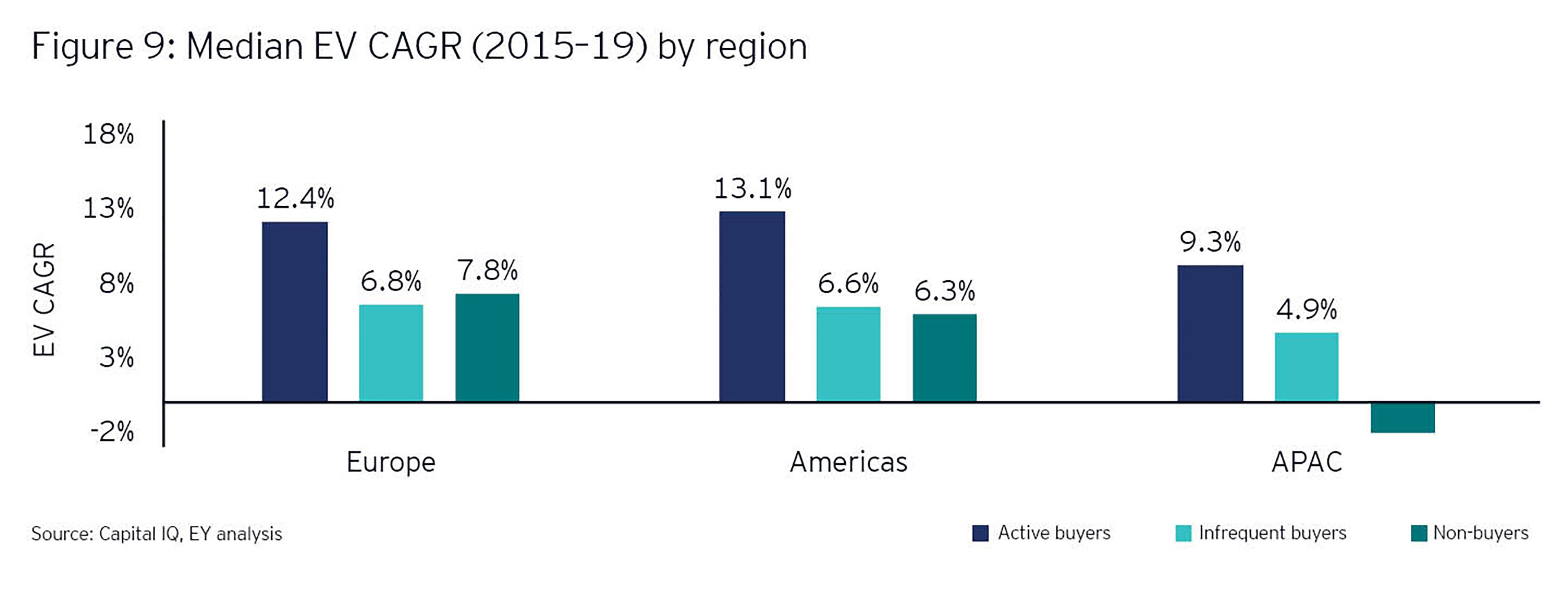

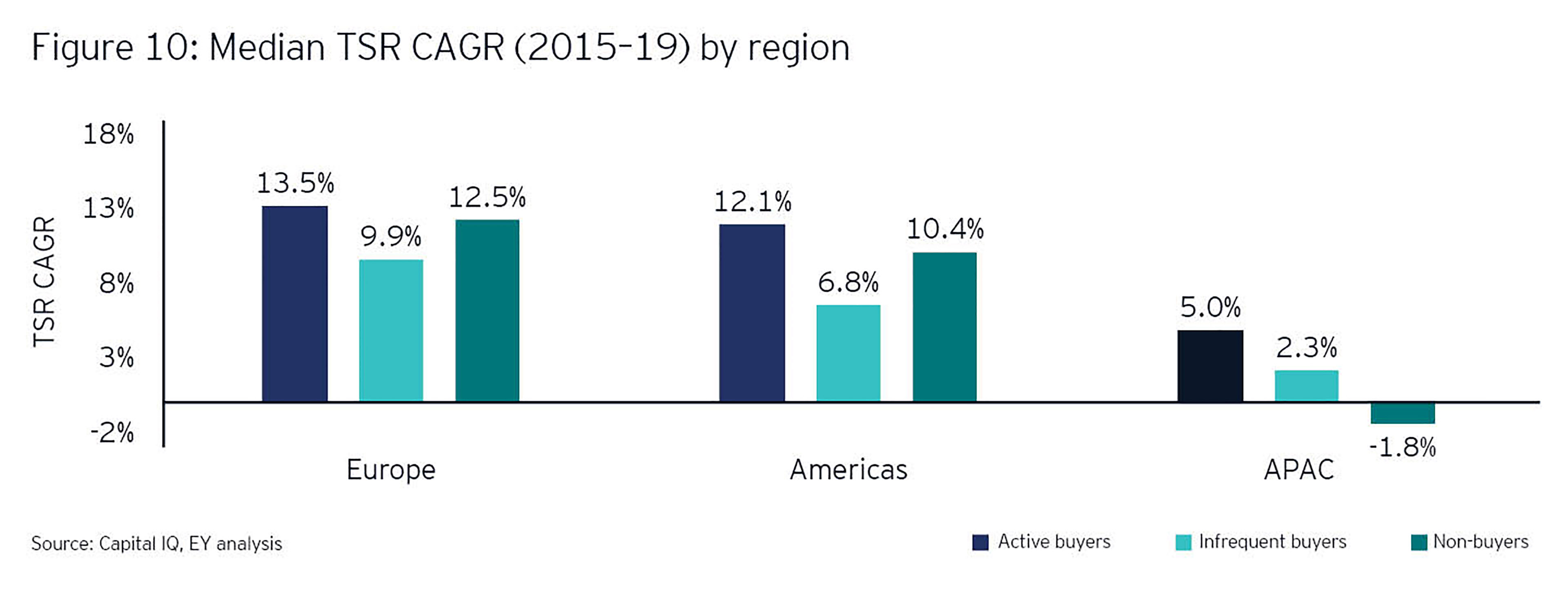

With media skepticism regarding M&A transactions, one may wonder why global M&A activity continues to rise. In a detailed analysis of shareholder value over time, to see if companies that execute frequent acquisitions create more value than those companies who don’t, the conclusions appear to be clear: strong positive correlation between M&A and enterprise value and total shareholder return growth.

Methodology

Perhaps the most widely used metric to assess value creation for a company is total shareholder return (TSR), which is predominantly driven by the change in a company’s share price over time. Incentive compensation for many executives includes share price and TSR performance targets. As such, the EY analysis used TSR and enterprise value (EV) growth as the key metrics to assess overall company performance. The analysis examined all public company M&A activity globally over a four-year period from 2015 to 2019. It eliminated incomplete information or data from small companies where returns and EV varied considerably above peer medians.

The resulting dataset included nearly 6,000 public companies and 13,000 M&A transactions, spanning all major geographies and 11 primary industries.

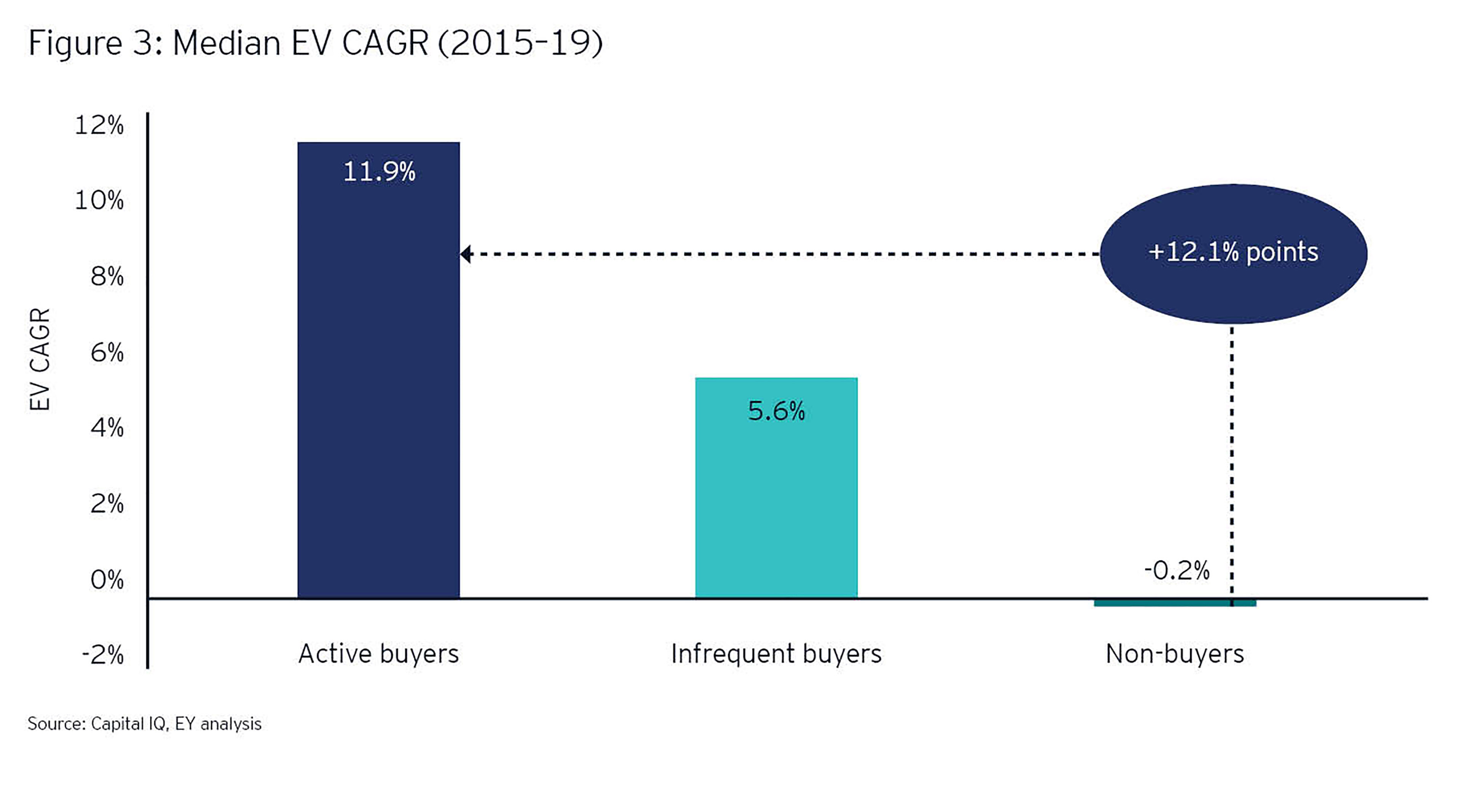

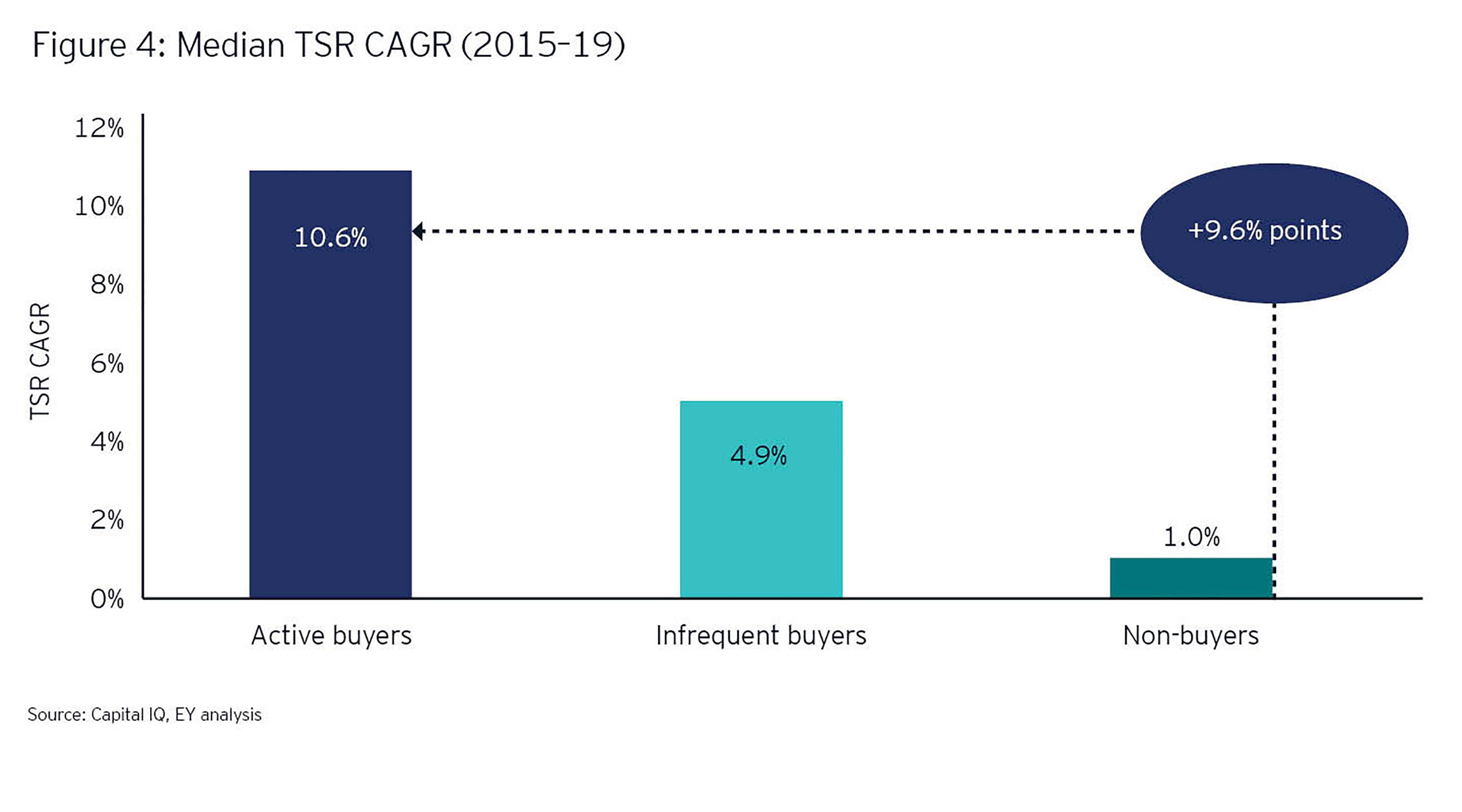

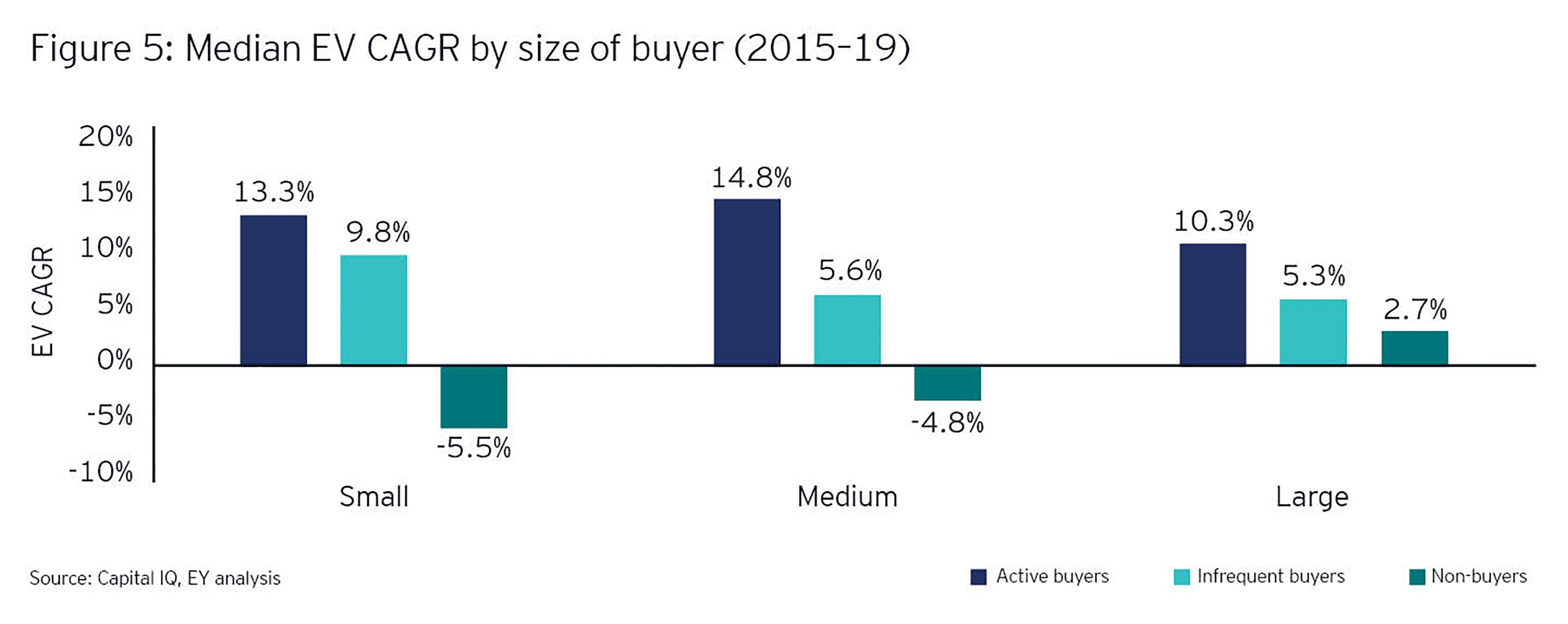

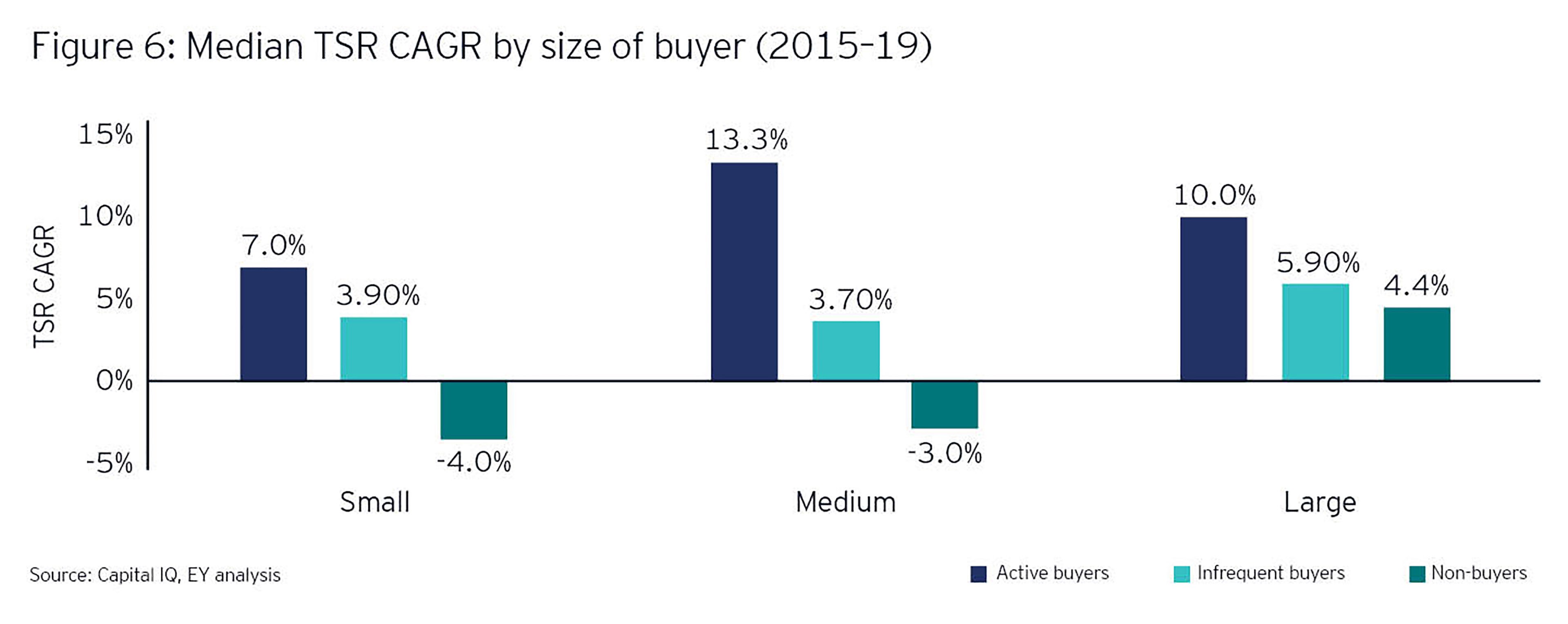

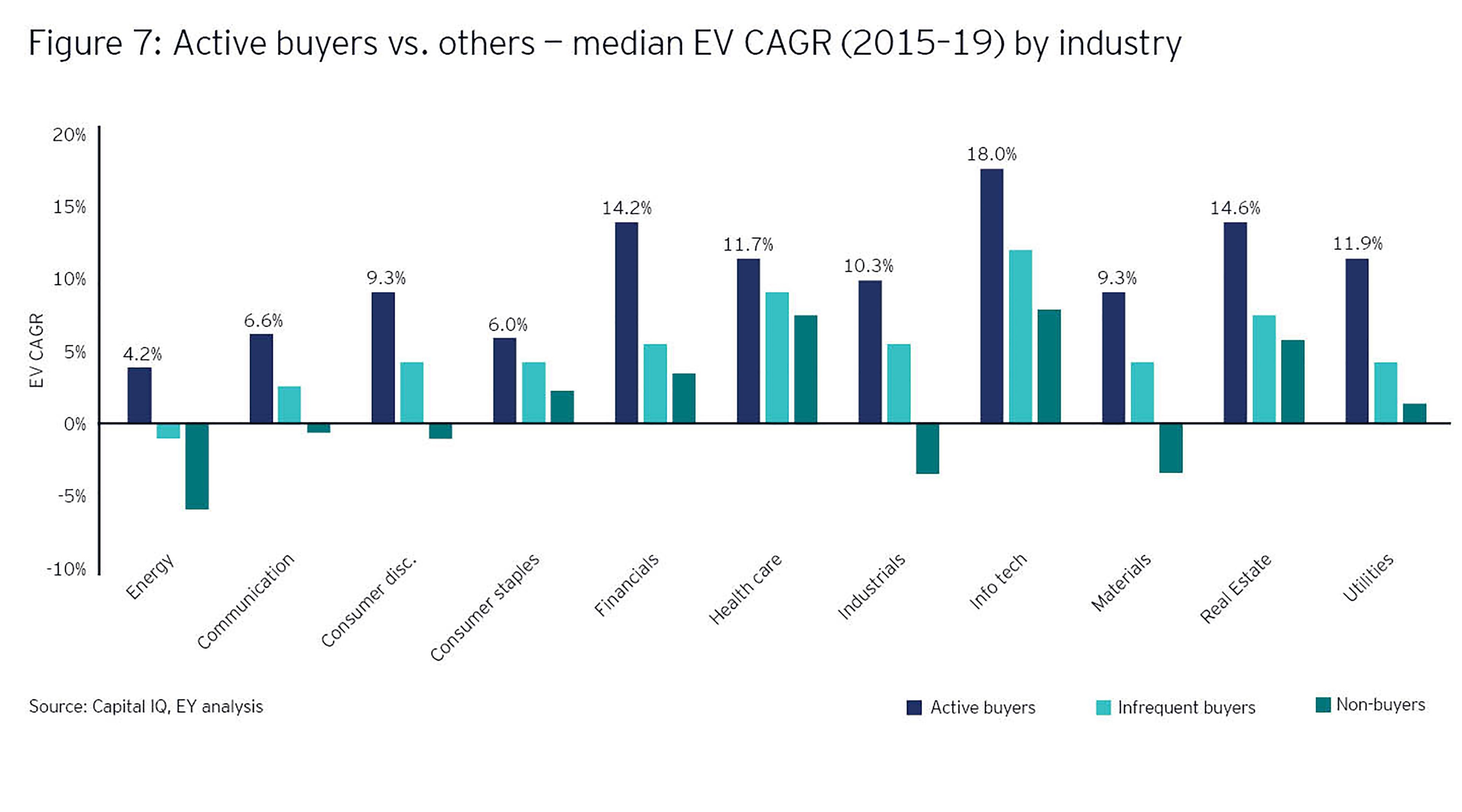

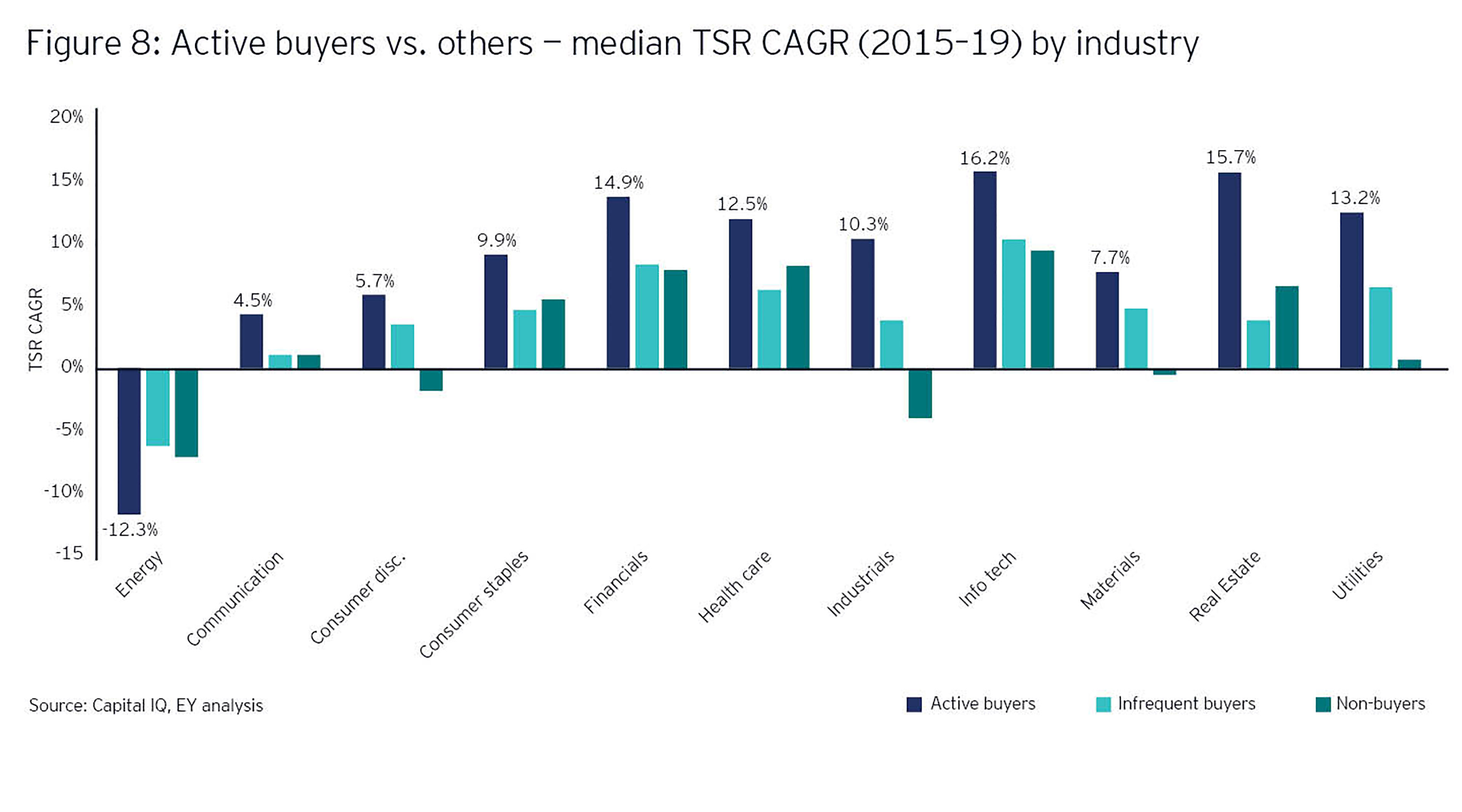

The study also looked at TSR performance and changes in EV through different lenses, including company size, industry, geography, frequency of M&A activity and cross-border transactions, to identify potential differences. It categorized M&A frequency into three groups over the 2015 to 2019 period:

- Non-buyers: The company did not engage in any M&A activity

- Infrequent buyers: The company transacted five times or less over the time period

- Active buyers: The company transacted greater than five times

The findings – strong positive correlation between M&A and EV and TSR growth

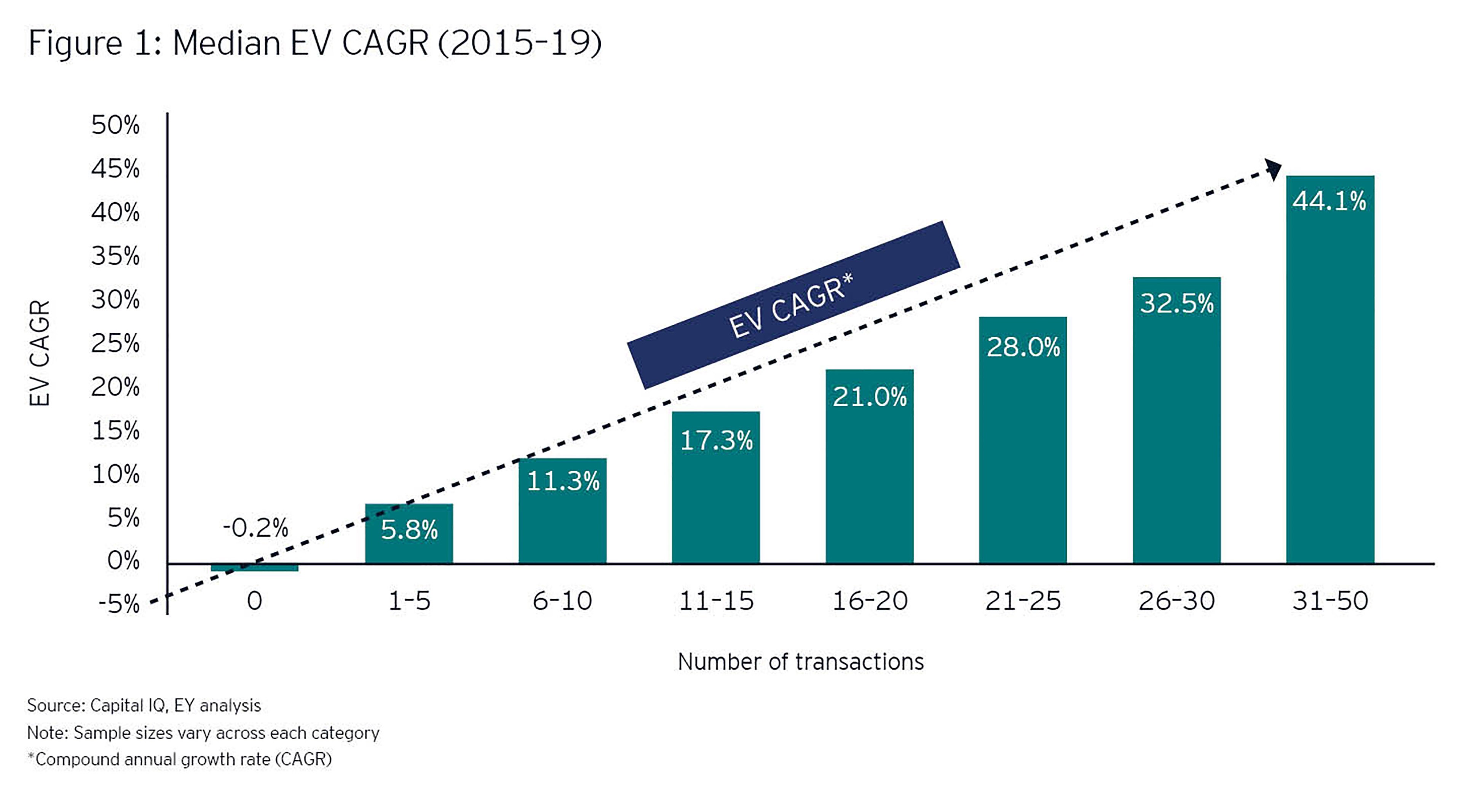

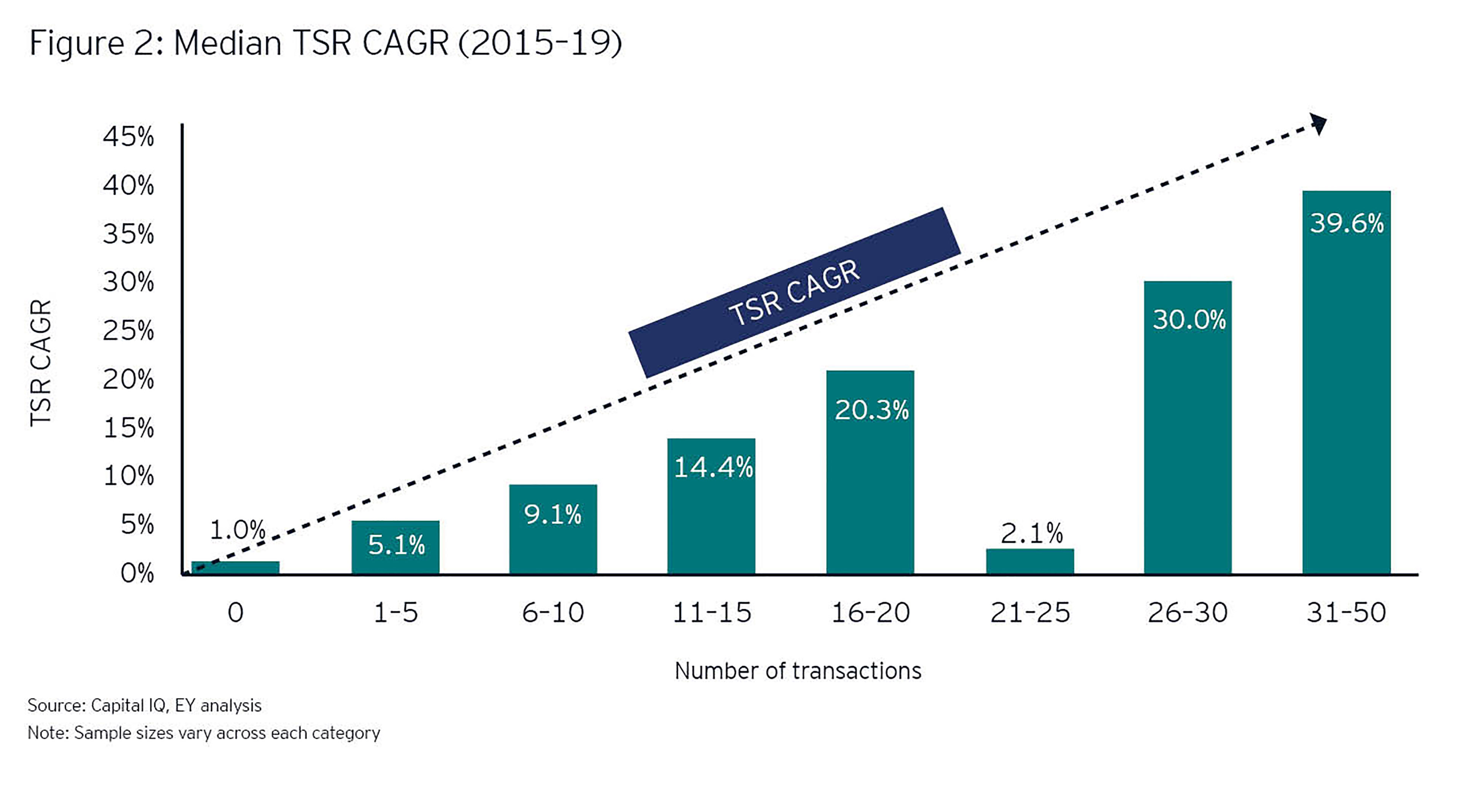

The study found a strong, positive correlation between M&A activity and EV and TSR growth, as shown in Figures 1 and 2. Stated simply, on an overall basis, the more acquisitive the company, the analysis shows, the greater the value created. Interestingly, companies that did not make any acquisitions experienced essentially flat EV and TSR growth, but companies that engaged in limited M&A activity (one to five companies) experienced EV and TSR growth at a rate nearly five times higher than non-buyers. As the scale increases, for every five additional acquisitions made, EV and TSR growth increased by roughly 500 basis points. Now, many of us remember from statistics class that a high correlation does not prove causation. This was true in business school, and it is true here. But it is clear from the analysis that there is a strong pattern of shareholder value growth, correlating with frequent acquisitions.