for success post-downturn, Greek executives are focusing on the fundamentals, increasing investment in operations (including internal functions such as finance, accounting and supply chain and logistics), talent (including workforce wellbeing and skills development), and resilience (including managing geopolitical risk and building digital trust).

At the same time, they are prioritizing overall cost reduction to help maintain profitability and margins (57%), reviewing capex (53%), while increasing outsourcing to reduce fixed costs (50%) and completing their digital transformation (50%).

Longer term, Greek executives are taking strategic action to adopt new working models and talent strategies to attract and retain employees (47%), investing in early-stage businesses to enhance their existing portfolio, access new talent or create new business platforms (43%), and adapt their supply chains for resiliency (40%).

Transacting to transform

While every Greek executive we surveyed says they expect to actively pursue a transaction in the next 12 months, they appear to be more inclined to dip their toes rather than diving into a transaction, with 57% of Greek executives saying they will be pursuing joint ventures (JVs) or strategic alliances with third parties. This is consistent with the transaction priorities of global executives (58%).

Within these alliances, 83% of Greek executives signal an affinity for deals in markets where Greece has a strong geopolitical and economic relationship.

Seeing the benefits of ESG integration

With ESG now a strategic imperative rather than an optional pursuit, Greek executives are seeing the advantages of embedding ESG factors into their corporate strategies, M&A agenda and portfolio transformation. Thirty-seven percent (37%) claim that diversifying their product and service offerings and meeting the changing ESG demands of their customers is a key benefit from ESG integration. The same percentage (37%) acknowledge that they are improving the ESG ratings scores that can positively impact investor decision-making.

The market is demanding that ESG initiatives align with the broader ESG agenda. Greek companies are taking steps to build brand trust in the market around their ESG credentials and take advantage of the wealth of funding mechanisms available in the EU for moving toward decarbonization.

Summary

According to the latest Greek CEO Outlook Pulse Survey, Greek CEOs are adopting strategies to reinforce the strength of their companies in the face of a possible economic downturn. Despite feeling pessimistic about the global economy, Greek executives are focusing on prioritizing the basics in the short-term, and are more likely to pursue joint ventures and form strategic alliances in the coming year.