Chapter 1

Grounded – airlines on the tarmac

Uncertainty remains, with airlines industry facing further headwinds post-COVID-19.

The COVID-19 pandemic has had an unprecedented impact on the aviation industry, with global passenger volumes down from 3.9 billion in 2019 to 1.5 billion in 2020 – a fall of 60%. This contrasts with a steady circa 6% growth in passenger volumes between 2012 to 2019. Cargo volumes were more resilient, with an 11% decline in global volumes in 2020 from 2019. Looking ahead, industry forecasts from the International Air Transport Association (IATA) are projecting that 2021 global revenue-passenger kilometers (RPKs) will be down 57% compared with 2019, and international RPK down 76%, with domestic RPK proving far more resilient, down just 4% over the same period.

The UK picture so far

The UK aviation sector has been hit particularly hard, with a 76% decline in passengers in 2020 compared with 60% globally, reflecting its higher weighting of international travel and, notwithstanding the much-welcomed recent Airport and Ground Operations Support Scheme (AGOSS) funding, more limited direct government support than other jurisdictions. The UK has also suffered one of the highest economic tolls during the pandemic, with GDP down 9.9% during 2020 against an estimated 3.5% for the global economy, although this difference may have been exaggerated by regions such as China, where recovery began during 2020. The UK picture has since improved markedly, with the Bank of England stating that annual average GDP growth is projected to be around 7.25% in 2021, driven in part by the success of the UK vaccination rollout. However, the wider international picture means that the UK, and indeed the majority of countries worldwide, still have restrictions in place to limit international travel.

Changing the mix

The effectiveness of remote working and videoconferencing during the pandemic, as well as heightened concerns over environmental impacts, mean that business travel now faces even greater headwinds to recovery than leisure travel. Adding greatly to these headwinds is the fact that corporate travel budgets are under scrutiny, with reductions in corporate spend of up to 70% – compared with pre-pandemic levels, and carbon emissions are an increasingly critical KPI for many businesses, meaning many employees will be actively discouraged from flying. This puts current airlines’ financial models under pressure because business travelers – who pay more, fly more frequently and fly all year round – are estimated to account for 12% of airlines’ passengers, but as much as 75% of their profits. The increased revenue seasonality associated with reduced business travel also exacerbates liquidity challenges for airlines when they are most vulnerable to them - in the winter season.

Chapter 2

Forecasting the UK flight path

Airlines must tackle short-term challenges, whilst planning for a sustainable future.

The EY Aviation Recovery Tracker (ART) is a modeling tool that uses IATA/tourism economic forecasts as its starting point but as, these existing measures will be replaced over time to create EY perspective. Underlying passenger demand numbers are determined by GDP (a proxy for household and business incomes), oil prices (a proxy for fuel costs and therefore fares), measures of preferences for business and leisure travel, and measures of the public health environment. This is then overlaid with a measure of border closures that reflect the current severe restrictions on international flights, but ease over the recovery period. For cargo, we add further specific modeling inputs, such as its relationship with global trade.

Crucially, our central forecast is supplemented by upside and downside scenarios, reflecting different paths for the economic recovery, public health environment, travel preferences and border restrictions.

UK air passenger numbers to take off, but trajectories vary

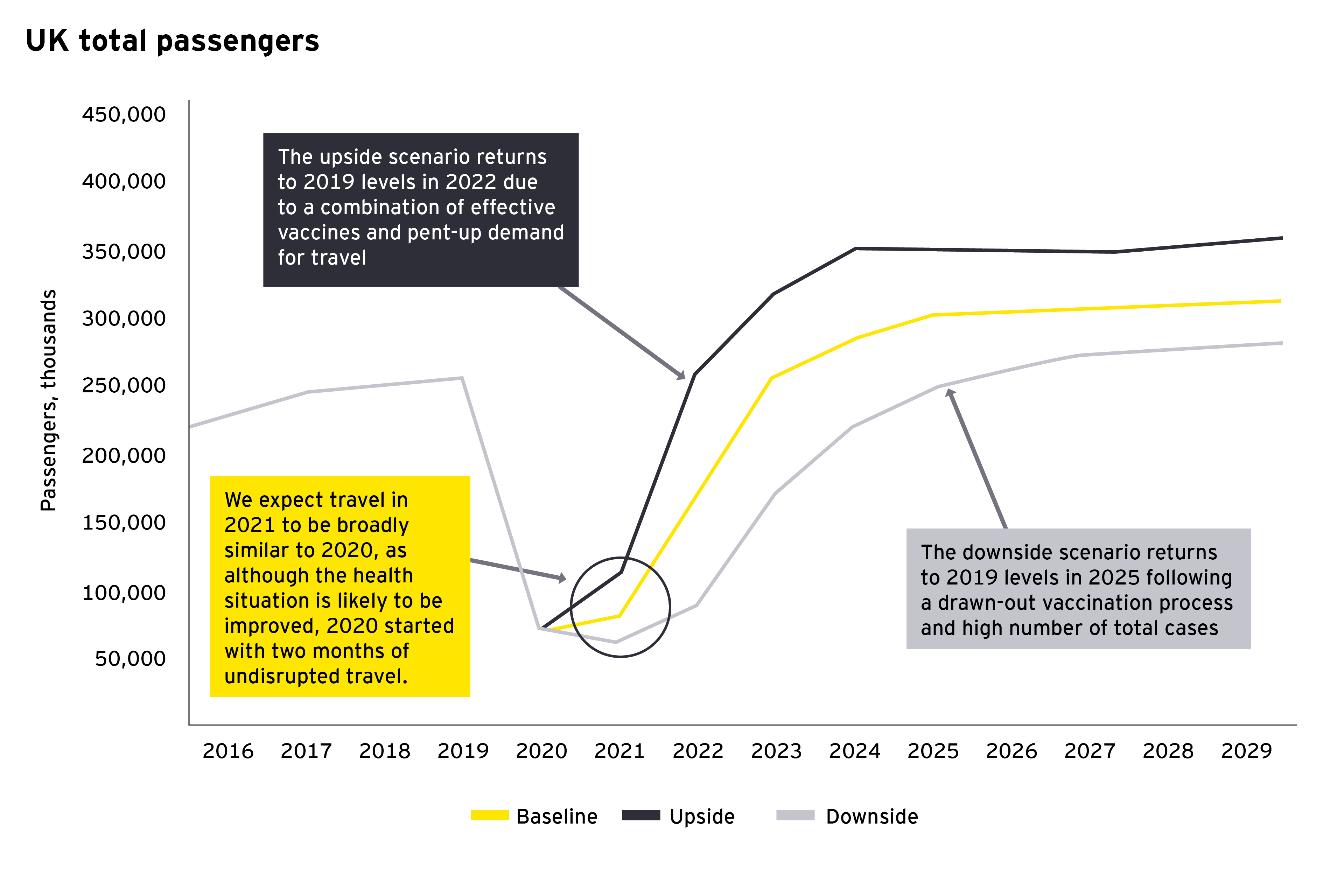

Our baseline forecast sees overall UK passenger volumes rebounding to 2019 levels by 2023, growing to around 300m passengers per year by the end of the decade. This represents cumulative growth of 23% between 2023 and 2030 or a compound annual growth rate (CAGR) of 2.9%.

This scenario is based on global success in vaccine deployment and the continued management of new variants, which may be more viable in developed countries with stronger balance sheets and health infrastructures. Our upside forecast expects UK passenger volumes to rebound strongly between 2021-2023, then far surpassing 2019 levels to reach 350m passenger per year by the end of the decade. The upside is driven by global success in permanently managing the virus, and a faster return to pre-pandemic customer behavior and economic activity, aided by pent-up demand.

Our downside projection sees a slow recovery for air travel, with passenger volumes not reaching 2019 levels until 2025 and then remaining fairly constant at around 280m per year. This is driven by a materially worse public health response, with the virus having a significant negative impact and volumes depressed into the longer term as customer preferences permanently move away from air travel.

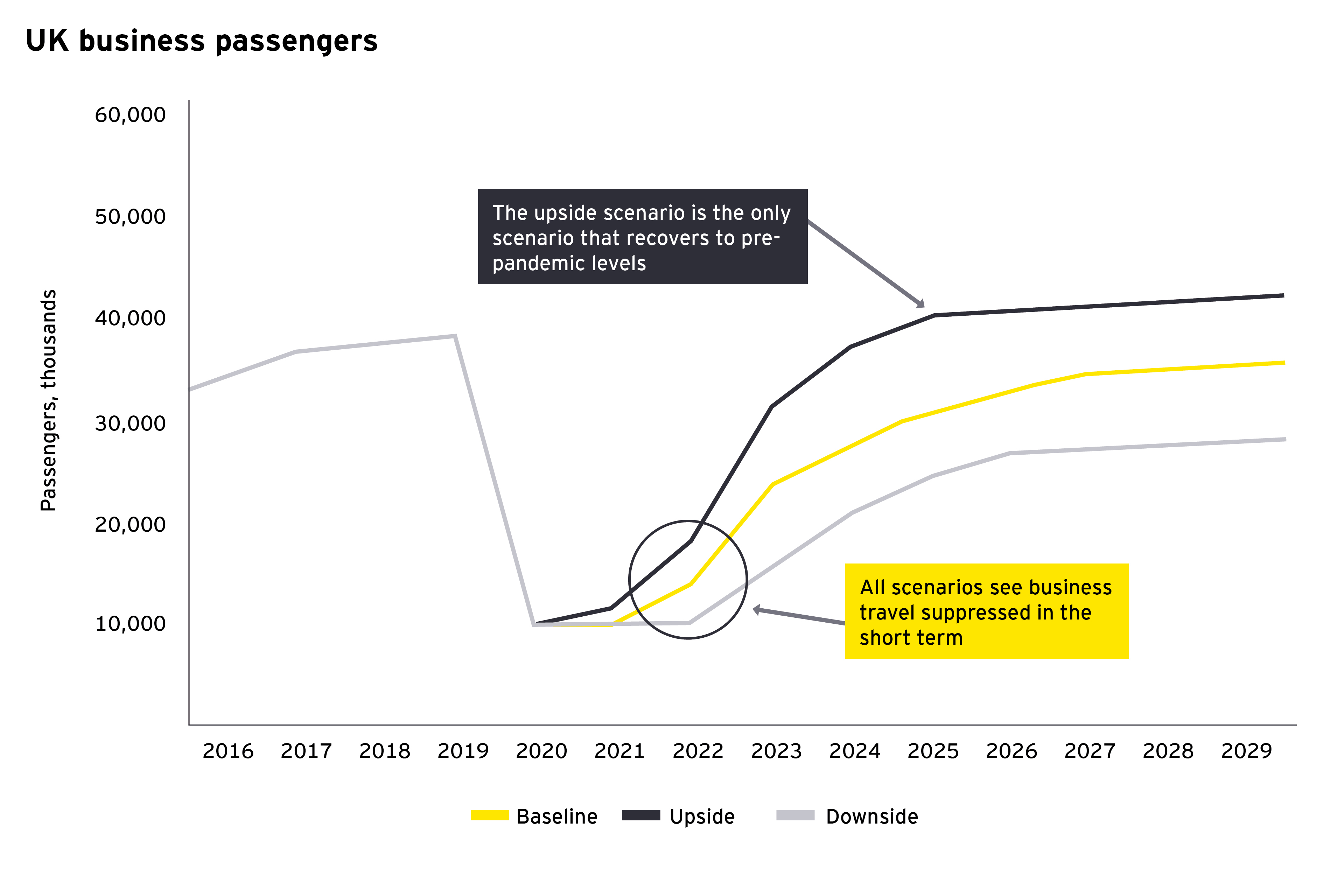

Business travel faces a permanent hit

Business travel has been greatly impacted by the COVID-19 pandemic but – unlike leisure travel – we expect to see a permanent reduction in this highly valuable revenue and profit source. Even in our upside scenario, we do not expect UK business passenger numbers to surpass 2019 figures until 2030. Our baseline forecast sees business travel preferences recover quickly to 80% of 2019 levels but only just reach pre-pandemic levels by 2030. In our downside scenario we are forecasting that business travel demand has been irrevocably reduced by the pandemic and by 2030 will only reach 80% of 2019 levels. This is supported by the Morgan Stanley corporate travel budget survey, which suggests that 27% of meetings will remain virtual in the future. Other views indicate this survey may be optimistic, with Bill Gates notably suggesting that 50% of business traffic will disappear permanently. Whilst there will be some temporary alleviation as pent-up demand for business travel is met once restrictions are eased, this is likely to be offset by the recent accelerated adoption of technology, as well the corporate pressure to meet cost saving and carbon emission targets. Winning in this challenging market requires airlines to have a clear narrative on how they are cutting their carbon footprint, whilst helping both passengers and corporate customers realise their carbon reduction targets through sustainable aviation fuel usage and carbon offset programmes.

We anticipate that the UK’s air travel demand will increasingly come from leisure travel, which is expected to see a gradual recovery from July 2021 onwards, with many airlines reporting a surge in bookings when the UK Government announced its plan to allow international travel to green list countries from 17 May. However, international vaccination rates, particularly in Europe, remain relatively slow and the travel traffic light system highlights the uncertainty around booking travel, hindering a more rapid recovery. It is easy to see that a second fallow summer may result, which would require many airlines to seek further financial support. Further news headlines about lengthy delays at airports will also likely dampen demand.

The overall impact is stark for airlines. Less traffic in its most profitable segment of high-yield customers, plus increased seasonality and a need to address carbon emissions to win corporate traffic all result in reduced cashflow and increased balance sheet stress, on top of the already significant increase in airline debt levels since lockdown. The sector really does face a sustained struggle for survival. Industry participants will need to deliver a coordinated response to deliver a green recovery from the pandemic.

Cargo recovery remains on hold

We forecast a slow take-off for air cargo because, despite strong signs of recovery in the UK economy, the impact of the COVID-19 pandemic on trade is likely to persist, with supply chains tending towards localisation and domestic production.

Our downside scenario sees the trends described earlier leading to a further 4% fall in air cargo volumes in 2021, before a slow recovery that sees 2019 cargo volumes only being surpassed in 2032. In our upside scenario, we forecast a more rapid recovery, with 2021 seeing a 12% increase on 2020 levels. This will be driven by greater UK economic growth, increasing imports of both finished consumer goods and intermediate products for manufacturing processes. A simultaneous recovery for many UK trading partners will also boost exports. In all scenarios, we estimate that air freight levels will move in line with the UK’s overall trade in goods.

Chapter 3

Ready for take-off – adapting to new realities

Airlines must plan for uncertainty to navigate turbulence and steer towards a brighter future.

The flight path to recovery has three key elements for the aviation sector: first, the conservation of cash and capital; second, the transition off government support and resumption of full-scale operations; and third, the transformation required to win in a challenging marketplace.

- Cash and capital conservation

Most airlines across the globe have secured their balance sheets with debt and equity raises, with EY research revealing that outstanding debt at US airlines in 2020 was 55% above 2019 levels. Therefore, the first priority for all airlines is how to conserve funds in order to withstand the restart and the highly unpredictable trading outlook. All the different recovery trajectories highlighted illustrate the need for agility to respond to shorter booking windows and last-minute shifts in customer demand, as well as potential customer refunds and/or increased regulation around the use of ring-fenced customer monies.

Conserving cash requires a change in network planning strategy that allows for week-to-week capacity management, rather than the traditional winter and summer season approach. Such decisions need to translate network decisions to cash in a way that many airlines are not able to achieve currently. This means a reset in enterprise planning such that cash leads all decision-making in airlines.

Given the success the sector had in raising capital quickly, it would be easy to assume that airlines have a secure capital base to weather the storms ahead. This would be a dangerously complacent assumption. Notwithstanding the high cash burn levels airlines experience currently, capital is squeezed by the transition to SAF, retirement of aircraft types (e.g., A380) and the need for further investment in technology. Few airlines have maximised the use of their “soft credit” resources. This can cover lessor renegotiations (rental profiles, early aircraft returns and return conditions, to name a few), credit card acquirer collateral, bonding lines and other working capital terms, all of which provide valuable sources of much-needed cash.

- Transition off government support

Whilst the lack of direct government support to the aviation sector has surprised many observers, the support provided from furlough, tax assistance and slot waivers has been crucial. This support is expected to end in autumn 2021, which will severely test airlines’ ability to survive, especially at a time when debt levels are rising.

Alongside the agility in capacity planning described above, close cooperation across the supply chain, working with third parties including airports, governments and other ecosystem partners will be essential during the recovery period.

Similarly, building flexibility into the airline cost structure is a key consideration. Airlines that are able to both engage their workforce with flexible employment propositions and leverage fixed infrastructure costs across their eco-system will recover quickest.

At the same time, as government looks to a “green” recovery from the pandemic, the case for public sector support in the transition to SAF needs to be clearly articulated. This investment area merits government support as it creates employment, reduces emissions and enables a struggling sector to make a transition that its balance sheet otherwise would not allow.

- Transforming to win

The longer-term challenges faced by the airline industry require more fundamental structural changes in order to respond.

The first challenge is the likely permanent reduction in the demand for business travel and the need to reconfigure fleets, operations and customer propositions accordingly. The principal impact of the shift away from business travel and towards leisure travel will be on year-round profitability and liquidity, but there will be a number of other impacts, including changes in flight destinations, a shift from long-haul to short-haul and a consequent move from hub-and-spoke to point-to-point routes. Customer needs and preferences will change post-pandemic. Understanding these changes and successfully redesigning the customer experience, accordingly, will require both insight and imagination.

The second challenge is the move to “jet zero.” Demonstrating a commitment to reduce emissions is already a key factor in the battle for corporate travel. This requires a different commercial strategy, which encompasses a wider range of functional touch points with corporate customers such that they understand the steps taken by an airline to contribute towards a corporate’s carbon neutral ambition.

The third challenge is one of technological transition, an area where airlines have historically underinvested as a sector. Commercial success and operational efficiency will depend increasingly on the successful deployment of data analytics across the customer lifecycle. Emerging technologies such as AI, machine learning and automation will all become essential in the future operation of a high performing airline. A clear technology roadmap, with robust investment plans, is a priority and needs to be factored into the capital considerations of all airlines.

More action will be required than managing short-term challenges – significant though they are – and getting ready for a highly uncertain recovery. Adjustments in both mindset and culture will be necessary to address permanent and structural differences. The winners will be those that are able to make best use of their cash and capital, internalise the increased flexibility demanded to transition off government support and transform their operation to succeed in a low carbon, technologically advanced world with reduced business travel.

EY teams are supporting clients as they plan and model their paths to recovery; take action to raise and preserve capital; and use technology and data analytics to control spending, increase visibility and enhance customer experience. Re-examining business plans and corporate decisions in the face of unprecedented uncertainty is also key to help ensuring resilience.

Clearer skies ahead?

Those that can rapidly respond to these changes and survive the recovery period will be best placed to thrive and gain share once the pandemic and its direct effects are over. Whilst a bumpy ride is still on the horizon for much of the sector, clearer skies await those able to navigate the turbulence and steer a path towards a brighter future.

Summary

The pandemic had a stark impact on the airlines industry. As the industry prepares for recovery, the winners will be those who are able to address short-term challenges quickly, whilst reshaping their businesses for the longer-term.