EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The 2024 Budget supported green hydrogen development, aligning with India’s energy transition and decarbonization strategy.

In brief

- Budget 2024 allocated INR600 crore to the National Green Hydrogen Mission and INR19,100 crore to the Ministry of New and Renewable Energy (MNRE).

- The budget's focus on expanding renewable energy infrastructure and supporting critical minerals may enhance energy security, reduce costs and drive green hydrogen production in the coming years.

The Union Budget 2024 provided significant support for the green energy sector. The National Green Hydrogen Mission (NGHM) received an enhanced allocation of INR600 crore for 2024-25, a substantial increase from INR100 crore in 2023-24. This funding is part of a larger outlay of INR19,744 crore up to FY 2029-30. The Ministry of New and Renewable Energy (MNRE) was allocated INR19,100 crore to promote schemes like PM KUSUM and the Green Energy Corridors, which will bolster the green hydrogen value chain.

Introducing climate finance taxonomy

The Government of India is planning to introduce a new climate finance taxonomy which will facilitate access to preferential financing for green projects. This taxonomy will play a crucial role in aligning economic activities with credible transition pathways, mitigating greenwashing risks and attracting international climate financing. It will also support the development of green bonds and funding for sustainable technologies.

Transitioning to emission-based targets and carbon markets

The government will soon transition hard-to-abate industries from energy efficiency targets to emission-based targets. This shift from the Performance, Achieve and Trade (PAT) scheme to the Indian carbon market is aimed at enforcing stringent performance standards, ensuring market stability and improving transparency.

Speeding renewable energy progress

The budget allocated INR930 crore to wind power and introduced viability gap funding (VGF) for 1 GW of offshore wind energy. To support domestic manufacturing, the government also scrapped customs duty exemptions on solar glass and tinned copper interconnects, strengthening the supply chain for solar energy components.

Focusing on the Critical Mineral Mission

The Critical Mineral Mission, announced in the budget, will focus on domestic production, recycling and overseas acquisition of critical minerals. The mission is aimed at establishing resilient supply chains, supported by customs duty waivers on 25 critical minerals and reduced duties on graphite, silicon quartz and silicon dioxide.

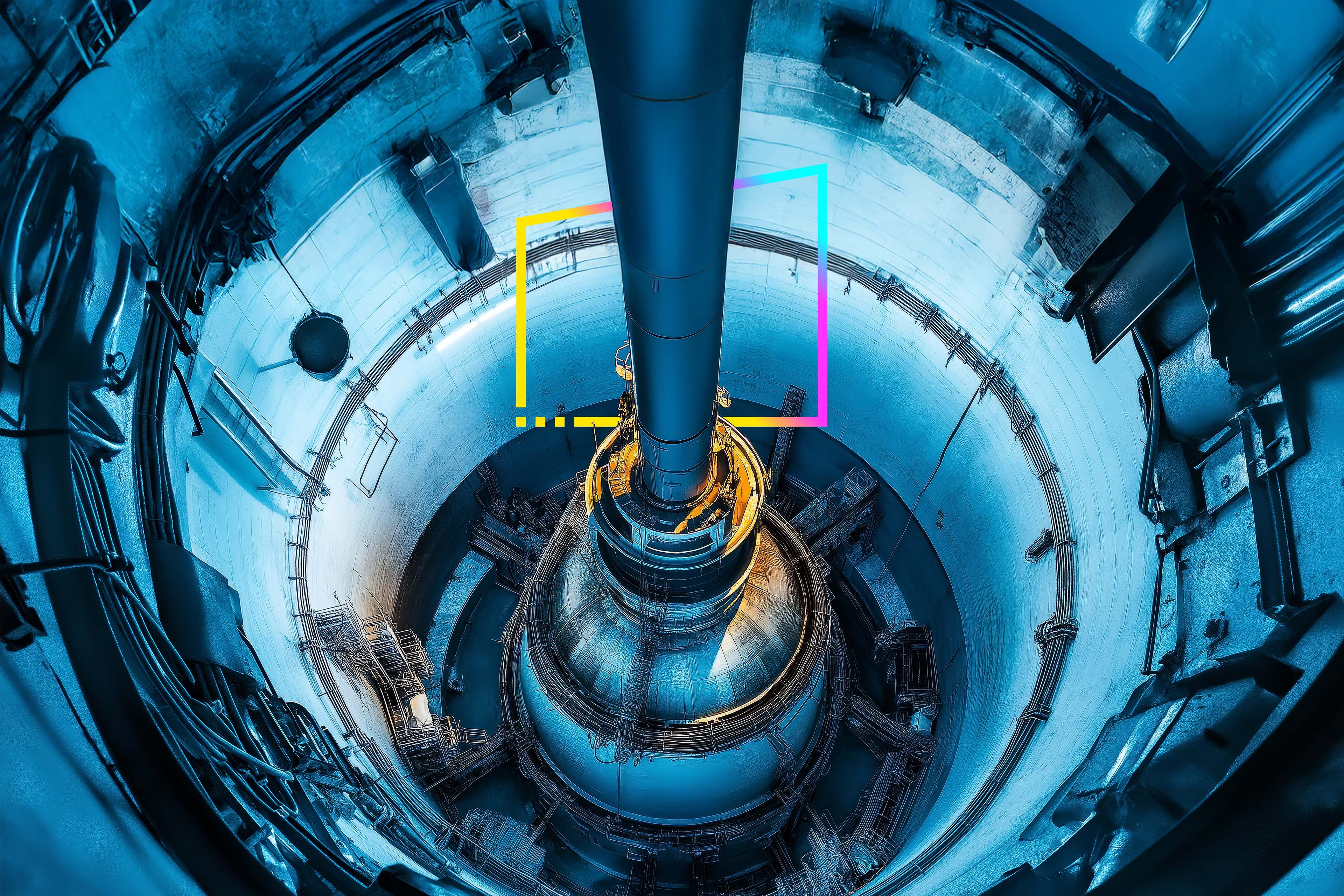

Prioritizing pumped storage and nuclear power

The government has also prioritized pumped energy storage, with a new policy to leverage India's 103 GW potential. Additionally, an outlay of INR96 was allocated for battery energy storage systems (BESS) in 2024-25. The government also announced a collaboration with the private sector to develop Bharat Small Reactors and Small Modular Reactors (SMRs), which are expected to diversify India's energy mix and support green hydrogen production.

These budgetary measures collectively aim to advance India's sustainable energy infrastructure, promote green technologies and ensure a stable, low-carbon energy supply.

Implications for enhancing green hydrogen and energy security

The expansion of renewable energy infrastructure, particularly in solar and wind, will necessitate the upskilling of the workforce. As the industry grows, it will achieve larger economies of scale, leading to reduced costs of green energy. This cost reduction will, in turn, make green hydrogen production targets more economically viable.

The Budget’s emphasis on solar and wind energy, along with investments in offshore wind, pumped hydro energy storage and Small Modular Reactors (SMRs), will create a diversified energy mix. This diversification will enhance the reliability and flexibility of the grid, helping address the intermittency of renewable energy sources. Electrolyzers will require round the clock green power and emerging standards and certifications will require green hydrogen production from clean energy sources. The introduction of these new renewable sources will also foster job creation and spur economic development. The announcements aim to enhance energy security by reducing dependence on fossil fuels. Initiatives such as the critical mineral mission are vital for energy security. Localizing parts of the value chain will reduce prices for solar panels, batteries, electrolyzers and increase the availability of these materials for domestic use. Rare earth minerals are crucial components of electrolyzers and the mission will help bring down costs and create a domestic supply of those components.

The combined emphasis on solar, wind and energy storage, along with supportive customs duty adjustments, should drive substantial growth in India’s renewable energy capacity. This growth will catalyze the development of green hydrogen infrastructure in the coming years.

Download the latest issue

Summary

The combined emphasis on solar, wind and energy storage, along with supportive customs duty adjustments, may drive substantial growth in India’s renewable energy capacity. This growth is expected to catalyze the development of green hydrogen infrastructure in the coming years.

Overall, these measures aim to create a more robust and sustainable energy sector, setting the stage for green hydrogen production and utilization.

How EY can help

-

EY DigiGST solution is one of the largest ASP- GST Suvidha Provider offering a secure cloud platform to meet all Goods and Service Tax (GST) compliance needs of businesses.

Read more -

EY India provides expert tax policy advisory services, offering insights and strategies to navigate complex tax regulations and drive business growth.

Read more -

Our Tax Managed Services team can help you reimagine your tax and finance models to keep up with evolving regulations, technology, and talent demands. Find out how.

Read more

Related articles

Union Budget 2024-25: Accelerating fiscal consolidation for sustained growth

Union Budget 2024-25: Drive fiscal consolidation for lower interest rates, boost private investment, and job growth.

Transforming tax: unveiling strategic alliance between EY and UiPath

In the first episode, we are joined by Sameer Prakash, Tax Technology and Transformation Partner, EY India and to explore the transformative impact of AI and Generative AI (Gen AI) in the tax ecosystem.

Impact of new GST law on skill-based online games

Explore the effects of the new GST law on skill-based online gaming. Understand the implications for players and industry with our in-depth analysis.