Chapter 1

Analysis: four factors to guide battery storage investment

Four factors can help potential investors navigate a complex market.

The world’s multiple energy transitions are gaining pace. But progress must significantly accelerate if the world is to meet climate goals, including the commitment made at COP28 to triple renewable energy capacity by 2030.

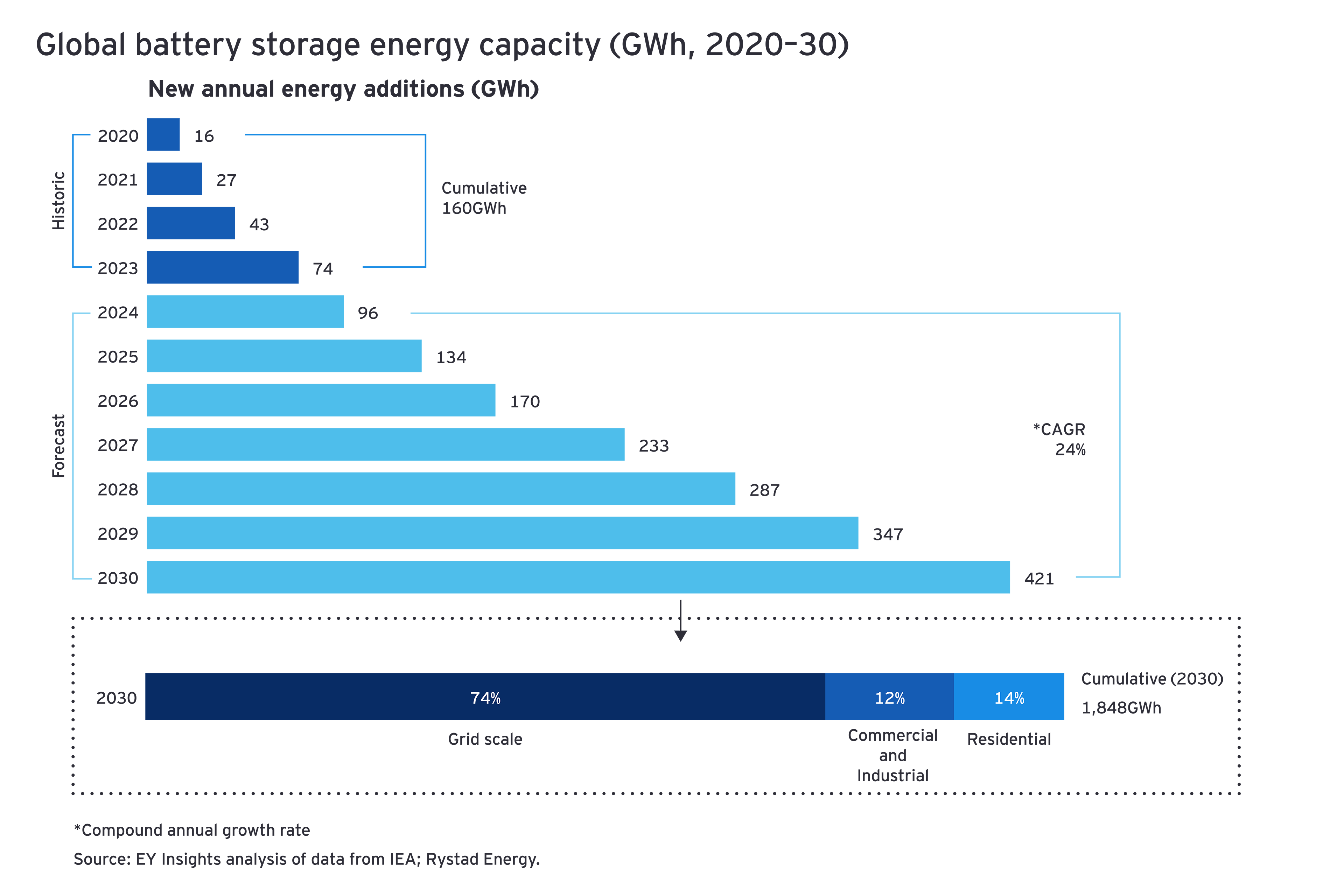

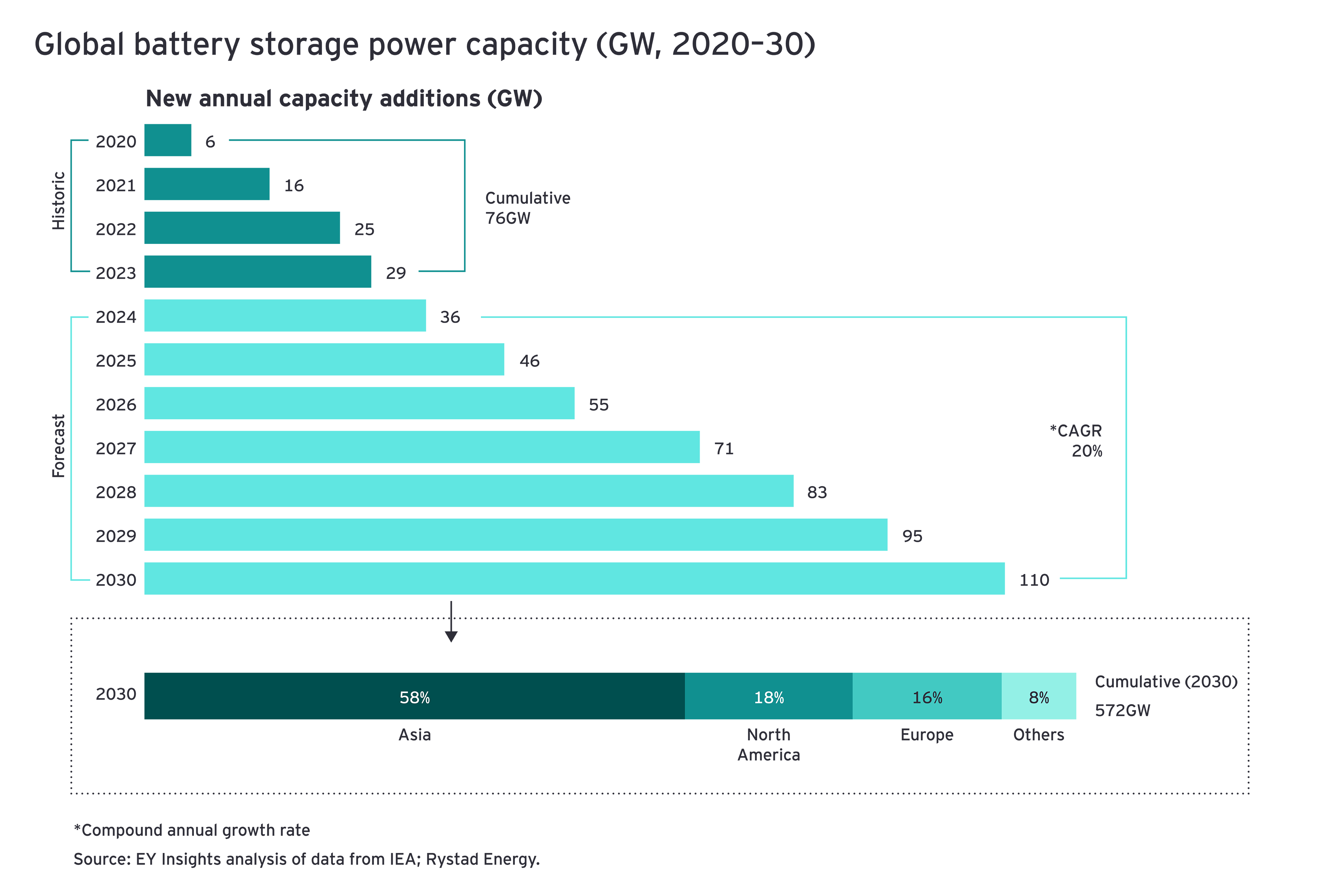

Rapid electrification, particularly in transport and heating, means that electricity will make up the majority of all energy demand by 2050, usurping gas and other fossil fuels — rising to 60% in Europe from around 20% today, for example.6 But this depends on a reliable, resilient electricity grid. Deploying BESS at grid scale can help achieve this, solving multiple energy system challenges. Specifically, BESS can decouple consumption from generation, reduce unnecessary energy exchange with the transmission grid and provide grid-serving operation. Demand for BESS is growing fast, with deployment forecast to quadruple to 572GW/1,848GWh by 2030, much of this adopted at grid scale.7

Investor interest is also on the rise. But this isn’t an easy market to master. BESS investments are a long-term commitment; projects typically run for 20 years or more with battery upgrades. They are also highly localized and carry more risk than some other clean energy investments. Success requires understanding the dynamic interaction of regional variations, electricity market design, technology and financing — as well as an acceptance of volatility.

To help cut through the complexity, EY teams have identified and ranked the attractiveness of the world’s top global battery investment markets for the first time. (This assesses factors including installed capacity and pipeline, as well as government support, such as tenders, subsidies, policy and deployment targets.)

Considering four factors can help investors build a strong business case, and navigate opportunities and risks:

1. How can I build a resilient investment case?

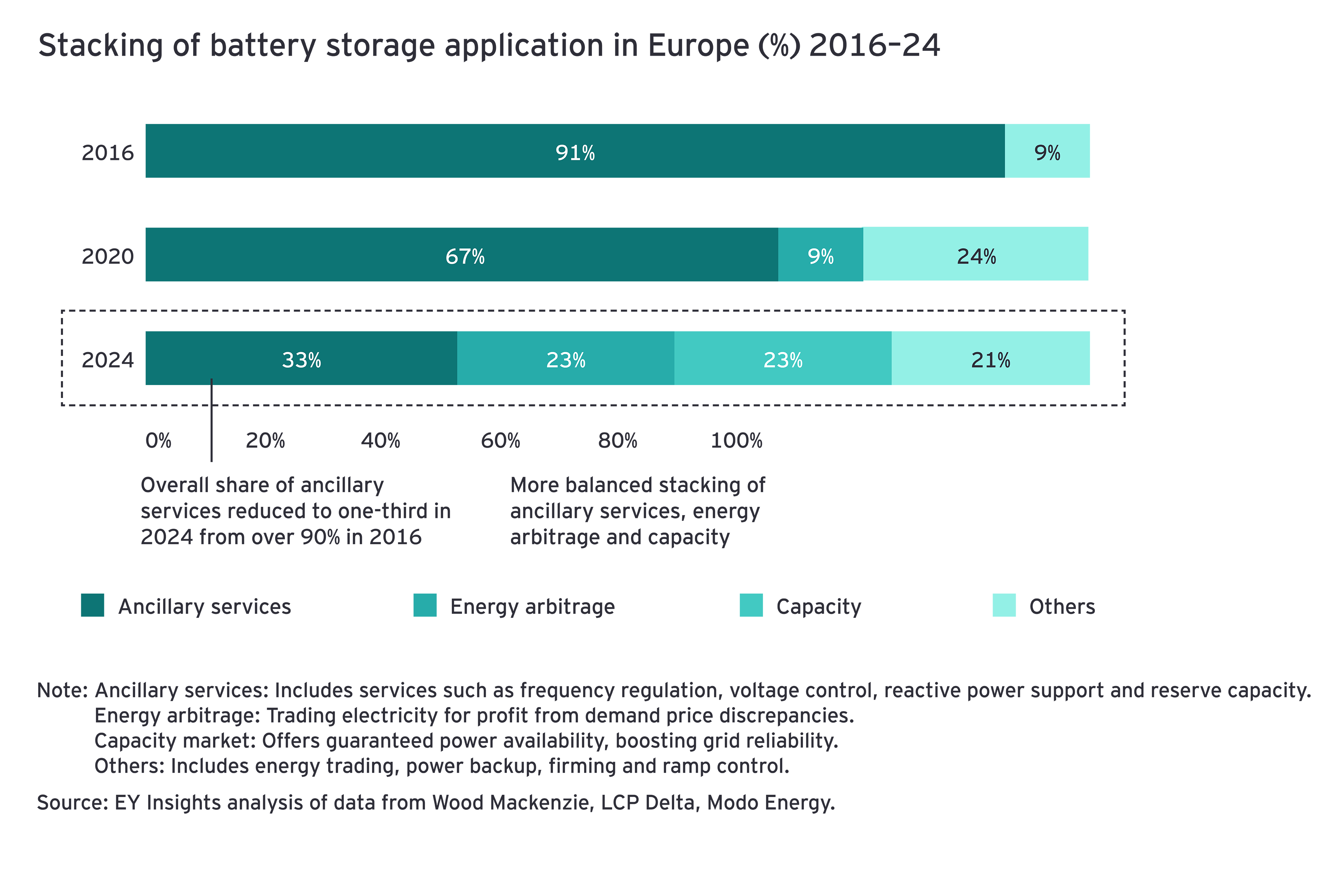

Batteries typically earn revenues through what is called “stacking” returns — accumulating revenue from multiple sources. These sources are drawn from participation across three main markets — ancillary, energy arbitrage and capacity — which operate with different processes across different timescales.

In many markets, ancillary markets, particularly frequency response services, have typically made up much of BESS revenue. But market saturation is seeing prices drop and the stack shifting toward energy arbitrage and capacity markets. For example, in the UK, ancillary services made up 84% of BESS revenues in 2022 but, so far in 2024, are only contributing 20%.16 Across Europe, it is a similar picture.

In the future, optimization and the right bidding strategy will be critical to ensure maximum returns on storage assets. Value opportunities will become more localized as renewables proliferate and volatility increases. Negative or zero-price events, already on the rise, will become more frequent, strengthening the role of storage.

2. How will I maintain the competitiveness of my battery?

Continuing to capture value in a fast-changing market requires agility. This demands both a flexible mindset and the artificial intelligence (AI) and digital tools that enable fast, insight-driven shifts.

“Understanding and leveraging AI and digital tools for optimized storage trading strategies can help companies de-risk investments, navigate regulatory changes quickly, and better monetize opportunities presented by new market structures and market volatility,” explains EY Global Energy & Resources AI Lead Ana Domingues.

Mastering data and monitoring technology evolution can guide smart decisions as technology evolves. For example, the move toward longer duration batteries and emerging competitiveness of alternative storage systems, such as hydrogen and vehicle-to-grid technology, could erode the future business case.

3. What are the optimal business models or financing structures for BESS?

BESS projects are capital-intensive, requiring financing and active management throughout their life. This means investors should ensure finance and offtake strategies with buyers are linked. For example, they should consider whether the goal is long-term contracted revenues or if they are willing to take merchant risk for a potentially higher return. Investors also need to accept a level of volatility and a longer-term view over various cycles.

The complexity of BESS projects means success will depend on investors having differentiated capabilities across the value chain, as well as strong management teams with local market capabilities. Relationships with landowners can smooth the development process, as can understanding local planning regimes and regulation, as well as offtake markets.

4. How can I navigate supply chain complexity risks?

The ability to reduce capex is vital to scaling up BESS investment. Costs of grid-scale BESS are expected to fall by around 20% to 30% across key markets by 2030, but reductions may be offset by volatile commodity prices and supply chain bottlenecks. For example, slow lead times in building transformers can delay the connection of new BESS projects to the grid.

China Mainland’s dominance of the battery supply chain amid growing resource nationalism and protectionism in many markets could impact the viability of future projects. Battery recycling could help mitigate some risks, and more companies including Iberdrola, Glencore, and FCC Ámbito, are collaborating on lithium-ion battery circularity solutions.

Chapter 2

Key developments: renewables highlights from around the world

Offshore wind pushes Canada, Japan and Denmark up the index, and India innovates around hybrid projects.

Ambitious decarbonization targets are driving a clean energy push in many markets, marked by record-breaking participation in offshore wind and solar tenders, as well as innovative projects in carbon capture and hydrogen.

While the top of our rankings remains relatively unchanged, Canada (9) and Japan (10) enter the top 10, with investors attracted by more opportunities in offshore wind. Spain (12) has dropped four places as investors feel the impact of continued low prices, while Italy (13) and Greece (16) have climbed up the ranks.

In a year when about half the world will be voting in elections, Argentina’s rise of three places (to 26) under a government determined to build a more sustainable, clean energy system is a reminder of how quickly government policy can impact investment.

Download the RECAI top 40 ranking (pdf) for details on technology-specific scores, and see Methodology for details on how ranking and scores are determined.

Chapter 3

Normalized index

Showcasing markets performing above expectations for their economic size.

The RECAI uses various criteria to compare the attractiveness of renewables markets, such as magnitude of development pipeline, that reflect the absolute size of the renewable investment opportunity. Hence, the index naturally benefits large economies. By normalizing with the gross domestic product, we can see which markets are performing above expectations for their economic size. In this way, the normalized index helps reveal ambitious plans in smaller economies, creating some attractive alternatives for potential investors.

Chapter 4

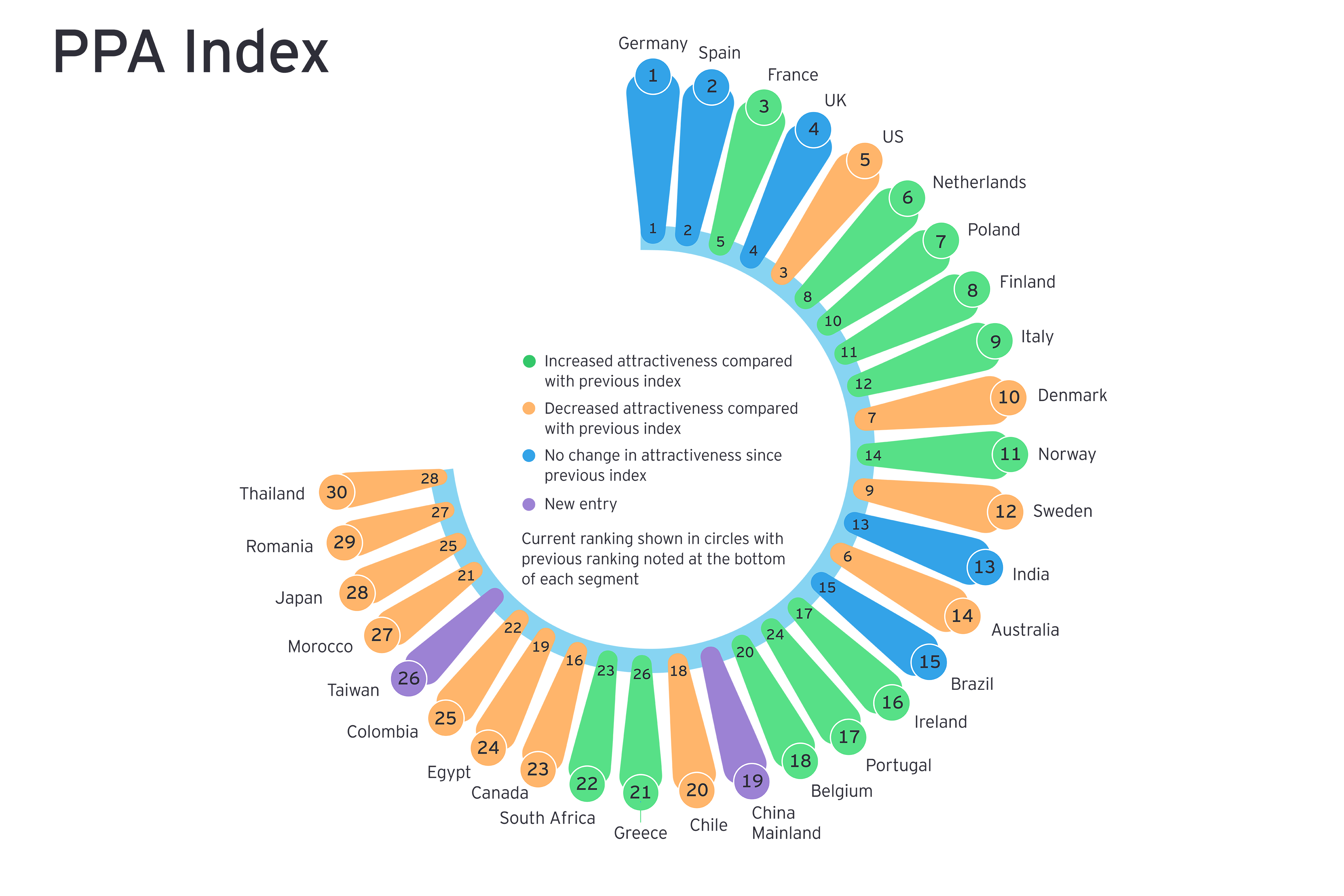

PPA Index: buyers taking upper hand in energized PPA market

Activity gains pace as corporates lock in low prices

2024 saw a slow start to corporate power purchase agreements (PPAs), but the market is now firing up and favoring buyers. PPA prices had become unsustainably high in some regions but are now correcting in line with markets. Economics are still tight, with wind costs not falling to the same degree as solar.

This PPA Index highlights the regional diversity of the PPA market. In Spain, corporates with fixed-price PPAs are feeling pain as excess renewables push prices to near zero. But in Italy, which has risen three spots in the index to ninth place, market prices remain stubbornly high, and more corporates are rushing to sign deals despite regulatory hurdles.

China Mainland enters the index for the first time, and we expect opportunities to increase as liberalization of power markets continues.

The EY corporate PPA Index uses key parameters from four pillars to analyze and rank the growth potential of a nation’s corporate PPA market. For details on data and methodology, download the EY corporate PPA Index (pdf).

RECAI is published biannually. See below for recent editions:

Summary

As 2030 climate goals loom, decarbonization of our energy system and broader economy must accelerate. Scaling up battery energy storage systems can help solve multiple problems currently holding up progress, including through stabilizing and strengthening network infrastructure and enabling more distributed energy resources to connect to the grid. Our ranking of the top global markets for battery investment can help investors build a resilient business case that considers four factors that are key to success.