EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

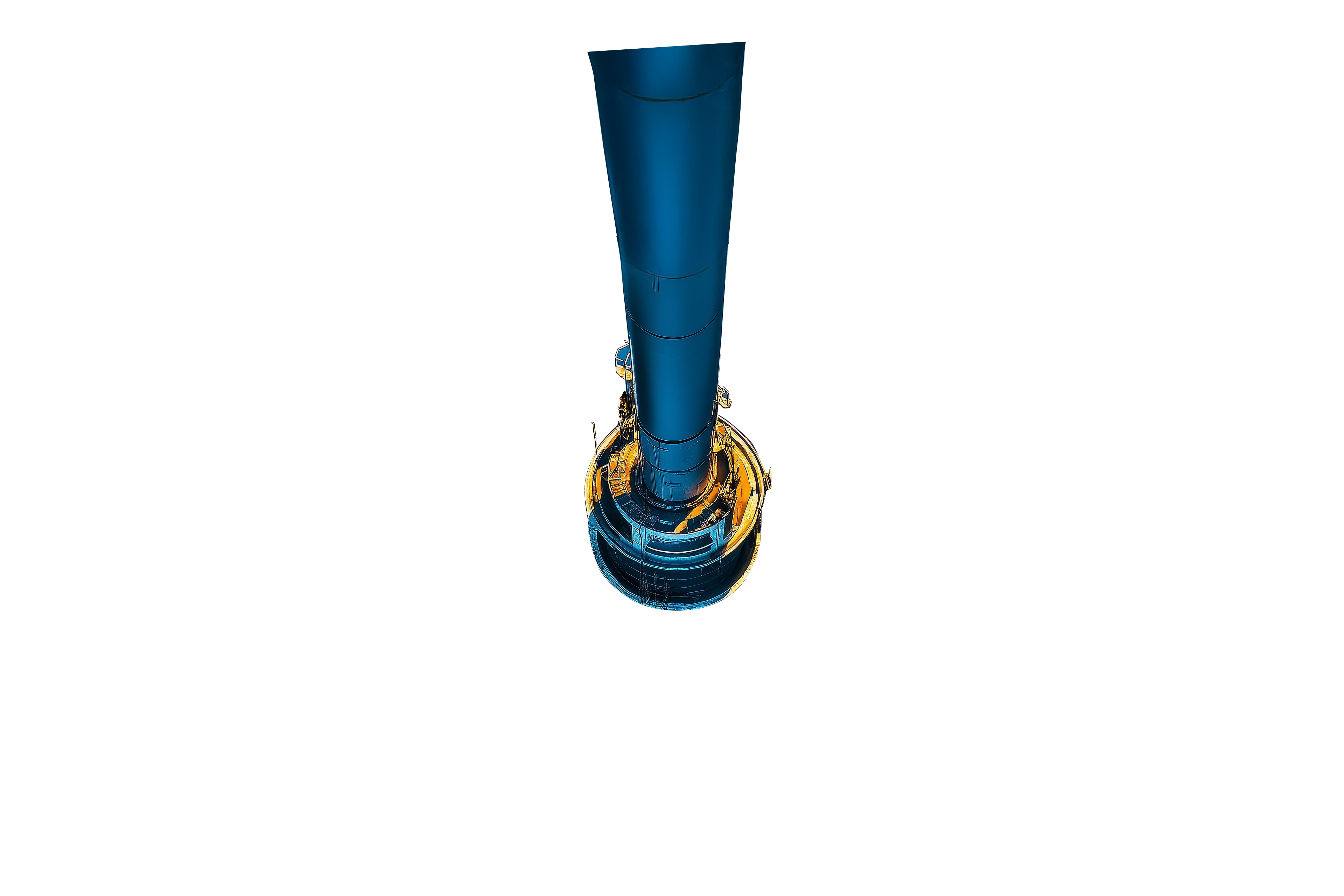

COP29: Why global efforts must reinvigorate towards nuclear power

Supporting nuclear energy as a stable contributor to renewable energy mix.

In brief

- Technology companies need larger quantities of clean energy for AI operations

- Advanced nuclear technologies have emerged, making adoption more viable

As countries look for reliable, low-carbon energy sources, nuclear energy is back in the spotlight. After years of being sidelined due to environmental and safety concerns, leading up to COP29 in Baku, Azerbaijan, 14 major global financial institutions announced support for last year’s COP declaration to triple nuclear energy capacity.

There are three primary reasons behind the renewed interest in nuclear energy. Technology companies need larger quantities of clean energy for AI operations. Countries, too, are diversifying their green energy goals while also meeting their country’s demand. At the same time, advanced nuclear technologies have emerged, making adoption more viable.

Technology giants’ need for power

Technology companies are looking at nuclear energy to power their AI energy needs. According to Electric Power Research Institute (EPRI), electricity consumption by data centres alone could more than double by 2030. In the US, data centres, which are critical for AI operations, are projected to consume up to 9% of electricity by 2030.

To support its AI business, Google is set to acquire 500 MW from Kairos Power's Small Modular Reactors (SMRs). To reduce its carbon footprint beyond net zero, Microsoft has a two-decade agreement with Constellation Energy to revive the Three Mile Island nuclear plant for 835 MW sustainable energy. As tech companies’ plan for their higher energy requirements, nuclear energy may see a bigger share in the energy mix.

Cleaner source of energy

Countries and governments, too, are seeking solutions to reduce carbon emissions, along with creating sustainable and stable energy supplies. In India, in Budget 2024, the government had announced plans to collaborate with the private sector to develop Bharat Small Modular Reactors (SMRs) with up to 300 MW capacity.

While nuclear energy fits the bill to a large extent, high cost remains an issue. India’s Central Electricity Authority (CEA) reports that the capital cost for a pressurized heavy-water reactor (PHWR) was approximately INR117 million per MW for the fiscal year 2021-22. By 2026-27, it is projected to rise to INR142 million per MW.

Till now, mostly governments have financed nuclear plants due to the challenges in securing funding, given the associated exceptional risks of leakage and proliferation concerns. Many global lenders are supporting nuclear energy as a stable contributor to renewable energy mix since solar and wind power suffer from intermittency. However, there is a funding gap and financial institutions have yet to disclose their investment levels.

In the meanwhile, innovative funding options are emerging. One of them is collaboration between governments and international institutions. The Emirates Nuclear Energy Corporation (ENEC) has a combination of government funding and loans from international banks. Such tie-ups increase the success ratio of the project while splitting the risk and creating a sustainable stream of funding.

Another method, though applicable only selectively, is crowdfunding or communities funding small-scale nuclear reactors. UK-based Moltex Energy has explored crowdfunding for its Stable Salt Reactor technology, raising funds through platforms like Crowdcube and engaging the public and smaller investors in projects.

Government support, followed by institutional funds, however, remain the mainstay of nuclear energy finance.

Nuclear technological advancements

Advanced reactors like small modular reactors (SMRs) and next-gen designs offer lower capital costs and reliable clean energy. Smaller size and advanced safety features lower the risk of accidents. They can be built near cities relatively safely, reducing long transmission, which leads to more efficient power delivery. Besides, some models can be built incrementally, allowing for capacity to be scaled up as needed.

In addition, developed countries and business giants have started investing in fusion technology, which is expected to develop further in the future. In 2023, U.S. Department of Energy (DoE) allocated US$46 million to eight companies to advance fusion power plant designs. In 2024, it has extended US$49 million for foundational research in fusion materials and nuclear science. If successful, fusion technology could provide a nearly limitless supply of clean energy, offering a powerful supplement or even an alternative to today’s fission-based reactors. However, when fusion technology achieves a significant milestone, it may not be inexpensive at first. If it is widely embraced on a global scale, we can anticipate a subsequent reduction in costs.

Summary

While it is still too early to fully measure nuclear energy’s impact, its inclusion in decarbonization and clean energy strategies is relevant for industries and stakeholders alike. With governments, financial institutions and industries mobilizing capital and investments, nuclear energy can become a competitive player in the clean energy space. However, a unified commitment is needed to promote nuclear technology as well as reduce its costs, making this source more viable in the quest for a sustainable, net-zero future.

How EY can help

-

Discover EY energy transition insights, people and services, and how they can help your business unlock the opportunities of an uncertain future.

Read more -

Sustainability services and solutions by EY India guide ESG strategy, climate action and reporting and decarbonization backed with data and technology.

Read more -

EY ESG & sustainability services help organizations address investor concerns, enhance ESG reporting and performance with long-term sustainable strategies.

Read more

Related articles

Decarbonizing India's steel industry: A strategic roadmap

Explore the roadmap for India's steel industry to achieve net-zero by 2070 with green hydrogen, EAFs, and CCUS technologies.

How India can lead the global green steel revolution while balancing growth

Unlocking India's green steel potential with sustainable production methods, innovative technologies, and strategic industry shifts. Learn more.

Unlocking low-grade iron ore: Role of beneficiation in India's steel sector

Explore the urgency of iron ore beneficiation to meet industry demand and improve eco-efficiency in our comprehensive guide on modern techniques.