EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Almost a third of business consideration is allocated to intangible assets and goodwill.

In brief

- Ind AS 103 Business Combinations (Ind AS 103) transforms the way companies plan and execute their acquisition strategies.

- Purchase Price Allocation (PPA) is relevant from an income-tax perspective; tax treatment for different intangibles and goodwill are different and have to be measured at fair value.

Understanding the implications of Indian Accounting Standard (Ind AS 103) is crucial since it not only affects the balance sheet of a company but may also have tax implications. It requires identification of key intangible assets and estimating their relative contribution to overall deal value while accounting for business combinations. Application of Ind AS 103 entails measuring assets and liabilities (including intangible assets and contingent liabilities which did not exist on the balance sheet of target entities and businesses) acquired in a deal at fair value through appropriate valuation methods, with the residual value allocated to goodwill/capital reserve. The standard applies to most business combinations, including amalgamations and acquisitions. Ind AS 103 impacts the way companies plan and execute their acquisition strategies.

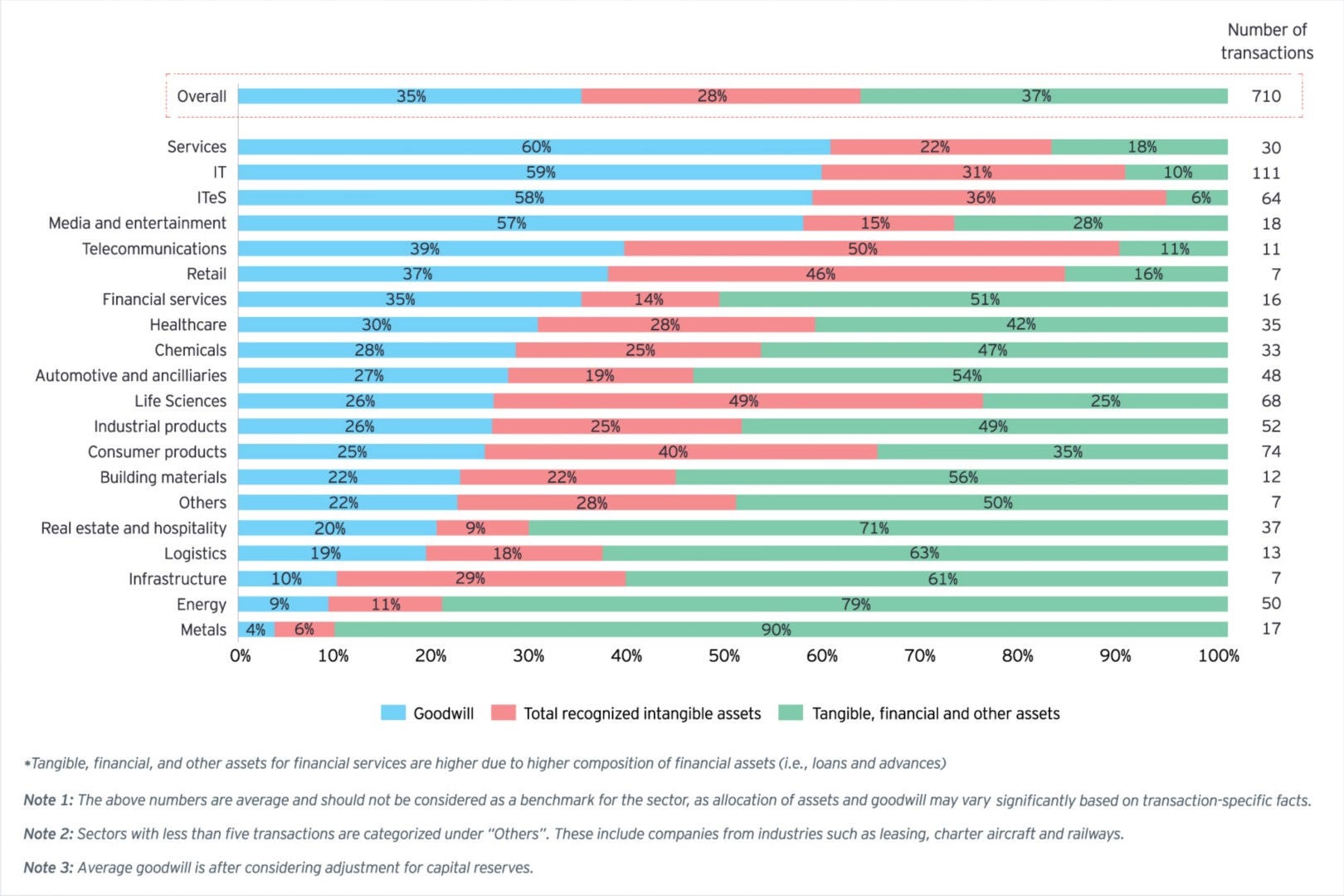

EY has undertaken a study of business combination accounting for transactions that were disclosed in annual reports of the top 500+ listed companies in India by market capitalization and over 80 private companies (covering over 700 transactions) since implementation of Ind AS till 31 March 2023. This study presents the results of assets (primarily intangible assets) that are typically recognized and reported by a company during an acquisition. However, the results of this study cannot be viewed in isolation, as each deal would have specific nuances.

Key findings of the PPA Study

- 28% of the enterprise value of acquired companies was allocated to identified intangible assets and 35% was attributable to goodwill, with the allocation varying considerably from industry to industry. The allocation to goodwill in India is largely in line with the proportion allocated in global deals (e.g., in the US).

- In sectors such as telecommunications, life sciences, retail, consumer products and technology (IT/ITES), a larger portion of deal value is allocated to intangible assets. This is reflected by the underlying products, brands, intellectual property, customer relationships, etc.

- Capital-intensive sectors, such as real estate and hospitality, energy and metals, allocate more than two-thirds of their enterprise value to tangible assets.

- Marketing related intangibles were the key acquisition driver in the customer products, life sciences and retail sector. Customer-related intangibles seem to be the acquisition driver in the IT/ITeS sector.

The purchase price allocation study also revealed some interesting results, which are mentioned below:

- Generally, a non-compete agreement is included in most acquisitions as a safeguard for the buyer. However, allocation of value to the non-compete agreement is typically on the lower side, possibly indicating either a shorter life or the perception that the probability/ impact of competition is minimal.

- Depending on the transaction structure, purchase price allocation (PPA) will also have relevance from an income-tax perspective, as tax treatment for different intangibles and goodwill would be different and have to be measured at fair value by applying appropriate valuation methods and residual value allocated to goodwill/capital reserve.

The sector-wise allocation trends of purchase consideration among Goodwill, intangible assets and tangible assets are as follows:

Download the PDF

Summary

Ind AS has consistently emphasized the importance of precise business combination accounting. While valuation guidelines may be prescribed in detail, assumptions and workings are still highly subjective in nature. An independent, reasonable test is very important. A thorough PPA study will help in keeping a check with other transactions in a similar space. This PPA study will help the management, auditors, tax officers and other advisors to assess the reasonableness of an individual PPA and predict the M&A impact on amortization expense.

How EY can help

-

Our Valuation, Modeling & Economics services guide you through valuation and business modeling implications to better understand the impact. Find out more.

Read more -

Discover how EY-Parthenon strategy consulting services can help your business achieve optimal long-term value. Learn more about strategy consulting.

Read more -

EY helps governments, regulators, and private clients with infrastructure advisory services and ESG support, aiding in strategic decision-making and sustainable project development. Learn how.

Read more

Related articles

Onwards and upwards: a positive outlook for private credit in India

Discover how the private credit market has progressed in India. Learn more about new fund registrations and funds raised.